AntonioSolano

By Alex Rosen

Summary

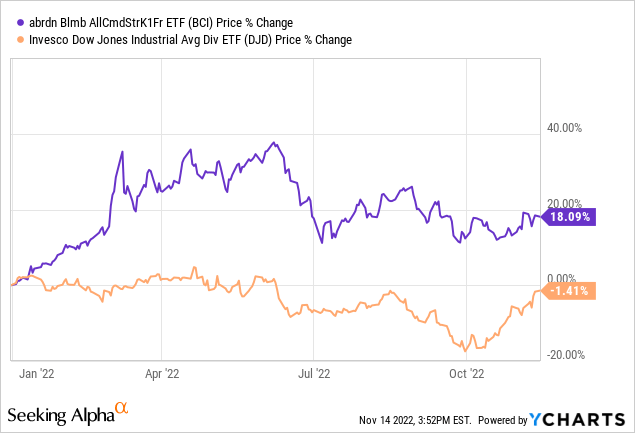

Aberdeen Standard Bloomberg All Commodity Strategy K-1 Free (NYSEARCA:BCI) is an ETF that tracks the commodities futures market. The fund is actively managed to maximize returns and is rebalanced annually. Fund sectors are capped by weight to make sure no one sector dominates. Currently, the fund holds 27 different futures contracts. We rate BCI a hold as it has shown a robust return in a bearish market.

Strategy

BCI holds futures contracts in the agriculture, energy, livestock, and metals sectors. These contracts are weighted two-thirds by trading volume and one-third by world production. The index rebalances each January, with weight caps applied at the sector level. Futures contract selection is made on a set schedule that varies depending on the commodity. BCI has no international exposure, with all holdings being based in the U.S.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Commodities

-

Sub-Segment: Commodities Index

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

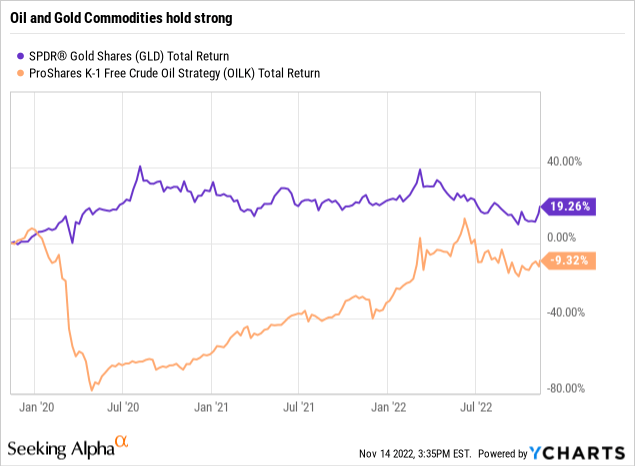

As of Sept. 30, 2022, BCI held strong positions in gold and fossil fuels, making up over 40% of the funds assets. The annual rebalance, active management, and rolling futures contracts act as a hedge against long-term bad positions, though the fund doesn’t have any actual hedges against currency movements.

Strengths

With key holdings in gold and oil futures, the fund is well-placed to weather the market fluctuations. BCI is strategically weighted toward relatively inflation-proof commodities and should manage to show continued stability. The Ukrainian conflict has shown how fragile the world economy can be, and with the sanctions against Russian fossil fuels and Russia taking all the gold it can out of Africa, it’s a good time to be holding strong positions in those commodities.

Weaknesses

Locking into futures contracts can always be a risky proposition. When those contracts are tied to highly volatile commodities like oil and gold, the possibility of a shock to the system will always exist. Today’s solid bet in oil is tomorrow’s pipeline explosion. Due to the basic nature of commodities, they have very little protection against external forces. There is no new technology in gold. It is what it is, and if suddenly the market is flooded with stolen Congolese gold, that could be a serious problem.

Opportunities

While BCI has diversified into a broad range of commodities, its real focus is on precious metals and fossil fuels. In times of uncertainty, these have always been dependable investments. As you can see, BCI is up 18% on the year.

Threats

A lack of significant exposure to a broader range of commodities makes BCI somewhat of a one-trick pony. This could potentially come back around to bite investors who are holding shares but is highly unlikely considering the commodities being held.

Proprietary Technical Ratings

-

Short-Term Rating (next three months): Hold

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

BCI works as advertised. It holds futures contracts in a broad basket of commodities, with concentrations in oil and gold. As a result, unsurprisingly, it has shown a very solid return this year. It is not a gimmick fund, nor does it have any complex investment strategy. Those who invest in it know exactly what they are getting into. This, in our opinion, makes it a quality investment.

ETF Investment Opinion

We rate BCI a hold due to the overall volatility of the market. In the current investing climate, it’s very difficult to find any solid buys. But there are plenty of funds capable of successfully navigating this investment climate, and BCI definitely seems like one of them.

Be the first to comment