BING-JHEN HONG/iStock Editorial via Getty Images

Investment Thesis

TSMC (NYSE:TSM) reported another robust earnings result for FQ1 as it outperformed estimates. Notably, the company raised guidance for FQ2, despite the macro uncertainties due to the Russia-Ukraine conflict, macroeconomic uncertainty, and China’s COVID-19 lockdowns.

If investors need any reminder that the secular digitization trend undergirding the multi-year growth in 5G, smartphones, high-performance computing (HPC), and IoT remains as strong as ever, this is it.

However, TSMC stock has fallen below its critical $110 support level as investors sold down semiconductor stocks. Furthermore, some investors have also been concerned with the geopolitical uncertainty surrounding China-Taiwan relations.

Nevertheless, we would like to point out that TSMC stock valuation has reverted to its 5Y NTM EBIT multiples mean. Therefore, we remain confident that TSMC will continue to find support along the $110 level moving forward.

As such, we reiterate our Buy rating on TSMC stock.

Q1 Earnings Card Dispels Concerns Over Slowdown

Many analysts at the earnings conference were justifiably concerned over whether the current macro headwinds would impact TSMC. They were also particularly apprehensive over how a potential recession could beset TSMC’s business in FY22. However, the company confidently dispelled those concerns as it guided to an even better Q2.

Taiwan Semiconductor reported revenue of $17.57B in FQ1, up 35.5% YoY and 12.1% QoQ. Notably, its gross margin also came in at 55.6% and operating margin at 45.6%.

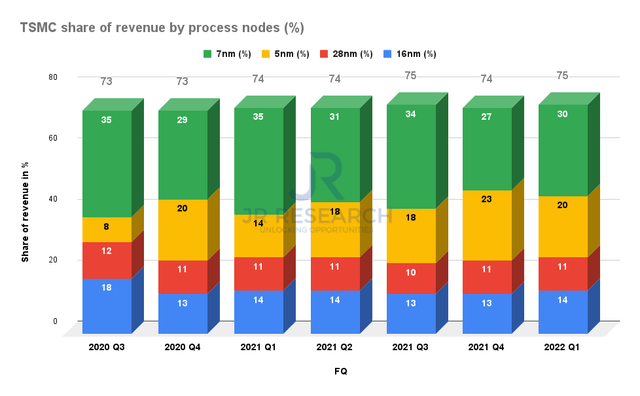

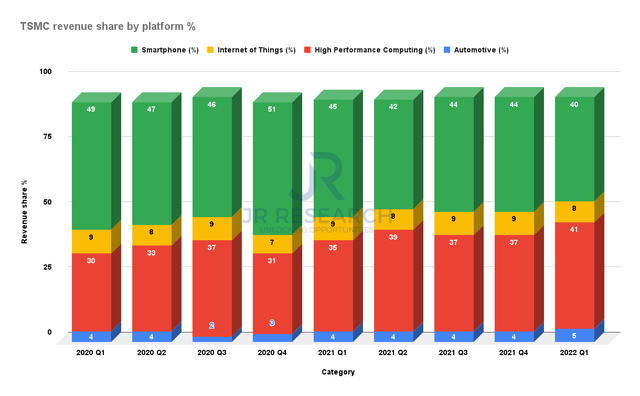

TSMC revenue share by process nodes % (Company filings) TSMC revenue share by platform % (Company filings)

TSMC’s advanced nodes (5nm and 7nm) maintained their 50% revenue share from FQ4’s results. In addition, its key trailing nodes (16nm and 28nm) also contributed 25% of FQ1’s revenue. Therefore, these four nodes accounted for 75% of TSMC’s first-quarter topline.

In terms of platform, HPC’s share surged above 40% for the first time in FQ1 over the last two years, as it reached 41%. However, smartphone seasonality was in play as its revenue share fell to 40%. It was also its lowest share over the last two years.

Robust Guidance Yet Again

Notably, the company raised guidance again as it continues to see strong secular demand over its HPC and automotive segments. CEO C.C. Wei accentuated (edited):

We expect our HPC platform to be TSMC’s strongest growing platform this year and the following years. And it will be the largest contributor to our growth. And this is all because of a structural megatrend driving increasing need for greater computation power and energy-efficient computing. As I said, these kind of technologies happen to be TSMC’s strong point. (TSMC’s FQ1’22 earnings call)

Therefore, investors can now better appreciate the criticality of TSMC’s position in the semiconductor value chain. As the world’s leading logic foundry, it’s exposed to the most important growth drivers underpinning digitization. Even as the smartphone growth cadence has slowed down, HPC came to the fore. If we refer to NVIDIA’s (NVDA) $1T roadmap and AMD’s (AMD) newly empowered heterogeneous compute strategy, it’s apparent. These fabless chipmakers will continue to depend mainly on NVIDIA’s leading-edge process for their most advanced data center chips.

Therefore, investors shouldn’t be surprised as TSMC reaffirmed its FY22 revenue growth guidance at the top end of the 20+% range. Notably, it also raised its FQ2 guidance despite the apparent weakness in smartphone shipments.

However, TSMC highlighted that it saw some supply chain disruptions over the wafer fab equipment (WFE) side. The WFE makers have experienced extended delays over their key supplies as lead time kept getting longer. However, TSMC highlighted that they don’t expect significant disruptions over their critical equipment. The company would also make necessary adjustments to cater to critical demand.

Notably, TSMC’s initial 3nm process (N3) is on track for volume production in 2H’22, with its improved N3E process scheduled for 2H’23. However, management also emphasized that it’s seeing good progress on N3E. Therefore, volume production on N3E could be brought forward, so investors should continue to monitor closely. Importantly, TSMC expects its 3nm process to be technologically superior to its peers (i.e., Samsung) when ready.

Is TSM Stock A Buy, Sell, Or Hold?

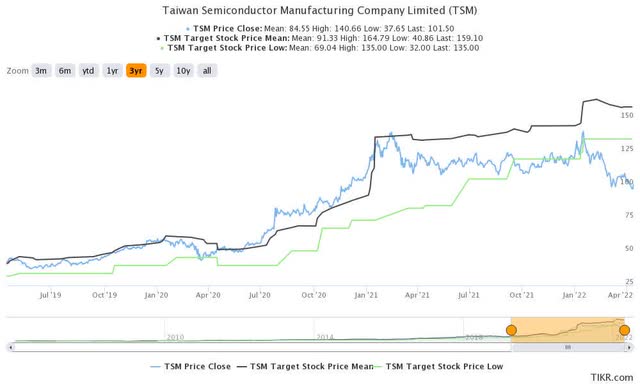

TSM stock valuation metrics (TIKR) TSM stock consensus price targets Vs. stock performance (TIKR)

TSM stock remains a buy. We noted that its NTM EBIT multiple of 16.4x has moderated to its 5Y mean. But, a caveat here relates to its NTM FCF yield of 0.9%. We believe TSM stock has several headwinds holding back its re-rating, despite its solid FQ1 results. These include the recent geopolitical headwinds, investors rotating to more defensive FCF yield plays, and peer multiples compression.

Hence, we encourage investors to be patient as the market digests the risk-averse environment in the near term.

Be the first to comment