megaflopp/iStock via Getty Images

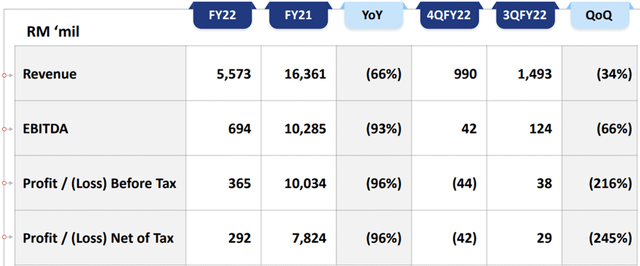

Leading glove manufacturer, Top Glove (OTCPK:TGLVY) swung to a first-ever net loss in Q4 2022, with cumulative net profit for the fiscal year also declining a whopping ~96% YoY. Despite the disappointing results, there are reasons for optimism – not only is the company looking to raise prices in the coming months, but it should also benefit from falling raw material prices and favorable exchange rate fluctuations.

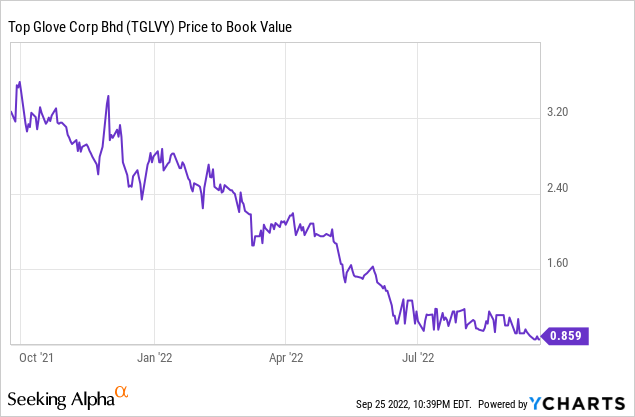

While skepticism about Top Glove’s pricing power is perhaps warranted given the current supply/demand imbalance, many of the loss-making newer entrants lack its scale economies and will likely be (eventually) shaken out at current market prices. As much of the COVID-driven capacity increase rationalizes, industry supply should come back into balance over time and drive an upswing in profitability, in my view. Either way, the attractive valuation offers ample safety margin at the current book value discount. Further stock buybacks via a renewed repurchase program (an up to 10% buyback program is currently subject to shareholder approval at this year’s AGM) or more purchases by the company’s chairman (who bought another 1.3m shares last week) offer upside catalysts.

A First Ever Quarterly Loss

Top Glove fell short of consensus expectations for its Q4 and full-year results, as COVID-driven capacity expansion throughout the industry and weaker demand following stockpiling during the pandemic exacerbate the ongoing supply/demand imbalance. In addition to the order weakness, the company also saw a steeper-than-expected decline in selling prices, as well as cost headwinds from energy, labor, and packaging. Coupled with a surprise inventory write-down due to the fall in selling prices during the quarter, Top Glove swung to a net loss for Q4 2022.

FY22 also saw a steep YoY net profit decline amid a ~25% YoY decline in sales volume and significantly lower selling prices. The dividend policy was maintained at a 50% payout ratio, but given the net losses in Q4, management has opted to skip the dividend and preserve cash instead – this still results in a full-year payout of ~41% (vs. the 50-55% pre-COVID payout).

Looking past the headline numbers, the operating metrics offered little cause for optimism – blended selling prices for Q4 were down to $24/thousand pieces, with nitrile gloves leading the decline at ~$21/thousand pieces and latex gloves at ~$22/thousand pieces. The average utilization rate for the quarter was also a disappointing <45%, reflecting the industry’s overcapacity situation, particularly for nitrile gloves.

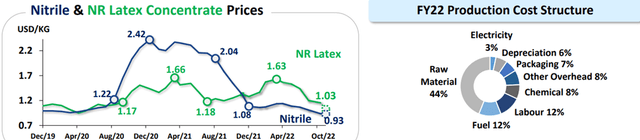

The only silver lining here is that raw material costs are on the decline. But higher gas prices (expected to increase further in the coming quarter) and labor cost pressures continue to weigh on the P&L.

Guidance Update Offers Some Hope

Heading into the next fiscal quarter, management has guided toward gas and labor costs staying high. Although initiatives are in place to further right-size the labor force, these will take time to pay off. What should work in the near term, though, is the continued raw material price declines – key input costs such as natural rubber latex and nitrile latex prices have fallen double-digit % over the last quarter. As an exporter, the stronger USD should also work in Top Glove’s favor.

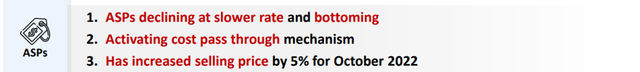

While near-term supply visibility remains challenged, management will be hiking prices by 5% in October to pass on higher costs. The rationale is that excess inventories will clear within the next six months or so. To be clear, this poses a near-term risk to volumes and market share, but management sees less elasticity this time around. I’d agree with this assessment – Thai peer Sri Trang Gloves has already pulled back on its capacity expansion (57bn pieces target revised to 2024) while smaller Malaysian peers like Comfort (OTC:CGLOF) and Careplus (OTC:CRGBF) are now making losses. As shown by their underwhelming quarters, key Malaysian peers Kossan (OTCPK:KSRBF) and Hartalega (OTCPK:HHBHF) are also nearing loss-making territory, with near-term volumes guided to be flattish to down QoQ. In sum, glove players are either pricing below cost, pulling back on capacity, or suffering losses, so it’s hard not to see the rest of the industry following through with similar hikes or rationalizing capacity from here.

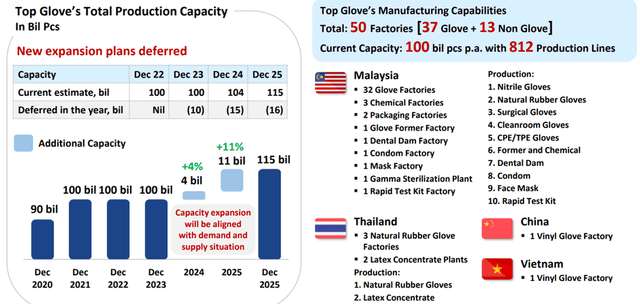

In light of the unfavorable glove industry dynamics (excess supply, limited demand, and intense competition), the company’s decision to postpone capacity expansion to 2024 came as no surprise. While this means capacity stays at the current ~100bn pieces, management’s focus on optimizing existing capacity and expanding in-house capacity for key supplies bodes well for utilization. It also helps the overall glove supply-demand imbalance and could pave the way for more rational industry dynamics going forward.

On the demand side, management cited signs of the COVID-driven inventory buildup easing as customers deplete their inventories and volumes return. The base case is for demand to fully recover by H2 2023 and regain ~10%/year growth. As excess capacity also shakes out, the industry will likely consolidate around the larger players with economies of scale, leaving Top Glove well-positioned to capitalize. In the meantime, targets to increase US sales and expand into green products offer additional pricing tailwinds.

Value Emerging from the Storm

Top Glove’s first-ever net loss in Q4 2022 was a negative surprise, as the company failed to offset rising gas and wage costs due to the prevailing oversupply situation. With few signs of an easing industry outlook, the stock was punished (perhaps too harshly) and now trades at a wide discount to historical levels. That said, management’s decision to raise prices is a positive sign for margins, along with the ongoing raw material price decline and FX movements, so we could be nearing an inflection point. Continued buying activity by the company’s chairman and a renewed buyback program (subject to approval at the upcoming AGM) offer upside catalysts from here.

Be the first to comment