onurdongel

(Note: This article was in the newsletter on September 12, 2022. This is a Canadian company that reports in Canadian dollars unless otherwise noted.)

Topaz Energy (OTCPK:TPZEF) is a relatively new issue that was brought public by Tourmaline Oil (OTCPK:TRMLF). Such backing by an established company often considerably lowers the new issue risk present in a lot of newly public companies. The company further lowers typical oil and gas risk through the purchase of overriding royalty interests and midstream interests in Canada. This particular market is not as well developed in Canada as it is in the United States. Therefore, competition for these types of transactions is somewhat limited. That gives this company an advantage over the United States competition.

The company has interests in a lot of Tourmaline areas of operations. But management has also diversified the company away from Tourmaline through a number of transactions. The company takes advantage of the latest trend to reduce debt fast by offering overriding royalty interests or by taking non-operating interests in midstream assets. The market cares about low or no debt far more than it worries about the cost of these other arrangements. Therefore, this company is experiencing rapid growth in some very desirable areas.

Overriding Royalty Interests

That growth is coming without the usual upstream risks. Yet investors can participate in some of the hottest Canadian basins.

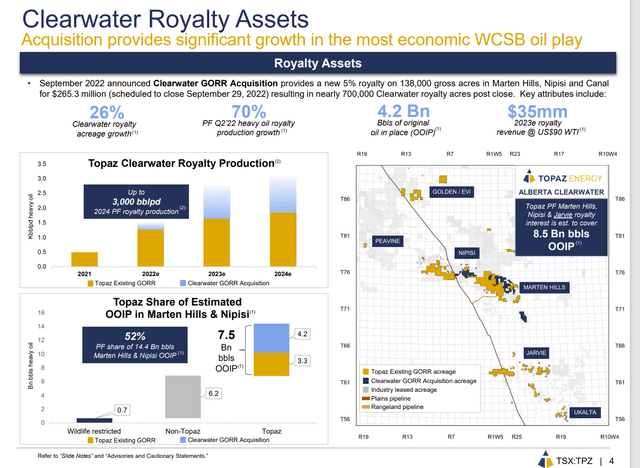

Probably the most notable basin is Clearwater.

Topaz Energy Clearwater ORRI Interests Map (Topaz Energy September 2022, Investor Presentation)

Topaz Energy management spends a fair amount of time discussing both the Tourmaline and the Tamarck Valley interests in this and some nearby basins. However, one of the more significant holdings is an ORRI (overriding royalty interest) that was purchased from Cenovus Energy (CVE) for the properties that were sold to Headwater Exploration (OTCPK:CDDRF). This is yet another fast-growing company I cover to provide another way to grow royalties significantly over the next few years.

The Clearwater area may be the fastest growing basin in North America. It certainly has some of the lowest average basin breakeven costs that I follow. The area benefits by having costs incurred in the weaker Canadian dollar while selling the production to prices linked to American dollars. Even though the production is primarily heavy oil, the unusually low costs have resulted in much higher-than-normal profitability. Therefore, development of the area is expected to remain on the “fast track” for the foreseeable future.

The company recently announced an overriding royalty agreement with Deltastream Energy (privately held). Tamarck Valley is going to merge with Deltastream to make probably the largest public entity focused on the Clearwater play. That means that one way or another, the areas with an overriding royalty interest are going to be developed.

Strategy

The strategy here is similar to Viper Energy (VNOM) in that the company has focused upon top-notch producers with leases that are likely to be produced. The difference is that Viper Energy has plenty of competition in the United States for such leases. Therefore, those interests purchased tend to be significantly more costly. (Off Topic: Another similarity is that Diamondback Energy (FANG) formed Viper Energy Partners which only pursues royalty interests.)

On the other hand, Topaz has relatively little competition. Therefore, management is free to choose leases that have better chances of development sooner without paying the United States premium one frequently sees in basins like the Permian. Therefore, cash flow growth per share is likely to be faster in at least the near future.

Companies with royalty and midstream interests tend to pay out most of the cash flow. That makes this relatively new company suitable for those investors that can determine the future cash flow at acceptable levels for the amount invested now.

Earnings will be somewhat volatile as royalty earnings will vary with the price of oil. Those earnings will be buffeted on the downside somewhat by the fast growth of the Clearwater Play.

On the other hand, midstream earnings will tend to be very steady. So, the volatility will be less than a typical royalty company but more than a typical midstream company. The valuation of such a company will be uncharted territory because such a combination is rare in the United States and not real common in Canada either.

Operators

The company itself does not operate properties. Therefore, the choice of strong operators is very important. Tourmaline, the parent company is well known as a very good operator. This is important because if costs get out of control, then development usually grinds to a halt.

Similarly, many of the other operators are financially strong. This again is similar to the Viper Energy strategy in the United States. This is an attempt to minimize the risk that the acreage would not be developed after the money is paid for an overriding royalty interest. That minimization looks very successful to me.

The importance of the Clearwater play in the minimization of non-development risk is hard to understate. This basin is known to have low costs as reported by many of the companies I follow. Therefore, even in cyclical commodity price downturns, development is likely to continue, even if at a reduced rate.

The usual royalty strategy is to offer an interest in a lot of acreage in the hope that some of the acreage will be developed. The cost may be higher using the current strategy and generally well-regarded operators, but the future cash flow is also flowing from growing production that is certain.

The Future

The company appears to be in a position to continue to sell stock or at least use stock in transactions to keep debt levels in check while making accretive transactions. Acquiring royalty interests from established operators is a relatively low risk way to participate in upstream growth in hot basins like Clearwater.

The presence of some midstream interests will provide a baseline of cash flow during industry cyclical downturns. How the company manages distributions with this kind of product mix remains to be seen. There is a possibility of special dividends in good years.

In the meantime, management again raised the distribution to C$.30 per share. For at least the immediate future, the distribution is likely to continue growing.

As a new issue, the appreciation from accretive transactions combined with the distribution make for a relatively low risk but still decent return in the teens. Profitability may turn out to be better than average as this type of security (and business) is relatively rare in Canada whereas in the United States there are several avenues for an upstream company to raise money. That appears to account for the pace of acquiring various interests.

Finances remain sound. Those investors that are satisfied with the backing of Tourmaline may find this issue interesting as an investment idea. Others may want to wait until they consider the stock seasoned.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment