xavierarnau/E+ via Getty Images

When conservative management such as Cirrus Logic, Inc.’s (NASDAQ:CRUS) place themselves on the clock, wise investors must heed the chimes. Although to some it was too quiet, Cirrus’ management grabbed the key, wound the clock and declared a path of growth unparalleled. Clocks, in past times, played critical roles in communities where often few, if any, possessed time pieces. That center of town meeting house time piece united its citizens with common synergy, a purpose we so hope to accomplish.

The Quarter

The company reported its quarterly results (Q1 2023), in our view secondary in significance, on August 2nd. The company reported a record revenue at almost $400 million, with non-GAAP earnings equaling $1.12. Cash increased slightly to $450 million. Interestingly, the company added $500 million to its already $135 million for repurchasing stock. Guidance for September, at the mid-point, increased year-over-year by a few percent. The solid results and guidance add intrigue, but certainly were not the real story.

Three Major Chimes

It was within the news and conference call that management proclaimed that they are now on-the-clock with three very real chimes. The company discussed quarter-hour and mid-day chimes also.

First Chime

It begins with this from the shareholder letter, “During the quarter, we started development of a next-generation 22-nanometer smart codec.” In the past, Cirrus hasn’t advanced this type of venture without first hooking a big fish. Three big catches come to mind. First, Apple (AAPL) replacing all of its codecs within phones and tablets with a new more powerful and lower power product. The second might be Samsung adding back a Cirrus codec in its high-end phones. Third, it might be a high-powered codec shoring up Cirrus’ greenfield laptop business. Winning in all three is also possible.

Looking backward helps determine ASP and timing. Cirrus first developed a 28nm DSP with the purpose of enabling voice biometrics. Within a year or so, a 22nm full mixed signal product appeared. Cirrus developed the hardware, but then stopped before adding the required intricate software functions. The targeted ASP for the DSP was $2. Not one fish bit. At the call, when asked about ASP growth, Forsyth stated:

“That’s really the logic that drives you down from — in this case from 55-nanometer to 20-nanometer and that increased processing represents more features and capabilities and so you do typically expect to see some ASP accretion on. . .”

In our view, it represents a $1-$1.5 ASP increase with the primary target being Apple, a codec increase from $2 to $3+.

With Cirrus’ business model, major efforts require a year of development and a year for the customer to test before the real revenue ramp. This chime could sound in two years.

A table shown next summaries revenue possibilities.

| Revenue | ASP Adder | Units (Million) | Revenue (Million) |

| Apple | $1.25 | *300 | $400 |

| Samsung | $3.5 | 75 | $250 |

| Laptop | NA | NN | Included within the Category below |

* iPhone plus tablet

We can’t fathom Cirrus undertaking this kind of resource intensive task without Apple demanding it. Samsung hasn’t been a reliable customer over time, adding and dropping Cirrus’ codecs.

Second Chime

Next chime rings with a deeper understanding of Cirrus’ movement into the laptop market. From the shareholder letter, “With ongoing engagements with numerous leading OEMs, in FY23 we expect to see over 40 new laptop models come to market featuring our high-voltage boosted amplifiers and codecs.” During the call, Cirrus’ CEO, John Forsyth, adds, “In terms of the overall size, I am not going to predict what we can do, but from a SAM perspective, we see this within our strategic planning horizon as getting to a $1 billion SAM or higher across audio haptics and power.” The parts for the three categories include:

- Codec: Audio, 1, $2-$3 ASP

- Amplifiers: Audio, 2-4, $1-$2 ASP

- Haptics: HPMS, 1-2, $0.60-$1.20

- Power Charging: HPMS, 1-2, $1-$2

- Battery Sensor: HPMS, 1-2, $0.50-$1.0

- Power Management: HPMS, 1, $1.0 (Question Mark)

- Total ASP Between $5.5 – $10.0

- Half ASP Audio, Half ASP HPMS

In the past, Cirrus’ penetration history results in achieving 60%-70% of its SAM. In our view, the likely wins over the next few years chime in at $600 million. This chime rang a few months ago and will continue gaining velocity. Again, as stated above, we aren’t sure the full purpose for the 22 nm codec, but if its primary purpose is for laptops, then the revenue falls within this chime. We doubt.

Third Chime

Management discussed a future market, battery charging, management plus sensor. From the last quarter’s conference, it appears that the future sensor will use 22 nm technology. Our interest in this development arises from two posted openings at Cirrus plus a statement made by Forsyth in the Q&A.

- 1st Opening: “You will play a fundamental role in bringing to market next-generation devices for our growing power and battery management business.” Location: Cupertino.

- 2nd Opening: Product Marketing Engineer – Battery and Power, “Working with multi-functional teams across the organization, you will assist with and/or lead initiatives for a strategic customer within a leading consumer electronics company.”

- Answering a question concerning Lion charging technology, Forsyth added, “That’s a big focus of our R&D efforts over the past year and in the coming years. So that will – I will leave it there given the custom nature of those products.” Cirrus has never produced fully custom products except with one customer, Apple.

Apple revenue with an ASP of $1.25 ($0.75 from a charging product and $0.50 from a sensor) equals the same as the codec change or $400 million. This chime rings no sooner than with 2023 iPhones.

The Quarter-Hour Chimes

Management discussed some in between the hour chimes. The first 15-minute chime surprised us. The Android business is significantly supply constrained and is expected to remain so through fiscal year 2023. We ask, so what is all the recent capacity expansion designated for? We are still waiting.

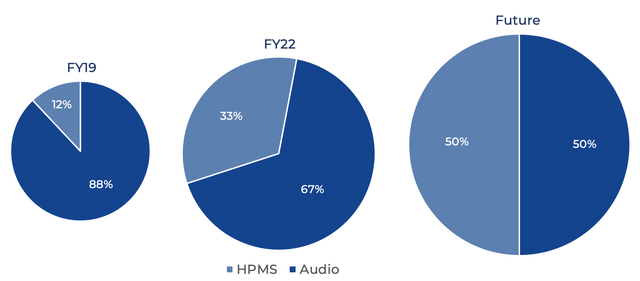

A half-hour chime might be a loud ring, a really loud ring. From the shareholder, we offer a slide.

The company’s goal is for 50-50, helps add support to our analysis.

| Revenues Breakout | FY-2022 | Codec Adder | Laptop Adder | Power Management Adder | Totals | Revenue Shortfall |

| Revenue | $1.8 B | $0.40 B | $0.60 B | $0.40 B | $3.3 B | |

| HPMS | $0.60 B | $0 | $0.30 B | $0.40 B | $1.3 B | $0.60 B |

| Audio | $1.2 B | $0.40 | $0.30 B | 0 | $1.9 B |

Our analysis suggests that we have missed a significant level of revenue from HPMS. Yet, with identified, more certain sources, the growth of total revenue from $1.8 billion to close to $3.5 billion over the next few years isn’t small by any means. The importance of the last call isn’t numbers; it’s the vision of what’s coming and its certainty. How much of the revenue can be found within the 15-minute chime isn’t known; it isn’t small.

The Noon Gong, Gong, Gong…

At noon, clock chimes can deafen our ears. Cirrus rang the noon sound. The company announced a massive increase in the stock buyback from the $135 million to $635 million. At $85 a share, this represents 7.5 million shares or almost 15% of the outstanding shares. Why? Does the company have the cash? At quarter’s end, Cirrus had approximately $435 million. The June quarter cash, not yet received, will equal approximately $70 million. With guidance near $500 million, the cash generated equals approximately $105 million. By the end of the September quarter, Cirrus will hold approximately all the needed $600 million plus in cash.

The question still remains why has Cirrus put in place an authorized buying program to purchase nearly 15% of the company? In the past, management addressed what it believes was a cheap value with heavy stock buying. Buying, during the September quarter may be significant, much higher than usual. This also points to a confidence that the stock price is cheap compared to the near-term future. Growth coming?

Risk & Investment

Cirrus is not a stock for the faint of heart. Its price moves drastically. Risks exist. The company may fail in developing 22nm codec, though not likely. A recession might end in a depression. But for us, this unusual news from management creates buying opportunities, especially on weakness. We are lifting our rating to buy again from hold, but only on weakness. Big Ben is chiming loudly. The noon gong almost deafened our ears. For investors looking for value, on weakness, we believe this is one to add. ASPs will be growing going forward, enormously growing.

With stable unit sales and three ordered chimes, Cirrus should see unprecedented growth. The importance of the last report was NOT in the numbers on the clock, rather from the ordered sounds of the chimes. Those sounds were clear, backed with historical precedence.

Be the first to comment