Lemon_tm

As I pointed out last week, gas prices are declining and down nearly $1 per gallon on average to $4.113 per share. Demand is declining, production is increasing, and inventories are rising. Furthermore, oil prices are slipping, and food prices are falling, all of which will probably make for better headline inflation numbers. Moreover, Job growth numbers have been near 400,000 for months and went over 500,000 in July, combined with a lower 3.5% unemployment rate shattering expectations. Next, reported second-quarter earnings are coming in better than expected. However, despite the recent rally, the stock market is still undervalued. Investor fears drove down prices of some stocks well into a bear market territory, and they are still worried about inflation and the inverted yield curve.

Therefore, we screen for undervalued Dividend Contenders and stocks with 10+ years of high dividend growth and identify five potential buys. Below, we discuss Brunswick Corporation (BC), Celanese (CE), Corning (GLW), Primerica (PRI), and Williams-Sonoma (WSM) as long-term buys.

Overview

We utilize six filters in this analysis to narrow the list of dividend growth stocks focusing on the Dividend Contender dataset. According to Dividend Radar, there are 348 stocks on the list in the last weekly update.

The six filters employed in the analysis are:

- Payout Ratio is not more than 65% – We pick this target value as a measure of dividend safety.

- Adjusted P/E Ratio TTM is less than or equal to 18X – This value is below the S&P 500 Index average.

- 5-Year Dividend Growth Rate CAGR is at least 10% – We are looking for stocks with double-digit dividend growth rates.

- 10-Year Dividend Growth Rate CAGR is at least 10% – We are looking for stocks with double-digit dividend growth rates.

- Market Cap is at least $1 billion – We are looking at large-cap stocks.

- YTD Returns are below (-20%) – We are searching for stocks in a bear market.

Additionally, we exclude distressed stocks by filtering for a positive P/E Ratio.

Results

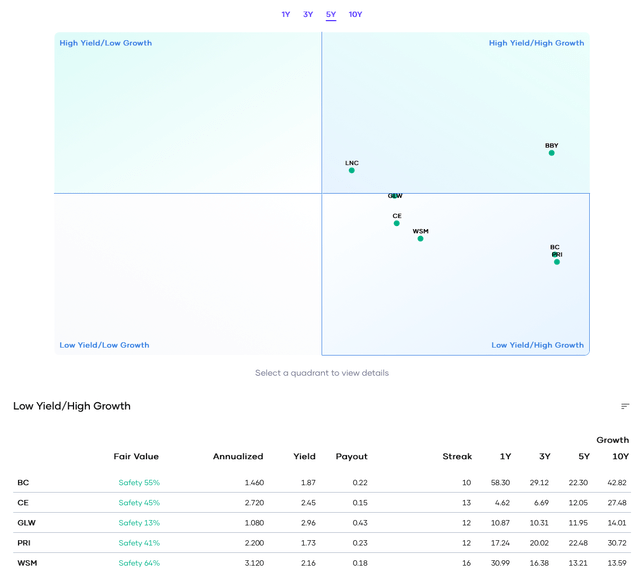

The results are shown in the table below, sorted by ticker. We have seven results, which are: Best Buy (BBY), Brunswick Corporation, Celanese, Corning, Lincoln National (LNC), Primerica, and Williams-Sonoma.

The table shows the seven stocks that passed the screening criteria. Additionally, the seven stocks are below their 52-week high and, in some cases, near their 52-week low. Also, all seven stocks are trading at a reasonable price-to-earnings ratio compared to the S&P 500 Index average.

We next assess dividend growth versus yield for the seven companies in the table. All seven companies are high dividend growth since we screened for double-digit increases over the past five years and ten years. However, only Best Buy and Lincoln National can be considered high yield. Brunswick and Primerica are the two companies with the highest dividend growth rates. Note that the yield mid-point is 3%, and the growth mid-point is 9%. The growth rates for trailing periods are in the accompanying table.

We analyze five stocks here, excluding Best Buy and Lincoln National, because we discussed them in our last article.

Brunswick

Brunswick Corporation was founded in 1845 and initially made billiard tables. Today, the company produces boats, engines, propellers, and parts. The company’s Mercury engines are in one of every two boats, and they have some of the most recognizable boat brands in the industry, like Sea Ray, Bayliner, Boston Whaler, etc. Fears of a recession have pressured the stock price, but the company beat second-quarter estimates.

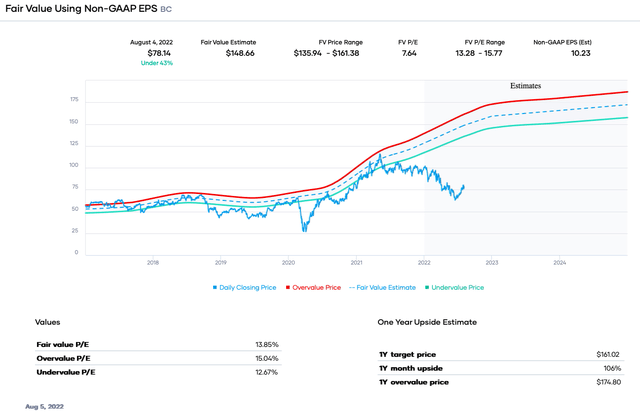

Brunswick has been growing revenue and profits during the pandemic, although fears of a recession may impact 2022. The company rewarded shareholders with significant dividend increases and has sustained double-digit gains for the past decade. Despite the aggressive increases, the payout ratio is a paltry 15% meaning the dividend is well protected.

The forward dividend yield is only around 1.8%, but it is above the 5-year average, and the significant increases make up for the low yield. The stock is undervalued, trading at a forward P/E ratio of approximately 7.6X. Additionally, Brunswick is producing patents at a rapid pace and positioning itself as a leader in electric and connected boats. The price decrease has lowered the valuation well below the 5-year and 10-year range, making for an investment opportunity.

Celanese

Celanese Corporation is a specialty chemicals and polymers company. It has three operating segments: Engineered Materials, Acetate Tow, and Acetyl Chain. The company is the world’s largest producer of acetate acid and vinyl acetate monomer used in paints, coatings, pharmaceuticals, adhesives, etc. It has benefitted from high pricing, but fears of a recession have affected the stock price.

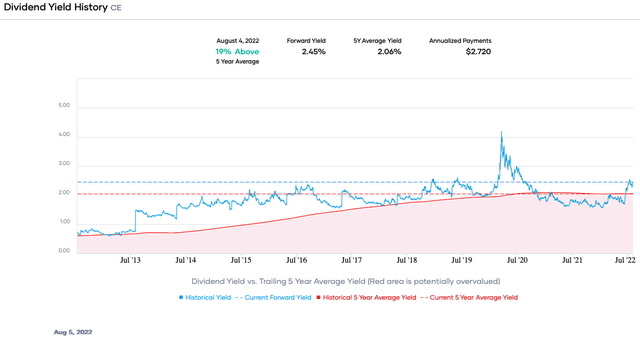

Despite long-term fluctuating revenue, EPS has generally trended up. Furthermore, the pandemic recovery has been good for Celanese as it has rapidly increased the top and bottom lines. The company benefits from more home construction, renovations, automobile production, etc. Consequently, the dividend growth has been strong at ~14.5% in the past five years and ~28.6% in the past ten years. The payout ratio is low at 15.8%, meaning more increases without sacrificing dividend safety.

The dividend yield of 2.45% is the highest since the pandemic and above the 5-year average. The forward P/E ratio is about 6.1X, below the 5-year and 10-year averages. The stock is attractive, especially if recently lower mortgage rates cause future home sales to rise. However, one risk is that the acquisition of DuPont’s Mobility & Materials business added to revenue but also debt, increasing leverage.

Corning

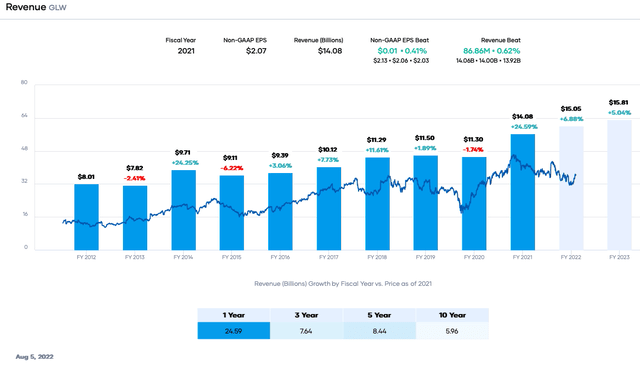

Corning was founded in 1845. Today, it is a market leader in specialty glass products. The company makes glass for TVs, displays, phones, optical fiber, sunglasses, wafers, labware, and other products. Most people know Corning through its Pyrex or Corning brands. However, the company’s stock price has been impacted by slowing demand in smartphone, automotive, and panel end markets.

Corning has generally increased revenue and earnings in the past decade despite the near-term weakness. That success has allowed the company to increase the dividend at a double-digit rate in the trailing five and ten years. The dividend has been raised for 12 years. Moreover, the payout ratio is roughly 46%, easing fears about dividend safety during a downturn.

Corning is paying a ~3% dividend yield, higher than the 5-year average of about 2.6%. The stock is trading at an earnings multiple of about 16.4X within the range of the past ten years but below the range in the past 5-years. Although not significantly undervalued, investors may want to look at this market leader. The continued growth of smartphones, optical communications, and ceramics should drive long-term growth.

Primerica

Primerica is probably little known to most investors. However, those with term life insurance may get it from this insurer. The firm is the No. 2 issuer of coverage in the US. Besides term life coverage, Primerica offers life insurance, investment and savings products, senior health products, etc. Unfortunately, poor quarterly earnings caused by losses in Senior Health combined with higher operating expenses have punished the stock.

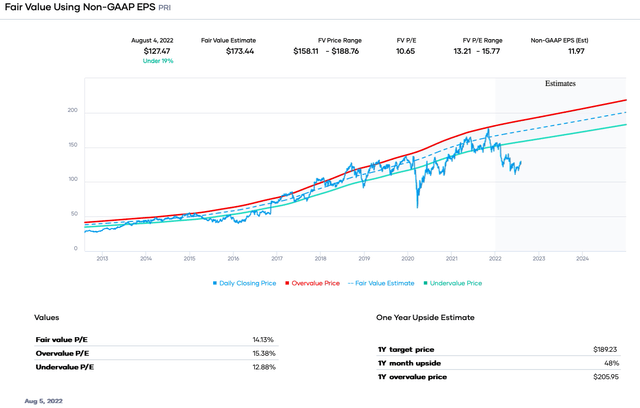

Near-term headwinds may remain, but the company has grown its client base over time. This point has been reflected in its substantial revenue and EPS growth. Consequently, Primerica has been generous with dividend increases at ~34% CAGR in the past decade. Moreover, the conservative payout ratio of only 16% indicates more gains to come.

The firm is undervalued with a valuation of approximately 10.7X, well below its 5-year and 10-year ranges. Primerica is significantly undervalued and is returning cash to shareholders. Although investors fear a recession, job growth is robust, meaning the firm should sell more insurance policies driving the top and bottom lines.

Williams-Sonoma

Williams-Sonoma is a specialty retailer founded in 1956. The company operates roughly 544 stores, 139 franchised stores, and e-commerce websites. Most investors know of the retailer as a seller of cookware, cutlery, furniture, bedding, lighting, etc. Major brands include Williams-Sonoma, West Elm, Pottery Barn, and Pottery Barn Teen. Fears of a recession and slower consumer spending have impacted the stock price.

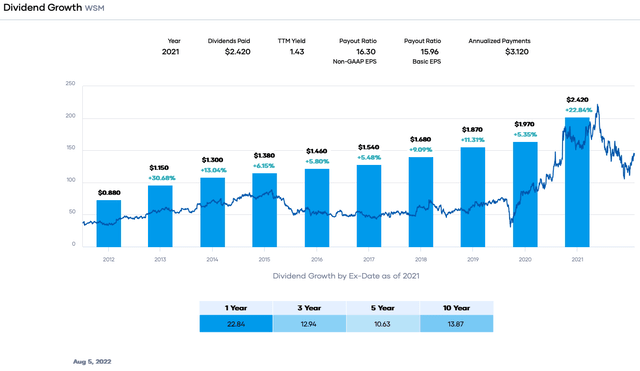

The company continues to grow organically and also by adding new stores. Moreover, the COVID-19 pandemic caused an enormous tailwind for both the top and bottom lines. Williams-Sonoma has increased the dividend for 16 years. The growth rate has been about 13.9% in the past decade. Despite the growth, the payout ratio is only about 16%, so concerns about a spending slowdown on the dividend should be muted.

Williams-Sonoma is a successful retailer that is undervalued. The forward P/E ratio is ~9.1X, below the range in the past five and ten years. Despite the fears of slower consumer spending, robust job growth may prove naysayers wrong. Furthermore, lower gas prices are putting more dollars in consumers’ wallets suggesting retailers may benefit.

Final Thoughts

Although fears of a recession are valid based on an inverted yield curve and high inflation, prices are moderating in many categories. Furthermore, solid job growth numbers combined with low unemployment suggest a more robust economy than forecast. This has created an opportunity for those seeking value and dividend growth stocks. As a result, I view Brunswick, Celanese, Corning, Primerica, and Williams-Sonoma as long-term buys.

Be the first to comment