AsiaVision

Investment Thesis

Toast, Inc. (NYSE:TOST) is a cloud-based point-of-sales (“POS”) software that is deployed to over 40,000 units, consisting of primarily SMBs (small and medium-sized business), as well as enterprise restaurants. Toast has been generating consistently strong growth over the past couple of quarters, which is impressive in my view.

However, there is an issue with how Toast is generating its revenue, and I’d argue that it could be cannibalizing its own merchants. This makes me raises questions about the management’s wisdom and whether they are being customer-centric.

How Does Toast Generate Its Revenue?

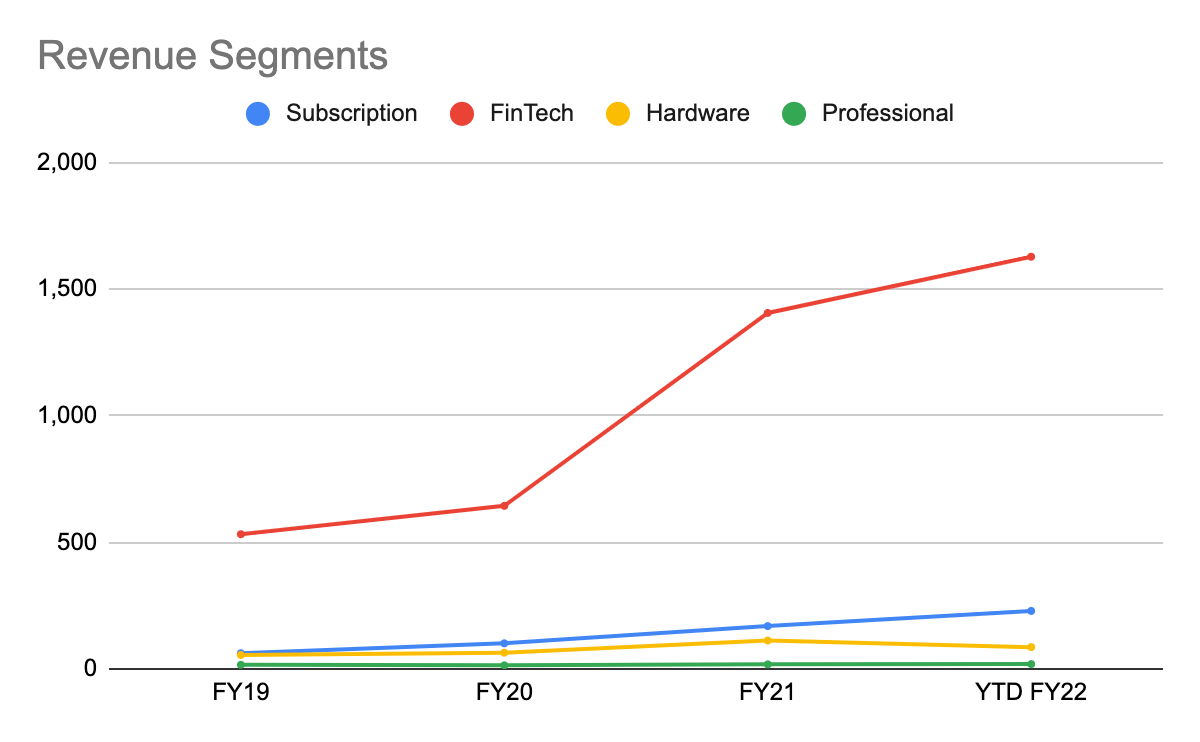

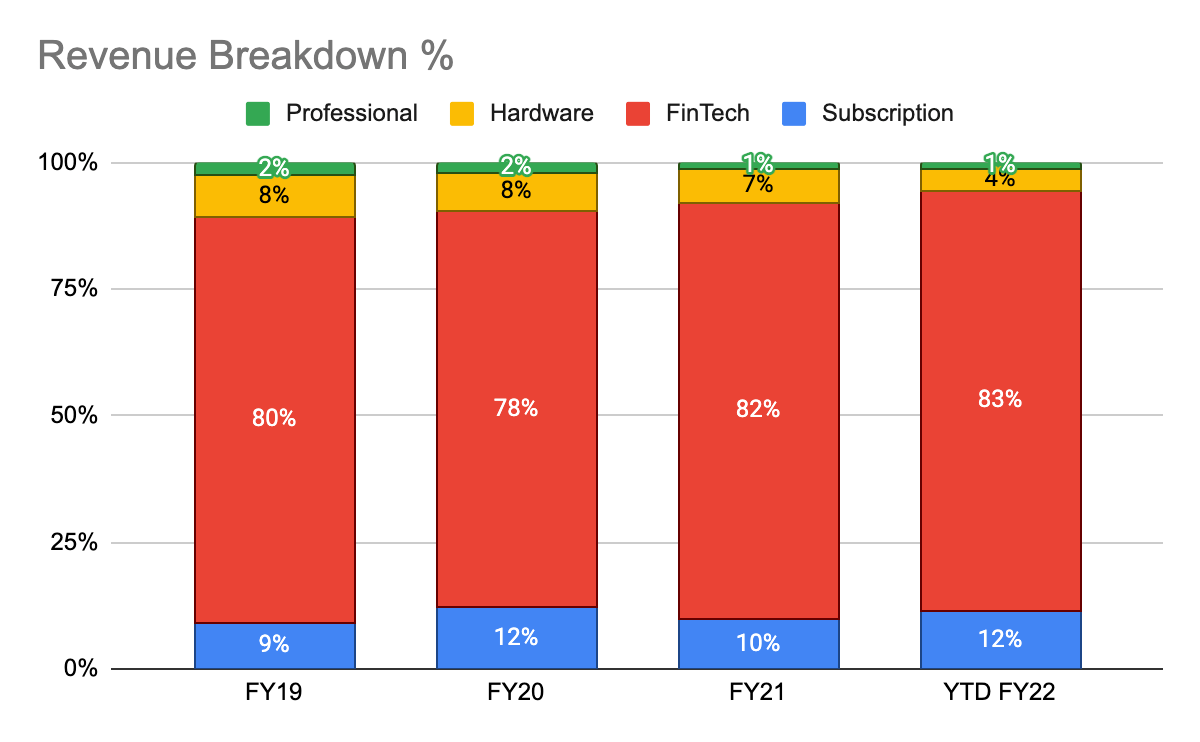

TOST 10-Q & 10-K TOST 10-Q & 10-K

Toast has 4 main revenue streams:

-

Subscription

-

FinTech solution

-

Hardware

-

Professional services.

In order to entice a merchant to adopt Toast products and services, Toast will typically offer free hardware, including the POS terminal, POS scanner, and credit card reader. For SMB merchants, this makes a lot of sense as this reduces the upfront CAPEX, and reduces the barrier to entry to adopting Toast’s full suite of solutions. For merchants, POS makes up the core of a merchant’s operation, and therefore, having a cloud-based POS platform (rather than a legacy POS platform with multiple integrations and chunky hardware) that bundles up multiple functionalities are critical.

However, there is a catch to that. In return for free hardware, Toast makes it a requirement for merchants to utilize Toast as a payment processor (hence the free credit card reader). Toast is unlike peers such as PAR Technology (PAR). PAR allows non-brink and brink customers to use ParPay, which is its payment processor. So, you might ask, what’s with using Toast’s payment processor?

Problem with how Toast is generating its FinTech Solution Revenue

I’ve made a comparison of Toast’s processing fees to its peers here, showing that its processing fees are higher than Lightspeed (LSPD) and National Retail Solutions (IDT). Recall that Toast derives its revenue mainly from its FinTech solution. What this means is that by subsidizing hardware, Toast intends to “recoup” through higher monthly processing fees. Like other payment processors, Toast has the ability to raise processing fees as well.

As hardware sales are non-recurring revenues, does it not mean that merchants are incurring more costs through payment processing fees over time since customers are likely to continue paying using credit cards? Even if they choose to purchase the hardware, it is still mandatory for merchants to adopt the Toast payment solution, but at a lower payment processing fee. It has also been recently brought to my attention that Toast has raised its fees by 99 cents (also known as surcharging, although they did not explicitly state that), and there are also incidents whereby there are extra hidden fees charged through tax deductions.

Despite This Issue, They Are Still Growing

While Toast’s ability to generate its FinTech solution revenue is questionable, its store counts continue to grow. This goes to show that the overall value proposition of the POS platform still remains, and hence, they are still incentivized to stay. Head to G2, you’ll see that Toast has an overall satisfactory customer review.

In the long run, would merchants come to realize that Toast is essentially cannibalizing its own merchants through the not-so-transparent payment processing fees? If so, what action would they take – (1) to pass on these costs to customers, (2) brush it aside and remain to use Toast, or (3) is it too insignificant to consider?

Conclusion

The point of the article is not to hate Toast, Inc., but rather to question the Toast business model and whether the management is customer-centric at all. Toast cannibalizing its own merchants may be detrimental to the health of the business in the long run, and investors ought to take note of it. After all, we want a company that is run by management that puts customers first and is not there to profit from its customers.

What are your thoughts on the Toast payment solution? Let me know in the comment section below!

Be the first to comment