mysticenergy

Two years ago, if you would have told me that the largest natural gas producer in Canada would be yielding over 10% (and healthily), I would have called you crazy. Now picture that stock going from under $10 to over $80 in the same time frame and you’d find yourself looking at Tourmaline Oil (OTCPK:TRMLF) or (TSX:TOU:CA). The 5th largest natural gas producer has come a long way and remains a solid buy for the long run. The company is going to continue to print money so long as commodity prices remain where they are, and shareholders will have to do nothing to reap the rewards. Sit back, relax, and count the money.

Because the company’s primary listing is on the TSX in Canada, this article will be in reference to that share price as well as all $’s are in $CAD.

How’s The Dividend?

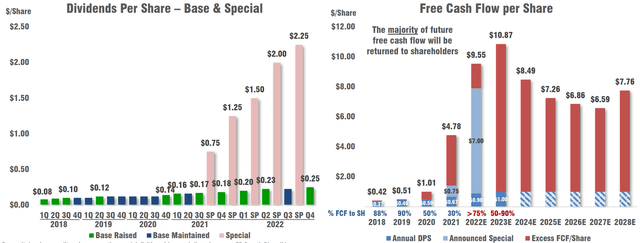

If Tourmaline has done anything, it’s kept its word. Shareholders have been getting paid. For all of 2022, shareholders will see $7.91 per share in dividends. For reference, in 2021 shareholders saw $1.42. No, the yield isn’t through the roof, it’s the special dividends that have been paying off. On the 3rd, Tourmaline announced that they would be increasing the dividend by 11% to $0.25 per quarter. They are also paying a special dividend of $2.25 per share. Payable Nov. 18; for shareholders of record Nov. 9; ex-div Nov. 6. This is the 5th special dividend. There has been an announcement every quarter and every quarter it has grown.

While the stock only yields about 1.2%, when you add in all the special dividends it jumps to just under 10% on the year, which isn’t too shabby. The good news is that it isn’t over either. I really like the model they have rolled out at this point. What this allows is for the company to stay in control without over-promising the dividend. Sure it’s tougher to buy as an “income” stock when the majority of the yield is coming in the form of special dividends, but it’s hard to ignore the cash flow story going forward. The company is focused on returning free cash flow to shareholders, and that’s obvious. But, besides dividends, free cash flow will be allocated towards maintaining a pristine balance sheet, high-return infrastructure investment opportunities, accretive bolt-on M&A, and modest exploration.

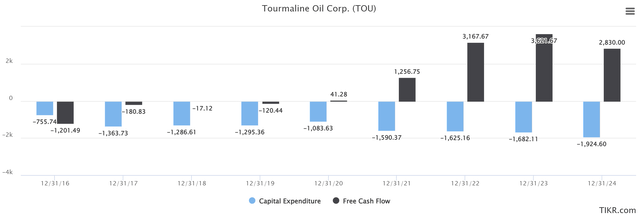

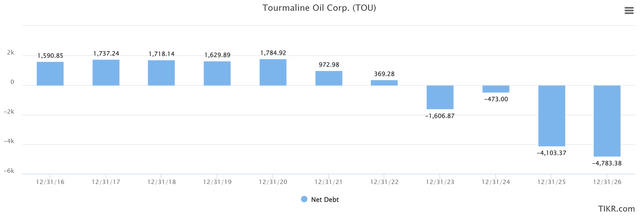

Looking above, you can see that there isn’t a huge appetite to increase CapEx by a large margin. This is crucial because it means they are really happy with where things are at and will continue to grow production at an appropriate rate. The Q4 2022 production forecast is 525,000 – 530,000 boepd. Meanwhile, the 2023 production forecast is 545,000 boepd. The company is expected to be debt-free next year and finish this year with a leverage ratio of 0.07x. It’s incredible to see these massive companies approach the point of being debt free. As I’m sure you know, the costs associated with running an Oil & Gas firm are enormous.

How Stable Is It?

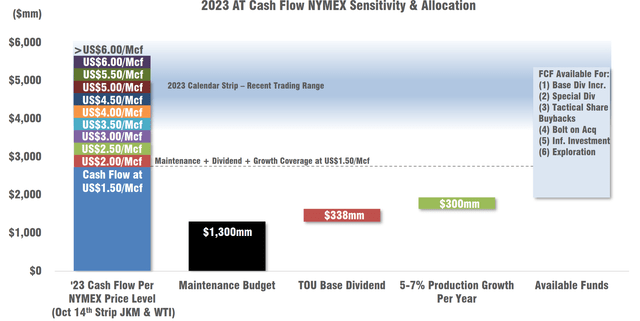

I mentioned that keeping the base dividend small is a good thing. The image below really outlines why. It provides stability across the organization (and shareholders) down to US $2.00/Mcf. Meaning that the commodity price would have to collapse by over 50% for there to be a real risk for a dividend cut. The image below really puts everything into perspective. The company will do what they feel is best for shareholders with the excess cash, and I would say they have done a fantastic job of proper allocation thus far.

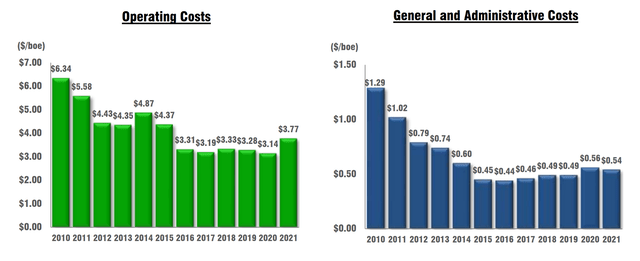

The other piece of the stability is the general costs involved with running the largest gas producer in Canada. Tourmaline has the lowest effective interest rate/borrowing costs in the North American energy sector. Out of EVERYONE! Let that sink in. $450mm of long-term public debt issued at ~2.30% maturing in 2028 & 2029. 2022 aggregate effective interest rate is expected to be ~3%. Looking below we can see that the costs have come down from where they were during the previous oil & gas boom. While commodity prices are back to where they once were, operating costs are not. It is incredible what Tourmaline has done.

What Does The Price Say?

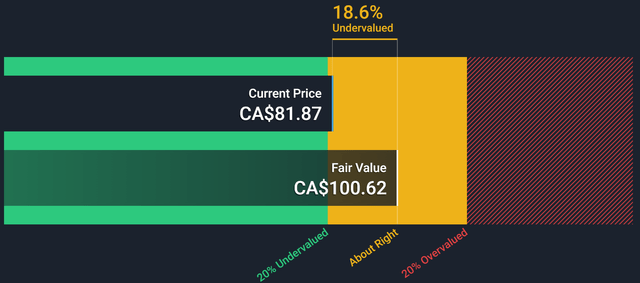

You have to love when the picture you paint comes to reality. When I last wrote on Tourmaline back in February, the share price was $46 and the fair value was around $74. I mentioned then that I wasn’t sure we would see $74, and definitely not quickly. Fast forward to today and we are seeing it trade at over $80. Crazy! We have entered into the realm of where it is coming in as “about right”. This is why it wouldn’t be a top pick for me at this point as I’m not sure how much more it could run. The stock is up about 100% on the year to this point and that alone is extremely impressive.

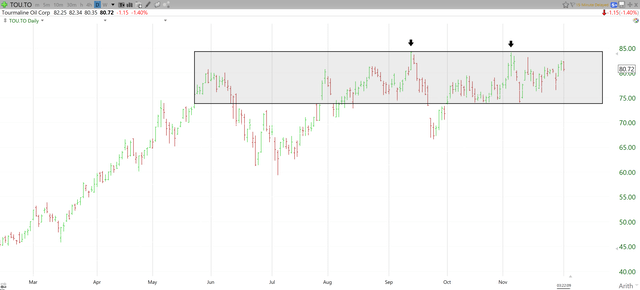

While I still have a buy rating on the stock, let me dive into why I’m not buying right this moment. Looking below we can see the box I have drawn. Now, it’s not been a perfect trading range over the last 6 months, but it has been over the last two. We have seen a re-test of the previous high and multiple tests off the low end. What I will wait for here is a clear signal that we are going higher, and that’s a breakthrough on the top end. We need to see $84.33 fall and then I will get excited about $100. I do think the stock will get to $100, the question is just when.

There is absolutely nothing wrong with creating a base like this. It is actually bullish in the long term as it provides really strong support for the next leg up. But with the momentum not carrying it anywhere in the last 6 months, it’s hard to get really excited about from a technical perspective.

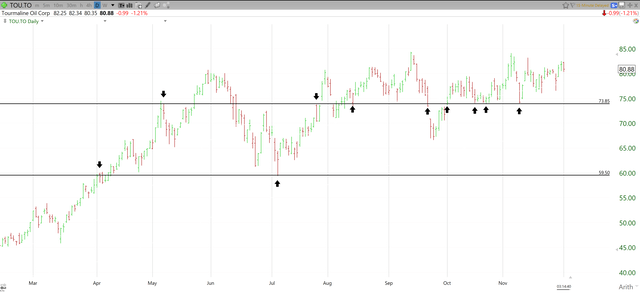

With respect to where I would have stops, the first point is very clear and that’s $73.85. Regardless of how long you have been in Tourmaline, $73.85 should be your first point. Whether that’s 50% or a full-on stop depends on just how up you are overall. It’s only about 9% from current levels which doesn’t leave a ton of space for error, but looking below you can see why this is important given all the support and resistance we have seen there over the last few months. Lastly, $59.50. This was the level I pointed out back in February based on the previous all-time high. We saw some turbulence as we first broke the level before accelerating to $80. Shortly thereafter we crashed right back to $59.50 but rebounded very strongly. A break of this level would almost certainly be a sign of worse things to come and a great point to lock in long-term profits and move on. It’s about 25% from current levels.

Wrap-Up

As you can see, there is a lot to like about what Tourmaline has done, and continues to do. This isn’t a company that is going to go away. They have been extremely diligent in their balance sheet management and it is finally paying off for shareholders. I think the special dividends will continue and I trust that the company will continue to make good decisions with the shareholder at the center of said decisions. While I am not buying right now based on the technicals, if you’re in it for the long run, you can tuck this away in a long-term account and sleep well at night. One of the best oil & gas companies out there.

Be the first to comment