Talaj

There has been very little discussion about Federal Reserve monetary policy and how the monetary actions of the Fed are affecting the value of the U.S. dollar.

I have argued from time-to-time that the Federal Reserve is very interested in maintaining a strong U.S. dollar and is especially focused on keeping the dollar strong against the Chinese Yuan.

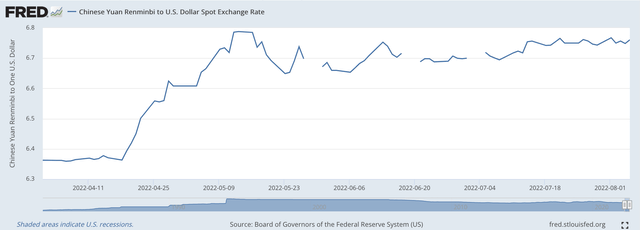

In this respect, something seems to have happened in April and May of this year.

Let’s look at the Dollar/Yuan relationship.

On April 18, 2022, it took 6.3630 Chinese Yuan to acquire one U.S. dollar.

By May 12, 2022, it 6.7860.

On Monday, August 15, the price settled around 6.7730.

Something happened around that April date.

But, were other currencies hit as well?

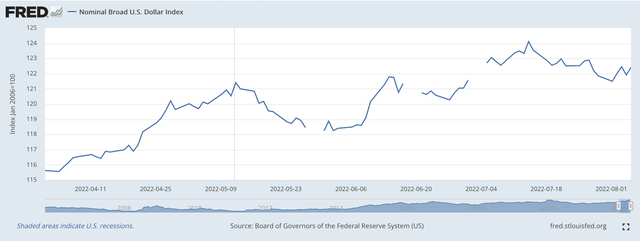

Broad U.S. Dollar Index (Federal Reserve)

On April 18, 2022, the value of this index was 116.9885.

It reached a level of around 124.0000 in the middle of July and then dropped off to its current level around 122.0000.

So, it appears that the general market was hit by the Fed’s actions.

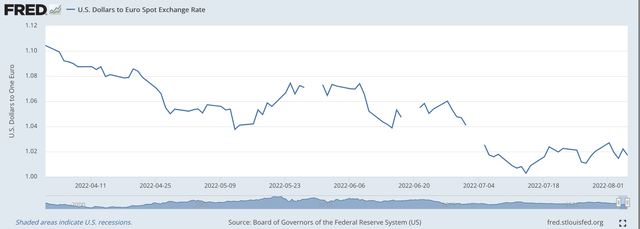

If we take a look a little further, we see the U.S. dollar definitely strengthened against the Euro and the British pound.

Here we see the relationship with the Euro.

U.S. Dollar to Euro Exchange Rate (Federal Reserve)

The value of the U.S. dollar against the Euro has certainly gotten stronger as the relationship now approaches parity.

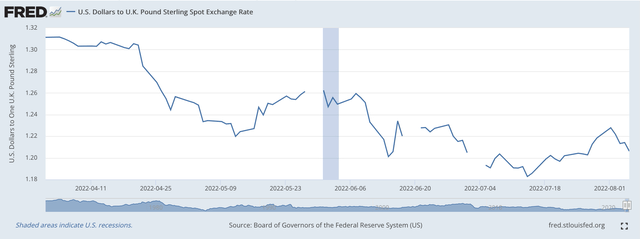

Here is the relationship with the British pound.

U.S. Dollar to Pound Sterling (Federal Reserve)

Again, the relationship looks very close.

Federal Reserve Action

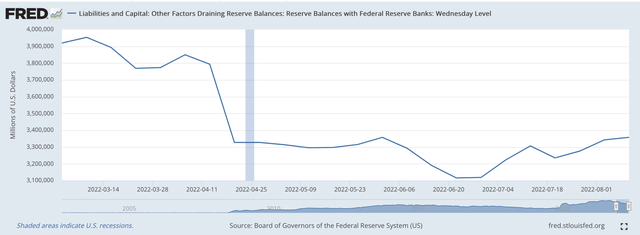

The Federal Reserve action that relates very closely to the above movements is Fed’s movement in April that reduced Reserve Balances at Federal Reserve Banks.

Here is a picture of what the Federal Reserve did.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

The line item on the Fed’s balance sheet labeled Reserve Balances with Federal Reserve Banks and represents the cash deposits that commercial banks maintain at the Federal Reserve Banks. It can be used as a proxy for “excess reserves” within the commercial banking system.

As can be seen from the chart, a major drop in Reserve Balances took place in the banking week ending on April 20, 2022. This is right at the time that the value of the Chinese Yuan dramatically declined.

Reserve Balances or “excess reserves” declined by around $466 billion this banking week.

These “excess reserves” dropped by another $200 billion during the summer, but have returned to around the April figure cited above.

The drop, however, is not an insignificant sum.

And, given the timing of the move, it seems to be closely tied to the increase in the value of the U.S. dollar during the summer months.

U.S. Dollar Policy

Does the United States have a U.S. dollar policy? Does the Federal Reserve have a U.S. dollar policy?

As I have written earlier, over the past couple of years, it definitely seems as if the Federal Reserve wants to maintain a relatively strong value for the U.S. dollar.

But, I think, one can make a very strong argument that the Federal Reserve System and the United States wants to maintain a strong value of the U.S. dollar against the Chinese Yuan.

I think that the Fed wants to maintain a position for the U.S. dollar that will not be closely threatened by the Chinese Yuan.

I believe that the Chinese government wants to have one of the strongest currencies in the world and I think that the ultimate goal is for the Chinese currency to replace the U.S. dollar as the primary reserve currency in the world.

And, along with this, the Chinese have already moved into the digital currency arena and so is developing knowledge and credibility in this particular area of the financial world so as to challenge the United States whenever the U.S. decides it wants to move into a digital unit.

This is a part, I believe, of the evolving competition between the U.S. and China over who will dominate in this particular space.

Right now, the United States has a large lead in maintaining its position for the U.S. dollar as the world’s reserve currency.

Just look as the flow of funds internationally over the past year or two as the Covid-19 pandemic spread throughout the world and the world experienced supply chain difficulties and many other disruptions.

Lots and lots of money flowed into the United States seeking safety and return. The world’s risk-averse investors still favor the United States by a great deal when it comes to protecting their money. And, this just shows up the lead that the United States has over China in this race.

But, as discussed many times before, the Chinese leadership thinks in terms of decades. The United States leadership tends to focus primarily on the next election.

So, the United States, the Federal Reserve, must not lose its concentration on this issue.

In the current time, I have been impressed with the performance of the U.S. dollar and its performance against other currencies around the world. The Federal Reserve has achieved a strong dollar during this time period.

But, the Fed cannot give up. The cannot just base policies on what is needed for “the next election.”

I think it would be unfortunate for the investment community to forget about this challenge. The U.S. dollar must be kept strong.

Right now, the U.S. seems to be doing relatively well in the battle against inflation.

England is having lots of problems in its battle against inflation and new information coming out seems to support the idea that they will continue to face price increase problems.

Europe is also not doing too well and with the attention it must now pay to the Russian/Ukrainian situation, inflation seems like it will be an issue there for some time.

And, China is having its own inflation problems.

The Federal Reserve seems to be doing a better job on the inflation issue that these other geographic areas. It appears that this relationship will continue.

This should mean that the value of the U.S. dollar should remain strong in the near future.

In watching the Fed, however, we must not lose focus on its responsibility to manage the value of the dollar.

Be the first to comment