Karl Marx’s Nemesis

Justin Sullivan

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Looks Like A Nice Guy, Rolls Like A Tough Guy

Tim Cook is an unlikely hero. Seems like a nice guy, right? The sweater and all. But beneath the friendly-uncle routine lies a cold heart of ice. Guy runs an oligopolistic consumer business that everyone loves. Lawsuits about excess App Store fees? Noise. Atrocious rate of genuine innovation in their lead product? Pshaw. Nobody cares. I can get my iPhone 27 in … a funky kinda blue color? Where do I sign? 72 month contract you say? No problem!

Apple the company is a machine, and Cook’s ability to run the thing without presenting as the modern equivalent of the mill owner in the heart(less)lands, is to his endless credit. The stock is holding up the S&P and the Nasdaq on its shoulders and it just printed a great set of earnings that can drive the indices higher in the coming weeks and months.

We previewed the earnings here, if you missed it.

Following the earnings print today, here are the numbers, valuation, and our latest stock chart with price targets and proposed stop-loss levels.

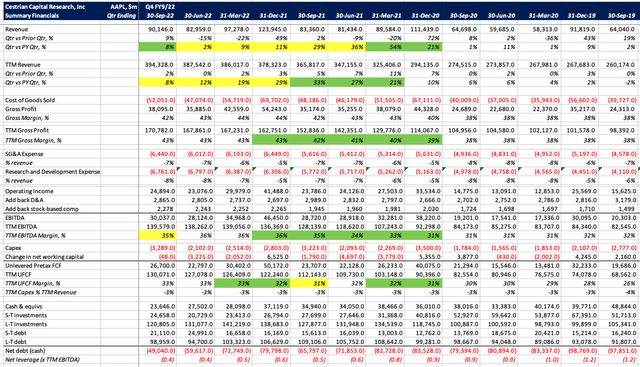

AAPL Financials (Company SEC filings, YCharts.com, Cestrian Analysis)

Allow us to walk you through the numbers as we see them.

- Most importantly of all, and unlike every single other Big Tech name, revenue growth accelerated. This quarter was +8% vs Q4 FY9/21, up from +2% Q3 ’22 vs Q3 ’21. Others – your Microsofts (MSFT) for example – have delivered earnings or revenue “beats,” ie the company exceeded expectations they had worked to damp down for some weeks; here the company actually grew faster vs. the same quarter last year than it achieved in the last quarter. This acceleration in a weak economic environment is indicative of a company winning share ie. winning share of the consumer dollar. Given the product set is high-end and expensive, this tells you that the consumer isn’t as badly off as many claim, and it tells you that AAPL’s sales and marketing execution remains strong.

- Gross margins were essentially flat ie. the company’s variable input costs relative to revenues were unchanged. Remember we live in an inflationary environment where everything costs more. And remember that AAPL is in large part an assembler of stuff, hence the lowish gross margins vs. say a software company. That gross margins held steady tells you that the company’s procurement and supplier management is working well.

- Accounting margins – EBITDA in our table above – also remained essentially flat (down 1% on a TTM basis). This means that, for instance, labor costs remained tightly controlled in the quarter.

- Cash flow margins – unlevered pretax free cash flow in our table above – were also flat on a TTM basis. Capex increased materially (>50% higher than in the last quarter) but careful management of working capital – meaning, collecting cash faster and paying cash out more slowly – meant that the capex spike didn’t dent cash flow margins. Again, indicative of very strong management here.

If the above sounds easy? It isn’t. Check most every other Big Tech company to see how not to do this.

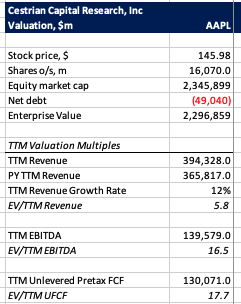

Now, despite the strong growth and margin profile, valuation remains acceptable from a buyer’s perspective.

AAPL Valuation (Company SEC filings, YCharts.com, Cestrian Analysis)

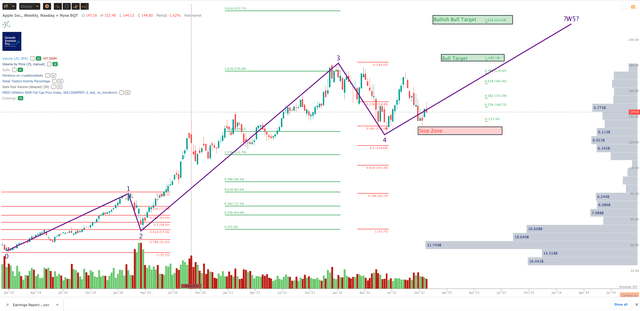

We believe that’s a perfectly sensible buy on fundamentals. The technicals support the fundamental analysis in our view. The chart looks to be putting in an early 1-up, 2-down move within an overall 5th wave higher to complete the cycle that began in the 2018 lows.

Here’s our latest chart. You can open a full page version, here.

AAPL Chart (TrendSpider, Cestrian Analysis)

In short?

Fundamentals very strong; valuation acceptable to buyers; technical perspective on the stock, bullish.

As a result we continue to rate Apple Corporation stock at Accumulate, with a minimum bull target of $185, a bullish bull target of $215, and a proposed stop-loss zone in the $130 zip code, just below the recent pivot low.

Cestrian Capital Research, Inc – 27 October 2022.

Be the first to comment