Thomas Barwick

Main Thesis & Background

The purpose of this article is to discuss my macro-outlook for the municipal (muni) bond sector as a whole. This is a broad take on the sector for readers to use to prepare for 2023. This is especially relevant for me because when 2021 was wrapping up, I told my followers to approach this sector cautiously in the year to come. While this was the correct outlook for early 2022, I erred by seeing the forthcoming correction as a buying opportunity. Munis continued to plunge throughout this calendar year, with only a couple minor respites.

However, we are in one of those upward corrections right now. Rather than use the recent uptick in muni prices to shed positions, I see some of the bullish momentum positively. I believe the sector is too beaten down and unloved, which marks an opportunity for patient investors. I believe buying in now presents retail investors a strong chance of gains in the next few quarters, and I will explain why in the paragraphs that follow.

The Yield Story Couldn’t Be More Different Than A Year Ago

To start the review I will focus on income. This is always a key attribute to consider when buying any debt product, muni or otherwise. Investors in debt/credit want to earn a reasonably yield since capital appreciation tends to be low (in normal times). For muni investors, consider the tax-equivalent yield (TEY) is a paramount consideration because the tax-adjusted yield can often be quite attractive on a relative basis. Simply put, munis make a lot of sense when they yield more after taxes compared to similarly-rated bonds.

So, where do they stand today? The good news is that yields are quite high given how poorly the sector has performed in 2022. If we look back to the beginning of the year, we see that current yields were not very attractive given how strong performance was in 2021 (with bond prices rising and yields declining). As we wrap up this calendar year, the opposite is true. Prices have plunged, pushing current yields well above the levels we saw this time last year. As a result, TEY’s are very attractive in my view:

Current Muni Yields Compared To A Year Ago (Bloomberg)

The disclaimer is that this in no way guarantees a positive return. Yields look attractive, but that was the case for me in mid-2022 as well. And we all know how that worked out. Yields are high, but could get higher, which means that buying in now could still result in a total return loss. But I see these yields as too attractive to pass up. On a tax-adjusted basis they are higher than corporates, and well above the 3% my savings and CD accounts are paying. At these levels, I feel very comfortable adding to my muni positions.

***I currently own the Invesco California Value Municipal Trust (VCV), the Nuveen AMT-Free Quality Municipal Income Fund (NEA) and the BlackRock Taxable Municipal Bond Trust (BBN). I also plan on buying the VanEck High Yield Muni ETF (HYD) in the near term.

Munis Are Unloved – I Love Contrarian Plays

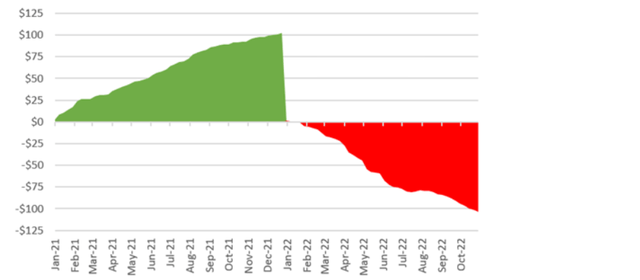

Keeping the outlook for munis macro-focused, the second reason I like this sector is that it is currently unloved by the masses. While this may sound counter-intuitive, the logic goes that the time to buy a sector/stock/theme is when nobody else wants it. That is often when you can find the best value and earn the most “alpha”. In the case of munis, 2022 is definitely a year when it is unloved. In fact, through early November, the market has seen fund outflows for this sector for thirteen consecutive weeks. Calendar year outflows reached a record of $103 billion (so far), more than offsetting 2021’s record inflows of $102 billion, as shown below:

Municipal Fund Flows (in billions) (Lipper)

I believe this graphic speaks for itself. Investors have been fleeing this space at levels that are actually accelerating as 2022 has gone on. This suggests we have some panic selling, as outflows have risen despite the value proposition gradually increasing over the same time period (in terms of yields rising and discounts on CEFs widening). My thought is using this sell-off as an advantage. Get in while the sector us hated and value is present, because this backdrop won’t be around forever.

State and Local Governments Remain In Good Fiscal Shape

My next thought is for readers to focus in on General Obligation (GO) bonds for exposure, in addition to a few select sectors. The reason is that there are risks across the muni debt world, primarily within the health care sector and student housing space. I prescribe to the idea to take a less sector specific approach and focus more on debt backed by the full taxing power of local and state governments. These bonds, known as GO bonds, have held up very well since early 2020 when some analysts were predicting widespread defaults.

This never occurred for a number of reasons – substantial federal aid, a resilient job market and the resulting retail spending from it, and rising property values. All of these allowed state and local governments to fill their coffers during a time period where it looked like muni debt was going to come under extreme financial stress. Looking ahead to 2023, there are reasons for concern. If we see a recession, especially a deep one, then state and local governments will have tough choices to make. However, I am not as concerned about this risk as I otherwise would be because of how strong the fiscal picture has been the last 2+ years.

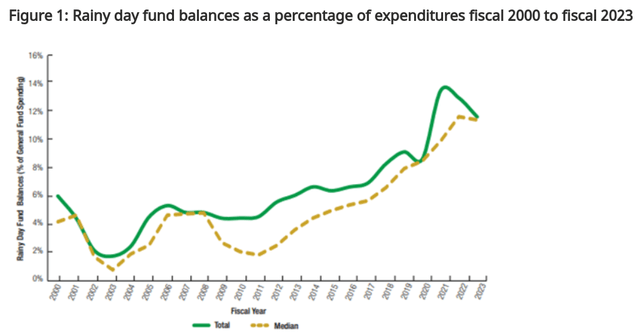

To understand why, consider that, at the state level, rainy day funds reached near record levels in fiscal 2022:

Rainy Day Funds (in total) (JPMorgan Private Bank)

This conclusion I draw is this bodes well for issuers even as we head into an uncertain economic situation in 2023. There is risk – I wouldn’t suggest otherwise – but I think the risk is managed to the level I feel comfortable buying in here.

Peaking Inflation Is A Tailwind For All Fixed-Income

The next topic to touch on is a potential tailwind for munis, but really for fixed-income sectors across the spectrum. This is inflation, which may sound odd because inflation has been the primary driver of losses for fixed-income in 2022. As inflation rose in 2022 (despite “experts” saying it was transitory a year ago), central banks got more hawkish in response. This led to massive waves of selling in credit markets and leaves us in the position we are in today.

However, we must look ahead at this time. While inflation remains a thorn in the side of credit markets, there are signs a reprieve could be on the way. If so, I see the potential for a big rally. This is especially relevant considering how far bond prices, and the prices for the ETFs and CEFs that hold those bonds, have fallen.

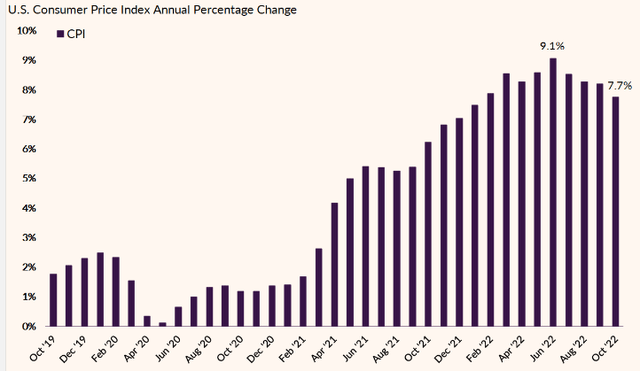

This begs the question – why the optimism? The reason being there are signs that the worst of inflation may be behind us. After breaching the 9% level a few months ago, October’s CPI reading came in well below that on a year-over-year basis:

This backdrop has led to a rally in stocks, but also in bonds. This is why we have seen muni prices and the corresponding ETFs and CEFs push higher over the past few weeks. If inflation continues to trend downward or even just stays at these levels, I see that as a win because things aren’t getting worse. This means credit markets will enter 2023 with a much brighter outlook than a year ago.

Risk-Free Opportunity? Not A Chance

Now that I have discussed the potential, I want to focus on the risks. As my followers know, I am not a pumper of any stock/idea/sector – even the ones I own. I think a balanced approach to any investment idea is critical when deciding where to put one’s hard-earned money. The clickbait and wild prediction articles we often see on the internet typically do not have great track records, yet they drawn in views anyway. I resist this urge for any topic I cover, but especially muni bonds. While generally safe and a reasonable source for yield, 2022 has proven aggressive losses can be a reality. In this light, readers need to assess whether they can withstand more pain if it comes.

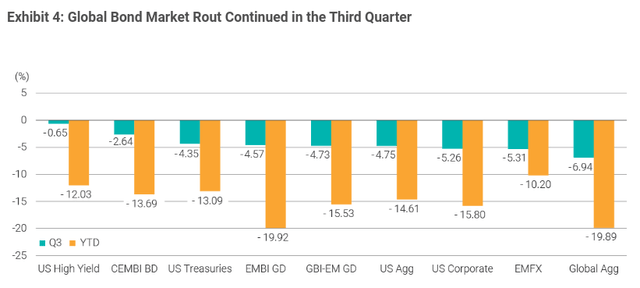

This is important now because fixed-income markets have continued to plague investors in 2022. Munis are down, but so is everything else. After even though there were signs inflation may be peaking, Q3 was still a negative quarter for investors in debt markets globally:

Q3 Returns (By Sector) (World Bank)

What I am getting at here is that losses have been steep and that could continue. I personally view this sell-off as a buying opportunity, but as I said before, I felt the same way earlier this year and I was wrong. I could very well be wrong again, and these types of losses are not something we should take lightly. If one is already overweight munis or any other debt sector, perhaps now is not the best time to keep on buying. It all depends on one’s individual circumstances.

Beyond the volatility and turmoil, another headwind is the potential for a recession in 2023. If that happens we could see muni bonds come under pressure as state and local governments struggle to pay their obligations. I mentioned that the “rainy day” funds should limit this risk, but is it still an important consideration.

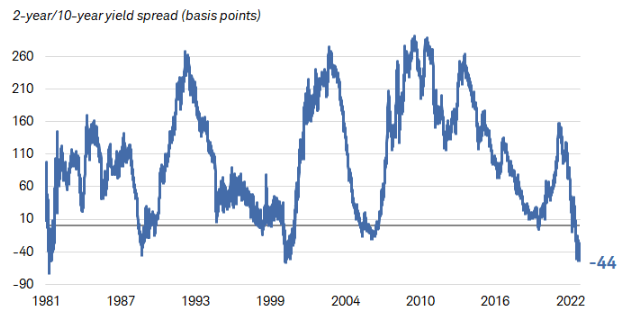

Beyond that, the yield curve is inverting again. This is often a recession predictor, but it impacts muni investors in another way. Because absolute yields tend to be low in the muni world, many investors use leveraged CEFs to play this space. This amplifies the yield, but also the risk. When the yield curve inverts, it puts pressure on immediate expenses, but limits the opportunity for yield pick-up at the longer end of the curve. Leverage works because you borrow at lower short-term rates and re-invest that money in longer dated securities that pay a higher yield. With an inverted curve, this opportunity is limited. This has been a headwind throughout 2022, and continues to be the case to this day:

Yield Curve (Charles Schwab)

For this reason I wouldn’t get too aggressive on leveraged CEFs at this moment. I own three of them already and will probably add in moderation because of the value I see. But I won’t get carried away. To offset some of this risk, I am going to buy HYD, which is a non-leveraged high yield muni ETF. The lower rated debt comes with risk, but I see that as less of a challenge than leverage at the moment. I think balancing my portfolio out with this option is the right way for me personally, and could work for others as well.

Bottom-line

I reduced my muni exposure late last year in what turned out to be a timely move. But after I saw 10% drops across the space, this defined “correction” told me the time was ripe to buy back in. Well, another 10-15% drop ensued, forcing me to lick my wounds for the second half of the year.

As prices across the muni space have dropped further, I simply see too much value here to not build on my positions. I think readers would be wise to take a managed approach to high yield rated debt and leverage. Still, the value today is far greater than it was a year ago. Long-term investors are almost certain to be rewarded, in my opinion. Therefore, I am rating the broader muni sector a “buy” going in to 2023, and suggest readers give this idea some serious consideration in the weeks and months ahead.

Be the first to comment