piranka

One must be a sea, to receive a polluted stream without becoming impure. ― Friedrich Nietzsche

When we first looked at Pure Storage, Inc. (NYSE:PSTG) in May, we concluded by stating the name merited a small ‘watch item‘ holding after the dip in the stock price earlier in 2022. This was despite a very tough environment for growth stocks due to rising rates and a slowing global economy. The stock is up nearly a third since that conclusion. Today, we circle back on this solidly growing tech name. An updated analysis follows below.

Company Overview:

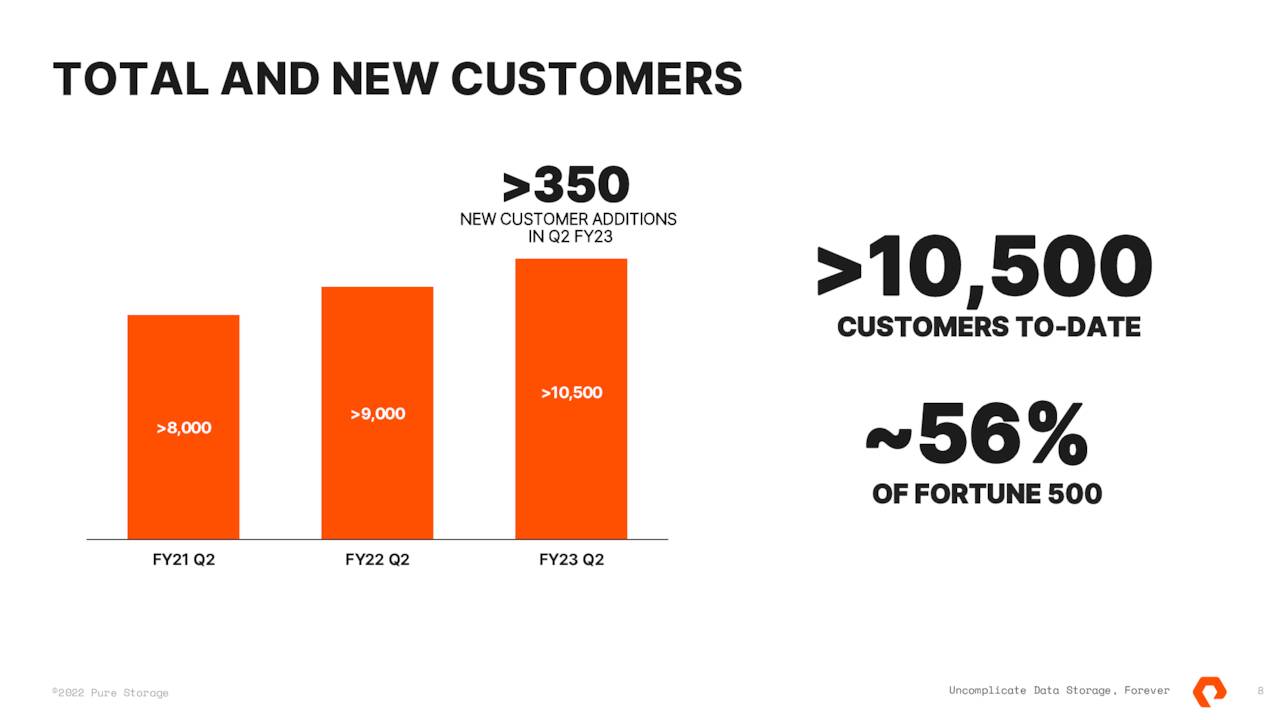

Pure Storage, Inc. is located just outside of San Francisco. As the company’s name implies, Pure Storage provides data storage technologies, products, and services both in the United States and globally. More than half the Fortune 500 uses Pure Storage’s products. The company also offers subscription services ‘Pure-as-a-Service‘ which now account for approximately 35% of overall revenues. The stock currently trades just above thirty bucks a share and sports an approximate market capitalization of $8.9 million.

August Company Presentation

Second Quarter Results:

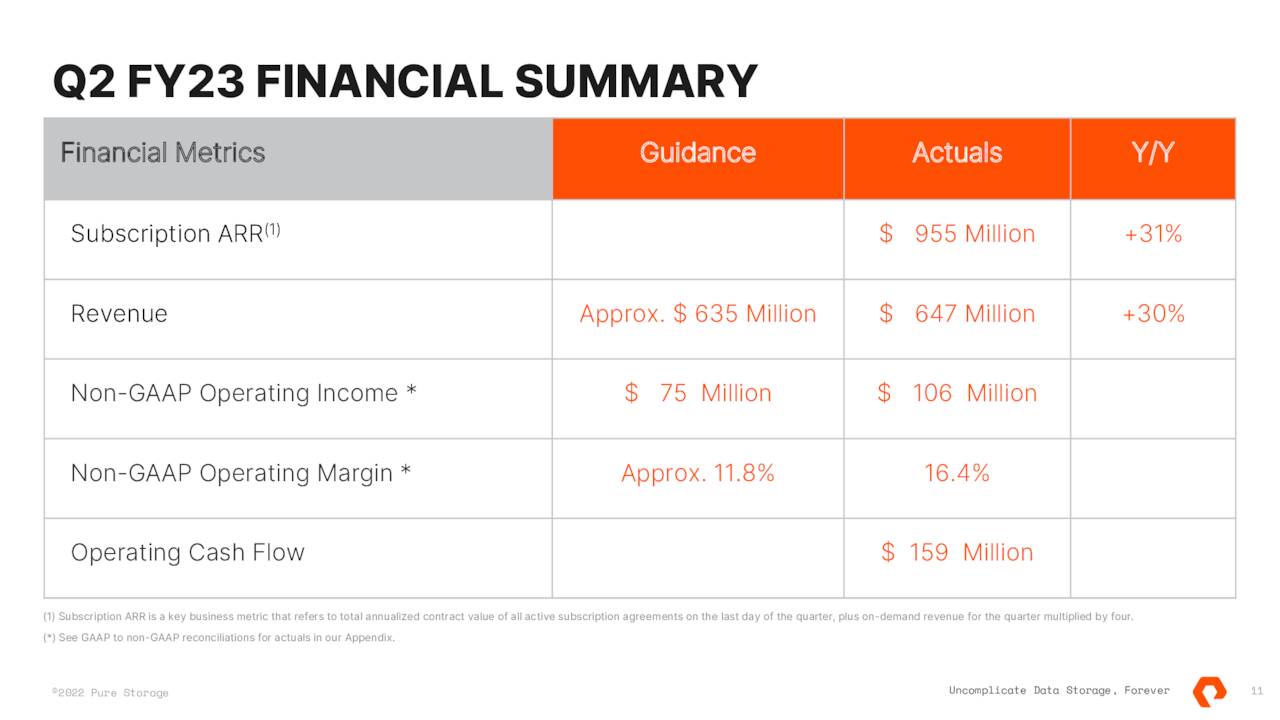

At the end of August, Pure Storage posted second quarter numbers. They showed this tech concern made a non-GAAP profit of 32 cents a share as revenues rose approximately 30% on year-over-year basis to just under $647 million. Both top and line results solidly beat expectations. Subscription services revenue came in $232.2 million, which was up 35% from 2Q2021. Subscription Annual Recurring Revenue or ARR was $955.3 million, up 31% year-over-year.

August Company Presentation

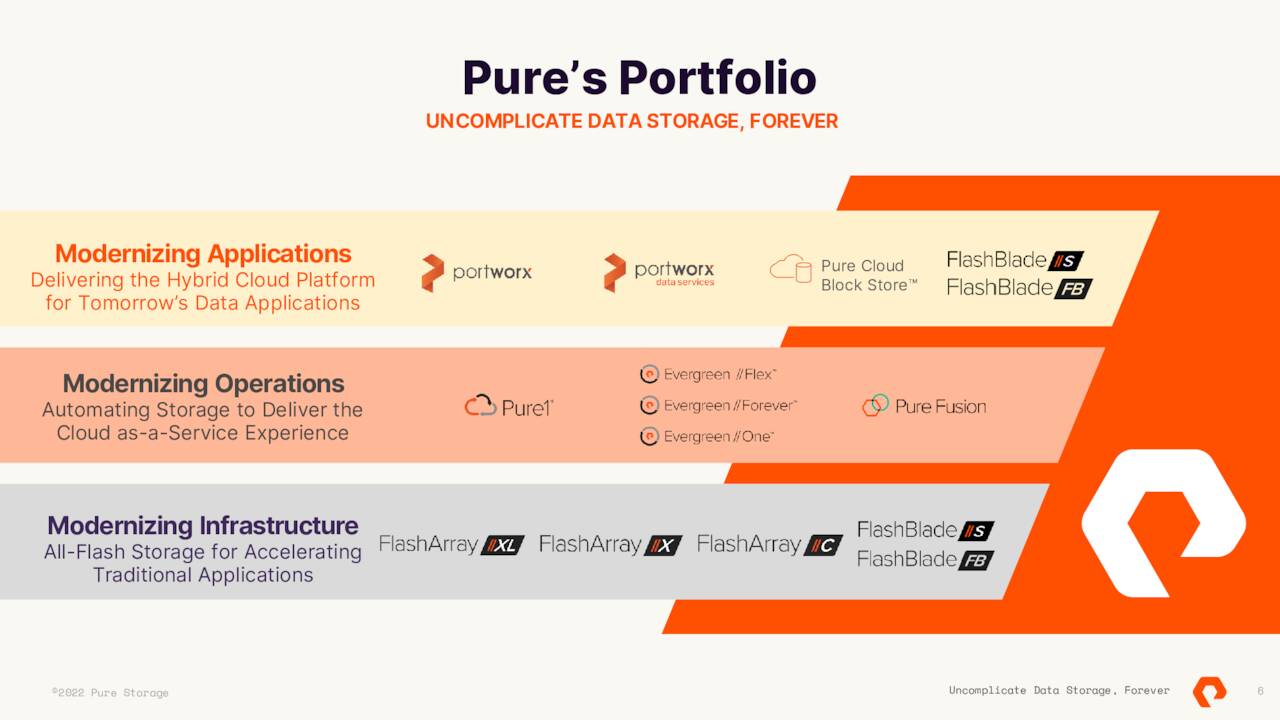

The company introduced its new FlashBlade//S family of products during the quarter. These are built with a modular architecture that shares components with the company’s industry leading FlashArray which is one of company’s core products (see below)

August Company Presentation

FlashArray:

Block-oriented storage, addressing databases, applications, virtual machines, and other traditional workloads.

FlashBlade:

A solution for unstructured data workloads of various types.

FlashStack:

Combines compute, network, and storage to provide an infrastructure platform.

FlashRecover:

An all-flash modern data-protection solution.

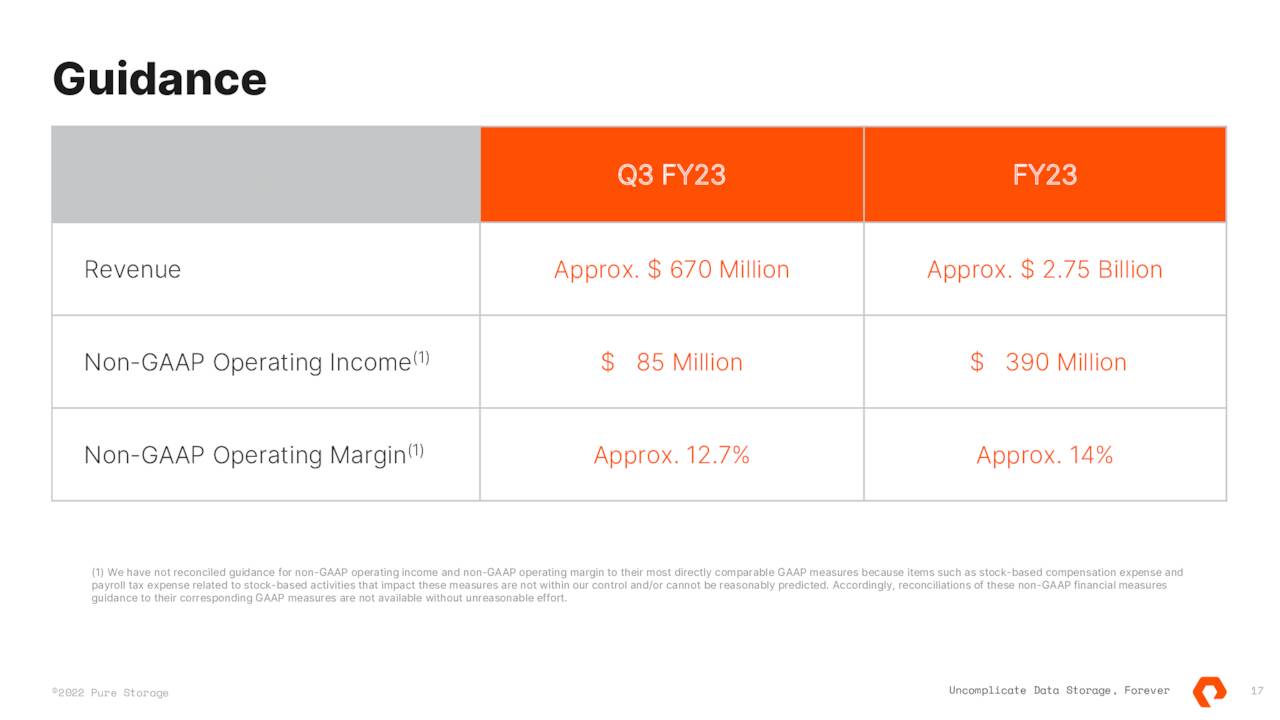

Management also bumped its full year sales guidance to $2.66 billion from $2.75 billion previously.

August Company Presentation

Analyst Commentary & Balance Sheet:

Since second quarter earnings posted, 11 analyst firms including Goldman Sachs and Bank of America have reissued Buy or Outperform ratings. Many of these contained slight upward price target revisions. Morgan Stanley upgraded PSTG to Overweight at the end of October. Price targets proffered ranged from $33 to $47. Both Wedbush ($35 price target) and UBS maintained their Hold/Neutral ratings on the equity.

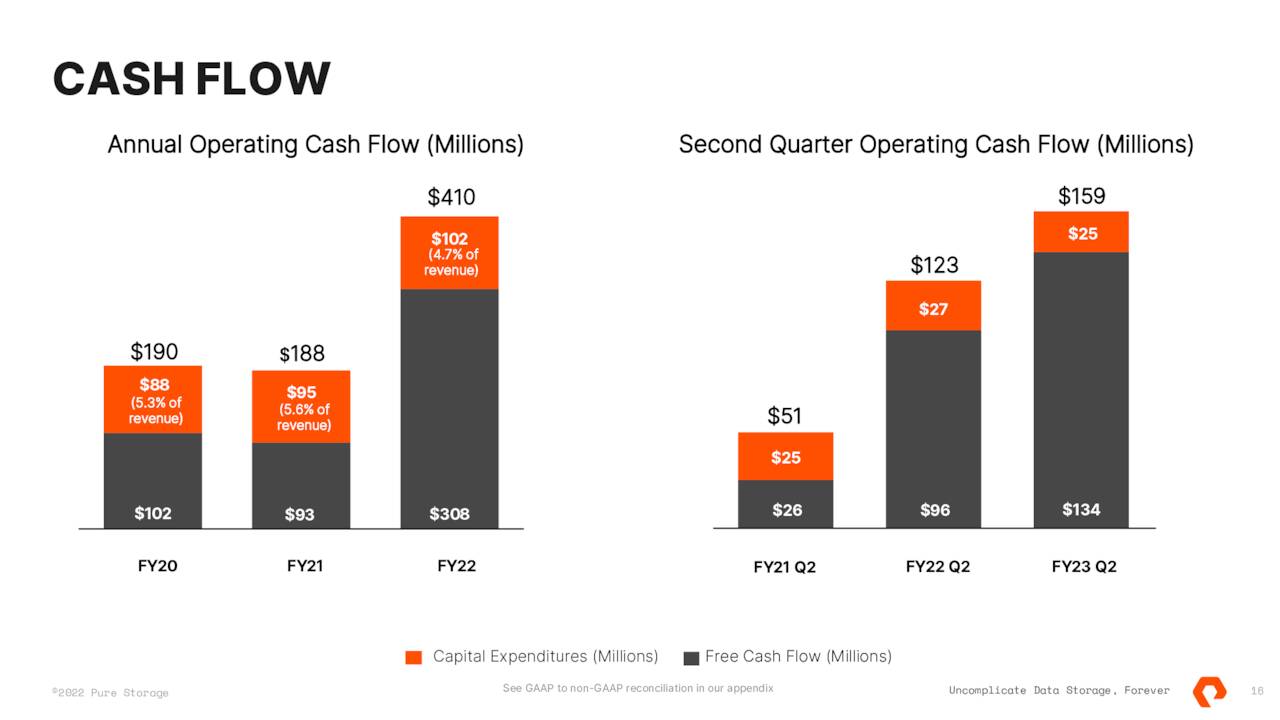

Just over eight percent of the outstanding float in PSTG is currently held short. Two insiders have sold off just over $2 million worth of shares in aggregate so far in 2022. There have been no insider purchases during the year. The company ended the second quarter of this year with just over $1.4 billion worth of cash and marketable securities against approximately $575 million in debt. Pure Storage produced $134.2 million of free cash flow in the second quarter.

August Company Presentation

Verdict:

The current analyst firm consensus has Pure Storage making $1.17 a share in profit in FY2022 as sales rise just over 25% to $2.75 billion. They have $1.31 a share in earnings projected in FY2023 as revenues grow in the mid-teens.

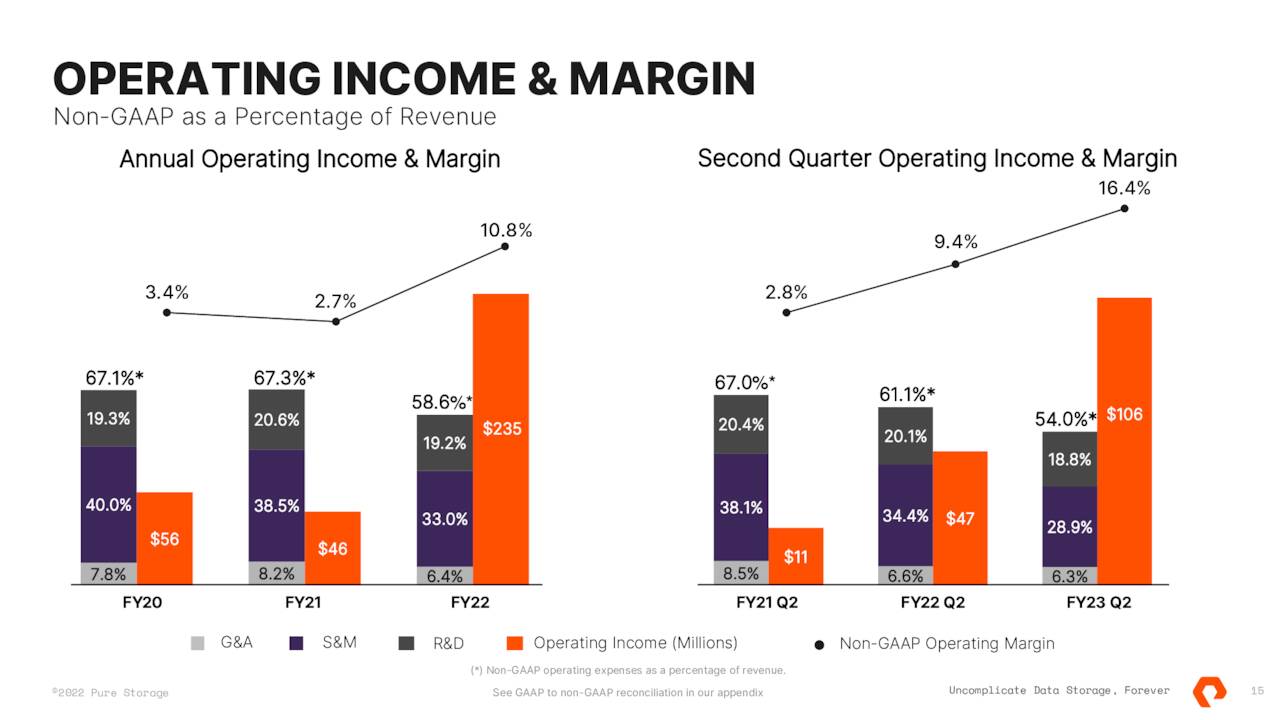

August Company Presentation

When we looked at Pure Storage in May, the equity traded at around $23.00 a share. The stock has rose roughly 30% since we stated the stock merited a ‘watch item‘ position. In May, PSTG was valued at approximately 20 times this year’s EPS. The stock now goes for just over 25 times that estimated EPS. A bit cheaper if one equates for the net cash on the company’s balance sheet. Management has done a commendable job improving operating margins (see above) as well as increasing cash flow. Sales growth is projected to slow significantly in FY2023 due to a challenging global economy. Therefore, I plan to keep my small position in PSTG, but I would not add to my holdings unless PSTG pulled back in the mid-$20s.

No one is more dangerous than he who imagines himself pure in heart: for his purity, by definition, is unassailable. ― James Baldwin

Be the first to comment