Justin Lambert/DigitalVision via Getty Images

Mediocre companies rarely make for attractive investment opportunities. But every so often, you will come across a company that really just is not that great but that is priced so low that it is difficult to not be tempted to buy in. One such firm is a specialty retailer called Tilly’s (TLYS). Prior to the COVID-19 pandemic, the company had exhibited consistent revenue growth. However, profitability and cash flows have been rather volatile. This was all magnified by the pain experienced during the 2020 fiscal year in response to the pandemic. Fortunately for investors, the worst of the crisis is over and the company is trading at levels that should be considered quite appealing no matter which perspective you view them from. Add onto this the fact that the company has no debt and a surplus of cash on hand, and although financial performance has been mixed in recent years, it could make for an attractive opportunity for value-oriented investors.

A specialty retailer

Tilly’s operates today as a specialty retailer focused on casual apparel, footwear, accessories, and hard goods. The company mostly targets young men, young women, boys, and girls. In particular, the company brands itself as promoting an active and social lifestyle, which makes sense given the demographic it’s targeting. Through its stores, the business sells a variety of leading third-party brands. These include Adidas, Brixton, Dickies, G-Shock, Ray-Ban, Spy, Roxy, and more. On top of this, the company has its own proprietary brands. These include RSQ, Full Tilt, Blue Crown, Sky & Sparrow, White Fawn, and others. These brands stretch across a wide variety of products, ranging from apparel for different demographics to accessories and fragrances and more. Though it is worth mentioning that their own proprietary brands only account for about 26% of sales, with its third-party brands representing 74% of overall revenue.

As I mentioned already, the company focuses on young men and young women, as well as boys and girls. According to the company, an impressive 37.2% of the firm’s overall sales come from men, compared to 26.3% that come from women. Boys’ and girls’ apparel make up 8.9% of sales, while footwear products make up 10.6%. Accessories are a particularly big category for the company, accounting for 15.8% of revenue. And hard goods make up the remaining 1.3% of sales. Another important note to make is that the company is dedicating significant resources to growing its e-commerce operations. Prior to the pandemic, e-commerce accounted for just 15.9% of the company’s overall revenue. That figure jumped to 32.6% during the company’s 2020 fiscal year, but it has fallen a bit since then. In the first nine months of the company’s 2021 fiscal year, for instance, e-commerce revenue accounted for just 19.9% of overall revenue, with total e-commerce sales dropping by 3.6% year over year.

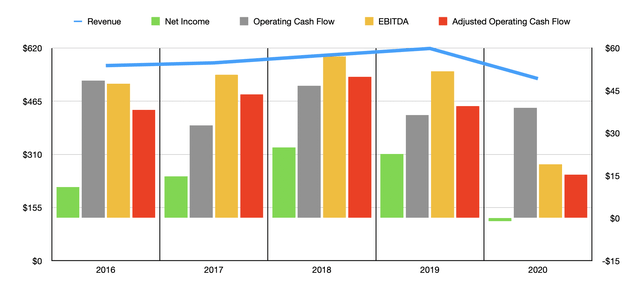

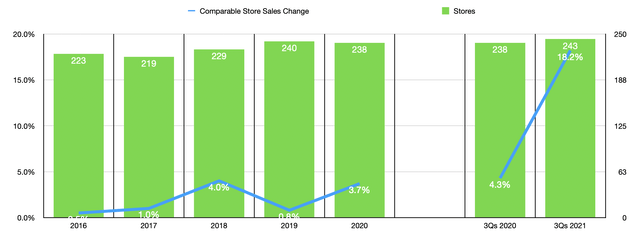

In recent years, management has done well to grow the company’s top line. Revenue rose from $569 million in 2016 to $619.3 million in 2019. But then, in 2020, sales dropped, declining to $531.3 million. Fortunately for investors, growth has resumed for the company. In the company’s 2021 fiscal year, total sales came in at $775.2 million. That represents an increase of 45.9% over what the company achieved in 2020 and it is 25.2% higher than the company’s 2019 fiscal year. While the company has benefited from consistent comparable-store sales growth in recent years, another driver, besides the e-commerce operations, has been the rise in store count for the business.

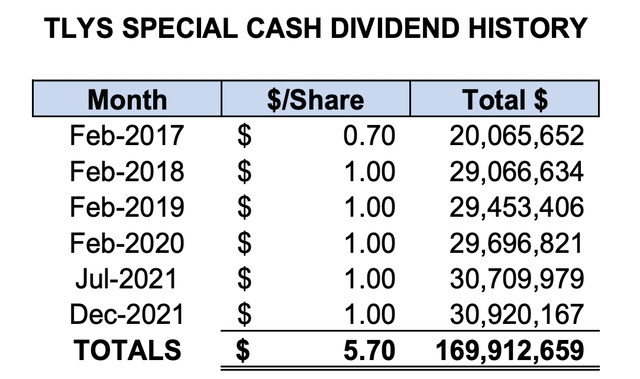

Between 2016 and 2019, the company grew from 223 locations to 240. As of this writing, the company has 241 stores in operation. Moving forward, management anticipates spending between $25 million and $30 million annually to add between 10 and 20 stores per year, with the 2022 fiscal year resulting in between 15 and 20 new stores. It is also worth noting that the company has achieved this growth even while paying out special dividends to investors over the past few years. Between its 2017 fiscal year and the end of its 2021 fiscal year, the company paid out $5.70 per share in distributions, totaling $169.91 million total.

Although this is great, it would be nice if management were to focus better on its bottom line. As the first chart in this article illustrates, net profits have been a bit volatile. After rising from $11.4 million in 2016 to $24.9 million in 2018, net income dropped to $22.6 million in 2019 before turning to a loss of $1.1 million in 2020. The good news for the company is that management is forecasting net profits for the 2021 fiscal year of $64.6 million, with $52.2 million already reported for the first nine months of 2021.

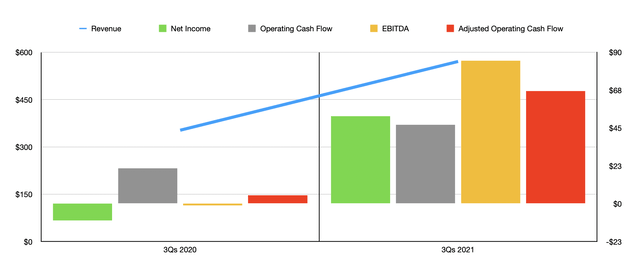

In addition to net profits, we should also pay attention to other cash flow metrics. Operating cash flow has bounced around within a fairly narrow range over the past five years. In 2020, it came in at $38.9 million, up from the $36.4 million reported one year earlier. Even if we adjust for changes in working capital, there is no clear trend with operating cash flow. And when it comes to EBITDA, the trend has been similar. Between 2016 and 2019, this metric ranged from a low of $47.5 million to a high of $57 million. But then, in 2020, it totaled just $19 million. The good thing is that all of these profitability figures are up for the first nine months of the company’s 2021 fiscal year. Operating cash flow of $46.9 million dwarfs the $21 million reported in the first nine months of 2020. And EBITDA of $85 million is significantly higher than the negative $1.1 million reported one year earlier.

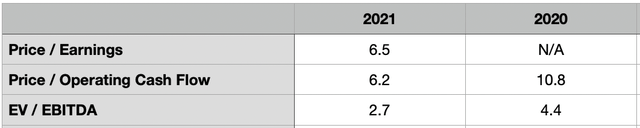

One thing that is important to note is that the volatility experienced by the company from an earnings perspective and from a cash flow perspective definitely muddies the waters when it comes to valuing the business. We can rely on management guidance for the net profit figure, giving us a price to earnings multiple, using the 2021 fiscal year, of 6.5. But there is no way to realistically estimate what operating cash flow and EBITDA might be for the year. To be conservative, I assumed that the final quarter of the year would be break-even for both of these, with the intention that I would rather be wrong in a conservative way than in a liberal way. Following this train of thought, the price to operating cash flow multiple with the company for 2021 would be 6.2, while the EV to EBITDA multiple would be 2.7. The latter of these benefits from the fact that the company has no debt on hand and $188.9 million in cash and cash equivalents on hand. That drastically reduces its enterprise value.

To put into perspective the company’s value, I decided to compare it to five similar firms. On a price-to-earnings basis, only two of the five companies I looked at had a positive reading, and these were 5.8 and 7.9, respectively. Using our 2021 data, that would make Tilly’s fall right in the middle. Using the price to operating cash flow approach, the range of the five companies was from 4 to 45.2. In this case, three of the five companies were cheaper than our prospect. And using the EV to EBITDA approach, the range was 3 to 4.6, with data for only three of the companies being positive. And in this case, our prospect was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Tilly’s | 6.5 | 6.2 | 2.7 |

| Citi Trends (CTRN) | 5.8 | 4.0 | 3.0 |

| Destination XL Group (DXLG) | 7.9 | 4.1 | 4.6 |

| Express (EXPR) | N/A | 45.2 | N/A |

| Chico’s FAS (CHS) | N/A | 10.0 | 3.5 |

| J. Jill (JILL) | N/A | 4.5 | N/A |

Takeaway

Although Tilly’s seems to be growing at a nice clip, I do not consider the company a high-quality prospect. Management is making a mistake by paying out large distributions instead of dedicating that to improving the company’s bottom line and focusing on additional growth. Having said that, although the company is a volatile prospect from a cash flow perspective, I cannot help but acknowledge that shares are priced quite low on an absolute basis. Add in the surplus of cash that it has on its books and the fact that it has no debt, and the overall risk for shareholders, at least in the near term, looks incredibly low. Because of this, it could be a good opportunity for long-term, value-oriented investors.

Be the first to comment