pixelfit/E+ via Getty Images

Trinity Capital (NASDAQ:TRIN) is among the best-in-class early-stage companies that have the potential to grow at multifold rates to achieve mid- or large-cap status. Its low-risk, high-return strategy can provide shareholders with robust and sustainable returns over time. Despite a slowdown in venture capital funding, demand for venture debt continues to gain momentum as venture loans enable founders to raise money without selling equity at a low price to venture capital. On top of robust fundamentals, the company’s stock looks cheap at current valuations. Moreover, the company’s gigantic dividend yield of over 9% makes it a good stock to buy and hold for the long term.

Trinity’s Business Model

Trinity Capital debuted on NASDAQ in 2020 as a business development company specializing in offering various types of fixed and floating venture debt to growth stage companies. In addition to loans, it also offers equipment financing combined with equity and warrant investments. As well as providing financing to startups, the company works closely with them to help overcome challenges. Interest income and fee income are the two main sources of revenue for the venture debt firm.

Trinity’s portfolio (Investor presentation)

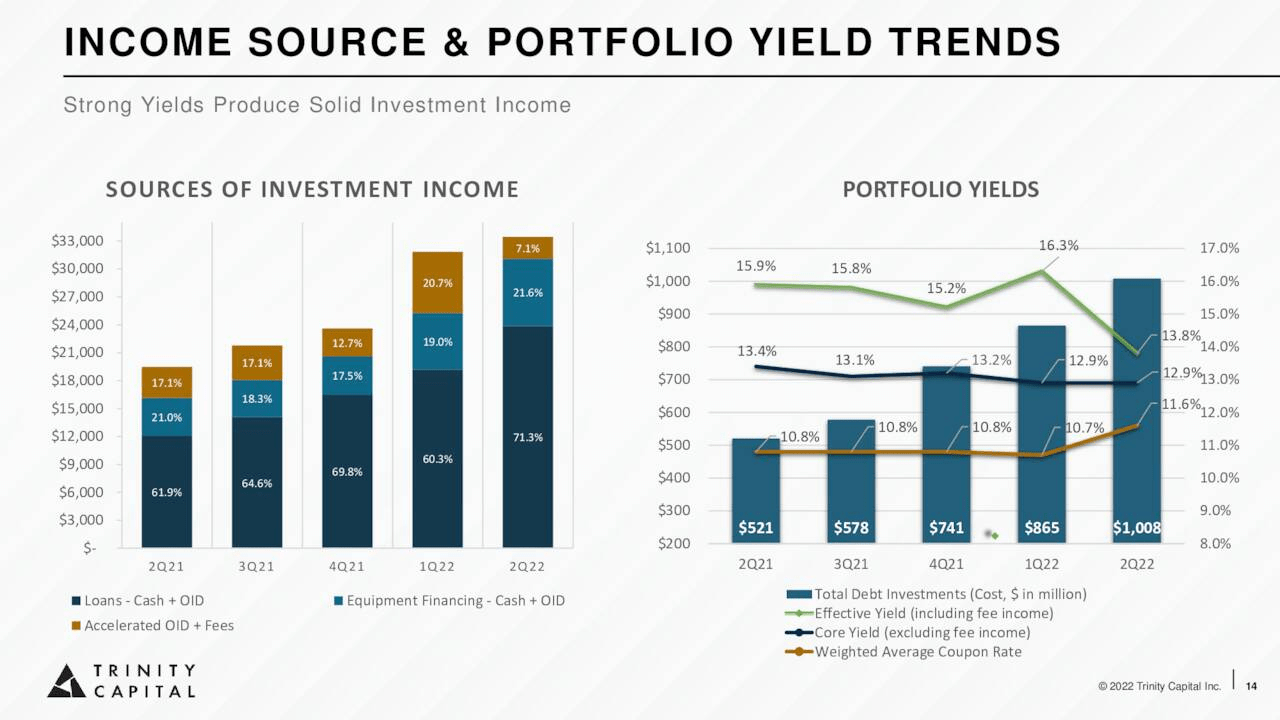

Although the firm’s portfolio is diversified across many sectors and geographies, manufacturing accounts for one-third of its holdings, followed by professional, scientific, and technical services with 24% and information with 8%. Through the issuance of equipment loans to three publicly traded digital asset mining and hosting companies in the June quarter, the firm has also expanded its portfolio concentration toward digital assets. Portfolio yield trends are robust, and Trinity Capital has grown its income quarter over quarter. Its effective portfolio yield hovered around 13.8% and its core yield clocked in at 12.9%.

The Federal Reserve’s strategy of raising rates would have a positive effect on Trinity’s investment income since the firm moved to floating rates instead of fixed rates. At the end of the June quarter, 64.4% of its loans had floating rates, compared to 59.6% at the end of the previous quarter and 49.3% a year ago. On top, the firm also borrowed 63% of its debt at fixed rates. As a result, it is projected to create a positive impact on net investment income of $4.1 million in 2022. Overall, the firm’s portfolio appears to be well positioned to benefit from the rate hike.

Trinity’s Blistering Growth Story is Likely to Continue

Trinity overview (Investor presentation )

To capitalize on increasing business opportunities and turn them into hefty profits, the venture debt company has doubled its team in the past 10 quarters. In the June quarter of 2022, the portfolio assets of the company reached $1 billion for the first time, more than double from $500 million when it debuted on the NASDAQ. In addition, the firm’s quarterly investment income surged from $10.9 million to $33.5 million in the past ten quarters and net investment income per share soared from $0.24 to $0.5.

Apart from the huge growth numbers in the last 10 quarters, the company’s fundamentals appear to be in good shape to continue its growth trajectory. Due to economic headwinds, the venture capital market slowed in 2022, but this has created opportunities for venture debt firms as capital-hungry startups are turning to venture debt to meet their needs. Trinity’s record first-half originations of $608 million also reflect this trend. Furthermore, it invested a record $460 million in start-ups in the first half, almost double the amount invested in 2021 when venture capital markets were at their peaks. Hence, the fundamentals for venture debt appear strong, which bodes well for Trinity’s growth prospects. The company’s decision to shift its loan portfolio focus to floating rates would also reduce volatility-related rate hikes.

For fiscal 2022, analysts expect it to earn $2.09 per share compared to $1.45 per share previously. The company’s earnings per share were $1.08 in the first half of 2022. Moreover, the company’s credit quality appears to be strong enough to support its growth plans. During the June quarter, the firm issued common stock and increased its credit facility by $100 million, bringing its total capacity to $400 million. Most of its debt will mature by 2026, so there is no risk of maturities in the short term.

A Perfect Time to Buy for the Long-term

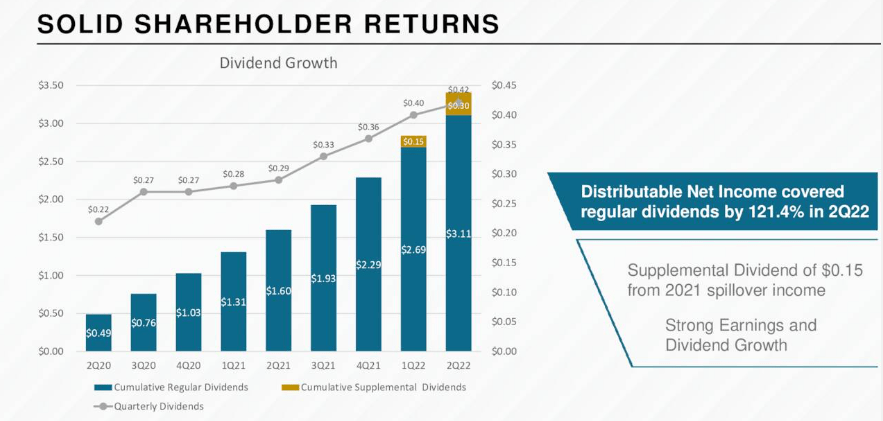

Dividend growth (Trinity’s investor presentation)

The dividend factor makes Trinity a good stock to buy and hold for long-term investors. Its dividend yield currently stands at around 9.38%, which is significantly higher than the S&P 500 average of 1.69%. A high yield like this is currently only offered by a few financial and real estate companies. Nevertheless, these sectors are susceptible to fluctuations in the economy and interest rates. Trinity’s dividends are completely safe thanks to its strong earnings growth potential. The chart above shows that the company has raised dividends every quarter over the past 10 quarters. Moreover, it offered supplementary dividends to shareholders in the past two quarters when many other dividend companies were struggling to increase their dividends. Its latest quarterly dividend of $0.42 per share is fully covered by its earnings per share of $0.51. With the expectation for earnings of over $2 per share, Trinity has more room to sustain its dividend growth in the following two quarters of this year.

Dividends alone do not make an investment great unless they are accompanied by solid capital growth. For that, it’s crucial to buy the stock at the right time. In the case of Trinity, the company’s stock is trading at a discount when compared to its recent average and industry trends. With the recent price drop and growth in earnings, valuations become even more attractive. Its stock is currently trading 7.7x forward earnings compared to the sector median of 10x and S&P 500’s forward price to earnings of 17.5x. The stock also looks attractive based on a forward price-to-book ratio of 1.1 compared to the industry average of 1.23.

Quant Ratings

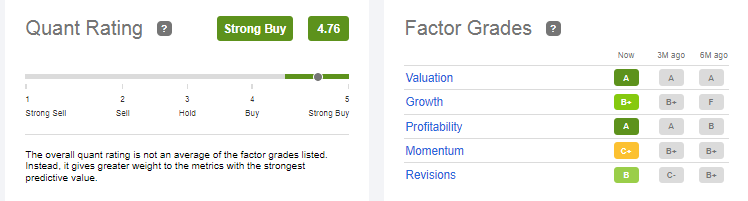

Quant Rating (Seeking Alpha)

Based on the Seeking Alpha quant grading system, Trinity received strong buy ratings, with a quant score of 4.8 out of 5. SA’s quant grading is based on five factors including, valuations, momentum, revisions, profitability, and growth. The momentum rating for Trinity is low, since its shares have been experiencing volatility due to broader market trends. Apart from that, all four factors received excellent grades, including valuations and profitability. A grade for valuation indicates that the stock is trading at a reasonable price, while an A grade for profitability implies that prospects are high for share price gains and dividends stability.

In Conclusion

When the real estate and financial sectors are struggling to sustain their growth, Trinity may be a good stock to add to a portfolio. Since its NASDAQ debut, the company has seen significant growth, and its future fundamentals suggest that trend will continue. Despite a slowdown in venture capital funding activities, the market dynamics for venture debt look strong, as cash-hungry start-ups are preferring loans instead of selling equity stakes at discount. Overall, Trinity looks like a good stock to buy at current valuations for both dividend and value investors.

Be the first to comment