ZoltanGabor/iStock via Getty Images

This article is first in a series that provides an ongoing analysis of the changes made to Fundsmith’s 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 5/16/2022.

Fundsmith was founded by Terry Smith in 2010. The flagship Fundsmith Equity Fund has returned 15.8% annualized compared to 11.2% for the MSCI World Index through 6/30/2022. The fund has underperformed in 2022: Negative 17.8% compared to Negative 11.3% for the MSCI World Index. Assets Under Management (AuM) is at around $53B. Their primary selection criterion is to choose securities that are estimated to have the ability to sustain high returns on operating capital employed. This has resulted in a concentrated portfolio of global stocks that has been held over the long-term. The setup has benefited from the magic of compounding.

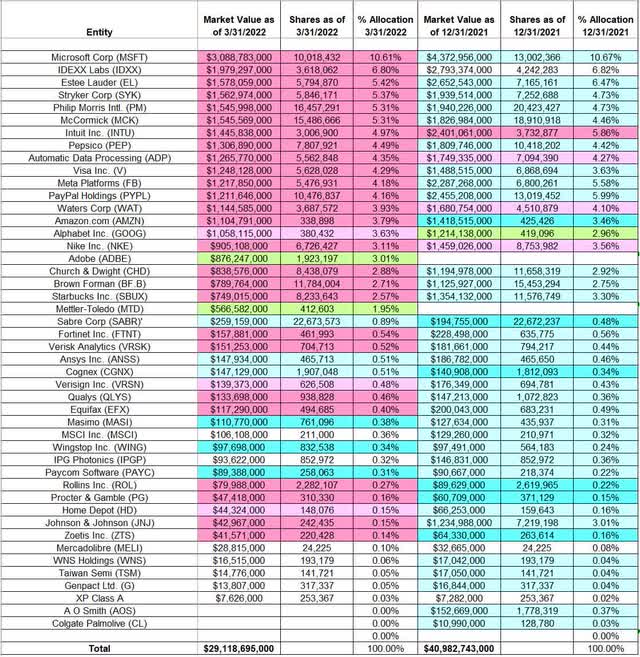

This quarter, Fundsmith’s 13F portfolio value decreased ~29% from $40.98B to $29.12B. The number of holdings remained steady at 44. The top three holdings are at ~23% while the top five are close to ~34% of the 13F assets: Microsoft, IDEXX Labs, Estee Lauder, Stryker Corp, and Philip Morris International.

New Stakes:

Adobe Inc. (ADBE): ADBE is a ~3% of the portfolio position purchased this quarter at prices between ~$412 and ~$564 and the stock currently trades below that range at ~$389.

Mettler-Toledo (MTD): The ~2% MTD stake was purchased this quarter at prices between ~$1289 and ~$1675 and the stock currently trades below that rang eat ~$1221.

Stake Disposals:

A. O. Smith (AOS) and Colgate-Palmolive (CL): These two minutely small (less than ~0.5% of the portfolio each) stakes were disposed this quarter.

Stake Increases:

ANSYS, Inc. (ANSS), Cognex Inc. (CGNX), and Sabre Corp. (SABR): These very small (less than ~1% of the portfolio each) positions were increased this quarter.

Note: they have a ~7% ownership stake in Sabre Corp.

Masimo Corporation (MASI), Paycom Software (PAYC), and Wingstop Inc. (WING): These minutely small (less than ~0.50% of the portfolio each) stakes were increased during the quarter.

Stake Decreases:

Microsoft Corp. (MSFT): MSFT is currently the largest position at 10.61% of the portfolio. The stake was built during the five-year period from 2013 to 2018 at prices between ~$27 and ~$115. Since then, the activity had been minor. There was a ~23% selling this quarter at prices between ~$276 and ~$335. The stock currently trades at ~$268.

IDEXX Labs (IDXX): IDXX is the second largest position at 6.80% of the portfolio. It was established during the 2015-16 timeframe at prices between ~$63 and ~$120. Since then, the position had remained relatively steady although adjustments were made in most quarters. There was a ~15% trimming this quarter at prices between ~$466 and ~$631. The stock currently trades at ~$379.

Estee Lauder (EL): The top three 5.42% EL stake was established in 2016 at prices between ~$75 and ~$95. 2018 saw a two-thirds stake increase at prices between ~$125 and ~$158. Since then, the activity had been minor. There was a ~20% selling this quarter at prices between ~$250 and ~$372. The stock currently trades at ~$252.

Philip Morris International (PM) and Stryker Corp. (SYK): These two top-five stakes were built during the last decade through consistent buying every quarter. Both positions saw selling this quarter. The 5.31% PM stake was established at prices between ~$60 and ~$120. This quarter saw a ~20% selling at prices between ~$89 and ~$112. The stock is now at ~$94. SYK is a 5.37% of the portfolio position purchased at prices between ~$50 and ~$275. There was a ~20% reduction this quarter at prices between ~$245 and ~$278. The stock currently trades at ~$201.

McCormick Inc. (MKC): MCK is a large 5.31% of the portfolio position built during the 2018-19 timeframe at prices between ~$108 and ~$177. The time period since had also seen minor buying. There was a ~18% reduction this quarter at prices between ~$245 and ~$311. The stock currently trades at ~$331.

Note: they have a ~6.2% ownership stake in the business.

Intuit Inc. (INTU): INTU is a fairly large ~5% of the portfolio stake built during the 2017-18 timeframe at prices between ~$115 and ~$225. Since then, the position had remained relatively steady although adjustments were made in most quarters. Last two quarters have seen a ~35% reduction at prices between ~$425 and ~$695. The stock currently trades at ~$407.

PepsiCo (PEP): The 4.49% PEP stake was built over the last decade through consistent buying during most quarters. The buying happened at prices between ~$65 and ~$170. There was a ~25% reduction this quarter at prices between ~$154 and ~$176. The stock is now at ~$172.

Automatic Data Processing (ADP): The 2013-19 timeframe saw consistent buying in ADP at prices between ~$52 and ~$173. Q1 2020 saw a ~40% selling at prices between ~$112 and ~$181 while in the next quarter there was a ~70% increase at prices between ~$128 and ~$160. Since then, the activity had been minor. This quarter saw a ~22% reduction at prices between ~$196 and ~$245. The stock is now at ~$217.

Visa Inc. (V): Visa is a 4.29% of the portfolio position built over the last decade through consistent buying in most years at prices between ~$30 and ~$245. This quarter saw a ~18% selling at prices between ~$191 and ~$235. The stock currently trades at ~$204.

Meta Platforms (META), previously Facebook: The 4.18% META stake was built in 2018 at prices between ~$125 and ~$210. The stake had remained steady since although adjustments were made in most quarters. There was a ~20% reduction this quarter at prices between ~$187 and ~$339. The stock currently trades at ~$171.

PayPal Holdings (PYPL): The bulk of the 4.16% PYPL position was built in the 2015-16 timeframe at prices between ~$32 and ~$44. The next two years saw incremental buying and since then the position had been kept relatively steady. There was a ~20% reduction this quarter at prices between ~$94 and ~$195. The stock currently trades at $73.43.

Waters Corp. (WAT): WAT is a ~4% of the portfolio stake built during the 2015-2017 timeframe at prices between ~$115 and ~$200. Next two years also saw incremental buying. There was a ~23% selling in H1 2020 at prices between ~$175 and ~$240. Since then, the activity had been minor. There was a ~18% reduction this quarter at prices between ~$307 and ~$365. The stock currently trades at ~$346.

Note: they have a ~6% ownership stake in Waters Corp.

Amazon.com, Inc. (AMZN): The 3.79% AMZN stake was built during the last two quarters at prices between ~$160 and ~$186. This quarter saw a ~20% selling at prices between ~$136 and ~$170. The stock is now at ~$116.

Alphabet Inc. (GOOG) (GOOGL): GOOG is a 3.63% of the portfolio position purchased last quarter at prices between ~$2665 and ~$3015. There was a ~9% trimming this quarter. The stock currently trades at ~$2403.

NIKE Inc. (NKE): The 3.11% NKE stake was built in H1 2020 at prices between ~$67 and ~$105. There had been minor buying in most quarters since. This quarter saw a ~23% reduction at prices between ~$118 and ~$166. The stock is now at ~$108.

Church & Dwight Co., Inc. (CHD): The 2.88% CHD position was built during the three quarters through Q2 2021 at prices between ~$72 and ~$93. There was a ~28% selling this quarter at prices between ~$95 and ~$104. The stock currently trades at $94.71.

Brown-Forman (BF.B): BF.B is a 2.71% of the portfolio stake built in 2019 at prices between ~$45 and ~$68. Last year saw a ~50% stake increase at prices between ~$67 and ~$81 while this quarter there was a ~28% selling at prices between ~$62 and ~$72. The stock is now at $70.16.

Starbucks Inc. (SBUX): The 2.57% SBUX stake was built in 2020 at prices between ~$58 and ~$103. Last year saw incremental buying while in this quarter there was a ~30% reduction at prices between ~$79 and ~$117. The stock currently trades at $79.28.

Equifax Inc. (EFX), Fortinet, Inc. (FTNT), Home Depot (HD), Johnson & Johnson (JNJ), Procter & Gamble (PG), Qualys, Inc. (QLYS), Rollins, Inc. (ROL), Verisk Analytics (VRSK), VeriSign, Inc. (VRSN), and Zoetis Inc. (ZTS): These very small (less than ~0.55% of the portfolio each) stakes were reduced during the quarter.

Kept Steady:

Genpact Ltd. (G), IPG Photonics (IPGP), MSCI Inc. (MSCI), MercadoLibre (MELI), Taiwan Semi (TSM), WNS (Holdings) (WNS), and XP Class A: These minutely small (less than 0.5% of the portfolio each) positions were kept steady this quarter.

The spreadsheet below highlights changes to Fundsmith’s 13F holdings in Q1 2022:

Terry Smith – FundSmith’s Q1 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment