porcorex

This article is part of a series that provides an ongoing analysis of the changes made to Tweedy, Browne’s 13F portfolio on a quarterly basis. It is based on Tweedy, Browne’s regulatory 13F Form filed on 8/12/2022. Please visit our Tracking Tweedy, Browne Portfolio series to get an idea of their investment philosophy and our previous update for the fund’s moves during Q1 2022.

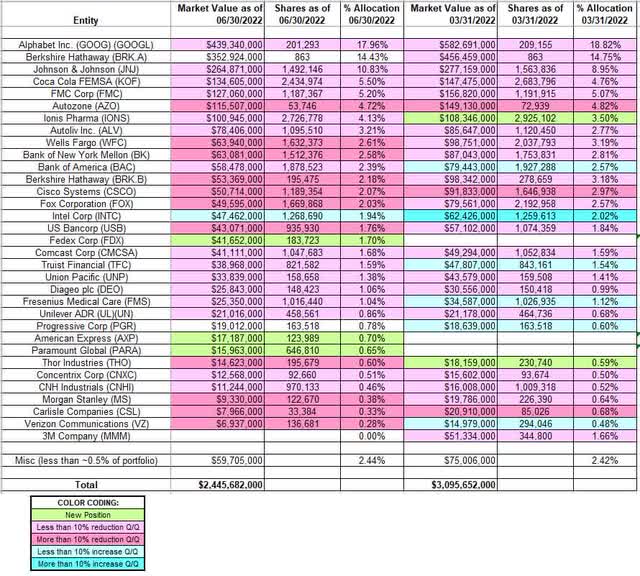

This quarter, Tweedy, Browne’s 13F portfolio value decreased marginally from ~$3.10B to ~$2.45B. The number of holdings increased from 44 to 45. The largest position by far is Alphabet at ~18% of the portfolio. The largest five individual stock positions are Alphabet, Berkshire Hathaway, Johnson & Johnson, Coca-Cola, and FMC Corp. Combined they are at ~56% of the portfolio. 32 of the 45 13F stakes are significantly large (over ~0.5% of the 13F portfolio each) and they are the focus of this article.

Tweedy, Browne has released a number of investment research papers over the years and that is a valuable resource for anyone looking to learn from their value investing philosophy. Also, Christopher Browne authored the book “The Little Book of Value Investing“, a great introduction.

Note: Tweedy, Browne’s flagship Tweedy, Browne International Value Fund (MUTF:TBGVX) has a global orientation with non-US allocation at ~80% of the portfolio and cash at ~4%. The top five holdings are Nestle (OTCPK:NSRGY), Diageo plc (DEO), TotalEnergies (TTE), GSK plc (GSK), and Roche Holding AG (OTCQX:RHHBY). Together, they are at ~19% of the fund. Per Q2 2022 Commentary, the fund returned negative 10.86% for Q1 2022 compared to negative 10.53% for MSCI EAFE (Hedged to US$). Since inception (1993), annualized returns are at 8.28% compared to 6.08% for MSCI EAFE.

New Stakes:

FedEx Corp. (FDX), American Express (AXP), and Paramount Global (PARA): These are the new positions this quarter. The 1.70% FDX stake was purchased at prices between ~$197 and ~$243 and the stock currently trades at ~$226. AXP is a small 0.70% of the portfolio position established at prices between ~$138 and ~$189 and it now goes for ~$159. The 0.65% PARA stake was purchased at prices between ~$24 and ~$38 and it is now near the low end of that range at ~$25.

Stake Disposals:

3M Company (MMM): MMM was a 1.66% long-term stake first purchased in 2008 at low prices. The five quarters through Q2 2017 had seen a combined ~46% reduction at prices between $165 and $213. There was a ~8% selling in Q4 2017 and that was followed with a ~18% reduction next quarter at prices between $215 and $259. The five quarters through Q3 2019 had also seen a ~15% combined selling at prices between $160 and $220. Q1 2020 saw a ~12% stake increase while last two years had seen similar trimming. The disposal this quarter was at prices between ~$129 and ~$154. The stock is now at ~$141.

Note: Their Q2 2022 commentary mentions this activity. They sold due to recent litigation around product safety – “forever chemicals”.

Stake Increases:

Intel Corp. (INTC): INTC is a ~2% of the portfolio stake established in H2 2020 at prices between ~$44 and ~$61. There was a stake doubling over the last two quarters at prices between ~$44.50 and ~$56. The stock is now well below those ranges at $33.86. There was a marginal increase this quarter.

Stake Decreases:

Alphabet Inc. (GOOG) (GOOGL): GOOG is currently the largest 13F stake at ~18% of the portfolio. It was first purchased in 2012 at much lower prices compared to the current price of ~$115. Q3 2016 saw a ~9% trimming at prices between ~$35 and ~$39. That was followed with a ~10% trimming in Q3 2021. Last two quarters have also seen minor trimming.

Note: the prices quoted above are adjusted for the 20-for-1 stock split last Month.

Berkshire Hathaway (BRK.A) (BRK.B): Berkshire Hathaway is a very long-term stake that has been in the portfolio since before the financial crisis. It is currently their second-largest position at ~17% of the portfolio. Back in 2009, it was a very small 0.60% of the portfolio position. The bulk of the current stake was purchased in 2010 and 2012 at prices between $65 and $90. Q3 2016 saw a ~42% reduction at prices between $142 and $151 while the pattern reversed next quarter: ~37% increase at prices between $143 and $167. The five quarters through Q3 2021 had seen a ~15% selling at prices between ~$200 and ~$292. The stock currently trades at ~$294. There was minor trimming in the last three quarters.

Johnson & Johnson (JNJ): JNJ is a large (top three) position in the portfolio at ~11%. It is a long-term stake. The position was built from 400K shares to just over 4.3M shares between 2009 and 2012 at prices between $48 and $72. Since then, the stake has seen minor selling in most quarters. Q4 2016 saw a ~20% reduction at prices between $111 and $120. The share count is now at ~1.49M. The stock currently trades at ~$166. Tweedy, Browne is harvesting long-term gains from this position.

Coca-Cola FEMSA (KOF): The 5.50% KOF stake was built over the three quarters through Q2 2020 at prices between $38 and $65. Since then, the activity had been minor. This quarter saw a ~9% trimming at prices between ~$53 and ~$60. The stock currently trades at $62.72.

Note: Tweedy, Browne has a ~4.2% ownership stake in the business.

FMC Corporation (FMC): FMC is a 5.20% of the portfolio position established in Q3 2021 at prices between ~$88 and ~$109. There was a ~20% stake increase next quarter at prices between ~$88 and ~$110. The stock currently trades at ~$115. There was a marginal reduction over the last two quarters.

AutoZone (AZO): AZO is a 4.72% position purchased in Q3 2017 at prices between $493 and $595 and increased by ~75% in Q2 2018 at prices between $596 and $693. The stock currently trades well above those ranges at ~$2232. Q1 2019 saw a one-third selling at prices between $810 and $1000. Since then, the stake was reduced by another ~55% at prices between ~$728 and ~$2254. Tweedy, Browne is harvesting gains.

Ionis Pharma (IONS) and Thor Industries (THO): IONS is a fairly large ~4% of the portfolio position purchased last quarter at prices between ~$30 and ~$37 and the stock currently trades above that range at $44.75. There was a ~7% trimming this quarter. The small 0.60% of the portfolio THO stake was established last quarter at a cost-basis of ~$94 per share. The stock is now trading at $87.22. There was a ~15% trimming this quarter.

Autoliv, Inc. (ALV): The 3.21% ALV position was established in Q1 2020 at prices between ~$40 and ~$82 and the stock currently trades at $79.84. Last nine quarters have seen only minor adjustments.

Wells Fargo (WFC): WFC is a 2.61% of the 13F portfolio position. The initial stake was established in 2010 with the bulk of the current position purchased in 2011 at prices between $25 and $34. H2 2016 saw a ~30% reduction at prices between $44 and $58. The next two years had also seen minor selling. Q1 2019 saw a ~15% further reduction at prices between $46 and $52. Last three years had seen another ~23% selling at prices between ~$22 and ~$58. That was followed with a similar reduction this quarter at prices between ~$37.50 and ~$49.50. The stock is now at $44.64.

Bank of New York Mellon (BK): BK is a 2.58% stake first purchased in 2010 in the mid-20s price range. Q1 2016 saw a ~40% stake increase at prices between $32.50 and $38. The three quarters through Q2 2021 had seen a ~50% reduction at prices between ~$34 and ~$52. That was followed with a ~14% selling this quarter. The stock currently trades at $42.98.

Bank of America (BAC) and Truist Financial (TFC): BAC is a 2.39% of the portfolio position established in H2 2020 at prices between ~$23 and ~$30 and it is now at $34.52. The 1.54% TFC stake was purchased in H2 2020 at prices between ~$33.50 and ~$49 and the stock currently trades at $49.11. Both positions saw minor selling this quarter.

Cisco Systems (CSCO): CSCO position was first purchased in 2011. It is currently a ~2% of the portfolio stake. The bulk of the original position was purchased in 2012 at prices between $15.50 and $21. Q1 2016 saw a ~45% stake increase at prices between $22.50 and $28.50. The position has seen selling since. The three years through Q1 2019 saw a ~44% reduction at prices between $41 and $54. Next quarter saw another ~25% selling at prices between $51 and $57.50. The last six quarters also saw a ~75% reduction at prices between ~$43 and ~$63. The stock currently trades at ~$47. They are harvesting gains.

Fox Corporation (FOX): The FOX stake was a minutely small position established in Q2 2019. Next quarter saw the stake built at prices between $31.50 and $38. There was a ~15% stake increase in Q4 2019 and that was followed with a ~72% increase next quarter at prices between ~$20 and ~$38.50. Since then, the activity had been minor. This quarter saw a ~24% selling at prices between ~$29 and ~$36.50. The stock currently trades at ~$32, and the stake is at ~2% of the portfolio.

U.S. Bancorp (USB): The 1.76% USB position had seen a ~45% increase over the first three quarters of 2020 at prices between ~$29 and ~$59. The stock is now at $47.19. There was a ~12% trimming in the last six quarters. That was followed with a similar reduction this quarter at prices between ~$45.50 and ~$53.

Comcast Corporation (CMCSA): CMCSA is a very long-term stake that has been in the portfolio since before the financial crisis. Recent activity follows: There was a two-thirds reduction in Q4 2017 at prices between $35 and $41. Q4 2018 also saw a ~23% selling at prices between $33 and $39.50. Q2 2020 saw an about turn: ~140% stake increase at prices between $32.50 and $43. The stock is now at $37.11, and the stake is at 1.68%. Last two years have seen only minor adjustments.

Note: The prices quoted above are adjusted for the 2-for-1 stock split in February 2017.

Fresenius Medical Care (FMS): FMS is a small ~1% of the portfolio stake established in Q1 2021 at prices between ~$34 and ~$43. There was a ~14% stake increase next quarter at prices between ~$36.70 and ~$42. That was followed with a ~40% stake increase in Q3 2021 at prices between ~$35 and ~$42. Next quarter also saw a ~20% stake increase at prices between ~$30 and ~$36. The stock currently trades at $17.71. Last two quarters have seen only minor adjustments.

CNH Industrial (CNHI), Concentrix Corp. (CNXC), Carlisle Companies (CSL), Diageo plc (DEO), Morgan Stanley (MS), Union Pacific (UNP), Unilever (UN) (UL), and Verizon Communications (VZ): These small positions (less than ~1.5% of the 13F portfolio each) were reduced during the quarter.

Note: Although the 13F position is small, the firm has a large stake in Diageo held in LSE.

Kept Steady:

Progressive Corp. (PGR): The small 0.78% PGR stake was kept steady this quarter.

The spreadsheet below highlights changes to Tweedy, Browne’s 13F stock holdings in Q2 2022:

Tweedy Browne Portfolio – Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment