pabradyphoto

Federal Reserve Chairman Jerome Powell and the rest of the members of the Federal Reserve Board continue to tell us that they will be “guided by the data” when considering how to adjust the Federal Reserve’s bellwether interest rate.

So when you read this headline, Consumer inflation of 6.2% Y/Y in September eases slightly more than expected you might have conclude that the Fed will be pausing its rate increases or, even better, executing that long-awaited “pivot” and lowering rates. That could be an expensive mistake.

As always, you have to look beyond the headlines that greet any economic announcement to learn what was actually reported. It was the Personal Consumption Expenditures (PCE) index for September. Recall that the PCE is generally considered to be “The Fed’s Favorite Inflation Gauge.” You can find the official version of the PCE data at the Bureau of Economic Analysis’ website. The Bureau of Economic Analysis is a part of the U.S. Commerce Department.

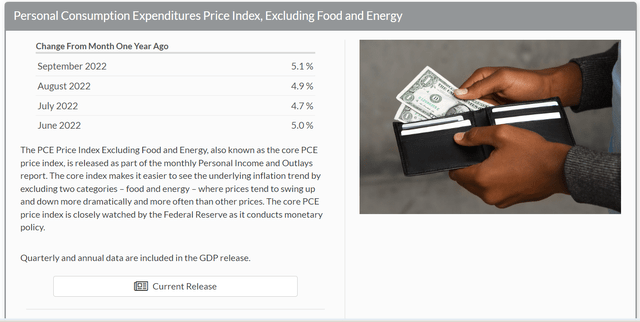

If you visit its site, what you will learn is that the PCE index for September was unchanged from what it was in August. You will also learn that in September the Personal Consumption Expenditures Excluding Food and Energy Index (also known as the PCE-Core index) rose by .2% and is now the highest it has been in four months.

PCE – Core June 2022 – Sept 2022

Bureau of Economic Analysis, U.S. Commerce Department

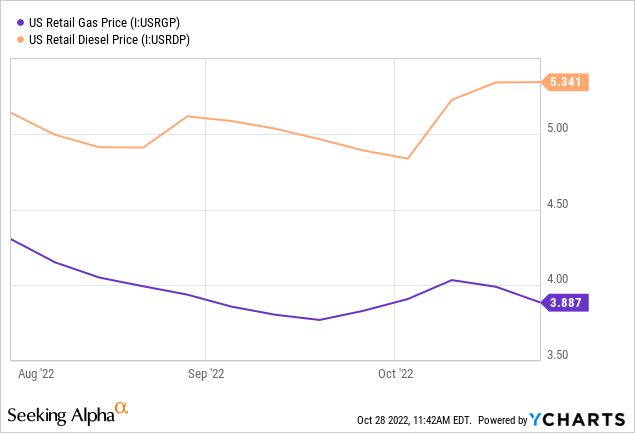

This figure should send shivers through the spine of anyone who was expecting the Federal Reserve to stop raising its interest rate. Why? Because the only reason that the full PCE index, the one that includes food and energy prices, stayed steady was because gasoline prices dipped temporarily in September. But if you’ve filled up your tank recently, you’ve noticed that gas prices have risen during October. More to the point, you will also have noticed that diesel prices have soared during this past month.

US Retail Gas and Diesel Prices Aug – Oct 2022

The average price of diesel has risen 4% just since the end of September. And note that this is an average price. I have been tracking prices at my local gas station, one that usually has reasonable prices, and have seen prices as high as $6/gallon this past month.

This gives the alert investor a clear warning that consumer prices are going to continue to rise for the foreseeable future. Why? Because diesel is what fuels the semitrailers and trains that deliver the raw materials U.S. companies manufacture and that ship the finished products they sell to customers. It takes a while for the increased price of fuel to affect shipper prices, but after a few months it always does. And when it does the cost of every can of soup, pair of shoes, or new phone or gaming console you buy will rise as companies pass on their costs to the final consumer.

The Heating Oil Crisis Will Make This Worse

Most people living in rural areas all over the North still heat their homes with heating oil. The U.S. Energy Information Administration tells us,

Because heating oil and diesel fuel are practically the same fuels, changes in demand for one fuel may affect prices for the other fuel.

Right now there is a disturbing shortage of heating oil throughout the Northeast in regions like the one where I live. In more northerly parts of New England and New York State temperatures routinely drop into the -10 range each winter and daytime temperatures may not rise above freezing for a week or two. It thus becomes a matter of life and death to make sure that crude oil that might have become diesel fuel is refined into heating oil. This which will further stress the price of diesel and lead to increased costs for everything that has to be shipped.

If Interest Rates Rise to the Level of Inflation the PCE Currently Indicates Bonds Will Take A Further Beating

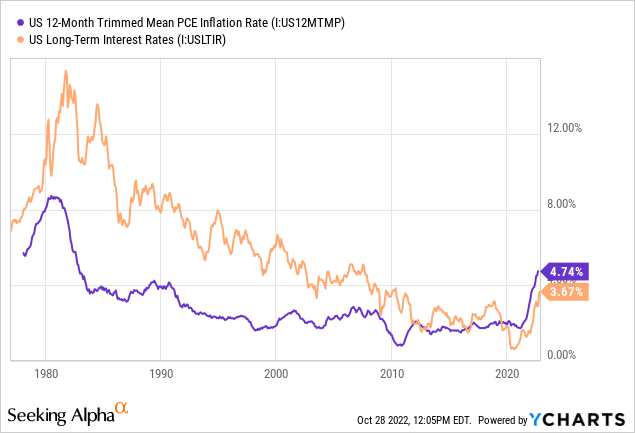

Inflation was not conquered in the early 1980s until the Federal Reserve raised its rate to a level that was higher than inflation. Rates then remained a couple points higher than inflation for years as the Federal Reserve in the 1970s had been too quick to take its foot off the pedal and learned its lesson the hard way.

US PCE vs US Long-Term Interest Rate 1977 – Now

The current members of the Fed Board have cited this 1970s mistake in recent talks. They are well aware of how dangerous it is to declare inflation “tamed” when it is just pausing for breath.

So if interest rates end up having to rise above inflation and remain there, that would represent a return to normal conditions rather than a threat to all business activity, or perhaps all life on earth, which is what you might have heard from pundits on some cable news channels and The-End-Is-Near websites.

If rates rise to just the current level of the PCE index, we would be seeing rates rise not to the high 4% range currently expected by investors, based on current bond pricing, but to 6% or 7%. And if the PCE rises sharply in response to the rising cost of fuel and the resulting rise in the cost of products and inevitably the rise in wages that follow the cost of products, it is not out of the realm of possibility that rates could rise another 2% or 3% before inflation was finally brought under control.

How To Profit From These Rising Rates

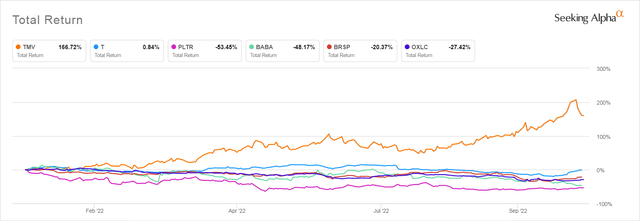

It really galls me when I realize that back while I was reading article after article about how AT&T (T), Palantir (PLTR), Alibaba (BABA), or securities paying extremely high dividends like BrightSpire Capital (BRSP) or December 2021’s Top Pick, Oxford Lane Capital (OXLC), would be my path to riches, the Trade of the Year slipped by almost completely unnoticed.

That trade was the Direxion Daily 20+ Year Treasury Bear 3x Shares ETF (NYSEARCA:TMV). A grand total of 4 articles about TMV have appeared on Seeking Alpha since the beginning of 2022 when it was starting to look like inflation was not going to be “transitory.” Only 2 of those articles recommended buying it.

Look what you missed if you invested in those other highly touted investments instead of TMV.

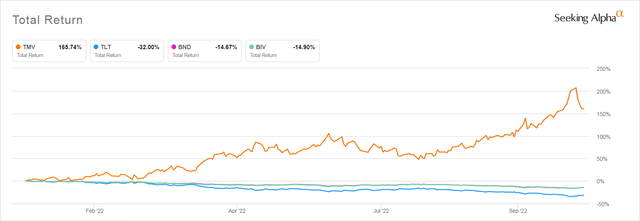

TMV Total Return Compared to Frequently Recommended Investments

TMV has generated a return of 172% since the beginning of the year. The rest of these continually promoted investments have barely broken even with dividends.

What is TMV?

TMV is an inverse 3X ETF. It seeks to give you, on a daily basis, three times the return of the US 20 year bond (US20Y). That makes it the equivalent of a triple short of the iShares 20 Plus Year Treasury Bond ETF (TLT). In fact, it achieves this result by using TLT swaps. Exactly how this works is way beyond my pay grade to understand. But the ETF has been around since April of 2009 and is still in business. Needless to say, it was a terrible investment through almost all of its life, because rates did nothing but drop after the Fed embarked on 12 years of Quantitative Easing. But the strategy it uses appears to do what it claims to do.

Like all inverse 3X ETFs, its prospectus warns that its results are only guaranteed to be triple short its benchmark on a daily basis. Over a longer time the return will diverge.

However, in a period of rising rates, it appears that divergence has been positive.

TMV vs Other Popular Bond ETFs

The chart above shows you how TMV’s return differs from that of TLT and two other popular bond ETFs, The Vanguard Total Bond Market Index ETF (BND) and the Vanguard Intermediate Term Bond Index ETF (BIV). As you can see, Since the beginning of 2022, TMV has risen 165.74%, while TLT, the bull 1X 20 year bond ETF has dropped 32%.

This is largely because TLT has a very high duration. It is currently 17.20 years, which is almost double that of the other popular bond ETFs that have durations closer to 6 years. But it is interesting to see that the prices of those shorter duration ETFs have dropped more than their shorter durations would have suggested, when compared to TLT.

TMV Can Be A Dangerous Investment

TMV is definitely not a safe, long-term Buy and Hold investment. As you can see from its price action over the past week, if bond yields retreat, which raises the price of bonds, TMV will drop by a significant amount. It dropped by about 7% this past week when, once again, investors convinced themselves that the Fed was about to pivot.

So an investment in TMV is a gamble and you should only put money in it you can afford to see decline. But that said, buying TMV it is a rational gamble. Given that long bond ETF TLT’s duration is currently 17.20 years, if rates rise another 1%, TLT’s price can be expected to drop by roughly 17.20% and if rates continue to edge up to 7% or more over the next six months or longer, the compounding we saw with TMV so far this year as rates have relentlessly climbed could make TMV deliver another outsized gain.

The Next Rate Hike is Priced Into TMV – The Fed’s Guidance Is Not

If you go back and look at the chart of how TMV has performed this past year you can see how when investors decided that the Fed was going to back down on rates its price sank, only to rise again after the Fed had its next meeting and gave guidance that stressed how resolute it planned to be going forward. You can see how the widespread misinterpretation of Fed Chairman Jerome Powell’s remarks given at the June Fed meeting knocked down TMV’s price, only to have it rise again as Fed speakers did their best to inform markets that they were applying wishful thinking to the Chairman’s words.

The Fed speakers have been making the same kinds of “Hey! Pay attention folks, we are serious” speeches since the last Fed meeting, until the quiet period before their next meeting on November 1-2 began. But no sooner did they go quiet than the financial press once again was filled with pundits assuring us that the Pivot was just around the corner, and as you can see, TMV’s price fell once again. A cynic might think that the pundits had a lot of long bonds to get rid of. I leave it to you to decide if that might be the case. But what is clear is that there is no more reason this month to believe that a Pivot is just around the corner than there was last month or the ones before.

Which makes this the perfect time to invest in TMV if you believe, as I do, that the Fed will follow the data, and that the data suggest that a growing economy (GDP up 2.6% YOY) with full employment (unemployment down to 3.5%), where consumers are paying 6.2% more for the goods and services they need while getting solid cost of living raises is perfectly able to handle rate increases that will take rates to a level no higher than where they were through the highly prosperous 1990s.

Invest in TMV If You Have a Large Bond Holding

Investing in TMV may look like an out and out gamble, and if you don’t hold bonds or CDs, it is. Though perhaps a profitable one. But investing in it makes sense if you, like many people with conventional portfolios, have a significant holding in bonds with a longer duration–like those held in BND or BIV or other longer duration bond ETFs like the iShares Core 10+ Year USD Bond ETF (ILTB) or the Vanguard Long-Term Bond ETF (BLV). Since the value of TMV will fluctuate in a reverse direction from the value of your bond ETF holdings, a small amount can take some of the pain out of the ongoing impact of rising interest rates which as many investors learned for the first time this year, can cause their “safe” bond allocation to lose almost as much as a speculative stock.

Investing in TMV also makes sense if you are invested in an index-based Fund of Funds that holds a substantial amount of U.S. bonds like a Target Date Fund.

Finally, a small allocation to TMV may be a good alternative to investing in whatever is the latest stock you are being told will make you rich and let you retire in splendor. At least you will have a pretty good idea in advance of what factors will cause your investment in TMV to rise or fall, which is not the case when you buy those risky Get Rich Quick stocks.

Be the first to comment