bojanstory

Introduction

Despite the fact that Tilly’s, Inc. (NYSE:TLYS) is down 54% YTD, this is not the best time to buy in my opinion. Negative trends continue. The company’s revenue is under pressure in both retail stores and e-commerce as consumers continue to cut spending after a strong 2021. In addition, the company is unable to offset the price cuts with cost cuts, and as a result, operating margins continue to be under severe pressure.

Survey of 1Q & 2Q results

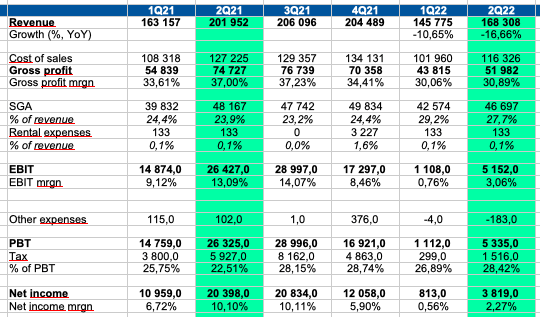

The company showed weak reporting for 1Q 2022 and 2Q 2022. We see a continuation of negative trends in key operating and financial indicators.

Company’s presentation

In 1Q22 and 2Q22, the company’s revenue decreased by 11% and 17%, respectively. According to management, revenue in 2022 will be weak, because in 2021 revenue was supported by the effect of pent-up demand.

In addition, at the moment, consumer confidence is under pressure due to negative macroeconomic trends. As a result, consumers are reducing spending in the discretionary segment.

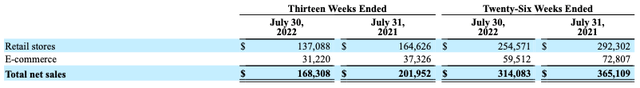

The company’s revenue continues to decline across all major sales channels. Revenue in the Retail stores segment decreased by 17%, while revenue in the E-commerce segment decreased by 16%.

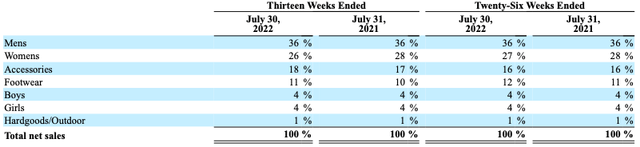

In addition, we see a slight change in the product mix. The share of women’s clothing decreased from 28% to 26% in Q2 2022.

Gross margin decreased from 37% in Q2 2021 to 31% in Q2 2022. I believe that such a decrease is caused by the inability to increase the price of final products to the level of inflation.

Operating margin decreased from 13% in Q2 2021 to 3% in Q2 2022. This decrease was due to:

1) a significant decrease in gross margin

2) an increase in the share of SGA (% of revenue) expenses from 24% to 28%.

Drivers

Macro: decrease in inflation and recovery of real incomes may have a positive impact on consumer confidence, which will support the company’s revenue.

Margin: rising prices for core products and passing on cost inflation to the end consumer can help a company maintain a sustainable operating margin.

Risks

Macro: rising prices for fuel, food and other goods have a negative impact on real consumer incomes and consumer confidence, which may have a negative effect on the company’s revenue growth.

Margin: rising prices for raw materials, input costs and increased competition for labor could have a negative impact on the company’s operating profitability.

Growth: the company notes that 2022 results will be worse than 2021 results, because now we will not see the effect of pent-up demand, which significantly supported revenue in 2021. Thus, business growth results in 2022 will look weak relative to 2021.

Conclusion

I believe that now is not the best time to buy shares of Tilly’s, Inc. First, rising interest rates have a negative impact on consumer confidence, which is negative for revenue growth. In addition, according to management statements, we will see a continuation of the negative trend, as the results in 2021 were largely supported by the effect of pent-up demand. In addition, we see that the company is not able to fully pass on the growth of costs and input costs to the end consumer, which has a negative impact on operating profitability.

Be the first to comment