ExperienceInteriors/iStock via Getty Images

Trex (NYSE:TREX) just reported Q3 2022 results, which were basically in line with expectations. Still, there are signs that the recovery might take a bit longer than expected, and that is likely why shares are responding negatively to the report. The company experimented a big sales decline, despite consumer sell-through demand still remaining at healthy levels, because distribution and dealer partners used the quarter to service demand requirements primarily through inventory draw-downs rather than reorders. Obviously, there is a limit as to how low distributors can reduce inventories, so this will likely subside sooner rather than later. According to the company, based on its internal data and market intelligence, it is confident that the inventory re-calibration will be completed by the end of 2022.

Given the difficult situation, Trex took measures to align the cost structure with the current demand by decreasing production levels, rightsizing the employee base, and focusing on cost efficiency programs. On the positive side, Trex has benefited from its strong position in the repair and remodel sector, which has helped make the company more resilient. Other piece of good news during the earnings call was that price increases to compensate for inflation are holding very well, and that raw material inflation has moderated, making it less likely that the company will have to continue to take aggressive price action.

Q3 2022 Results

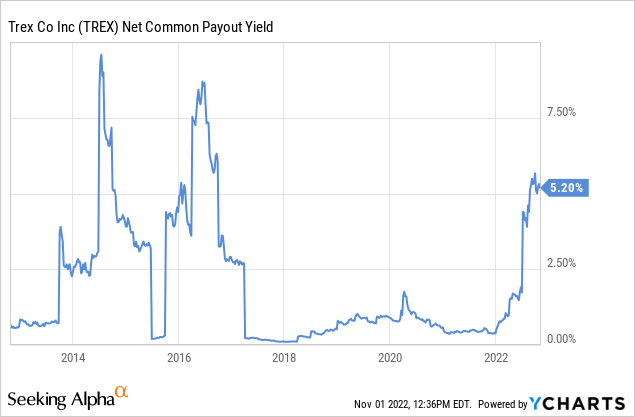

Third quarter 2022 net sales were $188 million, in line with guidance last quarter. Consolidated gross margin was 24.5% in the third quarter of 2022, compared to 38.2% in the year ago quarter. It was a significant decrease, and primarily due to lower production levels. Net income for the third quarter of 2022 was $14 million or $0.13 per diluted share, compared to $74 million or $0.64 per diluted share in the third quarter of 2021. This is obviously a very significant decline, but the company is guiding to things improving starting next quarter. Trex also showed confidence in its business by repurchasing 1.7 million of its shares, totaling ~$100 million.

For Q4 2022 Trex is guiding for net sales of $180 million to $190 million and an EBITDA margin of 22% to 25%. This is a significantly higher EBITDA margin than the 16.4% EBITDA margin delivered in Q3. The significant sequential increase in the EBITDA margin reflects expected benefits from the right-sizing of the cost base by the company.

Financials

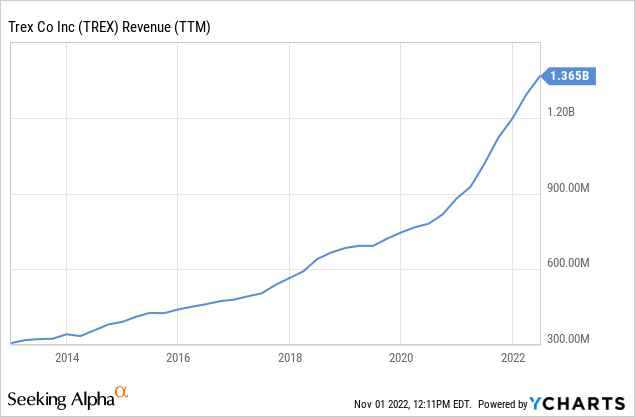

During the call the company mentioned a few times that it is currently producing to $1 billion for next year, since it doesn’t want to get too far ahead of demand in this weak economy right now. We believe that is one of the reasons shares are responding negatively, since it is basically a hint the probability of returning to posting record sales next year is basically very slim. To put that $1 billion in perspective, the trailing twelve months revenue for Trex is ~$1.36 billion. Therefore ~$1 billion for next year would mean a sales decline, and postponing the return to growth. Given that Trex has historically been considered a growth company, it is understandable that investors are disappointed.

Recessionary Environment

One particularly interesting comment by CEO Bryan Fairbanks was that he basically believes that we are already in a moderate recession. He also mentioned that he doesn’t see conditions changing that much into next year, adding to the signals that the company is expecting the recovery to take a bit longer than previously expected.

Well, I’d say we are in a moderate recession already in the back half of this year. And I am not sure that those economic conditions change all that much into next year and we will give you additional guidance on where we see the marketplace as we get to our end of the year earnings.

The good news is that CFO Dennis Schemm believes that Q3 was the peak for de-stocking, and that inventory draw-downs should have a more limited impact in Q4. The expectation is for roughly ~$200 million of inventory draw-downs for the full period.

I think that we saw a greater destock in Q3 than we will see in Q4. We probably got around $140 million to $160 million out in Q3. So we are well along the way and that’s why it gives us a lot of confidence to say that that recalibration will be done by the end of the year.

Valuation

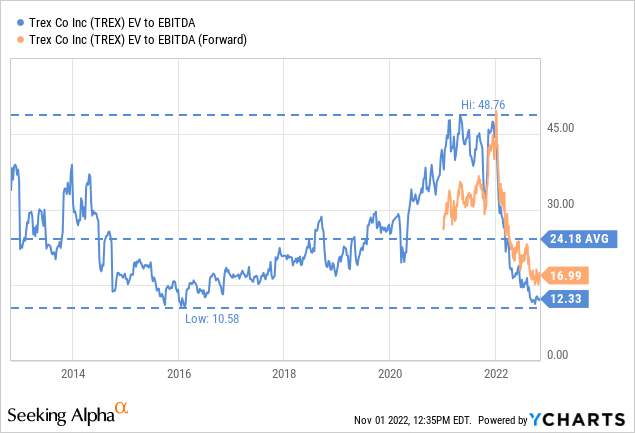

The good news for investors is that the tough current environment for the company has resulted in shares being priced quite attractively compared to its historical valuations. Especially when there does not seem to be anything particularly wrong with the company, aside from an economic environment that has turned, and which should eventually recover. Shares are trading at around half their ten-year EV/EBITDA average, even if EBITDA is expected to decline next year, and the forward multiple is higher.

We are also reassured that the company appears to see significant value in the shares at current prices, given that it is doing buybacks aggressively. Historically, the company seems to have had good timing in their repurchases, buying when shares were attractively priced, and reducing buybacks when shares looked overvalued.

Risks

The main risk we see is that even today Trex is considered a growth company. Investors seem to be pricing a bump in the road already, with results likely remaining weak for the rest of 2022, and probably 2023 as well. Still, even today, we believe the valuation reflects an expectation that the company will return to growing at a significant pace sometime in the future. Should investors start valuing Trex as a no-growth company, shares could certainly drop much further.

Conclusion

Trex’s Q3 results were far from surprising, given that the company delivered in line with expectations. We believe the reason shares are responding poorly to the report is the result of management’s commentary, which appears to be hinting at weakness continuing into 2023. Still, there are some positives, such as the guidance that Q3 was the trough in terms of lower profit margins and inventory draw-downs. Earnings are expected to start rebounding next quarter. Hope for a significant sales rebound next year appears to be fading, with the company currently producing to a target of ~$1 billion in 2023. If things improve, the company has the capacity to ramp up production, but given the weakening economy that would be surprising. In any case, given the widespread pessimism and the low valuation, this could turn out to be a great time to invest in the company.

Be the first to comment