Darren415

Tilray (NASDAQ:TLRY) reported a close to its fiscal 2022 year that left more questions than answers. While TLRY is arguably one of the more popular cannabis stocks among both retail and institutional investors, the company continues to struggle with growth in its Canadian cannabis operations and appears to have instead focused on diversifying its businesses away from cannabis operations. While the stock remains cheap enough to buy here, I continue to favor alternatives in the cannabis sector.

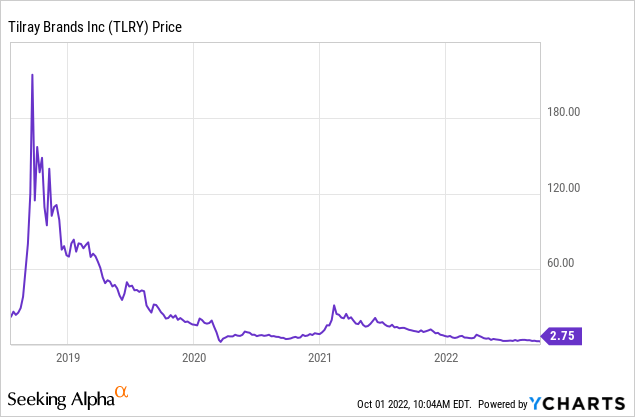

TLRY Stock Price

TLRY is down 88% since its 2021 highs and 98% since its all-time highs.

I last covered TLRY in July where I discussed how legalization can benefit its operations. After over 1.5 years of a bear market, the stock may be ready for its next bullish rally.

TLRY Stock Key Metrics

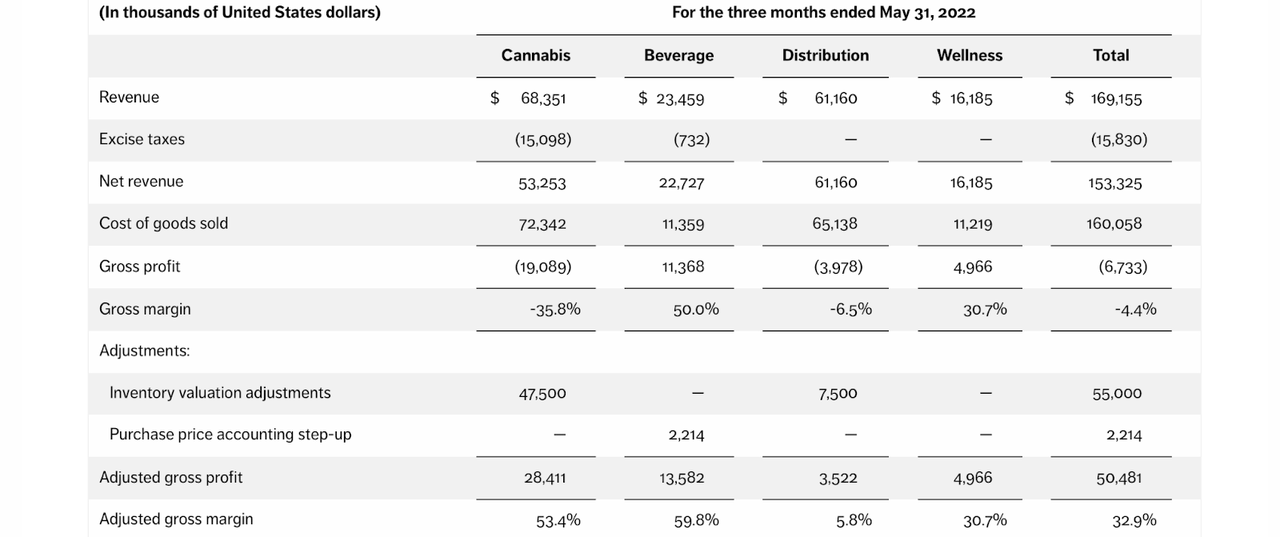

In the latest quarter, TLRY reported 8% revenue growth to $153.3 million or 14.5% growth on a constant currency basis. The net loss stood at $457.8 million due to a $395 million impairment primarily related to inventory write-down.

The company reported a negative 4.4% consolidated gross margin. That margin was heavily impacted by the impairment costs discussed above. Excluding the inventory valuation adjustments, adjusted gross margin stood at 32.9%.

FY22 Earnings Release

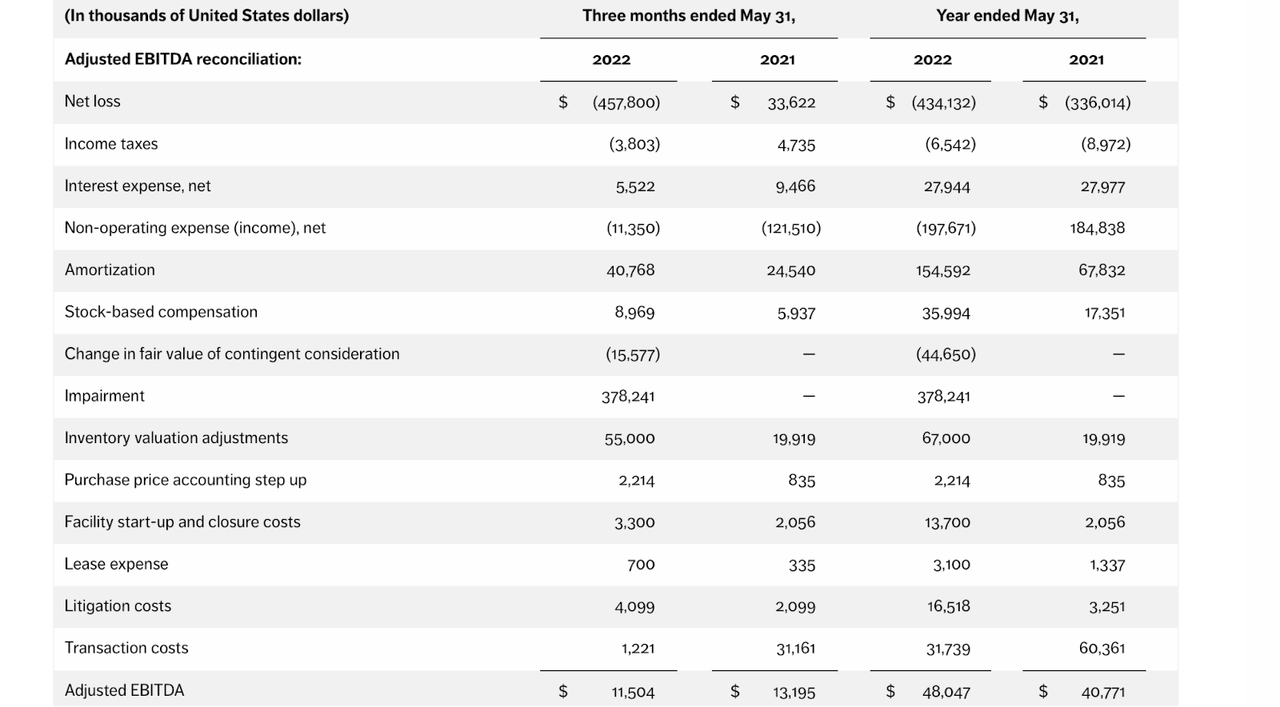

Adjusted EBITDA stood at $11.5 million – 7.5% of net revenue – though there are a lot of adjustment items to note.

FY22 Earnings Release

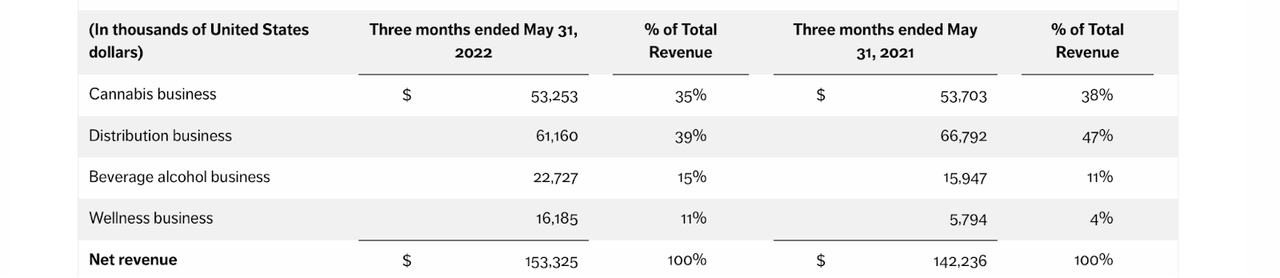

While TLRY is most recognized as a cannabis company, cannabis sales actually made up only 35% of overall sales.

FY22 Earnings Release

The company notes that it has realized $85 million of cost synergies from its Tilray-Aphria transaction, already exceeding the original target of $80 million of cost savings by the end of fiscal year 2023. The company has identified an additional $20 million of potential savings to be implemented by the end of this next fiscal year.

Based on this plus an additional $80 million of expected cost savings over the next two years related to its HEXO transaction, management expects the company to be free cash flow positive in fiscal year 2023. In comparison with the deep cash burn seen elsewhere in the Canadian sector, these numbers are solid, but the company will need to continue executing on those cost synergies for the benefits to begin accumulating for shareholders.

Is TLRY Stock A Buy, Sell, or Hold?

TLRY stock remains a confusing investment proposition. On the one hand, the valuation is no longer so demanding – at under 3x sales, this stock can really bounce if it begins to show a recovery in cannabis growth rates.

Seeking Alpha

Assuming 15% long term net margins, a 1.5x price to earnings growth ratio (‘PEG ratio’), and 12% growth rates, I could see the stock trading at 2.7x sales – implying 32% potential upside over the next 3 years. On the other hand it is hard to recommend buying TLRY when the stocks of US cannabis operators are investable and trading at compelling valuations. Stocks of operators like Green Thumb (OTCQX:GTBIF) trade at comparable sales multiples in spite of generating 30% EBITDA margins and GAAP profits. US cannabis operators have direct exposure to ongoing legalization at the state level, whereas TLRY only offers indirect exposure through its investment in MedMen (OTCQB:MMNFF). Sure, there’s also the potential for TLRY to eventually enter the United States upon federal legalization, but that kind of regulatory reform may be years, if not decades away and by then, will the US operators have already won all the market share? Other key risks here revolve around financial strength. Many Canadian peers like Aurora Cannabis (ACB), Canopy Growth (CGC), and HEXO (HEXO) have seen their balance sheets eventually suffer from the consequences of operating losses. While TLRY continues to post cash flow numbers that comfortably pace Canadian peers, that might not continue indefinitely – at the very least shareholders may continue to face ongoing dilution. I also question the various investments in non-cannabis businesses, as it is not clear the long-term strategy nor how they will lead to a path to profitability. While I continue to rate TLRY a buy on valuation, I heavily emphasize my preference for the stocks of US operators.

Be the first to comment