nonnie192

With the consumer price index on deck, it will be another big week for markets. The CPI report has been a market-moving event for the last few months, and the October report comes Thursday, November 10.

Estimates May Be Too Low

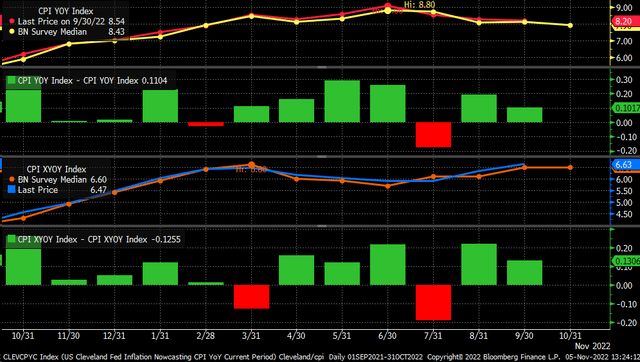

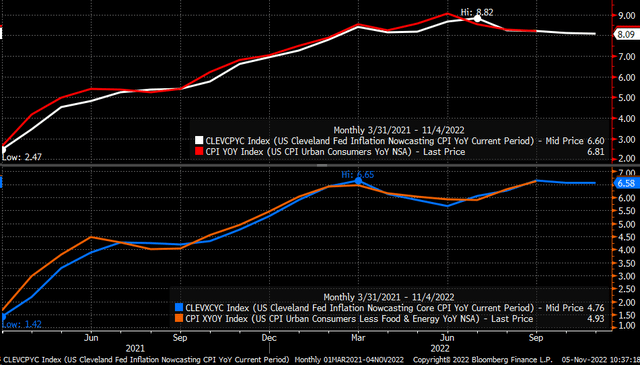

Consensus estimates may prove too low again for both headline and core CPI. For October, CPI is estimated to have risen by 7.9%, down from September’s reading of 8.2%. Meanwhile, core CPI is estimated to have increased by 6.5%, down from September’s 6.6%. The problem is that CPI and core CPI have met or beaten estimates in 10 out of the last 12 months.

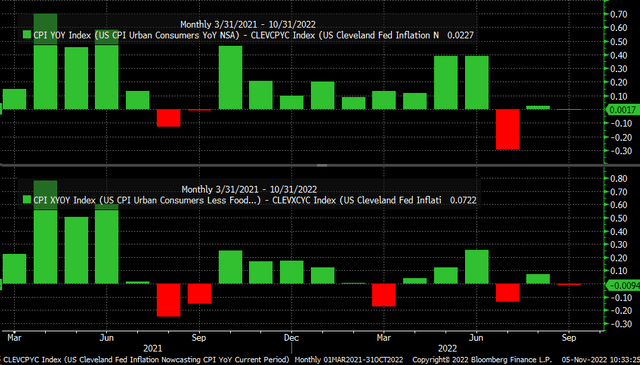

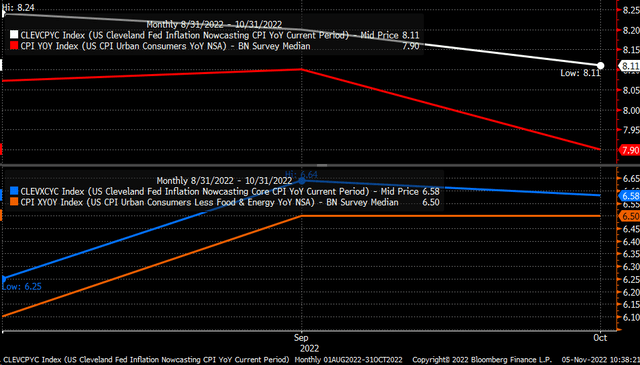

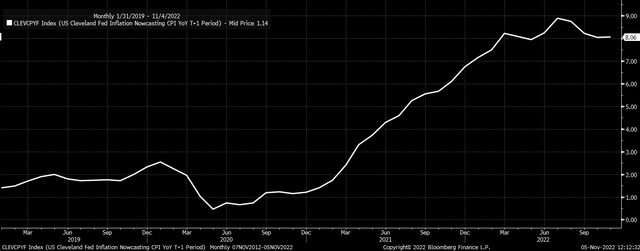

The Cleveland Fed is forecasting much higher inflation than current consensus estimates. For headline CPI, the Cleveland Fed indicates a year-over-year increase of 8.1%; for core CPI, it estimates 6.6%. If the Cleveland Fed is correct, analysts’ consensus estimates may prove too low and by as much as 0.2% for CPI and 0.1% for core CPI.

The problem is that the Cleveland Fed has historically underestimated the actual CPI results. Over the last 19 months’ headline, CPI has beaten the Cleveland Fed estimates 16 times, and core CPI has come hotter than the Cleveland Fed estimates 14 times.

So if the consensus estimates for headline inflation are 7.9% and the Cleveland Fed is at 8.1%, there is a good chance that headline CPI could come in significantly higher than the consensus and may even be higher than the Cleveland Fed’s estimates.

Meanwhile, consensus estimates for core CPI are 6.5%, and the Cleveland Fed estimates 6.6%; there is a good chance that core also beats.

Markets Appear Under-Hedged

So another hotter-than-expected CPI would undoubtedly be a shocker to markets and could create a lot of volatility. The difference between this month’s CPI reading and last month’s reading is that the market doesn’t seem as hedged going into this month’s inflation readout. So a hotter-than-expected CPI could have a much different outcome than last month’s more than 2% decline at the open, followed by a “flash rally” due to melting implied volatility and short-covering; in that case, the market appears to have been over-hedged.

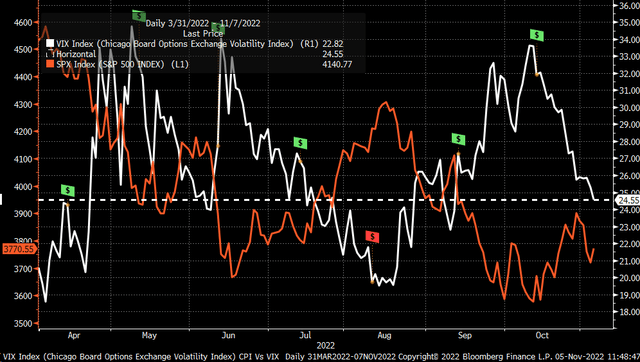

Going into last month’s CPI reading, the VIX was trading well above 30. This month the VIX is trading around 25. The only time this value was lower since April was heading into the August CPI report when it was trading around 20. Perhaps because the market feels that the next FOMC meeting isn’t for a month, there is no need to worry about monetary policy impacts. However, a hotter-than-expected CPI will likely ramp up the hawkish rhetoric and could even put a 75 bps rate hike for December back on the table.

Following the hotter-than-expected September reading, the market started to price in odds for a 75 bps rate hike at the December meeting. But that expectation began to cool around October 20.

However, a hotter-than-expected print would likely put the discussion for a 75 bps rate back on the table. Because the next FOMC meeting is scheduled for December 13 and 14, and the next CPI release date is scheduled for December 13.

The problem is that the Cleveland Fed doesn’t see CPI for November coming down. Currently, the estimates for November are 8.1%. This means that a reading that comes in below expectations for November is unlikely to have much influence at that point because the Fed will want to see consecutive months of falling inflation rates before thinking differently about monetary policy.

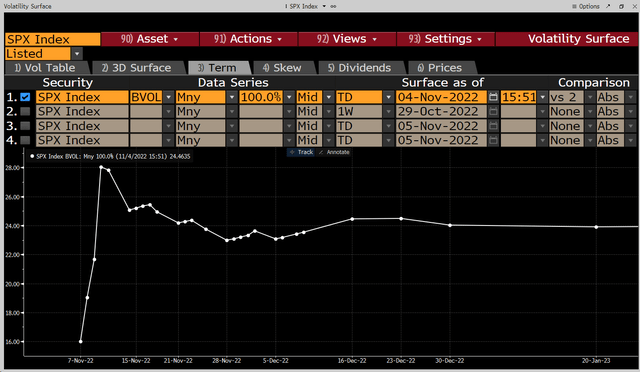

That would suggest that following a hotter-than-expected October CPI, investors are likely to scramble to buy longer-dated hedges than what they have done currently. Based on the S&P 500 current implied volatility term structure, it would appear that investors are hedging for the risk of a hotter-than-expected inflation reading but doing so using the November 10 S&P 500 expiration date.

Implied volatility for the November 10 S&P 500 expiration date for an at-the-money option is elevated relative to the volatility of the dates before and after the CPI report. The market is currently thinking only about the actual CPI print but not thinking about the potential impacts of what comes after the report.

It is also potentially why the VIX is depressed, as investors hedge for the day of risk but not after the fact risk. This means if the next CPI report and the FOMC are at the same time, investors may scramble to buy that protection 30 days from now, pushing the VIX index up.

Should investors scramble to put hedges in place after a hotter-than-expected CPI report, it is a potential headwind for stocks, as rising implied volatility pushes equity prices lower.

At this point, the market may be overlooking the risk of this October CPI report this Thursday. And should it come in hotter than expected, the downside risk to equity markets is significant, and the VIX would likely surge much higher.

Be the first to comment