CloudVisual

Thesis

Long-term investors in Transocean Ltd. (NYSE:RIG) have suffered over the past decade. The stock of the leading offshore drilling operator posted a 10Y total return CAGR of -22.7%, as it demonstrated its value-destruction capability for investors.

However, RIG has outperformed the market since its October 2020 lows, as the crude oil market capitulated toward its COVID bottom. Hence, it offered astute investors who capitalized on the market’s extreme pessimism to ride the recovery through its March 2022 highs.

Despite the steep fall (down nearly 60%) to its September 2022 lows, RIG has still outperformed the broad market in 2022, with a YTD total return of 5.4%. Hence, the adage “past performance is not indicative of future results” has caused bullish RIG investors to conclude that its secular long-term downtrend could be well over.

Our analysis indicates that the market remains tentative over re-rating RIG. We also noted that the market had not reversed RIG’s long-term downtrend, indicating that investors need to be wary of being overly enthusiastic about its future performance.

Coupled with the increasing likelihood of a global recession that could cause further demand destruction in the energy markets, we believe it’s prudent to be cautious at the current levels.

We highlight critical levels that investors should watch moving ahead. RIG’s analysts continue to see robust revenue and profitability growth through FY24. However, the market has not responded in kind, as we believe the dominant theme surrounding demand destruction remains intact.

As such, we rate RIG as a Hold for now as we postulate its reward-to-risk profile remains well-balanced.

Street Analysts Remain Optimistic Over Transocean’s Prospects

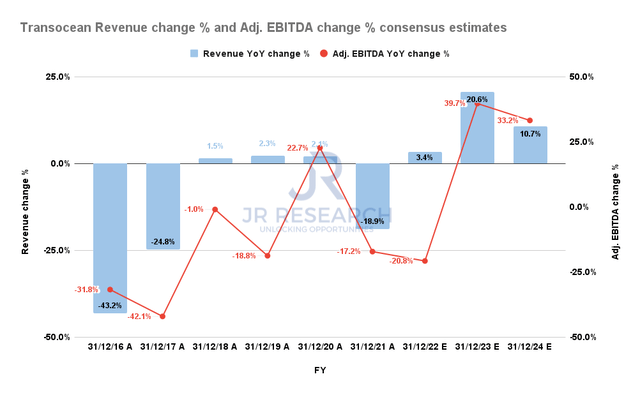

Transocean Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

As seen above, Street analysts are confident that the cyclical recovery for Transocean remains robust, as they project sustained revenue and adjusted EBTIDA growth through FY24.

Therefore, it has likely stunned investors that the market still decided to pummel RIG from its March highs. Furthermore, Transocean updated in a recent press release that its backlog of $7.3B (as of October 13) demonstrates strong visibility into its forward prospects.

However, Transocean also warned that downside volatility in the underlying energy markets could impact its operating performance. The company accentuated:

A slowdown in economic activity could further reduce worldwide demand for energy. These potential developments, or market perceptions concerning these and related issues, could adversely affect our financial position, results of operations or cash flows. An extended period of negative outlook for the world economy could further reduce the overall demand for oil and natural gas and for our services. (Transocean 10-Q)

Therefore, we believe it’s against this backdrop that the market anticipates further weakness in energy markets. In addition, the world is reeling from the impact of the Fed’s aggressive push to defeat inflation rapidly. As a result, we postulate that these market participants are pricing in the impact of a significant recession that could batter the forward operating performances of RIG.

Moreover, Chinese President Xi Jinping highlighted in his keynote of the 20th CPC National Congress over the weekend that China will not relent on its zero COVID strategy. As a result, it could increase the fears that soft oil demand from China could continue to impact the energy market’s weak outlook moving ahead.

Is RIG Stock A Buy, Sell, Or Hold?

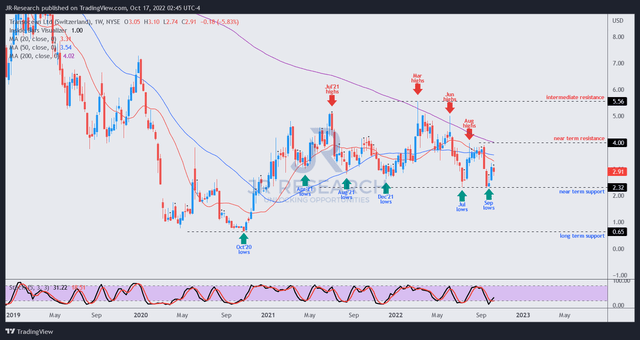

RIG price chart (weekly) (TradingView)

As seen above, the market has not shared the optimism of the Street analysts as RIG remains entrenched in a long-term downtrend, resisted by its 200-week moving average (purple line).

The rejection at its intermediate resistance level was significant as it demonstrated an astute bull trap (indicating the market rejected further buying upside) in March 2022. The market drew in buyers rapidly, anticipating buyers looking to capitalize on the Russia-Ukraine crisis back then. However, it proved to be a significant selling opportunity, corroborated by another bearish reversal in June.

Therefore, RIG remains embedded in a long-term downtrend, with a mean-reversion opportunity from its March 2020 capitulation levels. Despite robust forward estimates from the Street, the market has not changed its positioning.

We believe that the bear market rally in RIG has likely fizzled out decisively, with its near-term resistance possibly denying further buying upside.

Hence, investors are urged to watch the subsequent re-test of its near-term support, which RIG bulls are trying desperately to underpin. Losing that support zone decisively could force further selling pressure through the gap toward its long-term support, digesting RIG’s gains further.

Therefore, investors sitting on massive gains from its COVID lows are encouraged to consider taking some profits off the table. For now, new investors are urged to avoid buying the dips and watch from the sidelines.

As such, we rate RIG as a Hold.

Be the first to comment