pabst_ell

Note: I have covered Transocean (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

After the close of Wednesday’s regular session, leading offshore driller Transocean reported better-than-expected Q3 results with adjusted contract drilling revenues of $730 million coming in well ahead of the $670 million number projected by management on the Q2 conference call.

The outperformance was due to a combination of a larger-than-anticipated number of operating days, an early termination payment for the semi-submersible rig Transocean Equinox and higher customer reimbursables, partially offset by lower-than-expected revenue efficiency.

The company also exceeded bottom line expectations as Adjusted EBITDA increased to $268 million. In addition, Transocean generated an impressive $230 million in cash flow from operations partially due to favorable working capital movements and lower-than-expected operating and maintenance expense.

The company ended the third quarter with $954 million in unrestricted cash and cash equivalents and another $387 million in restricted cash.

Total liquidity including Transocean’s undrawn $774 million revolving credit facility amounted to approximately $2.1 billion.

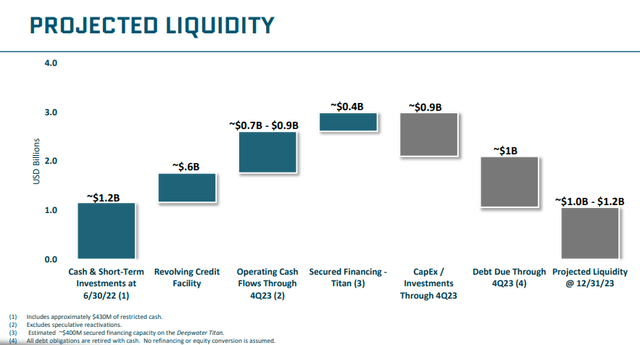

On the conference call, management affirmed its recently provided liquidity projections for year-end 2023:

Company Presentation

Keep in mind that the $1.0 billion to $1.2 billion range shown in the slide above includes $300 million in restricted cash and $600 million from the company’s revolving credit facility as well as the anticipated issuance of $400 million in new secured debt against the drillship Deepwater Titan in Q1/2023.

That said, adjusted contract drilling revenue is expected to drop by almost 20% sequentially to approximately $600 million next quarter. At the same time, operating and maintenance expenses are expected to increase by 7% quarter-over-quarter due to a number of scheduled maintenance activities having slipped from Q3 into Q4.

Even worse, capital expenditures are projected to increase by more than 500% sequentially to $575 million, mostly due to scheduled payments for the company’s newbuild 8th generation drillships Deepwater Atlas and Deepwater Titan.

As a result, the company’s year-end cash balances are likely to show a very substantial decline.

Transocean also provided initial guidance for next year:

- Adjusted contract drilling revenue: $2.9 billion to $3.0 billion

- Operating and maintenance expenses: $1.8 billion to $1.9 billion

- General and administrative expenses: $200 million

- Capital expenditures: $260 million

Due to the favorable combination of slightly increased contract drilling revenues and much lower capital expenditures, the company should return to substantial free cash flow generation in the second half of next year.

In his prepared remarks, CEO Jeremy Thigpen also confirmed the previously reported long-term contract awards for the drillships Deepwater Corcovado and Deepwater Orion offshore Brazil:

The much anticipated results of the Petrobras pool tender have been announced, and we are pleased to confirm that the Deepwater Corcovado and Deepwater Orion are among the 7 rigs that Petrobras selected for this work at day rates of $399,000 per day and $416,000 per day, respectively.

The period for public comment has passed, and we anticipate contracts will be signed in the coming weeks, at which time, we estimate we will add approximately $1 billion to our backlog.

In the Q&A session of the conference call, CFO Mark Mey tried his best to alleviate persistent debt and liquidity concerns with an aggressive timeline and increased amount for the anticipated secured debt issuance against the Deepwater Titan:

So we expect the rig to be delivered in the fourth quarter, probably later in the fourth quarter. Thereafter, the rig will mobilize to the U.S. Gulf of Mexico. Once the rig leaves Singapore, we plan to start working on a secured transaction. We said in the past that we could raise up to $400 million, that’s conservative. I would say it’s between $400 million and $500 million. And as the market has stabilized over the last, call it, 2.5, 3 weeks, we feel highly confident that we can achieve that. So you can expect to see this financing completed in the first quarter of next year right before the rig starts operating for Chevron.

Quite frankly, issuing secured debt against the rig without final customer acceptance doesn’t look like a viable option so the Deepwater Titan would have to commence its contract at some point in Q1 while the most recent fleet status report still shows Q2 as anticipated contract commencement date.

In the past, it has taken the company at least six months from formal contract commencement to close on the respective secured debt financing.

That said, after Transocean’s most recent debt and liquidity management measures and the issuance of an additional 16.2 million shares for net proceeds of $58 million during Q3, the company should be able to comply with the $500 million minimum liquidity covenant governing the revolving credit facility at the end of H1/2023 even without the proposed Deepwater Titan secured debt issuance closing in a timely manner.

Moreover, management stated its intent to not engage in further, potentially dilutive debt exchanges like the one executed two months ago which contributed to shares tumbling by 40% in the weeks following the transaction.

Even better, the company promised to abstain from selling additional shares into the open market under its recently established $435 million Equity Distribution Agreement with Morgan Stanley (MS) “absent any material increase in the trading price“.

Lastly, Transocean is exploring refinancing options for some of the company’s outstanding secured debt in order to extend maturities and improve near-term liquidity.

Not surprisingly, market participants cheered the company’s stated intent to abstain from further dilution for the time being thus causing shares to rally by 15% on heavy volume.

Bottom Line

While Transocean reported better-than-expected third quarter results with strong cash flow generation, management guided Q4 revenues well below the current analyst consensus. In addition, scheduled payments for the company’s newbuild 8th generation drillships will result in an eye-catching 500%+ sequential capex increase, thus causing liquidity to take a major hit.

But even without the proposed debt issuance against the drillship Deepwater Titan closing in a timely manner, recent liquidity management measures and additional open market share sales during Q3 are likely to keep the company from violating debt covenants in the first half of 2023.

Due to the favorable combination of increased contract drilling revenues and much lower capital expenditures, Transocean should return to substantial free cash flow generation in the second half of next year.

With the offshore drilling industry likely in the early innings of a multi-year growth cycle, I fully expect Transocean to resolve its long-standing debt and liquidity issues in due time.

While shares might be ripe for a breather after the 80% run from recent lows, investors should consider adding on any major weakness.

Personally, I decided to close out the remainder of my trading position which I accumulated at an average price well below $3 during the September sell-off.

Be the first to comment