D-Keine

I have held shares in The Trade Desk, Inc. (NASDAQ:TTD) for a year or two now, and I made my case for owning the company in a previous article. But I started to notice a pattern within my portfolio. It feels like every quarter, apparently out of nowhere, my shares in The Trade Desk, Roku (ROKU), Pinterest (PINS), PubMatic (PUBM), Unity Software (U), and Shopify (SHOP) would all tumble more than 5% on the same day, despite no news for these businesses.

The culprit? Snap Inc (SNAP).

There are a lot of companies tied to the digital advertising space in one way or another, and given that Snap is the first of these digital advertising companies to report, Mr. Market takes these results as a barometer for the rest of the industry. While a lot of the companies in the digital advertising space that I own are substantially different from Snap, yet they continued to be dragged down each quarter – none more so than The Trade Desk.

As I write this, Snap has just delivered another poor quarter, and, as usual, shares of The Trade Desk are down ~7% on the news. So, it’s time to decide if these share price falls are merited, or are they just another example of a knee-jerk market reaction?

Investment Thesis: The Trade Desk

The Trade Desk is leading the charge in a world of advertising that is demanding more transparency. This has been severely lacking due to the dominance of walled gardens such as Alphabet (GOOG, GOOGL) and Meta Platforms (META). The Trade Desk has grown into a true Ad-Tech leader, and as digital advertising (and in particular connected TV) continues to take up a higher share of global advertising dollars, I think this company is positioned to benefit immensely.

Its core offering is a demand-side programmatic advertising platform that ad buyers can use to get the most out of their advertising dollars. Through this self-service, cloud-based platform, ad buyers can create, manage, and optimize their digital campaigns across a variety of channels and devices, including computers, mobile phones, and connected TVs. It generates revenue through charging a platform fee based on a % of a customer’s total advertising spend, as well as through providing additional data and other services & features.

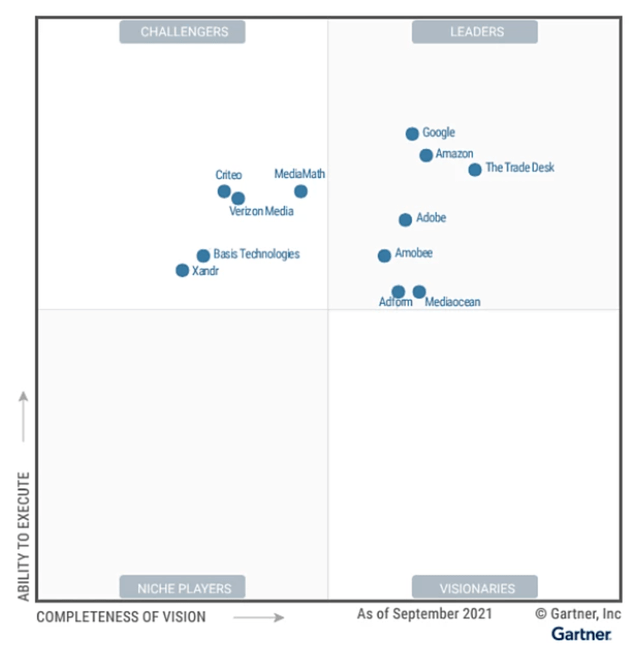

The transparent, independent approach taken by The Trade Desk has been a breath of fresh air, and the company has successfully built a market-leading product. One look at the 2021 Gartner Magic Quadrant for Ad-Tech shows how this business has grown into a leader, despite intense competition from some very big names.

The future also looks extremely bright for The Trade Desk, thanks to the secular growth within digital, programmatic advertising combined with new opportunities arising in areas such as connected TV. Recently, we have seen the likes of Netflix (NFLX) and Disney (DIS) planning to include an ad-supported tier for their streaming services. This will further boost The Trade Desk’s business, and help it capture more of the ~$750B Global Advertising Market that the company highlighted in its Q1’22 Investor Presentation.

When Will The Market Learn?

As mentioned, The Trade Desk’s shares are currently down by ~7% at the time of writing – this is driven by Snap releasing poor Q2’22 results, falling substantially short of both managements’ guidance and analysts’ expectations. The company grew revenue 13% YoY despite guiding for 20%-25% just a few months ago, and blamed a number of factors in a letter to shareholders, including:

- Platform policy changes (referring to the iOS privacy update)

- Macroeconomic headwinds disrupting many industry segments

- Increasing competition for advertising dollars that are now growing more slowly.

The company also decided not to give any guidance on both revenue and EBITDA for Q3’22 – and perhaps that’s not a bad idea, because this management team is pretty awful when it comes to guidance. Let’s take a look at how Snap usually performs, and the impact it has on The Trade Desk.

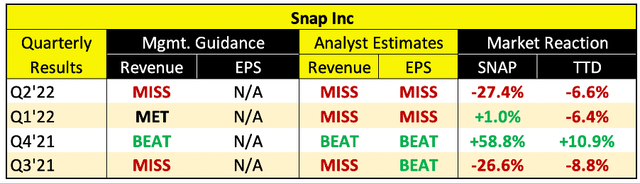

Investing.com / Snap Press Releases / Excel

Snap has only beaten its own revenue guidance once in the past 4 quarters, and has a habit of missing guidance and falling short of analyst estimates. Each time Snap has missed estimates over the past year, shares of The Trade Desk have fallen by at least 6% without fail.

Given this, the market must believe that both the performance and results of Snap and The Trade Desk are heavily linked – so, if Snap keeps missing estimates, then The Trade Desk must also be doing the same right? Wrong.

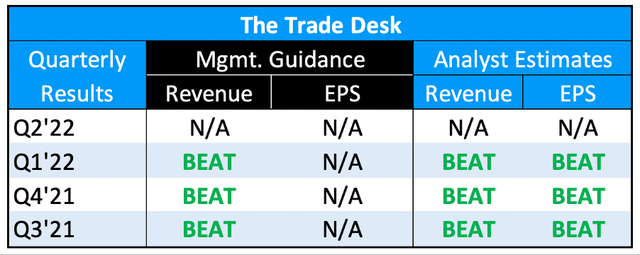

Investing.com / The Trade Desk Press Releases / Excel

For some reason, the market is still not understanding the following: regardless of how Snap performs, The Trade Desk simply does not miss. Despite shares constantly being dragged down by Snap’s earnings, this company continues to deliver quarter after quarter for shareholders – something the market has failed to grasp.

I’m writing this particularly for newer shareholders of The Trade Desk who might not be aware of this phenomenon, and may be surprised to see their shares get whacked out of nowhere. The next question is simply this – why? Both Snap and The Trade Desk are in digital advertising, so how is it that Snap’s earnings are all over the place whilst The Trade Desk continues to beat each time?

The Core Differences

I think the first mistake made by the market is grouping everything together as “adtech,” and assuming that if one fails, they must all be failing (and vice versa). Take these two business models: Snap’s revenue is driven primarily from companies placing adverts on its Snapchat app – but I put forward the case in a previous article that Snap’s audience of children and young adults are not necessarily that enticing for advertisers. The results of Snap are impacted by both the quality of its Snapchat app itself, and the quality of its audience.

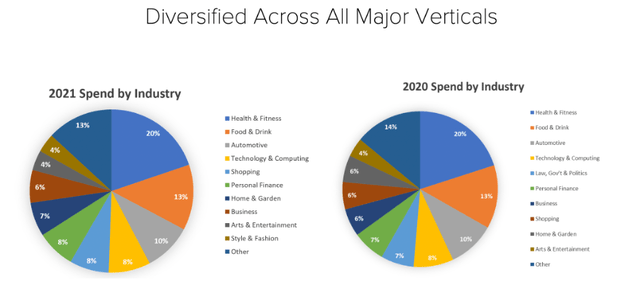

On the other hand, The Trade Desk is used by a huge range of advertisers for a huge range of products – it doesn’t matter where these companies are looking to place adverts, they will use The Trade Desk to make that happen. The Trade Desk is heavily integrated with these businesses and advertising agencies, whereas Snap is just one digital billboard out of many.

The Trade Desk Q1’22 Investor Presentation

There are also the famous privacy changes with Apple’s iOS last year, which reduced the ability of mobile apps such as Snapchat to effectively target users with advertisements. This was felt across the industry, and is part of the reason that even the behemoth that is Meta has seen its share price fall by 45% in 2022.

Now, The Trade Desk’s access to first and third party data is one of the ways in which it can increase the effectiveness of advertising spend, and there was certainly some concern after this iOS update severely reduced the data available to advertisers. Yet we have seen The Trade Desk continually beat results despite these iOS changes, and management have always been very clear on the impact. As per the Q3’21 earnings call:

As we predicted, the most recent IOS changes have had no material impact on our business, and we expect that to remain the case.

This has regularly been reiterated by The Trade Desk, and the results prove out. Its substantial partner ecosystem gives the company more than enough access to first party data such that it is able to cope with companies such as Apple or Google flexing their muscles. It’s also worth highlighting that video, which includes connected TV (TTD’s fastest growing segment) is not impacted by these privacy changes – and as of Q1’22, it made up ~40% of revenue.

I am a huge fan of The Trade Desk CEO Jeff Green, who I see as probably the best CEO of any company in my portfolio. He was predicting Netflix’s shift to an ad-supported model back in 2018, and has successfully positioned The Trade Desk to cope with an ever-changing advertising landscape; something the likes of Snap and Meta have failed to do.

Valuation

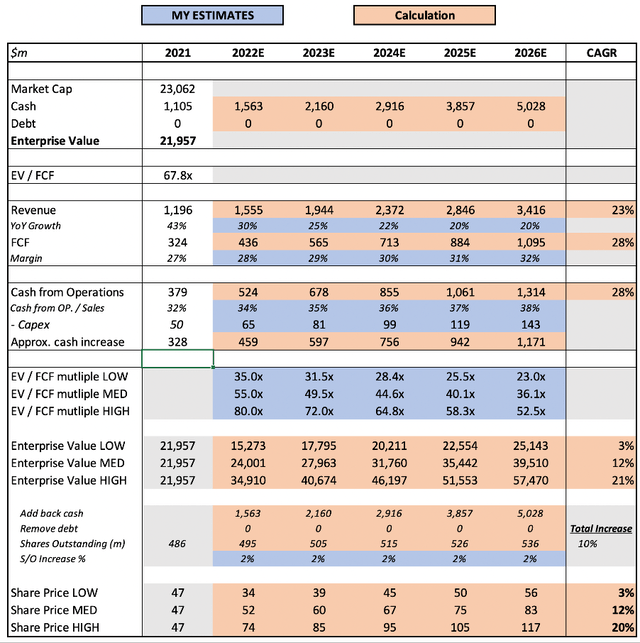

I also put The Trade Desk through my valuation model in my previous article, and everything remains unchanged apart from the current market cap. The company is still not cheap, but as Mr. Warren Buffett says, it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

The Trade Desk SEC Filings / Excel

Full details behind this model are available in the previous article.

Risks

Clearly, Snap hugely underestimated the combined impact of an economic slowdown and the shift in privacy changes to their business this quarter. An economic slowdown or a recession could certainly hamper The Trade Desk, as advertising is one of the easiest short-term cuts a company can make.

Yet what is also clear is Snap’s inability to give appropriate guidance, and The Trade Desk’s ability to continually under-promise and overdeliver. Snap CEO Even Spiegel recently said:

Well, the macroeconomic environment has definitely deteriorated further and faster than we expected when we issued our guidance for the second quarter.

But is the macroeconomic environment all that bad, or is this just a CEO trying to cover up some poor performance? If we take another example, NBCUniversal (CMCSA) saw a record upfront ad revenue of over $7 billion in its most recent quarter, with the rates charged for advertisements increasing YoY. According to Deadline.com:

Rates increased by high-single-digits, fueled by strong growth in categories like retail, quick-serve restaurants, consumer packaged goods, technology and streaming. Pharmaceuticals led all categories with nearly 40% growth over last year, followed by travel, which climbed 30%.

So it seems like Snap may not be the perfect barometer for the advertising market & the state of our economy – who would’ve guessed…

Bottom Line

The market loves a good old knee-jerk reaction, and that is exactly what it delivers every single time Snap reports results, often pulling The Trade Desk down with it.

But The Trade Desk is a different business, a better business, and is far more immune to the headwinds that have once again sent Snap’s shares crashing. Will this pattern keep on repeating? Probably, but I am very confident that over the long run, The Trade Desk will continue to deliver for shareholders, whereas Snap will continue to disappoint.

Be the first to comment