Morsa Images

The Chart of the Day belongs to the insurance and mortgage company Tiptree (TIPT). I found the stock by using Barcharts powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker first signaled a buy on 10/25, the stock gained 26.06%.

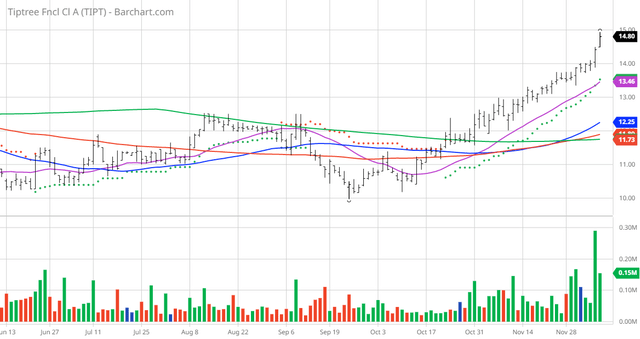

TIPT Price vs 20, 50 and 100 DMA

Tiptree Inc., through its subsidiaries, underwrites and administers specialty insurance products primarily in the United States. The company operates in two segments, Insurance and Mortgage. It offers niche commercial and personal lines insurance, credit insurance and collateral protection products, and warranty and service contract products and solutions, as well as premium finance services. The company also offers mortgage loans for institutional investors; and maritime shipping services, as well as invests in shares. It markets its products through a network of independent insurance agents, consumer finance companies, auto dealers, retailers, brokers, and managing general agencies. The company was formerly known as Tiptree Financial Inc. and changed its name to Tiptree Inc. in December 2016. Tiptree Inc. was incorporated in 2007 and is based in New York.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 28.00+Weighted Alpha

- 13.09% gain in the last year

- Trend Seeker buy signal

- Above its 20-, 50- and 100-day moving averages

- 17 new highs and up 15.84% in the last month

- Relative Strength Index 84.88%

- Recently traded at $14.80 with 50-day moving average of $12.25

Fundamental Factors:

- Market Cap $522 million

- P/E 9.33

- Dividend yield 1.11%

- Not presently followed by Wall Street

Analysts and Investor Sentiment:

I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping a stock, it’s hard to make money swimming against the tide:

- Seeking Alpha authors have written 2 strong buy and another buy recommendation recently

- CFRA’s MarketScope rates the stock as a strong buy

- 1,010 investors are monitoring this stock on Seeking Alpha

Ratings Summary

Be the first to comment