Lisa-Blue/E+ via Getty Images

Since I put out my latest article on Norwegian Cruise Line (NYSE:NCLH), where I spent even more time than usual bragging, the shares are down about 9% against a flat S&P 500. The company has released full year results since, so I thought it’d be interesting to look at the stock again to see if I should buy back in. In this article, I’m going to assume that the company waves a magic wand and returns to net income and passenger figures from 2019. What does that look like? What is a reasonable stock price, given the huge uptick in shares outstanding? Also, in my latest article, I suggested that call options were a better way to “play” this name and I want to see how that call worked out relative to stock ownership.

My regulars know that I provide a “thesis statement” paragraph at the beginning of each article. There are two reasons for this. First, it gives you the opportunity to save time. You get the “gist” of my thinking without the need to read 2,000+ words of prose. Second, you get in, get the “juice”, and escape while being exposed to the least amount of “Doyle mojo” possible. I provide this thesis statement which, from my point of view, is rather redundant. I do this for you people because I’m absolutely driven to make your lives as pleasant as possible. With that as preamble, let’s get to the spoilers. My chief point here is that even if the company returns to 2019 traffic figures, the Norwegian Cruise Line of 2019 no longer exists. The entity that bears the name today has 93% more shares outstanding and ~$5.64 billion more debt. If we assume a return to both 2019 net income, and valuation metrics, there’s ~$6 of upside for this stock in my view, given the massive dilution. Additionally, I think the 2019 valuation multiples are optimistic in light of the deterioration in the capital structure. Thus, I think it makes very little sense to buy shares at current prices. That said, members of the analyst community are growing bullish, and when that happens, retail money tends to flow into a name. Thus, while it may not be rational, I think it makes sense to buy call options here. These give us access to the crowd driven mania at a fraction of the risk. This trade worked out well before, and if you’re just coming to the party now, the calls I recommended are even cheaper today.

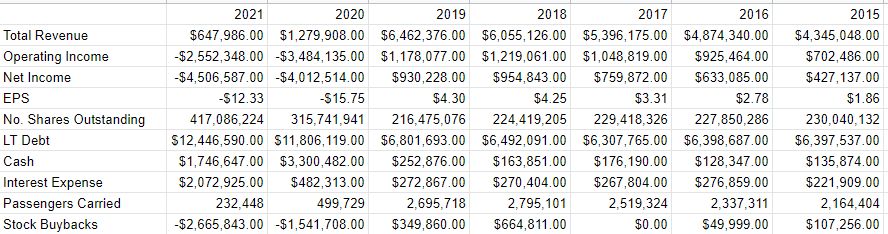

Norwegian Cruise Line – Financial Snapshot

There’s obviously little reason to go on about the poor financial results in 2021. Suffice it to say, it was bad. There being little reason for something never stopped me from doing that thing, though, so I’ll go through some of the highlights. Revenue was down another 49% from 2020, which was obviously a troubled year for obvious reasons. Net income was $5.4 billion lower in 2021 than it was in 2019. Shareholders were diluted significantly (more on that below), and 2021 was even worse than 2020. Then there’s the capital structure.

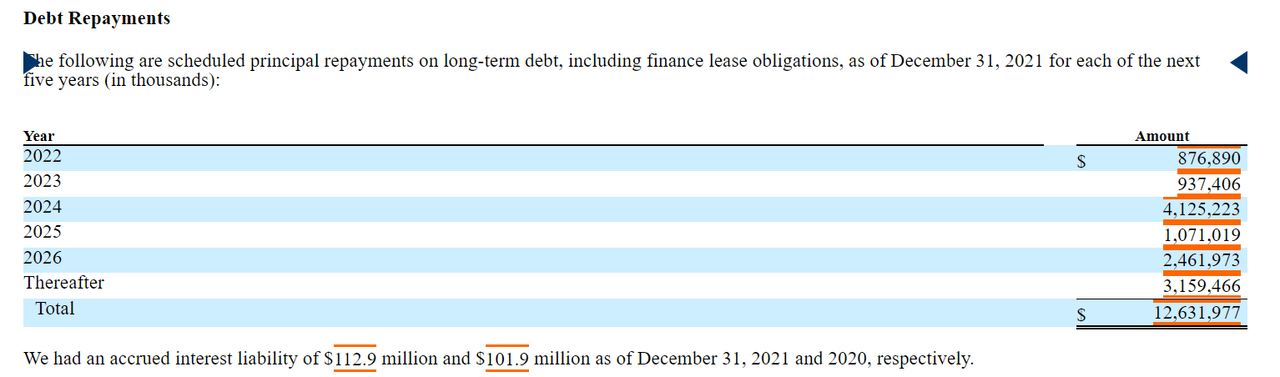

When I first reviewed the latest financial results I was actually most troubled by the massive uptick in debt over the past two years. Specifically, it’s about $5.64 billion or 83% higher now than it was in 2019. This caused me to reach for my fainting couch because I’m of the view that higher debt increases the level of risk present. It seems that things don’t get exceedingly frightening on this front until 2024, though, per the following table plucked from the latest 10-K for your enjoyment and edification.

Norwegian Cruise Line Debt Repayment Schedule (Norwegian Cruise Line latest 10-K)

Norwegian Cruise Line Financials (Norwegian Cruise Line investor relations.)

Hope on the Horizon?

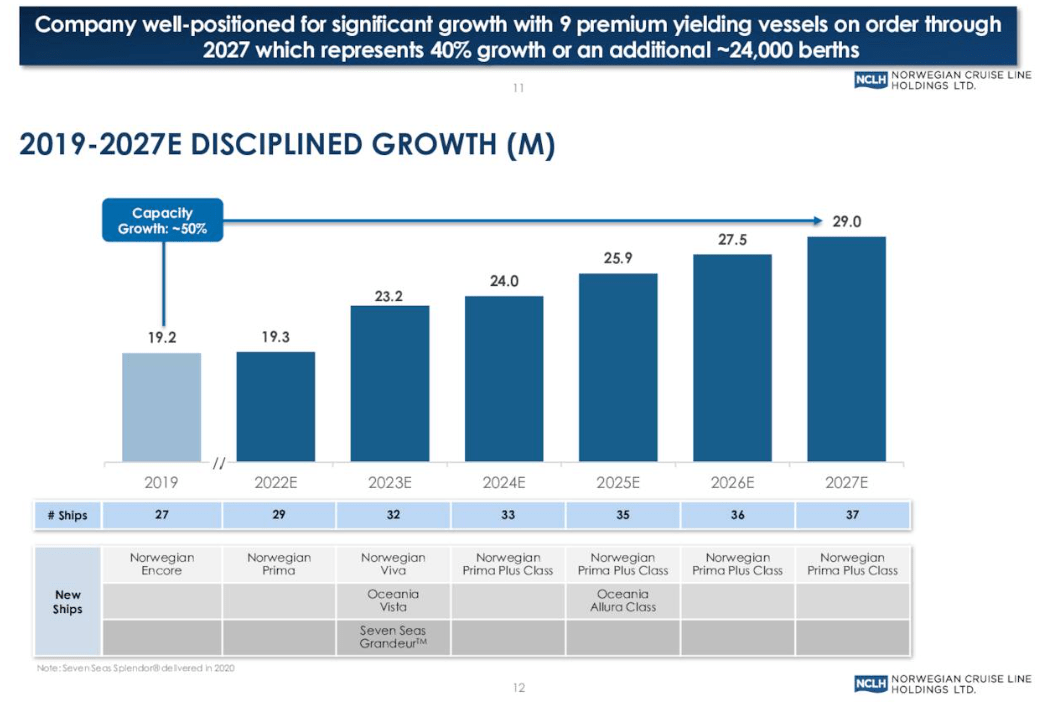

There are reasons to be upbeat about the future here, obviously. The pandemic seems to be over, or has been cured, or other things have taken over the news cycle. Whatever the reason, it seems that Covid is “so 2020”, and the company seems to be upbeat. For instance, did you ever wake up and wonder aloud to yourself “what does a compound annual growth rate of 7.1% look like exactly?” Well, if you did, wonder no longer, dear reader. Feast your eyes on Norwegian Cruise Line’s estimate of future growth that looks identical to a compounded annual rate of 7.1%.

Norwegian Cruise Line Growth Forecast (Norwegian Cruise Line Investor Presentation)

Not to be a downer or anything, but this is actually lower than the 8.26% CAGR that revenue grew by between 2015 and 2019. That aside, the company is obviously upbeat, and that’s good enough for some. Because I’m such a spoil sport, though, I’m in the mood to remind people that even when the company wasn’t reeling from a pandemic, it wasn’t a cash flow generating machine. For example, in 2019, the company generated cash from operations of $1.822 billion and spent $1.68 billion on CFI activities. This may be one of the reasons why the stock received a PE multiple of 12 before the pandemic.

All of my social life killing pessimism aside, if some of Wall Street’s finest, and smarter people than me have turned bullish, it might be worth considering buying the stock at the right price.

NCLH Stock

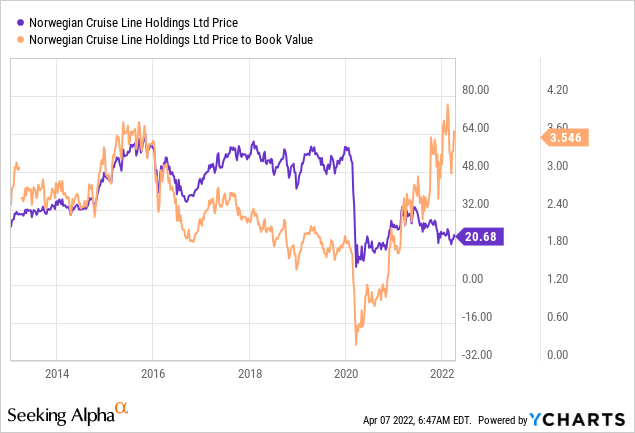

Because this is a “return to normal” situation, we can’t assume the continuity that I usually do when looking at a stock. I’m going to pull out a less frequently used tool this morning. I’m going to come up with a forecast for the stock using a ceteris paribus (holding all else constant) analysis. Before I get into that, though, I couldn’t forgive myself if I didn’t point out the market’s current optimism here. We see from the following that the market is applying a near multi-year high valuation to this stock on a price to sales basis. Now, we may assume that the pain of the pandemic is largely behind us, but for investors to pay more for $1 of sales today than it did in 2016, for instance, is a bit farcical in my view.

Let’s Forecast NCLH Stock Price and Review the Pernicious Effects of Dilution While We’re At It

I think it would be interesting to try to think about what a return to normal would look like, in order to come up with a reasonable target price. I think a good place to start is to remind ourselves of what exactly the company and the stock looked like pre-pandemic. I’m going to assume that the company returns to something like the last “normal” year of 2019. Before getting into the analysis, though, we need to remember that there are now ~93% more shares outstanding than there were in 2019. So, in my analysis, I’m going to assume that the company returns to 2019 net income of $930.2 million, and I’m going to assume that the market applies the same multiple to the EPS figure. Obviously, “S” in “EPS” has exploded higher, and I think we need to be aware of the impact of that.

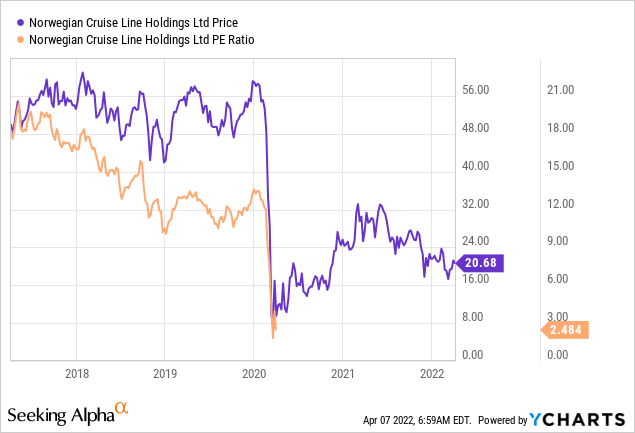

We see from the below that the market was willing to apply an earnings multiple of about 12 times in 2019, which is the multiple I’ll assume going forward. In 2019, the earnings per share was $4.30, hence the stock price in the low $50s.

There are now 417,086,224 shares outstanding. As stated above, the net income we’ll assume is $930,228,000. Applying some of the math skills so generously imparted to me by the good people at Holy Spirit School many, many, many decades ago, I work out that the forecasted EPS figure is $2.23.

Applying the ratio of ~12 times to this EPS of $2.23 gets us to a stock price of $26.76. Let’s remember that that’s what we get when the company has returned to normal, pre-pandemic levels. That price is, in my estimation, a short to mid-term ceiling. That’s what “perfectly normal” looks like, and it’s only about 23% higher than the current market price. Additionally, that’s the multiple the market was willing to give this company when it had $5.645 billion less debt. Investors might want to consider whether the potential upside to this level is worth the risk here.

It’s a Fool Who Looks for Logic In the Chambers of the Human Heart

Now, just because I’ve convinced myself that there isn’t much upside from here, using the power of reason doesn’t mean I don’t think there’s not tremendous potential here. I’ve been around in this game for many decades and I’ve learned that, in the short term at least, stock prices aren’t governed by reason. I can easily envision a scenario where some poor retail investor reads a bullish report from an analyst, assumes “return to normal” means “return to previous stock price” and buys aggressively. For that reason, I see some value in taking a bullish position here. In other words, I want to participate in any upside, in spite of the fact that I consider this to be a bit of a dumpster fire of a stock.

Calls To The Rescue

In my previous missive on this name, I made a recommendation which I’m about to echo, namely to buy call options in lieu of shares. Specifically, when the shares were trading hands at $22.75, I recommended spending $4.55 on the January 2023 calls with a strike of $22.50. Now that the stock is down about 10%, or ~$2, the calls have lost ~$1.20 of their value, and last changed hands at $3.34. So, as of now, the people who bought calls are doing better (more properly “less badly”) than the people who bought the stock on the day I published my latest piece on Norwegian Cruise Line. I consider calls to be the ideal instrument in a situation like this. They give you most of the upside flavour at a fraction of the risk calories. The risk, of course, is that the shares flatline from here, and the calls lose their value as time marches on. That would certainly be painful, but at least the “calls instead of stocks” strategy would give you the opportunity to employ the $17.46 not employed in the stock in some other investment.

Conclusion

I don’t think this company will return to “normal” or “pre-pandemic” levels. Even if the business recovers to the point where they’re carrying 2.6 million passengers again, this is a fundamentally different beast than it was in 2019. The share count has exploded, and the capital structure has deteriorated. I think that at some point the market will realise this, and when that happens, the shares will settle somewhere around $26. This is why I think this stock represents too much risk for too little upside at this point. That said, the crowd does some unpredictable, irrational things sometimes, and so we should be prepared for a spike higher. I think calls are the best way to play that. I’ll admit that call options are similar to a lottery tickets, but I think that is appropriate in this circumstance.

Be the first to comment