stockcam

Snapchat (NYSE:NYSE:SNAP) and Meta (META) have been hit pretty hard in the last year. One of the main issues they are facing is competition, from TikTok. Which came out of nowhere 3 years ago and has started dominating the social media space since.

In the last few years, Snapchat is down roughly 90%, as well as Meta pulling back over 50%. It’s been a bad ride for both, as TikTok has been dominating the social media markets and taking ad revenue/budgets away from both companies.

Snapchat’s stock is currently at severely depressed levels, the last few quarters have been tough, and with a lot of pointing fingers at ad revenue decline due to inflation as well as TikTok’s domination. I believe the market is not properly pricing the downfall of TikTok in America (with respect to Snapchat’s stock price). In this article, I will list several reasons why I believe TikTok will fail, and why Snap has the most to gain from this occurring.

There are several ways I believe TikTok could potentially fall, with the highest probability leaning towards the United States banning it as a security risk, or at the very least forcing TikTok to gimp the app making it less addicting. I will discuss several reasons in detail below.

How TikTok Is Dominating Snapchat

Before I dive into why I think TikTok will fail, it’s important to understand TikTok’s edge over Snap and Meta. The short answer is it’s simply a better product for consumers. It was also one of the first to only short-form video format videos (excluding Twitter (TWTR) and now-defunct Vine).

TikTok advantages come in many forms. It has better video editing software and a better algorithm for selecting videos to continually keep you hooked. Social Media is all about addiction; that is where TikTok excels and destroys the competition.

TikTok’s artificial intelligence algorithm is on a level where no other company can compete. The success of these apps is determined by one thing: how long can the app keep users engaged? With that metric, TikTok destroys the competition.

There isn’t much known about TikTok’s artificial intelligence algorithm, after all, if there were other companies that would copy it. But there have been many studies on understanding their proprietary algorithm. The consensus seems to point to the algorithm teetering on the line of being unethical. One of the most controversial aspects of the TikTok AI algorithm is measuring the looks of their content creators and promoting people’s videos based on their attractiveness. There have been many studies and experiments to prove this is likely the case, as shown here and as well as here. This type of selectiveness is quite controversial and does have a mental health impact on those who excessively use the app, where the attractiveness level does not represent the statistical norm.

In addition to the controversy listed above, TikTok’s algorithm is a step above many of its competitors. It takes a completely different approach in that it doesn’t require user feedback to introduce new videos to its users. It builds a total profile of your psychology (which includes your gender, political ideologies, religious beliefs, and so on). TikTok’s AI tracks the behaviors of all its users, and with that information, the app starts building a database of users’ personalities in more detail than many should be comfortable with. An in-depth article that explains the algorithm as well as the dangers compared to its competitors can be found here.

Make no mistake, these types of apps are actually dangerous to your health, it just so happens that TikTok is so addictive compared to its competition that the blame is put squarely on them, as their algorithm takes everything a step further. Studies are coming out concluding that apps like TikTok are harmful to mental health and can permanently damage the human brain. As social media apps have the ability to rewire your brain’s relationship with dopamine, there are tons of academic articles that are reaching the consensus social media is destroying our attention span, and causing lasting psychological effects, where TikTok is taking most of the blame in the media.

TikTok’s success is a double-edged sword. As the consensus among lawmakers and academics is social media addictiveness is directly correlated to the mental health damage it does to its user. This makes it an easy target for the government to take a stance in the name of mental health and start regulating social media to the point where it takes away TikTok’s edge and levels the playing field. Also, it’s easy to put the blame on TikTok since it’s not an American company. Clearly, the playing field is not even when it comes to the algorithm. TikTok’s unethical AI has an unfair advantage compared to Snap and Meta.

Why Snap’s Outlook Looks Positive

There are many headwinds that TikTok is potentially facing that aren’t going to be as difficult for Snap. In the previous section, I spent time explaining what makes TikTok much better than its peers, which I hope gives the understanding that its edge also makes it a mental health risk for people. Ironically, the Chinese government recognizes this and has the Chinese version of the TikTok app heavily regulated in its own country. The chances that TikTok is regulated and forced to tone down due to its unethical AI algorithm are a very real possibility. Senators have begun introducing bills to curb the mental health damage done by social media already.

The mental health angle isn’t the only issue TikTok survivability faces. There are two potential additional concerns, where I will leave the stronger argument last in this section. The first issue stems from the fact that TikTok is owned and run by a company in China called ByteDance (BDNCE).

I’ve been trading for well over a decade and the one thing I’ve learned and preached is don’t ever own Chinese stocks. There are many reasons for this, as almost all companies have ties to the Communist Chinese Party where corruption runs rampant. In China, company finances are not as regulated as they are in the states. This causes various issues, where companies can claim massive growth and profits, through fraudulent means, when none may exist. There are many examples of this happening, where US investors have gotten burned, one example is the fraud of Luckin Coffee. Once the fraud was exposed by short sellers, the stock plummeted over 90% eventually being banished from the US Stock exchange at the expense of causing pain to American investors.

Lately, the USA has taken a strict approach to Chinese stocks, with a lot of them being threatened to be delisted from American stock exchanges due to their tendency to make up their financials. Although ByteDance is not a public company yet, it’s reasonable for American investors to doubt its published financials. Just look at the latest real estate collapse with Evergrande in China.

There is definitely a chance, like a lot of Chinese companies, that TikTok can implode internally. This is further exacerbated by the details we get from people working there. Obviously, it’s challenging to get a feel of what’s happening in the China offices, but one could imagine it must be worse than what International employees have been enduring.

The current consensus is that ByteDance is a disaster on several fronts. Employees all over the world claim poor compensation, difficult work hours, and a horrible culture where many people don’t last more than a year. You can see examples on this anonymous blind post (plenty of examples like this) of an employee counting days they can leave (mostly tied to a sign-on bonus requiring you to stay at least a year). You can see even a further breakdown in this article on why working at TikTok is a nightmare. These types of stories don’t really represent a healthy and stable company. Talented employees are the staple of technology companies, if you don’t have the talent, you will eventually fade into obscurity. These employees will go to competitors and ignite a comeback there.

So far, we have covered a controversial AI algorithm that jeopardizes many lawmakers and academia who are claiming social media apps harm people’s mental health (with TikTok as the main focus), as well as painting TikTok as a difficult company to work for, where its talent is fleeing. Now, the most likely reason TikTok will fall is that it is a huge security threat, that many non-tech savvy people don’t understand. The amount of data collection TikTok accumulates is unheard of compared to its American peers, and worst yet, the information is stored in a country that is often viewed as an enemy of the United States.

ByteDance has direct government ties, and based on what we know, I think it’s safe to say TikTok is essentially run by the Chinese government. There is no doubt that ByteDance is an extension of the Chinese government, there has been confirmation of at least 300 TikTok employees have ties to the Chinese state-aligned media.

This information is not new, in fact, it’s well known by the US government, where the previous administration had started a procedure to ban TikTok. The reason? Because TikTok is a national security threat. Unfortunately, the current administration did not think the ban would survive legal challenges and is now dropped.

In terms of a security risk, what separates TikTok from other social media apps is its aggressive data collection. It goes beyond the normals of what you see with Snapchat and Facebook. This aggressive data collection includes biometric data, keystroke patterns, passwords, draft messages, texts, location data, and so on. It is unclear what this data is being used for, as it’s likely stored in the Chinese data center, to which the Chinese Communist Party has access. Many would argue this lack of clarity of how ByteDance handles user info violates app store policies of the Apple Store and Google Play. The FCC has accused TikTok as a surveillance tool by the Chinese Communist Party to monitor Americans and has recommended Apple (AAPL) and Google (GOOG, GOOGL) remove TikTok from their app stores.

Although the ban has been dropped by now, it has not been forgotten as pressure by Congress continues on taking action against ByteDance. It’s only a matter of time before Congress figures out a legal solution to the invasive app. As you can see, the headwinds listed in this section are only applicable to TikTok, and TikTok alone. Snap and Meta do not have any of the issues listed in this section, leaving a clear path for them to regain market share from TikTok. On an interesting note, it’s really not that far-fetched that TikTok might get banned in the US, after all, India is one of the latest to do it citing national security concerns.

Why Snap Has The Most To Gain

As I’ve laid out several reasons why it’s unlikely TikTok’s dominance will last, it’s important to understand who benefits the most from its potential demise. I believe those two companies are Meta and Snap. Snapchat’s stock likely gaining the most, since it’s a mid-level sized company, with its stock price plummeting 90%.

Snap and Instagram have similar products to the short-form videos of TikTok. Snap calls their product Spotlight, while Meta calls theirs Reels. Naturally, if TikTok were to be removed or gimped in some form, I believe consumers will naturally move to Snapchat for their short-term form needs. As TikTok and Snapchat are both popular among Gen Z, it would only be natural for Gen Z to migrate to their second-favorite app, Snapchat. Although admittedly not as addicting or as good as it would be on the TikTok platform, this migration will increase daily active users, as well as increase revenue, as ad money would move from TikTok back to Snapchat. Both these metrics are the pinnacle of how social media stocks are judged on Wall Street, and with both of them increasing, it’s only natural the stock price will appreciate.

Why Snap Will At Minimum Double

First off, let’s be clear Snap stock has corrected over 90% from its highs, it hasn’t been pretty. In the most pessimistic of cases, a stock never goes directly to 0, it often lags around, bounces a bit, then goes to 0. Assuming we are in the worst case, the stock is due for a bounce, in the best case, we will never see these lows again. In other words, it’s highly likely Snap will see a significant bounce in the upcoming months, even if you believe the stock will eventually go to 0.

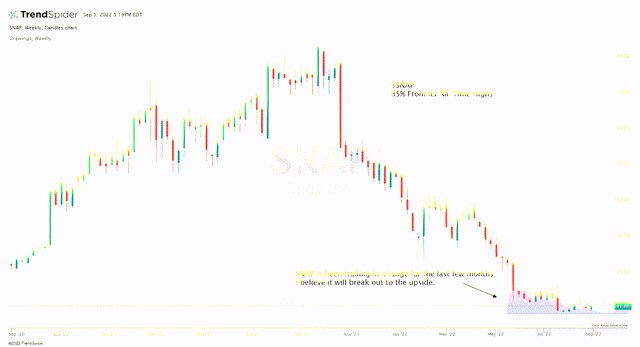

The weekly chart below shows a somber picture of a high-flying pandemic stock. What exactly went wrong? The first issue was Apple decided to control how user information can be extracted via the use of their phones. That was the first significant drop in October 2021. The stock then proceeded to trade in a range of around $50 until Meta released catastrophic Q4 Earnings in Feb 2022, and Snap fell via sympathy. A week later, the stock rallied 40-60% when it released earnings. Snap was on track to post its best revenue quarter in Q1, then the Russia Invasion of Ukraine put a damper on that. From there, things fell apart, as the stock traded around $10, when in Q2 earnings, they declined to forecast any sort of forward-looking financial numbers.

Recently, Snap announced a layoff of 20% of its employees (1000 out of 5000 total). In true stock market fashion, the stock has rallied by almost 20% from the news as they plan on cutting a lot of projects (including hardware).

Snapchat Weekly Chart (TrendSpider)

What gives me hope that this stock will rebound to a degree is that users have not declined and it continues to grow even during the latest earnings report. Additionally, things have gotten weird when it comes to Apple limiting user information across apps, as they are now potentially going into the ad business themselves. This in itself may lead to a reversal of previous tracking limitations across apps, either by Apple or via lawsuits.

To sum it up, the stock has declined purely based on macroeconomic conditions impacting the market, as well as its difficulty maximizing ad revenue, as its daily active users continue to grow. The fact daily active user growth is still intact gives hope that it’s not exactly necessary for TikTok to falter for the stock to rebound significantly.

Conclusion

I believe I may have taken a somewhat controversial approach to how Snapchat is likely to rebound at the expense of TikTok. But keep in mind, that Meta faced very similar scrutiny when in Europe, where they ended up being slapped with aggressive regulations, that several affected the price of the stock.

I’ve laid out reasons why I think TikTok’s dominance may come to an end and why Snapchat may be poised for a strong bounce. You can be assured that the problems I’ve listed above with TikTok are well known to Meta and Snap and are likely heavily lobbying Congress as we speak. As for the time frame, that is difficult to say (after all, this is an investing website), but given these levels that Snap is currently trading at, and the uncertainty of TikTok’s dominance, I believe Snap is a great purchase at its current levels, where at the minimum is likely to return 2X at current levels.

Be the first to comment