Kruck20

This article is part of a series that provides an ongoing analysis of the changes made to Fairholme’s 13F stock portfolio on a quarterly basis. It is based on Fairholme’s regulatory 13F Form filed on 11/14/2022. Please visit our Tracking Bruce Berkowitz’s Fairholme Fund Holdings article for an idea on how his holdings have progressed over the years and our previous update for the fund’s moves during Q2 2022.

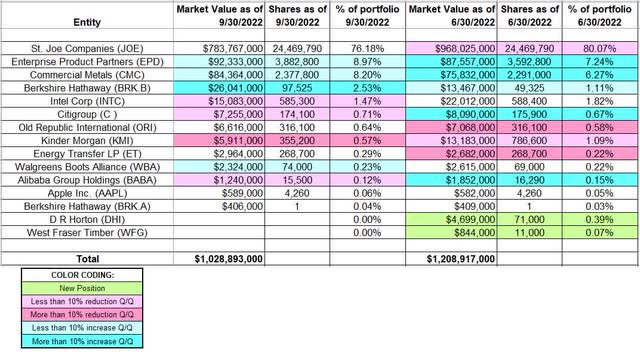

Berkowitz’s 13F stock portfolio value decreased ~15% from $1.21B to $1.03B this quarter. The 13F portfolio currently has most of the assets invested in St. Joe Company.

Berkowitz’s flagship Fairholme Fund (MUTF:FAIRX) has generated significant alpha since its December 1999 inception: the fund returned at an annualized rate of 9.18% compared to 6.32% for S&P 500 index through H1 2022. FAIRX has however underperformed over the most recent 10-year period. The other funds under Fairholme umbrella are Fairholme Focused Income Fund (MUTF:FOCIX) and Fairholme Allocation Fund (MUTF:FAAFX). Equity holdings that are not in the 13F report include Fannie Mae (OTCQB:FNMA) pfds, Freddie Mac (OTCQB:FMCC) pfds, and Imperial Metals (OTCPK:IPMLF).

New Stakes:

None.

Stake Disposals:

D. R. Horton (DHI) and West Fraser Timber (WFG): These minutely small (less than ~0.5% of the portfolio each) positions were disposed this quarter.

Stake Increases:

Commercial Metals (CMC) and Enterprise Products Partners (EPD): The 8.20% of the portfolio stake in CMC was built over the last five quarters at prices between ~$29 and ~$44 and the stock currently trades at $48.22. This quarter saw a ~4% increase. EPD is a ~9% of the portfolio position primarily built over the last four quarters at prices between ~$21 and ~$28. The stock is now at $23.39. There was a ~8% increase this quarter.

Berkshire Hathaway (BRK.A) (BRK.B): Q1 2019 saw a 5.6% of the portfolio stake purchased at prices between $188 and $209. The position was reduced by ~85% to a very small 0.84% portfolio stake next quarter at prices between $197 and $219. Q1 2020 saw a ~9% portfolio stake built at prices between ~$162 and ~$230. There was a one-third increase next quarter at prices between $170 and $202. Q4 2020 saw a ~80% selling at prices between ~$201 and ~$234. That was followed with a ~15% reduction next quarter at prices between ~$227 and ~$265. This quarter saw the stake almost doubled at prices between ~$264 and ~$307. The stock currently trades at ~$302 and the stake is now at 2.57% of the portfolio.

Walgreens Boots Alliance (WBA): The minutely small 0.23% of the portfolio stake in WBA saw a ~7% stake increase this quarter.

Stake Decreases:

Intel Corp. (INTC): The 1.47% INTC stake was purchased over the last four quarters at prices between ~$45 and ~$68. The stock currently trades well below that range at $26.44. There was marginal trimming this quarter.

Citigroup (C): The 0.71% Citigroup stake was built over the last three quarters at prices between ~$44 and ~$73. The stock currently trades at $43.81. There was a minor ~1% trimming this quarter.

Kinder Morgan (KMI): The 0.57% KMI position saw a ~220% stake increase in Q4 2020 at prices between ~$11.50 and ~$15 and it currently trades above at $17.61. H2 2021 saw a ~57% stake increase at prices between ~$15.25 and ~$18.70. There was a ~25% selling in Q1 2022 at prices between $16.35 and $19.25. That was followed with a ~60% reduction this quarter at prices between ~$16 and ~$19.25.

Alibaba Group Holdings (BABA): The minutely small 0.12% stake in BABA saw a minor ~5% trimming this quarter.

Kept Steady:

St. Joe Company (JOE): ~76% of Fairholme’s 13F assets are in St. Joe stock. The bulk of the position was purchased in the 2008-2009 timeframe and there have only been minor adjustments since. Last three quarters of 2017 had seen a combined ~14% increase at prices between $16.35 and $19.55. Since then, the activity has been minor. The stock is now at $37.76. There was marginal trimming in the last three quarters. They control ~42% of the business.

Note: Fairholme’s 2022 semi-annual report had the following on St. Joe: Although supply-chain issues have slowed progress there is no letup in demand.

Old Republic International (ORI): The very small 0.64% stake in ORI was increased by ~60% in Q4 2021 at prices between ~$23 and ~$26. The stock currently trades at $23.71. There was a ~15% trimming last quarter.

Apple Inc. (AAPL) and Energy Transfer LP (ET): These two minutely small (less than ~0.25% of the portfolio each) positions were kept steady this quarter.

The spreadsheet below highlights changes to Fairholme’s 13F stock holdings in Q3 2022:

Bruce Berkowitz – Fairholme Capital Management’s Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment