sharrocks/iStock via Getty Images

In The Intelligent Investor, the author, Benjamin Graham wrote that “investment is most intelligent when it is most businesslike.“

What that means is that Graham looked at the businesses behind the securities as a prospective buyer would of the whole business. Pat Dorsey, Founder at Dorsey Asset Management and author of two books on investing, explained it like this,

“To me, the core insight of Benjamin Graham is that you view a stock as a piece of a business and, by doing so you remain focused on the cash the business will generate and on its balance sheet as opposed to the opinions of other investors in the market. The importance of that hasn’t changed since Graham’s time.”

In Security Analysis, Graham wrote,

“It must never be forgotten that a stockholder is an owner of the business and an employer of its officers.”

Throughout his life, Graham informed investors that they, not management, are the rightful owners of these businesses and ought to be treated with the respect and consideration that owners of a private enterprise would expect from its management. Warren Buffett said,

“The business owners approach is so fundamental that, unless it’s ingrained as part of your basic philosophy, you’re going to get in trouble in life when you do investments.”

I think it’s extremely important for readers to think like the business owner because this is core to being a true value investor, and, of course, in the REIT sector this means that you must always “Think Like a Landlord.“

The Building Blocks

For me, being a landlord is part of my DNA.

I grew up in a family where real estate was always around me.

My grandfather owned motels.

My mother sold houses.

I played Monopoly (and usually won).

As soon as I graduated from college, I went to work as a leasing agent and then I became a developer. Over the course of my 30+ year career in commercial real estate, I have either owned, leased, or brokered around $1 billion of transactions.

Over the last 11 years, I have written more than 3,000 articles (on Seeking Alpha) on various REITs, and I have analyzed most every property sector including:

- Lodging

- Gaming

- Net Lease

- Shopping Centers

- Malls

- Office Buildings

- Industrial

- Cell Towers

- Data Centers

- Apartments

- Campus Housing

- Manufactured Housing

- Timber

- Billboards

- Farming

- Cannabis

- Healthcare

- Self-Storage

- Single-Family Rentals

My first tour of duty being a Landlord was also buying my very first home. I bought a small two-story home over 30 years ago and I converted it into a duplex. I rented the top floor for $300 per month, and I had a roommate on the ground floor that paid me $300 per month.

My mortgage payment was around $400 per month and, after paying the property taxes and insurance, I had around $50 per month leftover. I know that sounds like a modest sum of cash flow, but remember, I had ZERO occupancy cost and, most importantly, this deal was my launch pad to becoming a multi-millionaire.

Within a year I had bought two more duplexes, after convincing my banker that I was credit worthy. I began to assemble more rentals within a 1-mile radius; this way, I could easily manage the properties and collect the rent myself.

Then, after I had assembled a portfolio of around 10 rentals, I decided to venture out into the “big boy” business by developing free-standing net lease stores “from the ground up.“

My first project was for Advance Auto Parts (AAP). I recall that it was a 10-year “gross” lease, which means the landlord was responsible for paying the taxes, insurance, and maintenance.

I learned quickly that the best leases to obtain were triple net contracts in which the tenant is responsible for paying these costs (taxes, insurance, and maintenance).

Many landlords only offer triple net leases because they can reduce their investment risk by having tenants assume responsibility for expenses that can increase unexpectedly, such as replacing a roof or repaving a parking lot.

Investors also enjoy the stability provided by leases typically lasting 10 years or more with clearly defined monthly rental income.

Triple net leases also are often inked by tenants with strong corporate balance sheets, which can minimize investment risk. Also, triple net leases often include options to account for additional rent increases adjusted for inflation.

With each new deal that I developed, I learned more about the lease structure, and I began to tighten up costs such that I could improve my investment spreads and overall cash flow.

By utilizing the NNN lease structure, my pro formas were much more predictable, as I could easily estimate the future cash flows without guessing about the cost for snow removal, potholes, or tax increases.

Over the years, I began to expand my portfolio by adding shopping centers and warehouses, all the time working to grow cash flow and enhance diversification.

My goal was to become a REIT and list shares such that individual investors could benefit from the value creation process.

But that didn’t happen…something much better did though!

There’s Another World Out There

In my new book, The Intelligent REIT Investor Guide, I explain,

“…equity REITs allow the investor to determine the type of property he or she invests in and often even the geographic location of the properties in question.

Most equity REITs today are specialized, best-in-class operating companies that invest in only one or two property types. This makes them concentrated experts in their fields of business, which gives greater chances of investors reaping significant benefits over time.”

As I reflect on my pre-writing career (pre Great Recession), I now feel like a kid in the candy store in which I can now have access to a global real estate empire.

With the touch of a button, I can buy or sell shares in over 150 U.S. equity REITs and the best thing is that I can “avoid the 3 T’s” (taxes, trash, and toilets).

No longer do I have to manage real estate, because as a shareholder in over 40 REITs, I have hired these various CEOs to generate value for me. Quoting from my book again,

“To create value from external growth initiatives, a REIT must earn a return on any new investment that exceeds the cost of the capital deployed.”

I added,

“…disciplined decision making, adequate financial controls, and incisive forecasts are becoming increasingly important to publicly traded management teams as they seek to get ahead of the competition.”

With that being said, I will now examine three REITs through the lens of a landlord, recognizing that I am a fractional owner in all of the buildings in the portfolio (of all three REITs).

Remember, as a REIT investor, you must always think like a landlord!

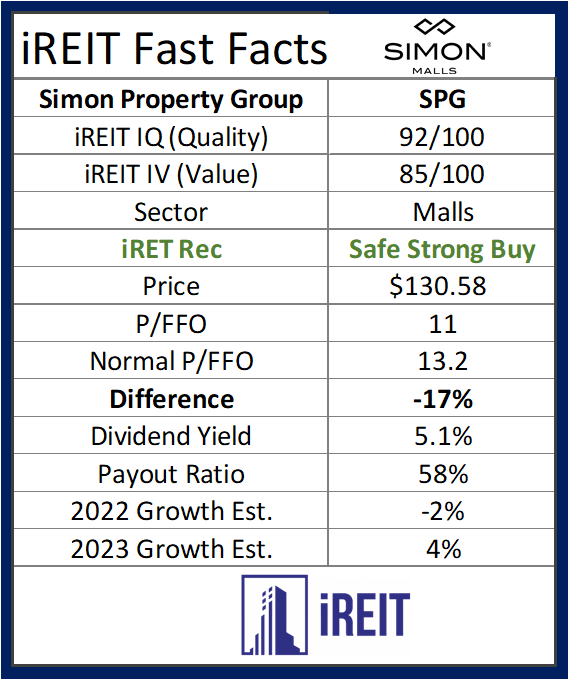

Pick #1: Simon Property Group, Inc. (SPG)

Simon Property Group is the largest landlord of regional malls in the U.S. and is also a major owner of retail properties in Asia and Europe. SPG’s portfolio consists of 232 regional malls and outlet centers, totaling 186 million square feet of GLA.

Again, thinking like a landlord, you always want to have the scale advantage.

Also, over five years ago SPG began building out a non-real estate platform to gain greater insight into the consumer, develop extensive relationships with leading brands, and utilize its strong investment skills. These retail operations investments include SPARC Group and JCPenney.

SPARC includes seven brands— Aéropostale, Brooks Brothers, Eddie Bauer, Forever 21, Lucky Brand, Nautica and Reebok. SPG entered a JV (with Brookfield Asset Management and Authentic Brands Group) to acquire JCPenney out of bankruptcy in December 2020.

2021 was an exceptional year for SPG, culminating in a significant recovery for the stock and its earnings from property operations / cost controls and a meaningful contribution from its retailer investment platform.

This company was a classic example of a baby being thrown out with the bath water during the COVID-19 crash in 2020, and we’re pleased to take advantage of SPG’s weakness in the iREIT portfolios.

2022 thus far has been a year of opportunity and cautious optimism for SPG given improved leasing and sales, earnings upside potential, and a discounted valuation. Although we don’t consider M&A a catalyst, we believe SPG could become a buyer of Unibail-Rodamco – Westfield’s U.S. mall portfolio.

Q4-21 results were extremely strong for SPG, as the company came in well above expectations on the street. Mall occupancy grew to 93.4% in Q4-21, which was up over 200bs in the past year, though it remains below the mid-90%s levels of the prior decade.

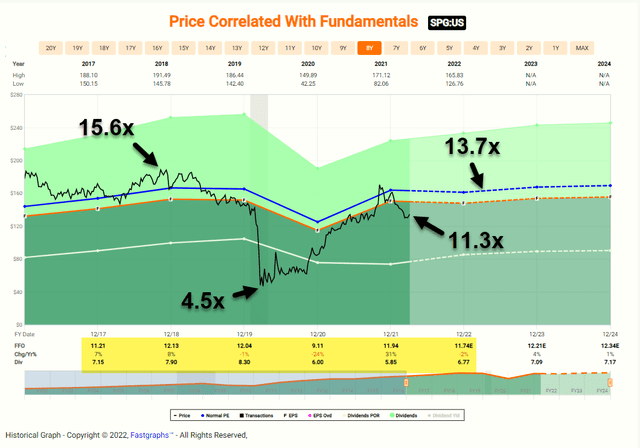

At the end of 2018, shares in Simon were trading as high as 15.6x FFO, and during COVID they traded all the way down to 4.5x. Since the depths of the pandemic, shares have partially recovered and are currently trading at 11.3x.

If you’re going to place any chips on the retail sector, SPG is an easy one, especially now as shares have sold off ~20% YTD. Shares are currently trading at $127.35, which is 20% below our buy under target of $157.50. Modest growth is forecasted – based on analyst estimates – but the dividend is well-covered. We believe a 13x multiple in warranted (~20% 12-month total return forecast).

iREIT on Alpha

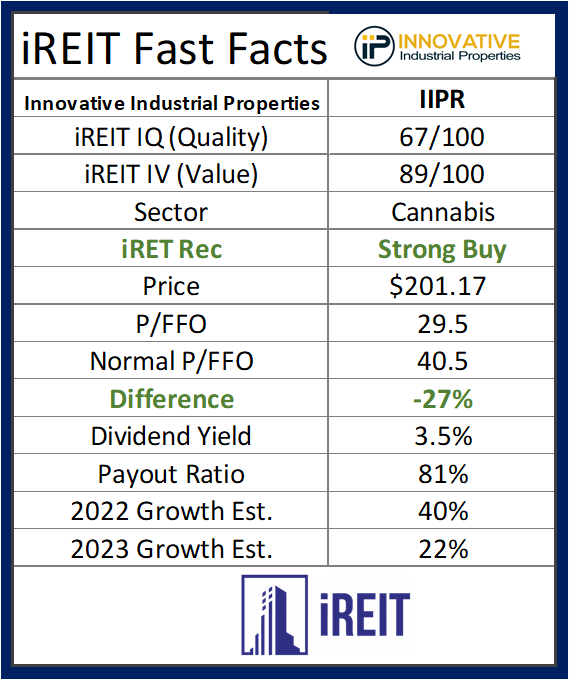

Pick #2: Innovative Industrial Properties, Inc. (IIPR)

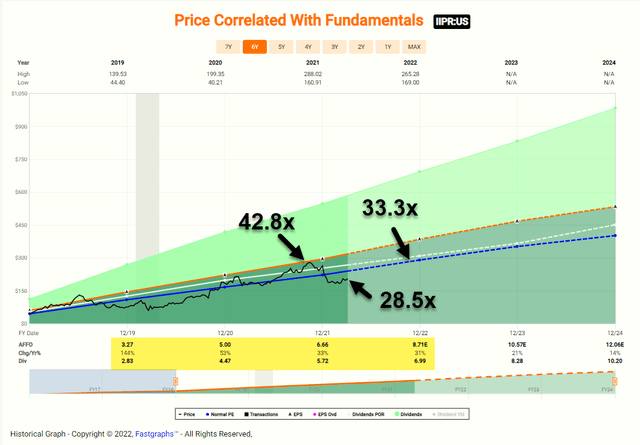

If you want to become a landlord in the cannabis sector, you must own Innovative Industrial, a “pure play” cannabis REIT that owns 105 properties (as of Q4-21) in 19 states. IIPR has one of the strongest balance sheets with no secured debt, and no debt maturities this year (or next year).

IIPR recently announced a dividend increase of almost 17%, boosting its quarterly payment from $1.50 per share to $1.75 per share. And, just last week, IIPR issued 1.5 million shares at $190/share. IIPR priced the offering as with all public follow-on offerings. For any company, stock offerings will be made generally at a discount to the last offering price.

As I informed iREIT on Alpha members,

“IIPR priced the offering as aggressively as it could, in order to continue to fund the acquisition of properties in the pipeline. IIPR was also able to upsize the transaction by more than 50% from the original launch, which is reflective of the strong level of investor interest in this offering.”

The bigger news recently was the passing of the MORE Act in the House of Representatives, which would remove marijuana from the list of scheduled substances and remove most criminal penalties.

The MORE Act would also allow the government to offer loans to cannabis businesses, which could start to narrow spreads. All that being said, a very similar bill was passed by the house in 2020 which then stalled in the Senate, likely the same fate for this piece of legislation.

IIPR shares trade at $194.00, with a P/AFFO of 29.5x (was 43.0 x in November 2021). Given the immense forecasted growth over the next few years, we’re expecting shares to continue higher. The dividend yield is 3.5% and we’re forecasting shares to return ~40% over the next 12 months.

iREIT on Alpha

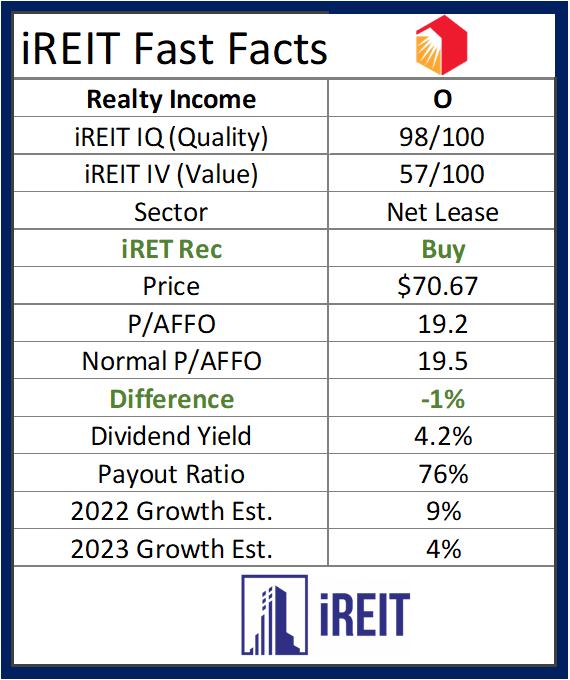

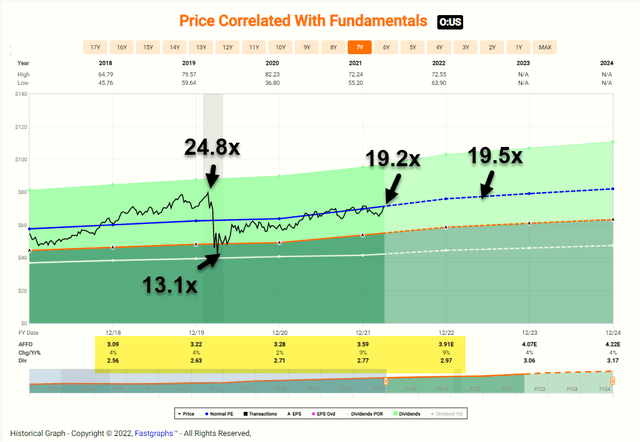

Pick #3: Realty Income Corporation (O)

As I said earlier, I was a net lease landlord for over twenty years, and, in fact, I heard about Realty Income because I used to sell buildings to them. I have deep experience in the net lease sector, having developed, brokered, and/or invested in over $250 million of such product.

So why would I want to become a landlord under the Realty Income wrapper?

First off, just consider the diversification attributes. The portfolio is comprised of net-lease retail (83%), industrial (15%), and other commercial (2%). It consists of 11,136 properties in 50 states and Europe, leased to tenants including Walgreens (WBA), Dollar General (DG), 7-Eleven (OTCPK:SVNDY), Dollar Tree (DLTR), and FedEx (FDX).

Much like Simon, scale has its advantages. Realty Income is one of the few net lease REITs that can facilitate a large-scale sale-leaseback transaction. Simply put, Realty Income’s external growth opportunities are broad and unconstrained by property type or geography.

Also, approximately 44% of revenue is generated from investment grade rated tenants. Once again, Realty Income is able to maintain growing cash flows guaranteed by large, national, blue-chip operators.

Realty Income has a market cap of ~$42 Billion, which is 3x the size of the next largest peer. This is important because it’s one of the most important competitive advantages.

Recently, Realty Income announced it was acquiring the Encore Boston, a trophy Wynn property that cost $2.6 billion to build. Realty is buying it for $1.7 billion, far below replacement cost, and that equates to a 5.9% cap rate for a Class A property. Due to Realty Income’s low cost of capital (WACC is ~4%), this deal is expected to generate an investment spread of almost 200bs.

Prior to Covid, shares in Realty Income were trading as high as 24.8x AFFO, and as low as 13.1x at the peak of Covid. Since then, as shown above, shares have returned to normal levels; however, we believe there’s room for multiple expansion as the company contains to scale (diversify) and take advantage of global opportunities.

Shares recently moved above the $70.00 mark but remain below our buy below target of $72.00. Once again, as one of the dominant landlords in the REIT sector, we believe portfolio M&A and sale-leasebacks will result in continued growth. We suspect Realty Income will become a $100 Billion landlord over the next 10 years.

Given the dividend history of the company (4.4% compound annual dividend growth rate since 1994 and 114 dividend increases), we see significant value creation in the future. The management team has navigated through multiple recessions and a global pandemic. Although I would never recommend owning just one REIT, if you decide to own just one, it should be Realty Income, “the monthly dividend company.“

iREIT on Alpha

Are You Thinking Like a Landlord?

If there’s one thing that you’ve learned from this article, it should be that being a landlord is easy, especially when you’re a REIT landlord.

If you don’t like the management team, you can fire them with one swift click of a button.

If you like the management team and you want to double or triple down, you can do that, too… with one swift click of a button.

In addition, you become a landlord to practically any form of real estate and diversify across a variety of categories. So, the next time that you decide to buy shares in a REIT, remember that you are not just an investor in the company…

You’re also a landlord!

Be the first to comment