MicroStockHub

The Direxion Daily 20+ Year Treasury Bear ETF (NYSEARCA:TMV) provides -3x levered returns to long-term treasury bonds. While I expect interest rates to grind higher due to the Fed’s ‘higher for longer’ policy, interest rate volatility is expected to be higher in 2023, and act as a headwind for inverse levered ETFs like TMV. Furthermore, if we look at history, even if 2023 is a down year for long-term treasuries, chances are it will not be the same magnitude as 2022. TMV’s incredible returns from 2022 is highly unlikely to repeat.

Fund Overview

The Direxion Daily 20+ Year Treasury Bear ETF provides -3x the returns of the ICE U.S. Treasury 20+ Year Bond Index. The TMV fund achieves its -3x daily exposure target through total return swaps with investment banks that are reset every day. The TMV ETF charges a 0.95% expense ratio.

Strategy

I highly encourage readers to take a look at some of the other articles I have written on levered ETFs to learn the mechanics of how they work. There are two key concepts investors should understand. First, levered ETFs have ‘positive convexity’ in the direction of their bet (exposure grows as price action goes in the fund’s favour). Second, they suffer from ‘volatility decay’ due to the daily reset of their exposures.

TMV’s goal is to provide 1-day returns equal to -3x the return of the ICE U.S. Treasury 20+ year Bond Index (“Index”). This index is designed to measure the performance of U.S. dollar-denominated, fixed rate treasury securities with minimum term to maturity greater than 20 years. In plain English, TMV is betting that long-term interest rates will rise, and treasury bonds will fall in price.

Portfolio Holdings

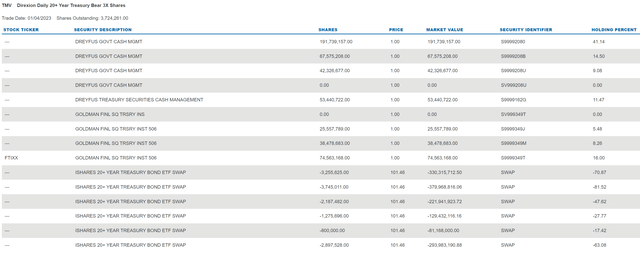

As mentioned above, the TMV ETF achieves its -3x daily exposure via total return swaps with major investment banks (Figure 1). Altogether, the fund holds -300% exposure in swaps (in the figure below, the exposure is -308%) and 100% exposure in cash (106% in the figure) to settle the daily gains and losses.

Figure 1 – TMV portfolio holdings (direxion.com)

Returns

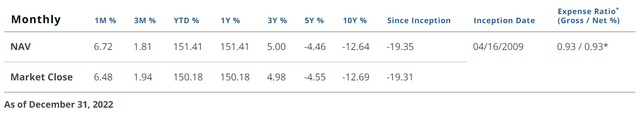

2022 was a fantastic year for the TMV ETF, as the fund returned 151% to December 31, 2022, on the back of rising interest rates (Figure 2).

Figure 2 – TMV historical returns (direxion.com)

Note, the TMV ETF significantly outperformed -3x the return of the underlying index, which we model with the iShares 20+ Year Treasury Bond ETF (TLT). TLT lost 31.4% in 2022 while TMV gained 151%. This outperformance of the TMV ETF shows the ‘positive convexity’ effect that I mentioned previously.

However, investors should be mindful that the TMV ETF has very poor long-term returns, with 5Yr and 10Yr average annual returns of -4.5% and -12.6% respectively. This reflects the ‘volatility decay’ of the levered ETF.

TMV Is A Clone Of The TTT

In practical terms, the TMV ETF is a mirror copy of the ProShares UltraPro Short 20+ Year Treasury ETF (TTT) that I recently wrote about (actually TTT is a clone of TMV, since TMV has an earlier inception date). Both funds are designed to provide -3x the daily exposure of the ICE U.S. Treasury 20+ year Bond Index, and both funds charge a 0.95% expense ratio.

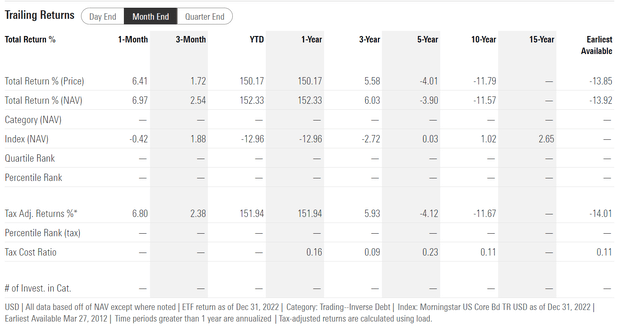

However, investors should note there is a slight difference in returns between TMV and TTT. For example, the TMV ETF has 1/3/5/10Yr average annual returns of 151.4%/5.0%/-4.5%/-12.6% to December 31, 2022 vs. 152.3%/6.0%/-3.9%/-11.6% for the TTT ETF (Figure 3).

Figure 3 – TTT historical returns (morningstar.com)

While the difference is small, it may be an indication of greater transactional slippage with Direxion’s daily rebalancings compared to ProShares. Furthermore, a 1% underperformance per year can become quite significant if compounded over long periods of time.

Interest Rate Volatility Likely To Increase In 2023

In my TTT article, I highlighted my thoughts on the recent bounce in treasury yields and what it means for inverse levered ETFs like TMV and TTT. Although I believe interest rates are still headed higher due to the Fed’s ‘higher for longer’ monetary policy, I expect there would be increased 2-way volatility, as weak economic data may lead to declines in treasury yields as investors brace for a recession. Conversely, strong economic data will give the Fed more leeway to stay ‘higher for longer’.

Increased 2-way volatility is the bane of levered ETFs, as their daily rebalancings can quickly eat away at the fund’s NAV.

History Unlikely To Repeat

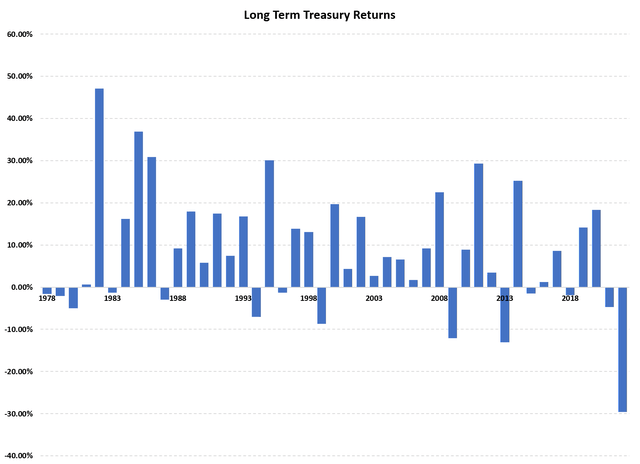

Furthermore, if we look at the historical returns of long term treasury bonds, 2 facts stand out (Figure 4). First, 2022 was the worst performance for long-term treasuries since 1978 (dataset from Portfolio Visualizer). Second, historically, long-term treasury bonds rarely have back to back negative years.

Figure 4 – Annual returns of long-term treasuries (Portfolio Visualizer)

Prior to 2022, the last time long-term treasuries had back-to-back declines was in 1980, when it had 3 negative years in a row. Incidentally, investors may remember the late 1970s as the last time the world economy faced an inflation scare like in 2022 and Paul Volcker had to raise short-term interest rates to 20% to kill inflation.

While history may indeed repeat with long-term treasuries set for a third year of declines due to rising interest rates, chances are, the decline in 2023 will be far milder than what we saw in 2022.

Conclusion

In summary, while I expect interest rates to grind higher due to the Fed’s ‘higher for longer’ policy stance, interest rate volatility is expected to be higher in 2023, and act as a headwind for inverse levered ETFs like TMV. Furthermore, if we look at history, even if 2023 is a down year for long-term treasuries, chances are, it will not be the same magnitude as the record breaking decline in 2022. The TMV ETF will not perform well in a grinding market, as it will suffer from volatility decay.

Be the first to comment