Nastassia Samal

A few months ago, I wrote an article highlighting the potential value in Traegar, Inc. (NYSE:COOK) that was underappreciated by the market. While there’s no denying that the company’s fundamentals were poor, it was mostly because of a bloated cost structure.

Since my article, Traegar’s stock has rallied over 50% on the back of a takeover offer for a competitor, Weber Inc. (WEBR). While Traegar’s recent quarterly earnings were disappointing, it does not detract from the potential value inherent in its business and brand. Based on the offer on the table for Weber, there is still significant upside in Traegar’s stock.

Brief Company Background

For those not familiar, Traegar is the creator and category leader for high-end wood pellet grill. Wood pellet grills uses hardwood pellets as the fuel to grill and barbeque foods. This embeds a wood-fired flavor to the cooked foods that other kinds of gas and electric grills cannot replicated.

Quarterly Earnings Was Unsurprisingly Bad

Recently, Traegar reported their Q3/2022 earnings which continued to underwhelm investors. Revenues declined 42% YoY to $94 million and COOK reported a net loss of $210 million or $1.75 / share. Importantly, grill sales fell 64% YoY to $39 million while consumable sales were more stable, declining only 10% YoY to $25 million. Accessory sales actually increased $18% to $30 million, driven by the success the MEATER smart thermometer business.

Traegar’s poor Q3 results was not a surprise to me. In my prior article, I mentioned:

In an effort to turn around the business, Traeger also announced several strategic initiatives including workforce reductions (expected to save an annual $20 million), inventory clearance (will work with channel partners to align inventories with demand), and gross margin optimization. Inventory clearance will continue into early 2023 and gross margin initiatives will show benefits in 2023, so the next few quarters are expected to remain weak.

There were certainly signs of inventory clearance in the latest quarter, as Traegar’s gross margin was only 27.7% (or 29.4%, excluding one-time restructuring costs) versus 33.5% YoY and 36.7% in Q2/2022. Seasonally, Traegar’s margins are lowest in Q3, as the company works with channel partners to clear out summer inventory. The question now is whether Traegar’s actions have cleaned up 2022’s inventory, setting the stage for a recovery in 2023.

Inventory Levels Remain High

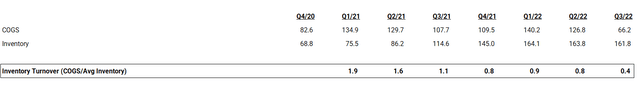

Unfortunately, inventory levels were still elevated at $162 million in the quarter, down marginally from $163 million in Q2/2022, but still 41% higher than $115 million in Q3/2021. Worryingly, Traegar’s inventory turnover slowed even further to only 0.4x in Q3/2022, down from 1.1x YoY and 0.8x QoQ (Figure 1).

Figure 1 – COOK inventory turnover (Author created with data from tikr.com)

According to the CEO on the earnings call, consumer demand for Traegar’s grills remained robust, but the issue for the company is that channel partners were aggressively destocking their inventory and have been slow to place new orders.

It is important to understand the magnitude of retailer destocking, which is the largest driver of the decline in our grill sales in the second half of 2022. We believe that more than 2/3 of the anticipated decline in grill sales in the second half of the year can be attributed to retailer destocking as opposed to lower levels of consumer demand.

– CEO Jeremy Andrus on Q3/2022 earnings call

Frustratingly, the company did not provide more clarity regarding channel inventory except to say it will take more time to work through: (author has highlighted the relevant sentences in the earnings call)

John Glass

First, can you just talk about what — to the extent you know what the channel inventory actually looks like now, maybe how it’s changed quarter-to-quarter given the promotional activity? Do you have reasonably good knowledge just given what you’ve sold to them and their sell-through or do you not really know exactly what [indiscernible] looks like?

Dom Blosil

No, we do. I mean at least for our larger accounts, we have good visibility into in-channel inventory levels. Some of our smaller accounts like specialty, we talked about in the past, where they don’t have the capacity to carry a lot of inventory. And so we’re less concerned with that long tail of specialty.

But as we measure in channel inventory levels across our largest accounts, which obviously make up a majority of the business and where we have the best information within kind of the sell-through data that we collect, we are seeing sequential improvements over Q2 on that front. And it really varies from SKU to SKU or certain SKUs are heavier and other SKUs are actually finding a path toward a more kind of rightsized level. And so it’s a continued kind of progression as we help our retailers work through these inventory levels and channel, posting promotions helps accelerate that. But part of this is really going to be about time, right? And kind of letting these inventory levels work through accordingly at the cost of some revenue.

And that will be the biggest lever, especially when we head into Q1 and Q2 of next year where we start to really ramp up volumes. And that will, in turn, accelerate the bleed down of in-channel inventory levels as well as help improve our own balance sheet.

– Exchange between Dom Blosil the CFO and John Glass, an analyst at Morgan Stanley

Costs Still Far Too High

One of my main criticisms of Traegar (and the main opportunity) is its bloated cost structure relative to the company’s revenues. On this front, the company did attempt some cuts in the quarter, with layoffs and cost cuts amounting to annualized savings of $20 million. Traegar also ‘brought down’ SG&A to $96 million in Q3/2022 vs. $124 million YoY. However, SG&A actually increased QoQ by 33%.

As a slap in the face to beleagured investors with the stock down 64% YTD, part of the reason the G&A expenses remained so high was because of a $6.4 million YoY increase in equity-based compensation to the CEO and certain directors arising from current period modifications to their equity awards. As the 10-Q is not yet available, I wasn’t able to figure out what was modified in the stock awards plan to justify the increase in equity compensation.

Nonetheless, with LTM SG&A expenses of $326 million vs. LTM gross profits of only $250 million, Traegar’s cost structure is clearly not sustainable and further cuts will have to be made.

Weber Take-Over Offer Read-through

The main reason I held a bullish view on Traegar was because I could clearly see the issue with Traegar (bloated costs), and a possible solution (a corporate takeover). On this front, we saw some interesting developments in the industry in the last few months. BDT, the majority owner of Weber, a large grill competitor, offered to take Weber private for $6.25 / share.

The $6.25 offer for Weber is approximately a 55% discount to the company’s IPO price of $14 / share back in August 2021. By the same simple metric, Traegar’s stock looks cheap, as Traegar IPO’d at $18 / share and is now trading for only ~$4 (note, Traegar was trading sub $3 when I wrote my prior article).

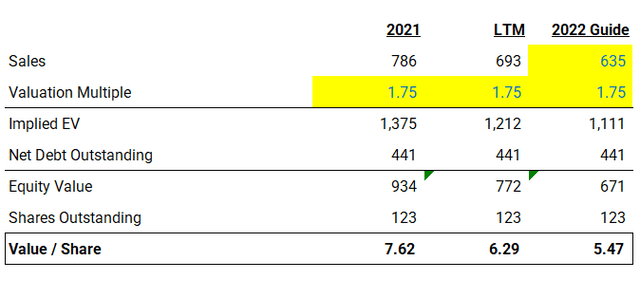

A $6.25 offer for Weber would value the company at $1.8 billion market cap or $3.1 billion enterprise value vs. LTM sales of $1.77 billion or 1.75x EV/Sales (Weber has negative LTM earnings and EBITDA, so it is difficult to analyzing using normal valuation metrics).

Using 1.75x LTM EV/Sales to value Traegar, the implied value for Traegar stock would be $6.29 / share. Even if we are conservative and apply the multiple to the low range of management’s guidance for 2022 revenues of $635 million, Traegar equity still has an implied value of $5.47 / share, far above the current share price (Figure 2).

Figure 2 – Traegar implied value from WEBR takeover offer (Author created with data from tikr.com)

Of course, this is all hypothetical, as there are currently no offers on the table for Traegar. However, this analysis does highlight the potential value in Traegar’s brand and established manufacturing and sales infrastructure.

Technicals Trying To Bottom

Technically, Traegar’s stock is trying to complete a bearish to bullish reversal. My prior article on August 31st coincided with the absolute low on the stock price, and Traegar has rallied to the 150DMA on the back of the Weber takeover offer rumour/news earlier in October (Figure 3).

Figure 3 – Traegar trying to form a bearish to bullish reversal (Author created with price chart from stockcharts.com)

Encouragingly, despite the poor Q3/2022 earnings results that drove the stock down 26% at one point, Traegar’s stock rallied back to close only marginally lower. This indicates potential exhaustion from sellers.

Conclusion

While Traegar’s recent quarterly earnings were disappointing, it does not detract from the potential value inherent in the business and brand. A recent takeover offer for Weber, a competing grill business, highlights the potential upside in Traegar’s stock. I suspect the Weber offer may have triggered some hard goods manufacturers to take a closer look at Traegar. At a minimum, investment bankers must be working overtime and furiously putting together M&A models of Traegar combined with company X , Y, or Z.

Be the first to comment