Torsten Asmus

The crash in inflation-linked bonds appears to be at or near its end as surging real yields meet with increasingly weak economic growth prospects. The iShares TIPS Bond ETF (NYSEARCA:TIP) now offers an incredibly favorable risk-reward profile. With a real yield to maturity of almost 2%, holders of the TIP will most likely handsomely outperform inflation over the next 7 years (which is roughly the weighted average maturity of the ETF), while enjoying relatively low volatility given the fund’s relatively low duration. There is also the potential for strong capital gains if and when the Fed is forced to respond to intensifying economic weakness by ending its rate-hiking cycle.

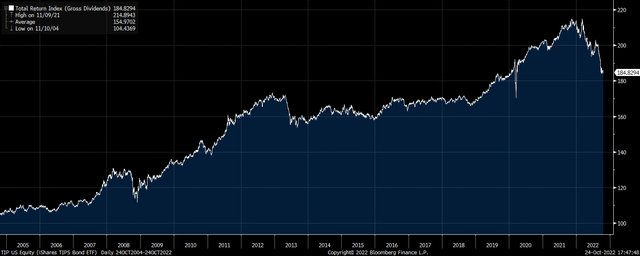

TIP ETF Total Return (Bloomberg)

The TIP ETF

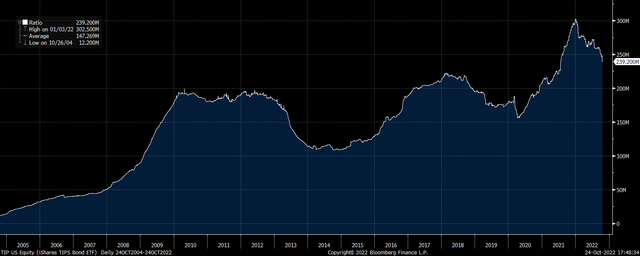

The ETF tracks the performance of U.S. Treasury inflation-protected securities, with a weighted average maturity of 7.3 years and an effective duration of 6.7 years. The current real yield on the TIP is 1.96%, which is what investors should expect to receive per year over the long term after inflation. The ETF has seen a 21% decline in assets under management since the start of the year as investors have shunned the inflation-linked bond market amid the Fed’s aggressive tightening campaign, which should be seen as a contrarian indicator.

TIP ETF Assets Under Management (Bloomberg)

Comparing The TIP With Equities

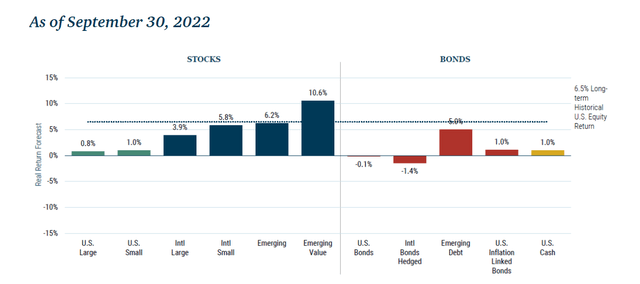

While many investors may see this real yield as relatively low in the context of long-term equity market returns, there are two key points worth noting. Firstly, U.S. equity market valuations remain consistent with long-term real returns of around zero. This can be seen in the chart below from asset management firm GMO, which as of September 30 had a 7-year real return forecast of just 0.8 for the S&P 500.

7-Year Real Return Forecasts (GMO)

It is also worth noting that the real yield on the TIP is now higher than the dividend yield on the S&P500 for the first time since 2007. This means that for stocks to outperform over the next 7 years, we would have to see dividends rise faster than inflation and/or equity valuations remain at current elevated levels.

Secondly, the duration of the TIP ETF, and therefore the expected volatility, is significantly lower than that of the equity market. The relatively low volatility of the TIP can be seen in the chart below. The ETF’s largest drawdown, which occurred during the global financial crisis, was just 14%, versus 55% for the S&P 500.

The Real Economy Continues To Deteriorate

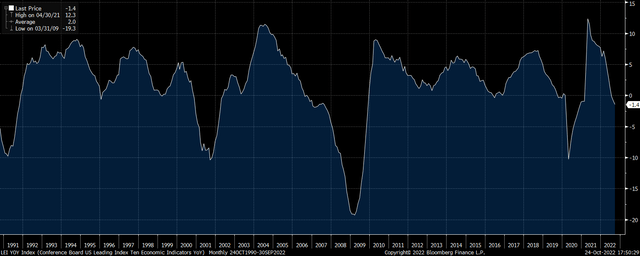

Leading economic indicators continue to point to a deepening U.S. recession. Most notably, the Conference Board’s Leading Economic Indicator which came out last week printed its lowest level since 2020 at -1.5%. There is little doubt now that the surge in real interest rates is beginning to reveal the underlying weakness of the U.S. economy, which had relied on easy money for too long.

US Leading Economic Indicator Index (Conference Board)

In my view, we are getting increasingly close to a Fed pivot as the risks of a financial crisis are rising. The contracting real economy simply cannot tolerate the current restrictive monetary policy stance, and if and when the Fed steps in to foster calm in the Treasury markets, we are likely to see both a fall in yields and a rise in inflation expectations, causing real yields to plunge and TIPS to surge.

This was the scenario we have seen in U.K. gilt markets over recent weeks. As the Bank of England was forced to restore calm to the market by extending its quantitative easing program, yields plunged, and inflation expectations soared, causing the Vanguard U.K. inflation-linked bond index to rise 30% off its lows in just two days. U.K. 10-year real yields are now back around zero after briefly rising above 1%. If U.S. real yields were to fall back to zero – where they were just 5 months ago – TIP holders would see double-digit gains.

What Are The Main Risks?

The main risk is that the Fed continues its increasingly restrictive policy stance in order to crush inflation, which causes bond yields to continue rising and inflation expectations to fall. While any renewed deflationary concerns would likely cause the Fed to reverse course, as we saw during the global financial crisis and the Covid crash, inflation-linked bond prices could fall sharply before any such reversal takes effect. Nonetheless, any such weakness would further improve future return prospects.

Be the first to comment