xeni4ka/iStock via Getty Images

This article first appeared on Trend Investing on December 14, 2021; but has been updated for this article.

With lithium prices hitting new record highs each day (currently at CNY 327,500/t (~US$51,553/t)), investors can consider what companies will benefit most from high lithium prices, now and in the next few years.

Lithium carbonate spot prices in China at record high of CNY 327,500/t (~US$51,553/t)

China spot lithium carbonate price

There are several ways to play the lithium boom. Investors can buy the lithium producers, the near term producers, and/or the lithium juniors. My view is it is good to have a mix of all three.

When it comes to the lithium producers their stock prices have naturally surged higher the past year due to the ~5x increase in lithium prices. Looking ahead lithium prices may well remain high given the forecast 10-11x demand increase this decade (or the IEA forecast for a 13-42x increase in the next 2 decades), primarily due to the electric vehicle [EV] boom. This would mean those producers that can best ramp up their production should do the best.

While I agree Albemarle (ALB) and Sociedad Química y Minera de Chile S.A. (SQM) are the top 2 global lithium producers today, neither are lithium pure plays and both rely heavily on production from Chile, where large royalties reduce their profits. Both companies have large lithium expansion plans both in and outside of Chile, so are worth owning. I view these stocks as core holdings and I own both. Below are some useful articles on ALB and SQM.

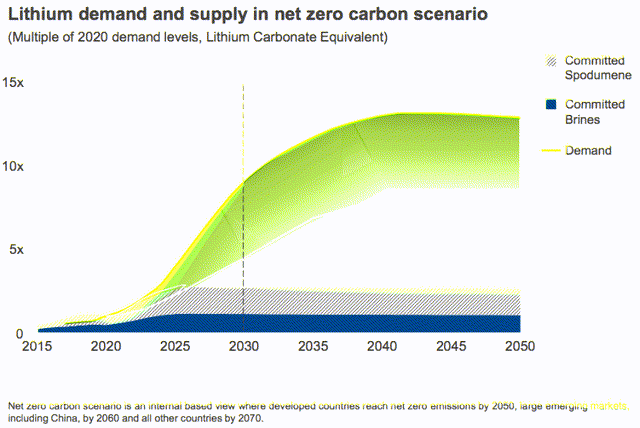

Lithium demand to roughly increase 10x over the next 10 years

As shown below my forecast is for lithium demand to increase roughly 10x over the next 10 years from ~350,000tpa in 2020 to ~3.4m tpa by end 2030. It does assume electric car sales go from 4.2% share at end 2020 to 32% by end 2025 and 80% by end 2030. If we get EV/ICE parity before 2025 I think only waiting lists will slow the uptake of EVs, as we already see today with over 2m orders on EV waiting lists globally, led by Tesla (TSLA).

This will need a massive supply surge from all the lithium miners, both producers and juniors.

By end 2025 my forecast suggests we will need an additional lithium supply (from 2020 levels) of about 1 million tpa, and by end 2030 an additional supply of about 3 million tpa. Beyond 2030 is hard to forecast, but recycling will then start to play a larger role.

My lithium demand forecast to 2030

| end 2020 (actual) | end 2025 (forecast) | end 2030 (forecast) | |

| EV global market share | 4.2% | 32% | 80% |

| Lithium global demand (tpa LCE) | 350,000 | 1.4m | 3.4m |

| Additional LCE tpa needed from 2020 level | ~1 million | ~3 million | |

| Increase | ~4x | ~10x |

Rio Tinto’s forecast lithium emerging supply gap – Will require ’60 Jadar mines’ to fill the supply gap

Lithium demand chart by Rio Tinto to 2050 – Multiples of 2020 demand levels

Rio Tinto

Source: Mining.com courtesy Rio Tinto

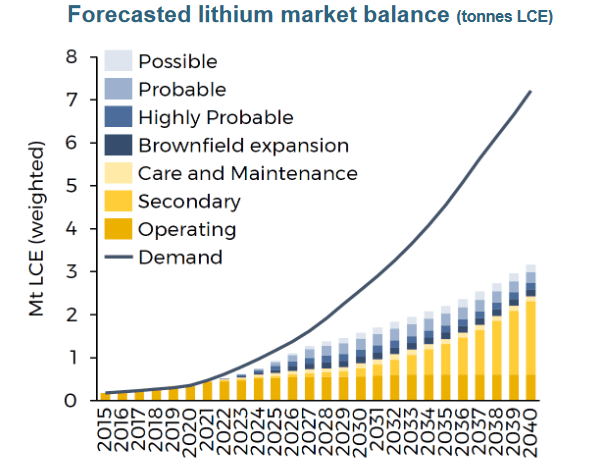

Lithium demand v supply forecast by Benchmark Mineral Intelligence in Q3 2021

Forecasted lithium demand v supply balance

Allkem presentation courtesy Benchmark Mineral Intelligence

Source: Allkem company presentation courtesy Benchmark Mineral intelligence

Top 5 lithium pure play producers with the biggest expansion plans

Ganfeng Lithium [SHE:002460] [HK: 1772] (OTC:GNENF) – Price = CNY 128.63

Ganfeng Lithium plan to expand their lithium carbonate equivalent (“LCE”) production from 54,312 tpa in 2020 to 200,000 tpa in 2025, or a roughly 4x increase, and then to 600,000 tpa by about 2030 (long term target). Wow!

Ganfeng has been the most active buyer of global lithium assets the past 5 years, so certainly has the assets to be able to meet this incredible expansion plan.

Some of their largest deals included accumulating 50% of the Mt Marion Lithium Project (JV with Mineral Resources), 51% of Lithium Americas [TSX:LAC] (LAC) Cauchari-Olaroz Lithium Project, 100% acquisition of Bacanora Lithium who own the Sonora Lithium Project, 100% acquisition of International Lithium Corp.’s [TSXV:ILC] (ILHMF) Mariana Project, and 35% of Arena Minerals’ [TSXV:AN] (OTCPK:AMRZF) Sal de la Puna Project.

Looking ahead to Ganfeng’s expansion plans for this decade they are truly incredible and unparalleled.

On June 11 Mining.com reported:

The Chinese company in March announced an ambitious plan to increase its lithium production capacity roughly fivefold to 600,000 tonnes of lithium carbonate equivalent a year.

On September 18, 2021 Breakinglatest.news reported:

Ganfeng Lithium: The company plans to form a lithium product supply capacity with a total annual output of not less than 200,000 tons of LCE by 2025]. Ganfeng Lithium (002460.SZ) stated on the investor interactive platform on September 18, The company plans to form a lithium product supply capacity with a total annual output of not less than 200,000 tons of LCE by 2025, which will include lithium extraction from ore, lithium extraction from brine, and lithium extraction from clay. The company is optimistic about the longer-term global development of the lithium market. In the future, it will form a lithium product supply capacity of no less than 600,000 tons of LCE, and a more competitive lithium resource project reserve that matches it. (Daily Economic News).

Ganfeng’s current market cap is US$27.3b. Current consensus is a ‘buy’ with an analyst’s consensus price target of CNY 215.10, representing 67% upside. I rate Ganfeng an accumulate.

Pilbara Minerals Limited [ASX:PLS] (OTCPK:PILBF) – Price = AUD 3.72

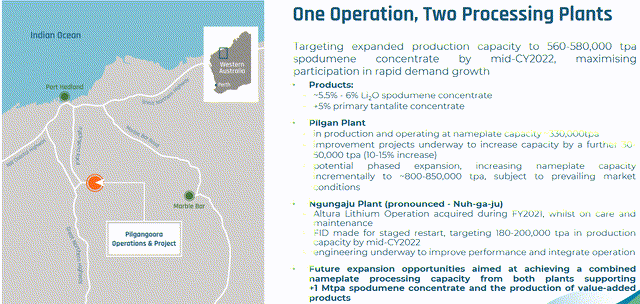

Pilbara Minerals 100% own the massive Pilgangoora Lithium mine in Western Australia, which has grown bigger since taking over Altura Mining’s neighboring project which includes both a mine and a mill. Tremendous expansion potential with top tier off-take partners.

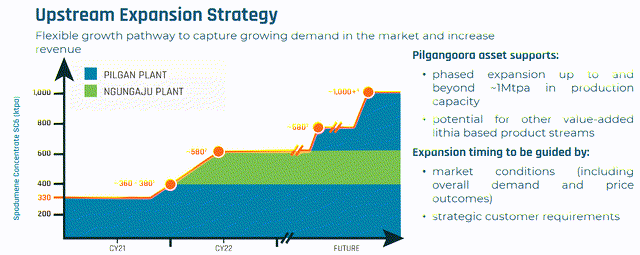

Pilbara Minerals state in their latest company presentation that they plan to build capacity to 1 million tpa of spodumene (~150k tpa LCE) from their total combined project. No date is given, but rather to meet market demand, which suggests by end 2025 may be possible.

Pilbara Minerals plan is to expand to 1m+ tpa of spodumene production (~150k tpa LCE)

Pilbara Minerals plan is to expand to 1m+ tpa of spodumene production (~150k tpa LCE)

Pilbara Minerals

Pilbara Minerals expansion strategy

Pilbara Minerals’ current market cap is A$11.07b (~US$7.97b). Current consensus is a ‘hold’ with an analyst’s consensus price target of A$2.68, representing 28% downside. I rate Pilbara Minerals a hold (could take some profits).

Mineral Resources [ASX:MIN] (OTCPK:MALRF) Price = AUD 65.62

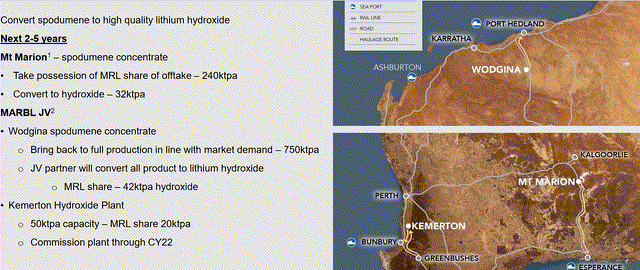

Mineral Resources is an iron ore producer and mining services company with two large lithium JVs. I have made an exception here as Mineral Resources is not a ‘pure play’ lithium miner, but they have two of the biggest spodumene mines globally, and very large production expansion plans.

The first lithium JV is the producing Mt Marion spodumene mine (50% MIN: 50% Ganfeng), and the second is the soon (Q3, 2022) to restart Wodgina spodumene mine (MARBL JV – 60% Albemarle: 40% MIN), both located in Western Australia. Mineral Resources has also partnered (60% Albemarle: 40% MIN) in the Kemerton lithium hydroxide conversion facility due to be constructed by late 2021 with first sales in H2, 2022.

Mineral Resources LCE production plan is to rise from 35,000 tpa in 2020 to around 74,000 tpa by perhaps 2025.

Mineral Resources’ lithium strategy

Mineral Resources’ lithium strategy

Wodgina Lithium Mine (60% ALB: 40% MIN) plans to restart during Q3, 2022

Wodgina Lithium Mine (60% ALB: 40% MIN) plans to restart during Q3, 2022

Mineral Resources

The 50ktpa Kemerton Lithium Hydroxide refinery (Train 1 to be constructed by late 2021 with first sales in H2, 2022)

Wodgina Lithium Mine (60% ALB: 40% MIN)

Mineral Resources’ current market cap is A$12.39b (~US$8.93b). Current consensus is an ‘outperform’ with an analyst’s consensus price target of A$54.38, representing 17% downside.

I rate Mineral Resources a hold, noting iron ore is the main revenue source, but lithium will grow in importance each year. Therefore suitable if you are bullish on iron ore and lithium.

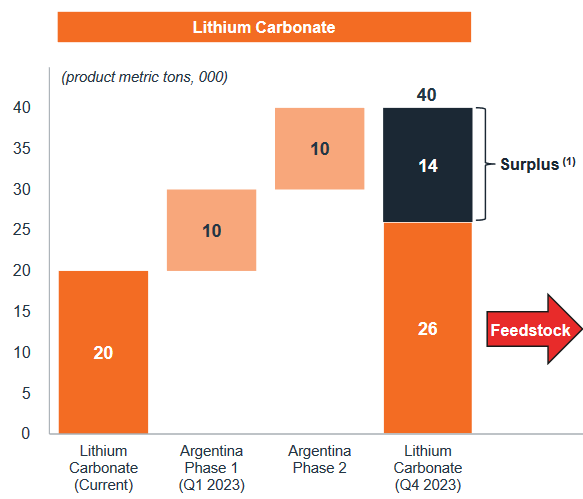

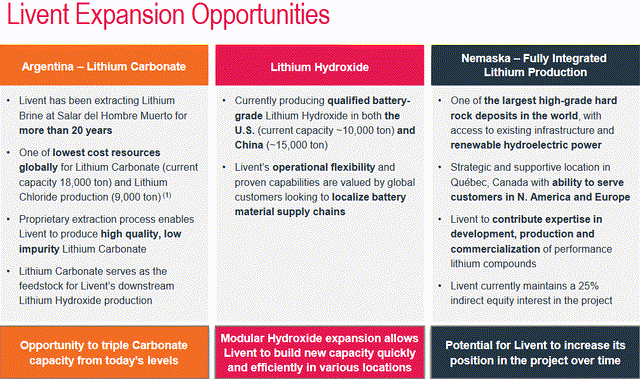

Livent Corp. (LTHM) [GR:8LV] – Price = USD 24.58

Livent owns the Fenix lithium mine at the Salar del Hombre Muerto salar in Argentina as well as “a 25% indirect equity interest in the (Nemaska Lithium) project” and various lithium processing operations.

It looks like Livent will potentially grow LCE production from ~20,000 tpa in 2020 to about 60,000 tpa by end 2025.

In May 2021 Livent stated:

Longer-term, Livent’s plan remains to triple its carbonate capacity in Argentina to roughly 60,000 metric tons and to expand hydroxide capacity in multiple geographies to meet growing customer demand.

Livent plans to initially double, then triple their LCE production

Livent plans to initially double, then triple their LCE production

Livent

Livent expansion opportunities

Livent’s current market cap is US$3.97b. Current consensus is ‘outperform’ with an analyst’s consensus price target of US$28.85, representing 17% upside. I rate Livent an accumulate.

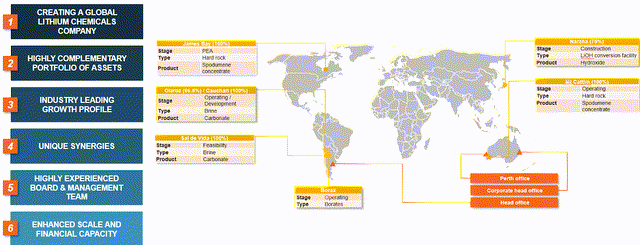

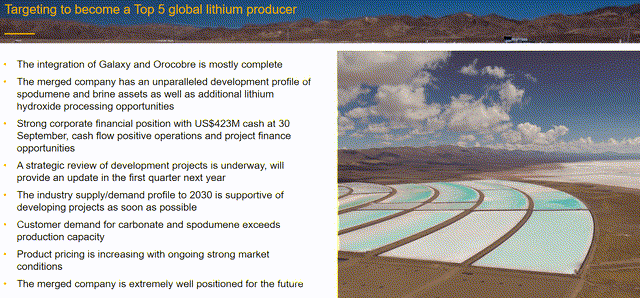

Allkem Limited [ASX:AKE] [TSX:ORL] (OTCPK:OROCF) (formerly Orocobre) – Price = A$11.43

Allkem (formerly Orocobre) 66.5% owns the Olaroz Mine in Argentina. In 2021 Allkem (then Orocobre) acquired Galaxy Resources (100% owner of the Mt Cattlin lithium mine (Australia) and the advanced stage Sal de Vida Project (Argentina), as well as the James Bay Project (Canada)).

Allkem is building the Naraha lithium hydroxide plant (Allkem’s share is 75%) and expanding their Olaroz Mine production to reach a total 42,500 tpa LCE. Further upside potential once they bring Sal De Vida into production.

It looks like Allkem will therefore potentially grow LCE production from ~12,600 tpa in 2020 (66.5% attributable to Allkem) to about 60,000 tpa attributable by end 2025 (66.5% of 42,500 at Cauchari = 27,720 + ~32,000tpa Mt Catlin)), or perhaps higher if Sal de Vida comes online.

Allkem’s global operations and projects

Allkem’s global operations and projects

Allkem

Allkem targeting to become a top 5 global lithium producer

Allkem’s current market cap is A$7.3b (~US$5.25b). Current consensus is ‘outperform’ with an analyst’s consensus price target of A$10.76, representing 6% downside.

Switching soon from low lithium contract prices to higher prices should give Allkem a near term boost. I rate Allkem as an accumulate on dips.

Other smaller lithium producers

- Tianqi Lithium Industries Inc. [SHE:002466] – Have reduced their lithium exposure at Greenbushes by selling half their share to IGO Limited [ASX:IGO] (OTCPK:IPGDF). Greenbushes is now owned 25.5% Tianqi: 25.5% IGO: 49% ALB. (Actual is Tianqi Lithium Corporation/ IGO Limited JV (51%) and Albemarle Corporation (49%)).

- AMG Advanced Metallurgical Group NV [AMS:AMG] (OTCPK:AMVMF) – Vanadium and lithium producer with expansion plans for each. Quite a well valued stock with growth potential.

Lithium juniors with significant expansion potential

- Lithium Americas [TSX:LAC]

- Sigma Lithium [TSXV:SGML] (SGML)

- AVZ Minerals [ASX:AVZ] (OTC:AZZVF) – DRC risk.

- LIONTOWN RESOURCES [ASX:LTR] (OTC:LINRF)

- Wesfarmers [ASX:WES] (OTCPK:WFAFY) – Took over Kidman Resources, the joint owner (with SQM) of the large Mt Holland Project.

Some other juniors with potential

- Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

- Firefinch Limited (ASX: FFX)(OTCPK:EEYMF)

- Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTC:CORX)(OTCPK:CXOXF)

- Argosy Minerals [ASX:AGY] (OTCPK:ARYMF)

- Lithium Power International [ASX:LPI] (OTC:LTHHF)

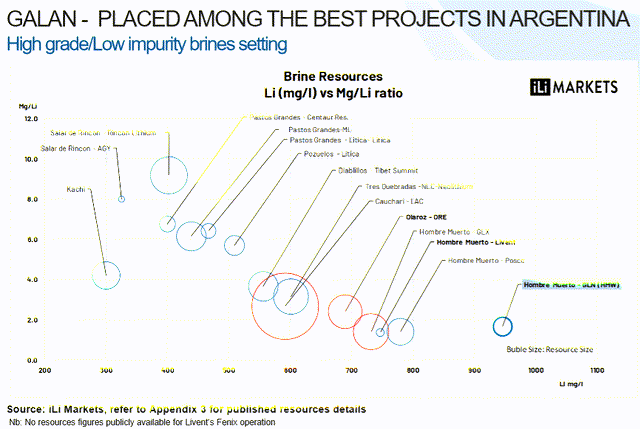

- Galan Lithium [ASX:GLN]

- Alpha Lithium [TSXV:ALLI] (OTCPK:ALLIF)

- Arena Minerals [TSXV:AN] (OTCPK:AMRZF)

- Piedmont Lithium [ASX:PLL] (Nasdaq:PLL)

- Standard Lithium [TSXV:SLI] (SLI)

- European Metal Holdings [ASX:EMH] (OTCPK:EMHLF)

- Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

- Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

- Lithium Energy Limited [ASX:LEL]

- Global Lithium Resources [ASX:GL1]

- International Lithium Corp. [TSXV:ILC] (OTCPK:ILHMF)

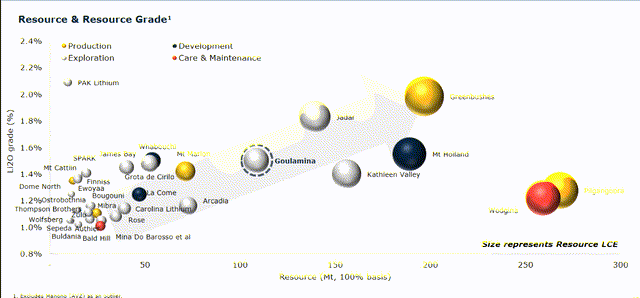

Projects compared by resource size and grade (excludes AVZ’s Manono in DRC)

Projects compared by resource size and grade (excludes AVZ’s Manono in DRC)

Comparison of many brine projects in Argentina by size (circle size) grade and mg/Li ratio (LAC Cauchari is the biggest one shown in this chart)

Comparison of many brine projects in Argentina by size (circle size) grade and mg/Li ratio (LAC Cauchari is the biggest one shown in this chart)

Summary table showing potential LCE expansion by company to end 2025 (based on company plans and my estimate)

| Company |

Ganfeng Lithium |

Pilbara Minerals |

Mineral Resources |

Livent |

Allkem (Ex-Orocobre) |

| 2020 LCE production pa | 54,312 | ~25,000 | ~35,000 | ~20,000 |

~8,000 (attributable) |

| 2025 forecast/target LCE production pa | ~200,000 | ~150,000 | ~74,000 | ~60,000 | ~60,000 (attributable) |

| 2030 forecast/target LCE production pa | 600,000 |

Note: Albemarle and SQM would definitely be near the top of the list of the top 5 or even top 7 if they were to be included. Not included in this article as my focus was on ‘pure play’ lithium producers.

Note: Pilbara Minerals & Allkem (Mt Cattlin mine) 2020 production was scaled back due to weak demand and low prices in 2020.

Risks

- EV sales may slow or decline. Lithium prices may fall.

- Lithium production targets may not be achieved or may be delayed.

- Technology change – Lithium could be replaced by other battery electrolytes such as sodium. Looks very unlikely for now.

- The usual mining risks – Funding, production, partner risks.

- Business risks – Management, liquidity, and currency risk.

- Sovereign risk – Higher risks in Chile, Argentina, etc. than in Australia, Canada, USA. My top 5 in this article are mainly focused in Australia and Argentina.

- Stock market risks – Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Further reading

Conclusion

Looking at the summary chart above it shows the following ‘potential LCE tonnes per annum production expansions’ to end 2025:

- Ganfeng Lithium – 54,000 to 200,000 = 146,000 gain. Mostly China, Australia & Argentina risk.

- Pilbara Minerals – 25,000 to 150,000 = 125,000 gain. Australia sovereign risk.

- Mineral Resources – 35,000 to 74,000 = 39,000 gain. Australia sovereign risk.

- Livent – 20,000 to 60,000 = 40,000 gain. USA base with Argentina project sovereign risk.

- Allkem – 8,000 to 60,000 = 52,000 gain. Mostly Argentina and Australia risk.

With China spot lithium carbonate now selling at US$51,533/t (and costs often <US$5,000/t) (note global averages are around US$30,000/t), a 146,000 tpa gain for Ganfeng by 2025 has the potential to boost revenues (sales less lithium costs of production) by around US$4.38b pa. (based on current high global average lithium prices, and assumed low costs). Ganfeng’s 2022 revenue is forecast to be CNY 18.6b (US$2.93b). So clearly game changing numbers.

Also of interest is that the above additional production volumes (from the 5 in this article), if achieved, would add ~400,000 tpa of production. If we add in 200,000 tpa additional from ALB and SQM combined, plus say 100,000 tpa additional from others (Tianqi, AMG, China miners), then we are at 700,000 tpa additional LCE supply by 2025. But recall my statement at the beginning of the article: “By 2025 my forecast suggests we will need an additional lithium supply (from 2020 levels) of just over 1 million tpa.” This means there should potentially be a supply gap of 300,000tpa for the lithium juniors to fill. I discuss who they will likely be in the next article.

Of course meeting the additional 3m tpa demand by end 2030 from 2020 levels will require multiple juniors to succeed. If we assume the following: Additional demand is 2m tpa (3m tpa-1m tpa) from 2025 to 2030, lithium juniors will mostly fill this supply gap, each junior can rise to 50ktpa LCE; then we would need 40 new junior miners to succeed to production. Or as Rio Tinto says, this decade we need 60 more Jadar mines.

Final conclusions on my top 5 pure play producers with the biggest expansion plans are:

Ganfeng Lithium – They will become the global number 1 and a giant in the lithium world. A must own stock.

Pilbara Minerals – They have the second biggest lithium expansion plan in the group. Another future lithium giant. Pilgangoora is a massive mine.

Mineral Resources – Large lithium expansion plan plus a share in a future value add via the Kemerton Hydroxide facility starting in 2022. Wodgina is a massive mine. Must remember they are primarily an iron ore producer.

Livent – Solid expansion plan from their quality salar.

Allkem – After some very poor production years has made a great acquisition with Galaxy Resources and has potential to expand very significantly.

Finally, don’t forget the current leaders Albemarle and SQM who both have very large expansion plans, but were not included in this article. Owning all 7 of these names the next 5 to 10 years should be a winning strategy, even buying at what seems high levels today. Many of these stocks have surged higher recently so a staged buying approach, or accumulate on the dips is worth considering.

Please be sure to read the risks section and follow your investment rules. The conclusions in this article are based on assumptions that investors should assess and decide for themselves if they think they are realistic.

As usual all comments are welcome.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment