Galeanu Mihai/iStock via Getty Images

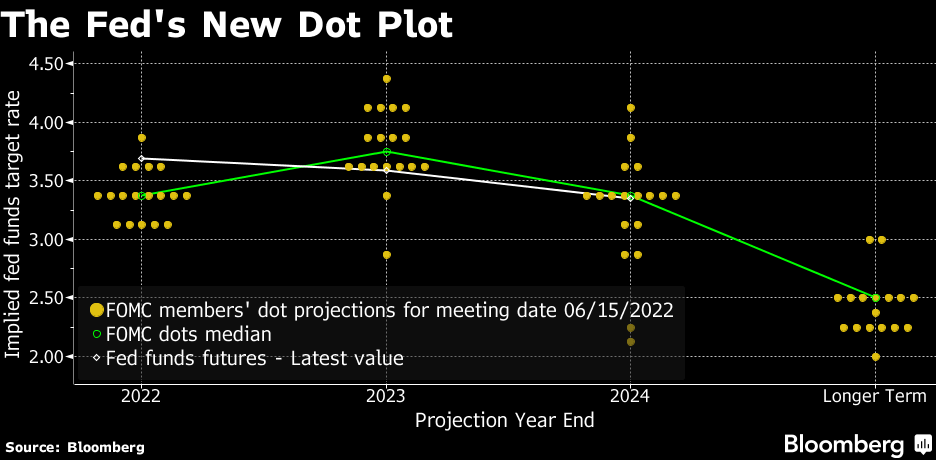

Yesterday the Fed raised short-term rates by the most in 30 years to combat the highest inflation rate in 40 years. More important than the 75-basis-point rate increase, it finally revised its outlook for interest-rate policy so that it is now in lock step with the market’s expectations. That eased concerns that the Fed was falling behind the curve in its fight to tame inflation. The committee members now see short-term rates as high as 3.4% by the end of this year, which is up from what was 1.9% in March and very close to the 2-year Treasury yield at 3.27%. It also lowered its forecast for the rate of economic growth this year from 2.8% to 1.7%. Long-term rates fell on the news with the 10-year Treasury yield settling at 3.39%, while oil prices dropped below $116 and the dollar weakened. That combination led to a strong rally in the major market averages, ending a five-day decline that shaved 10% off the S&P 500.

finviz

Powell’s press conference struck just the right tone with investors as well. He made it clear that the Fed would do what it took to bring the rate of inflation down, but he also asserted that the economy was strong enough to absord monetary policy tightening. He stated that “the consumer is in really good shape financially,” and that “you see shifts in consumption, but overall spending is very strong.” He also noted that “there’s no signs of a broad slowdown in the economy,” which I interpreted as no sign of recession because the economy is clearly slowing down.

Bloomberg

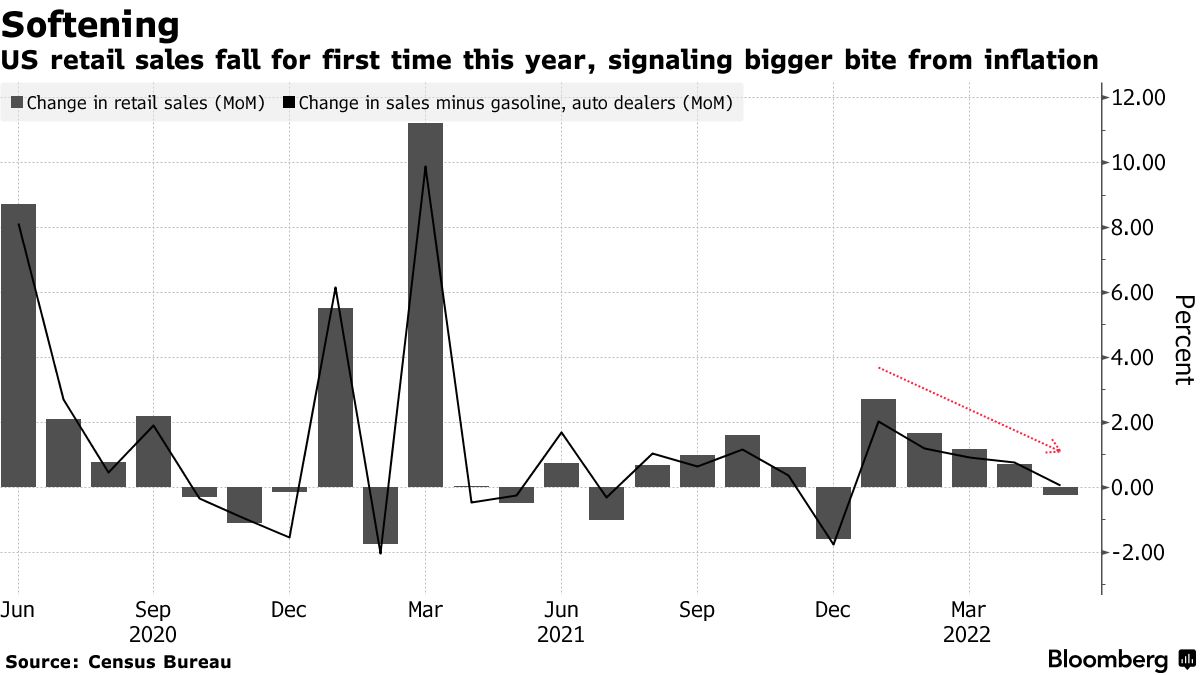

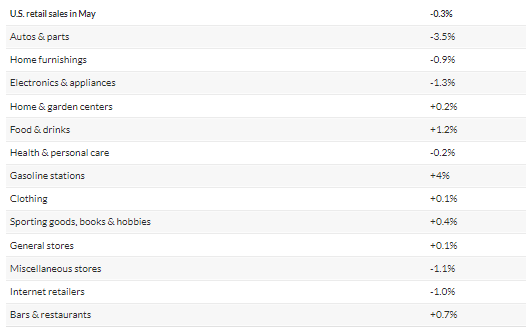

We can see that slowdown in yesterday’s retail sales report, but it hardly indicative of a consumer who is in the fetal position. Retails sales in May declined modestly for the first time since December, which was due predominately to a 3.5% slump in auto purchases. Sales at gas stations rose 4%. But the decline in auto sales likely has as much to do with a lack of supply as any weakening in demand. When we exclude autos and gas, retail sales rose just 0.1%.

Bloomberg

This number was red meat for the recession forecasters, because it is not inflation adjusted. When we subtract the 1% rate of inflation for May from sales, it results in a much larger decline, but we also know that consumers spending has shifted from goods to services in dramatic fashion this year as the economy has fully reopened. The only category representing services in the retail sales report is bars and restaurants, which rose a solid 0.7%. This category tends to flatten out or turn sharply negative when consumers are distressed about their own economic well being. We will gain the full picture on spending later this month in the Personal Income and Outlays report.

MarketWatch

I think yesterday could mark an inflection point in this market cycle now that the Fed and investors are finally aligned in terms of what both think it will take to tame inflation. It seems that the Fed has regained some credibility through its revised forecast, which was evidenced by yesterday’s rebound in risk asset prices. That may mean we start to see some market stabilization, which is needed before we can start to recover this year’s losses on a sustainable basis. Of course, that is conditioned on the rate of inflation gradually declining during the second half of this year, which is still my base case. If so, the Fed’s revised forecast sets that stage for less aggressive tightening than expected later this year, which would be extremely bullish for risk asset prices.

That theory will be tested this morning, as futures are sharply lower on renewed growth concerns. Chairman Powell was clear in that the Fed is willing to see the unemployment rate rise in order to reduce demand in the economy enough to bring down prices. That means it is temporarily ignoring its mandate to achieve full employment in order to move closer to its mandate for stable prices, which is why it increased its projection for the unemployment rate for this year from 3.5% to 3.7%. Still, we have never had a recession in this country with the unemployment rate below 4%.

The good news about growth concerns is that it should cap any further increase in long-term interest rates. It is also scaring futures traders out of oil contracts, as the price of WTI crude oil has traded as low as $114 this morning. Lastly, the dollar seems to have halted its relentless rise. At the same time, slower growth translates into weaker revenues and earnings growth. It will be a balancing act as we move forward, but I remain optimistic about the second half of the year.

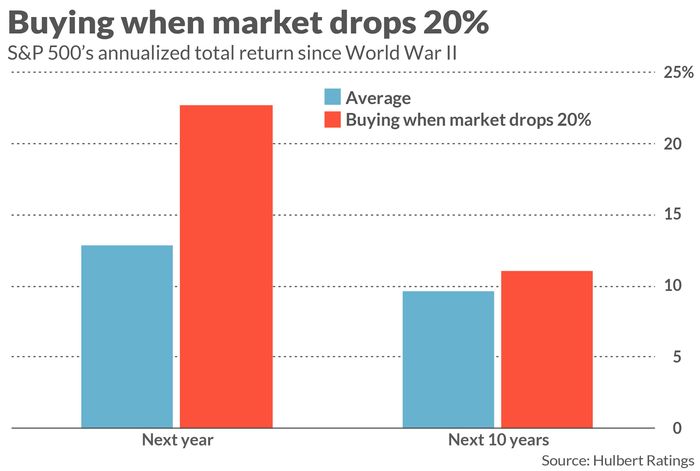

If you bought the S&P 500 every time it dropped 20% since World War II, you would have averaged a 22.7% rate of return 12 months later. Granted, this is an average, but you would have realized gains in 10 of those 12 instances. Even in the two that resulted in a loss, it just took longer to eventually realize the gain. I am sure I will be told that this time is different, but how many times in that past has that been the case?

MarketWatch

Be the first to comment