orgnmaster

The Risk Of Relying On Past Performance

We have all gotten used to the Fed Put and the notion that no matter what tomorrow brings, the Federal Reserve will come to the rescue of our beloved equity market.

Similar to the frog that is slowly boiled to death, we have also gotten used to the assumption that loose monetary conditions would persist and there would always be plenty of liquidity out there to support the lofty valuations we observed during 2021.

I am often amazed at how often people use the peak valuation multiples of 2021 to justify that their favourite growth stock is now a bargain simply because it trades at a fraction of the P/E ratio it used to trade only a year ago.

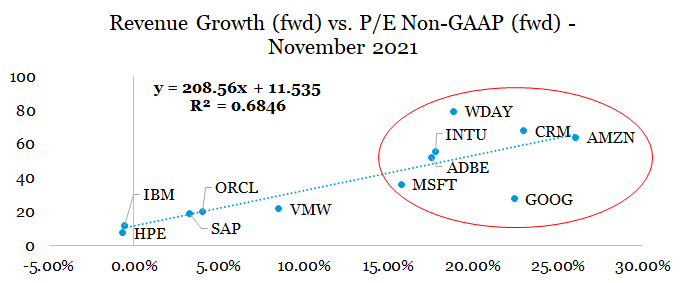

Back in November of last year, I warned of the major risk overshadowing the high growth names by giving an example of the cloud sector:

The unprecedented amount of monetary and fiscal intervention has created risks that many retail and professional investors are failing to take into account. In the highly growing cloud space, where topline growth rates are by far the most important business characteristic, the external risk of rising interest rates and fading momentum trade is at one of its highest levels.

Source: Seeking Alpha

I showed why the companies circled in red below were at a major risk of repricing solely due to pending normalization of monetary conditions.

prepared by the author, using data from Seeking Alpha

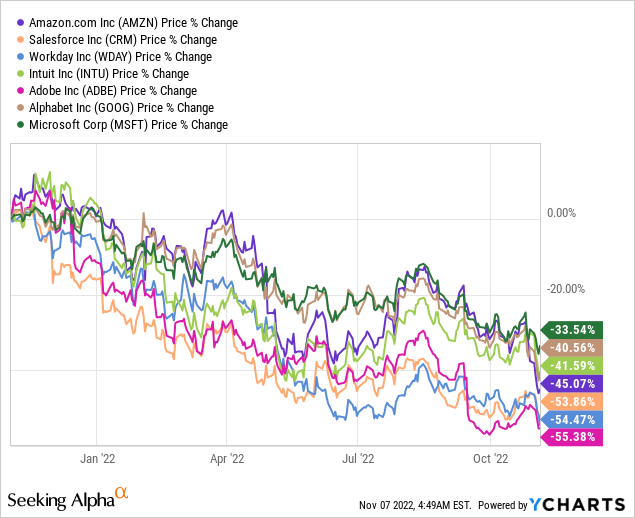

One year later, returns within this highly priced peer group is between -34% to -55%, with higher quality business models, such as Microsoft (MSFT) for example, faring far better than their peers.

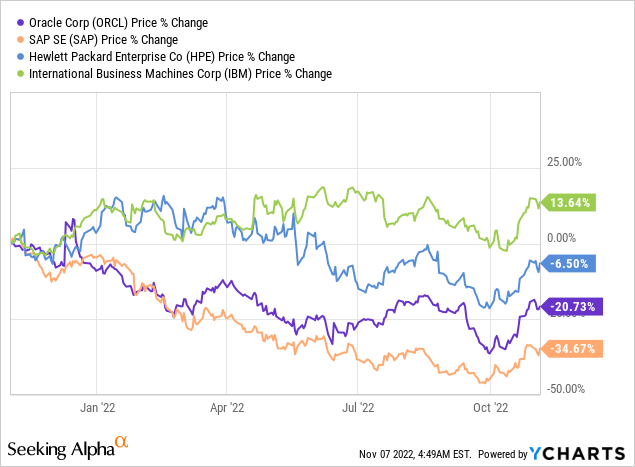

While the second group of companies showed above was by no means immune to idiosyncratic risks, the overall return profile of these value companies has been far better.

I spent a considerable amount of time warning of these risks for a wide range of high-growth names that were once seen as companies that could only go up.

These were companies, such as Adobe (ADBE), Salesforce (CRM) and Intuit (INTU), that have all experienced abysmal returns over the past year or so.

Seeking Alpha

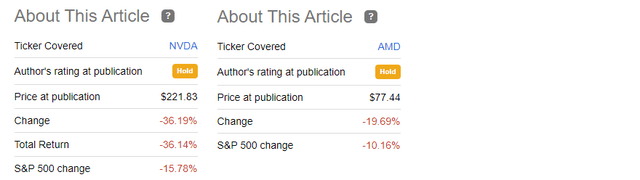

The high-flying semiconductor stocks were not spared either, even though their businesses have been benefiting from sustained tailwinds. (see here and here).

Seeking Alpha

Even the largest disruptors of our time did not stand a chance against the normalizing monetary conditions.

Seeking Alpha

Between A Rock And A Hard Place

Unfortunately, for everyone who has been riding the wave of this monetary experiment over the past decade or so, the environment we are faced with today makes it highly unlikely that the next decade will be anything like the past 10-year period.

The current reversal of globalization that started a few years ago has created a significant headwind for the deflationary forces that we are so used to. On top of that geopolitical events from this year further accelerated this trend, by ending a long period of cheap energy prices.

I showed why all of this is a major problem for the current monetary system and predicted that deflationary environment will most likely slowly morph into inflationary in a thought piece from April of 2020, called ‘What The New Market Paradigm Would Look Like‘.

Another major conclusion from the analysis was that the correlation between equities and bonds will likely turn positive during this period of higher inflation. This has been very bad news for the classic 60/40 portfolio and more specifically for the already strained pension system.

Since this inflation is primarily a supply driven phenomenon, in order to reduce it, monetary authorities now have the burdensome task of cooling-off demand. On top of that, years of exceptionally low interest rates have created significant risks for the global economy – from excessive risk taking by yield starved pension funds and other institutional investors, to the proliferation of zombie companies and the misallocation of capital.

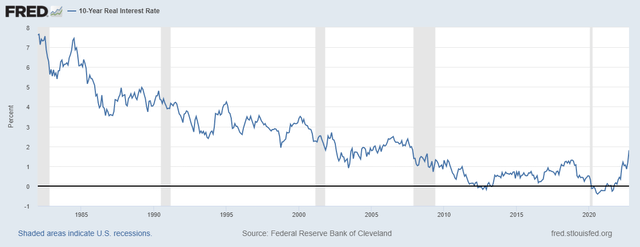

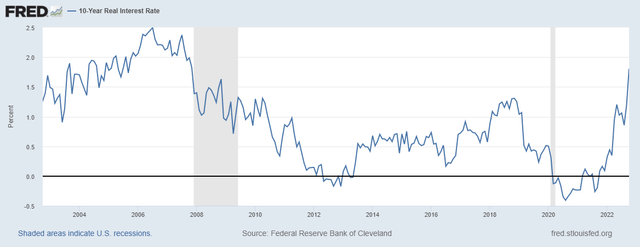

As a result, the long-end of the yield curve has broken up from its long-term down trend. For example, the 10-year real interest rates are now at their highest levels since 2007.

FRED

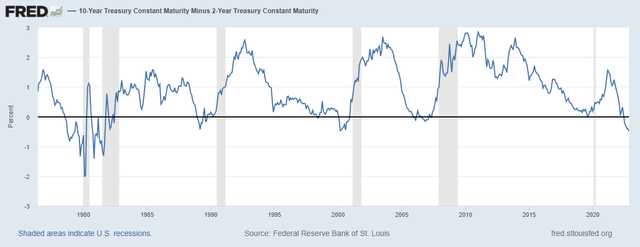

At the same time the yield curve’s inversion continues to accelerate and a deeper and longer than expected recession now seems highly likely.

FRED

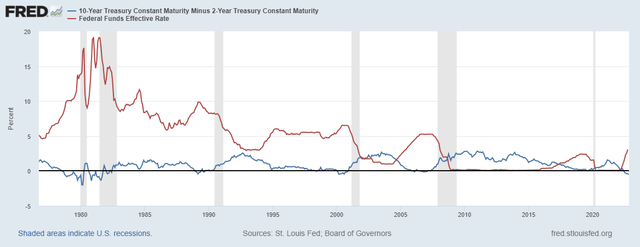

Although the recent hikes by the Federal Reserve give it some ammunition to fight the upcoming recession as it used to do historically (see graph below), this time it’s different.

FRED

A too aggressive easing by the Fed could now easily add fuel to the fire of inflation which is an undesirable outcome by politicians. On the contrary, however, the highly indebted public and private sectors could not afford too high interest rates which puts the monetary authorities between a rock and a hard place. As a result, the risk of a monetary regime change is looming.

What Could Work In This Environment?

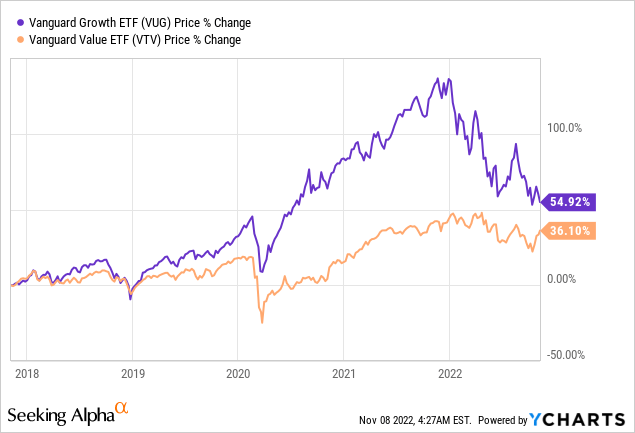

After everything I said above, the premium paid for growth will likely diminish. With that, I expect the gap between growth and value stocks to continue to narrow.

That is why, most investment strategies that worked well during the past decade (excluding 2022), will need a rethinking in this new environment. In my marketplace service The Roundabout Investor, I also outlined which sectors are well-positioned to perform by utilizing Fama and French 5-factor model.

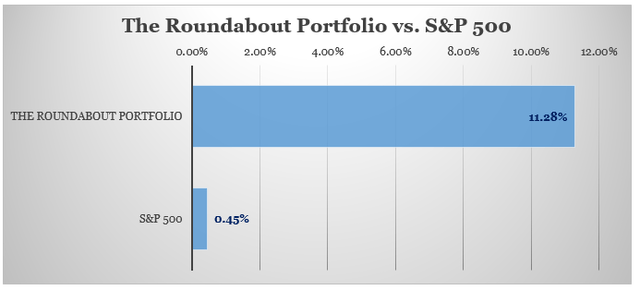

The all-equity portfolio, which I construct within the service is also performing exceptionally well at a time when the market delivered only 0.45%.

The Roundabout Investor

* Returns since inception of The Roundabout Portfolio

Precious metals, such as gold and silver, could also benefit within this environment. Especially, if the current monetary regime undergoes significant changes in the coming years as gold excels during such transitional periods. That is also the reason why the price of the precious metal has broken away from its inverse relationship with the real interest rates.

FRED

As a matter of fact, this relationship could turn positive during certain periods. You can read more about that here and explore the concept of gold performance during monetary regime changes here.

Conclusion

Relying on past performance to inform the future is now an exceptionally risky endeavour. With that the ‘buy the dip’ mantra and simple momentum and narrative driven strategies are unlikely to produce meaningful results. Moreover, even the once thought as invincible mega cap disruptors are facing the reality of a new monetary regime. In the meantime, high quality businesses that did not succumb to the prevalent short-termism in the markets are well-positioned to outperform in the coming years. Some areas of the fixed income market also appear attractive at the moment and gold remains a good addition to equity portfolios.

Be the first to comment