Article Overview

As the coronavirus outbreak spreads globally, there are increasing uncertainties on the outlook for the global economy. The stock market plunge coupled with a sharp decline in oil prices is already indicating that GDP growth can be muted in the first half of the year.

This article will discuss some key indicators of the global economy and the implication of these on asset classes. Based on the likely trend in asset classes, the article will discuss the portfolio allocation for the near to medium term.

The Global Economy Was In Recession in February 2020

A good indicator of global economic activity is the Purchasing Manager Index for the manufacturing and the services sector.

The chart below gives the global PMI for the month of February 2020.

It is clear that both manufacturing and services activity plunged in February 2020. The composite index was at 46.1 indicating that the global economy was potentially in a recession for the month.

This explains the recent rate cut of 50 basis points by the Federal Reserve. This also explains why Goldman is expecting another 75 basis points rate cut by June.

Since the coronavirus continues to spread globally, there is unlikely to be any respite for the economy in March 2020. It would not be surprising if the global GDP growth is negative for the first quarter of 2020.

It is worth noting that 10-year Treasury yield has already plunged to 0.70% and this elaborates on the extent of risk-off trade in the markets.

The Plunge in the Baltic Dry Index

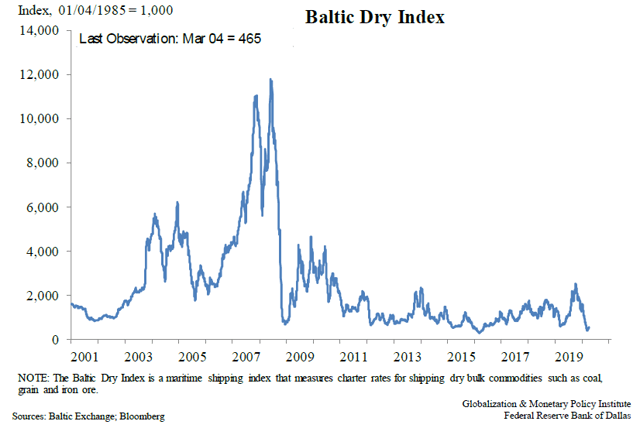

Another good indicator of the level of global economic activity and global trade is the Baltic Dry Index.

As the chart below shows, the Baltic Dry Index is near the levels seen during the financial crisis of 2008-09.

While the index has recovered since March 4, 2020 (last reading in the chart), it remains depressed. Further, I don’t see a strong bounce back in global trade anytime soon with more countries reporting coronavirus cases.

The important point to note here is the potential supply chain disruption globally. According to an article by Harvard Business Review, manufacturing will be impacted globally with the impact lasting for a few months. Therefore, there can be inflationary pressure on the price of certain goods.

Oil Price Decline Will Exaggerate Economic Impact

With Saudi declaring an all-out price war, oil plunged by 30% in early trade on Monday and is below $30 per barrel.

Goldman Sachs is already talking about $20 per barrel oil with the double impact of price war and weak global economic activity due to the coronavirus outbreak.

There are several economic implications:

First, the Middle-East economy is likely to see a significant negative impact. In addition, Russia will also be impacted by the big plunge. This will lower the demand for luxury goods and services, which is primarily from Europe.

Second, US shale will be impacted if oil sustains in the region of $20 to $30. Oil companies are likely to cut back on capital spending and this will impact overall economic activity in the United States.

Therefore, the oil price plunge will not just impact the Middle-East. There is likely to be a wider impact on growth and investments.

The Implications for Investments

There is panic in the markets as indicated by the big plunge in Treasury yields. For now, it makes sense to have the following investment strategy:

First, it’s important to have cash holdings. When all asset classes decline, it’s a bull-run for cash. Of the total investment allocation, 25% to 30% cash holding is advisable for bottom fishing in the coming weeks or months.

Second, the Fed has cut rates by 50 basis points and is likely to cut rates by another 75 basis points in the coming months. Gold has already been surging higher and I expect the trend in gold to remain bullish. Therefore, investment in gold and gold mining stocks can provide good returns even as the broad markets decline. Just as an example, the S&P 500 index is down 14% for YTD20. For the same period, Newmont (NEM) is higher by 15%. I remain bullish on Newmont Mining even at current levels and investors can consider fresh exposure to the stock.

Third, I am also bullish on stocks that can benefit from the spread of the coronavirus. Just as an example, 3M Company (MMM) will benefit from strong demand for face masks and sanitizers. While the company’s safety and industrials division is negatively impacted due to the manufacturing slowdown, the healthcare segment should offset this weakness. Another stock that has gone ballistic in the recent past is Inovio Pharmaceuticals (INO). The company has accelerated the timeline for COVID-19 DNA Vaccine INO-4800. The company expects to produce 1 million doses of the vaccine by the end of 2020. This could be a potential game-changer for the company.

Conclusion

There is no doubt that the global economy has slowed down significantly at the beginning of 2020. This has resulted in expansionary monetary policies. However, once the outbreak of the coronavirus is controlled, global growth should be back.

Investors should, therefore, use this panic as an opportunity to gradually accumulate high-quality stocks. Even some stocks in the energy sector might be worth considering in the coming months.

Overall, instead of panic, there should be cautious optimism. This phase for the world economy is likely to pass and renewed growth will take equities higher. For now, capital protection is the first priority.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment