Cindy Ord

This article is part of a series that provides an ongoing analysis of the changes made to Gabelli Funds’ 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 11/10/2022. Please visit our Tracking Mario Gabelli’s Gabelli Funds 13F Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q2 2022.

Assets Under Management (AUM) is at around $33B. Their 13F portfolio is diversified with over 1400 positions in recent reports. Around 42 of them are sized above 0.5% of the portfolio and they are the focus of this article.

This quarter, Gabelli Funds’ 13F portfolio decreased ~7% from $13.02B to $12.13B. The top five holdings are at ~7% of the 13F assets: NextEra Energy, Microsoft, National Fuel Gas, Genuine Parts Company, and MasterCard.

Stake Increases:

NextEra Energy (NEE): NEE is currently the largest 13F position at ~2% of the portfolio. It was built during 2011 in the low-teens price range. The next several years saw minor trimming at higher prices. 2020 saw an about turn: ~250% stake increase at prices between ~$48 and ~$77. The five quarters through Q1 2022 had seen a ~10% trimming at prices between ~$71 and ~$93. Last two quarters saw a ~16% stake increase at prices between ~$69 and ~$91. The stock currently trades at $84.32.

Newmont Corporation (NEM): NEM is a 0.86% of the portfolio long-term stake that has been in the portfolio for well over a decade. The position has wavered. Recent activity follows. Q2 2020 saw a ~12% selling at prices between ~$47 and ~$68. Last nine quarters have seen only minor adjustments. The stock currently trades at $45.49.

Paramount Global (PARA): The 0.41% of the portfolio position in PARA has been in the portfolio for well over a decade. The bulk of the current position was purchased in 2019 at prices between ~$36 and ~$53. There was a ~10% trimming next year at prices between ~$12 and ~$41. That was followed with a one-third selling in Q1 2021 at prices between ~$36 and ~$97. Since then, the activity has been minor. The stock currently trades at ~$18.

Aerojet Rocketdyne (AJRD), Allegheny Corp, Bank of New York Mellon (BK), Lennar Holdings (LEN.B), Southwest Gas Holdings (SWX), and UnitedHealth (UNH): These small (less than ~0.75% of the portfolio each) stakes were increased during the quarter.

Stake Decreases:

Microsoft Corp (MSFT): MSFT is a top-three 1.34% long-term stake. Last major activity was in the 2011-12 timeframe when there was a ~20% reduction in the high-20s. There has been minor selling since. Last seven quarters have seen a ~7% trimming. The stock currently trades at ~$242.

National Fuel Gas (NFG): The 1.23% of the portfolio NFG stake was built in the 2011-12 timeframe at prices between ~$43 and ~$75. The stake had seen minor trimming since. Last ten quarters had seen a ~25% reduction at prices between ~$38 and ~$74. The stock currently trades at $63.40. There was marginal trimming this quarter.

Genuine Parts Company (GPC): GPC is a 1.22% of the portfolio stake built in 2011 in the high-50s price-range. The stake had seen trimming since. Last four quarters have seen a ~5% trimming. The stock is now at ~$180.

MasterCard Inc. (MA): The 1.15% of the portfolio MA stake saw a ~47% selling during the 2016-20 timeframe at prices between ~$85 and ~$365. Last seven quarters have also seen a ~14% reduction at prices between ~$283 and ~$393. The stock currently trades at ~$343. They are harvesting gains.

Deere & Company (DE): DE is a 1.14% of the portfolio long-term stake. The last decade has seen consistent selling every year. The period since 2010 saw the original position reduced by ~75% at prices between ~$75 and ~$445. The stock is currently at ~$406. They are harvesting gains.

Ametek Inc. (AME): AME is a 1.14% of the portfolio position built in the 2011-12 timeframe at prices between ~$22 and ~$40. Since 2015, there has been a ~40% selling at prices between ~$44 and ~$148. The stock is now at ~$139. They are harvesting gains. There was marginal trimming this quarter.

Apple Inc. (AAPL): AAPL is a long term 1.13% of the portfolio stake. 2016 saw a ~50% stake increase in the mid-20s price range. 2017-2019 timeframe saw a ~60% reduction at prices between ~$30 and ~$74. Since then, the activity had been minor. The stock currently trades at ~$149. There was a ~6% trimming this quarter.

Alphabet Inc. (GOOG): GOOG is currently the largest 13F position at 1.12% of the portfolio. It was established in 2016 at prices between ~$34 and ~$40. There has been minor selling since. Recent activity follows. Last seven quarters have seen a ~20% trimming at prices between ~$87 and ~$150. The stock currently trades at ~$99.

American Express (AXP): AXP is a ~1% long-term position that saw a ~50% selling over the 2017-2020 timeframe at prices between ~$74 and ~$135. Last seven quarters have also seen a ~17% reduction at prices between ~$114 and ~$198. The stock is now at ~$153.

GATX Corp. (GATX): GATX has been in the portfolio for well over a decade. 2011 saw a roughly one-third stake increase at prices between ~$31 and ~$44. The 2014-16 timeframe saw a ~11% selling at prices between ~$36 and ~$63. The period since 2018 have seen another ~22% reduction at prices between ~$55 and ~$125. The stock is now at ~$109.

Sony Group (SONY): The 0.82% of the portfolio SONY stake was built in the 2013-14 timeframe at prices between ~$11 and ~$22. Since 2019, there have been a 40% selling at prices between ~$42 and ~$126. The stock currently trades at $81.14. They are harvesting gains.

Diageo plc (DEO): DEO was a fairly large stake that has been sold down over the last decade through minor trimming in most quarters. Recent activity follows. 2020 saw a ~12% selling at prices between ~$110 and ~$171. Last few quarters had seen minor increases. The stock is now at ~$176 and the stake is at 0.78% of the portfolio. There was marginal trimming this quarter.

AES Corporation (AES): AES is a 0.70% of the portfolio long-term stake that has remained remarkably steady although adjustments were made in most quarters. The stock currently trades at ~$28.

Amazon.com (AMZN): AMZN is a very long-term stake. The original position was sold down in 2011 and rebuilt in the 2013-14 timeframe in the mid-teens price-range. The stake has wavered. Recent activity follows. 2020 saw a ~10% stake increase at prices between ~$89 and ~$170. Last six quarters had seen a similar increase at prices between ~$104 and ~$185 through consistent buying in most quarters. The stock is now at ~$97 and the stake is at 0.68% of the portfolio. There was a ~4% trimming this quarter.

Honeywell International (HON): HON is a 0.60% of the portfolio long-term stake that has seen selling since 2015. The 2016-2019 timeframe saw a combined ~55% reduction at prices between ~$104 and ~$182. Next year saw another ~38% selling at prices between ~$113 and ~$215. 2021 had also seen minor trimming while the last two quarters saw a marginal increase. The stock currently trades at ~$214. There was marginal trimming this quarter.

S&P Global Inc. (SPGI): SPGI is a 0.50% of the portfolio long-term stake. The position had been sold down through consistent trimming. The 2016-2020 timeframe saw a ~38% reduction at prices between ~$85 and ~$365. Recent activity follows. There was a ~10% stake increase in Q1 2021 at prices between ~$306 and ~$363. That was followed with a ~8% increase in Q1 2022 at prices between ~$373 and ~$461. The stock currently trades at ~$354. Last two quarters saw minor trimming.

Liberty Global (LBTYK): LBTYK is a 0.48% of the portfolio stake. The bulk of the current stake was built in 2014 at prices between ~$30 and ~$40. It was sold down by ~30% next year at prices between ~$33 and ~$43. Last major activity was a ~16% stake increase in H2 2021 at prices between ~$25 and ~$30. The stock is now at $20.43. There was minor trimming in the last two quarters.

Berkshire Hathaway (BRK.B), Brown Forman (BF.B), CNH Industrial (CNHI), CVS Health (CVS), Eversource Energy (ES), Evergy Inc. (EVRG), Mondelez International (MDLZ), Mueller Industries (MLI), PNM Resources (PNM), Republic Services (RSG), Rollins Inc. (ROL), Verizon Inc. (VZ), WEC Energy Group (WEC), and Xylem Inc. (XYL): These small (less than ~1% of the portfolio each) stakes were reduced during the quarter.

Kept Steady:

Crane Holdings Company (CR): The 0.66% of the portfolio CR stake is a long-term position. The sizing peaked at ~1.35M shares in 2011 but has seen selling since. Recent activity follows. There was a ~13% selling in 2020 at prices between ~$40 and ~$88. The stock is now at ~$105.

American Electric Power (AEP): The very small 0.96% stake in AEP was kept steady this quarter.

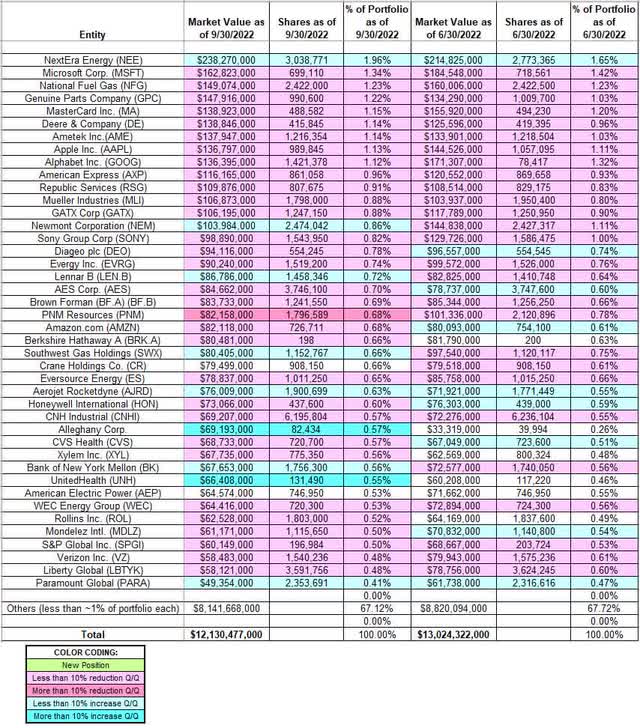

The spreadsheet below highlights changes to Gabelli Funds’ 13F holdings in Q3 2022:

Mario Gabelli – Gabelli Fund Management’s Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Gabelli Funds’ 13F filings for Q2 2022 and Q3 2022.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment