sshepard/E+ via Getty Images

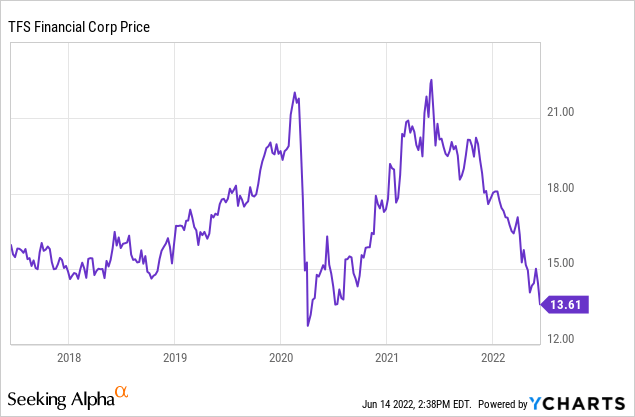

TFS Financial (NASDAQ:TFSL) is a regional bank stock I own primarily for its yield. I own it to serve as a fixed income alternative, as do many of its other holders. With the recent sell-off in bonds, preferred stocks and other income investments, TFSL stock has gotten hit as well:

After recovering its pandemic-induced losses in the early part of 2021, shares have now nearly returned to the March 2020 lows.

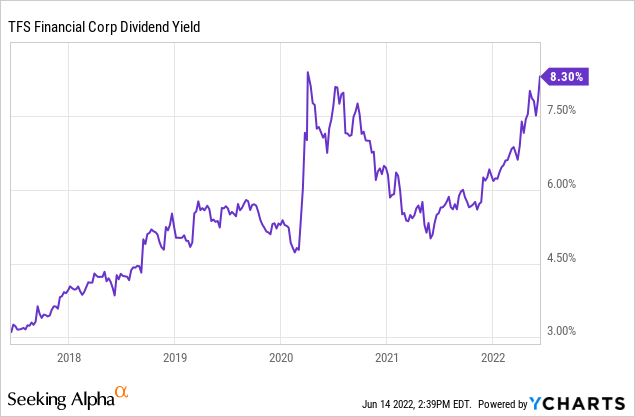

While the stock price has been going down, the dividend yield has been increasing. TFS has increased its dividend for seven years in a row, so there’s been dividend growth in addition to the rising yield even as the share price has slid:

As long as TFS Financial can cover its dividend – which, as we’ll see in a moment that it can – shares are highly attractive as a fixed income alternative at today’s prices.

TFS Is A Mutual Holding Company: Here’s Why That Matters

TFS Financial is a unique situation since it is a mutual holding company “MHC”. In an MHC structure, shares which haven’t yet been issued to the public are still counted as outstanding shares and thus greatly dilute a company’s reported earnings and other financial metrics. The truth is that the vast majority of TFS and other MHCs’ reported “shares” don’t actually exist in any meaningful way and therefore the market caps, PE ratios and all other such financial metrics you see in screeners are wrong.

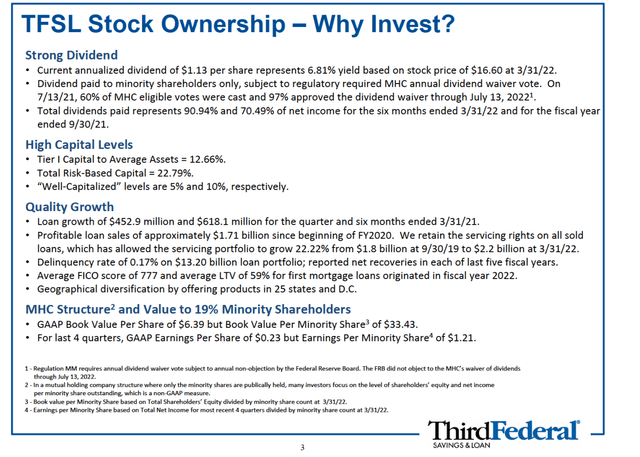

Thankfully, TFS’s management has started trying to help the public understand the true financials with helpful slides in its recent quarterly earnings presentations:

TFSL stock overview (corporate presentation)

As the slide explains, the dividend only goes to the minority shareholders. Thus, despite paying a then 6.8% (now 8.3%) dividend yield, the company’s dividend was fully covered and then some out of net income, with the payout ratio being 91% and 70% of net income over the past six months and fiscal year, respectively.

Furthermore, TFS Financial has had incredible consistent results in recent years. Here is its last five years of earnings per minority share:

- FY ’21: $1.51

- FY ’20: $1.57

- FY ’19: $1.52

- FY ’18: $1.61

- FY ’17: $1.64

There’s not been any growth to speak of, and the bank’s returns of equity and net interest margins remain low. But when a bank can reliably earn around $1.50 per share per year and pay out $1.13 of those earnings as dividends every year, that’s still an attractive offer when shares are selling for just $13.50. That makes for an 8.3% dividend yield and a greater than 10% earnings yield.

Also, as the company explains in that slide, the true book value per minority share is now up to $33.43, this has risen considerably over the past decade. The dividend isn’t the only way shareholder value is being generated.

As an additional point speaking to dividend safety, the company is capitalized far beyond regulatory requirements. This gives TFS plenty of room to pay large dividends and/or continue acting on its currently authorized share repurchase program regardless of short-term volatility in earnings or market conditions more generally.

Safe Low-Risk Operations

As mentioned, the big knock against TFS Financial is that it is not a particularly profitable bank. It earns an unappealing 1.82% net interest margin “NIM” as of last quarter. This is far below your average regional bank, which would be closer to 3%. However, in return for earning low yields on its loans, TFS has a loan book of excellent quality.

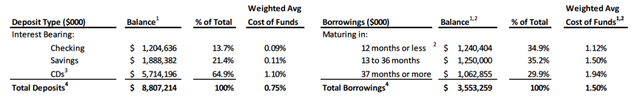

The company’s cost of capital is also quite low, averaging just 1.0% as of last quarter.

TFS cost of funds (Corporate presentation)

This is because it has a strong deposit base with a sizable portion of its total deposits consisting of checking and savings accounts paying just 0.1% on average. Its CDs are offering just 1.1% as well. The company’s borrowings from other sources are also costing just 1.5% overall with even longer maturities being available for less than 2%.

On the asset side of the equation, TFS does face some risk in that 36% of its loans are fixed rate mortgages with 10 years or more to maturity. This is where TFS can get hurt if rates appreciate significantly and stay elevated. However, 10% of its loans are fixed-rate mortgages which mature in 10 years or less, and the other 54% of the loan book is adjustable rate mortgages, HELOCs, and ELOANs, which should have better return profiles in a rising rate environment.

It’s also worth noting that 50% of TFS’s loan book is in the state of Ohio. This means TFS has less risk than if its loan book were exposed to faster-growing housing markets with more elevated prices and levels of speculation.

In addition, TFS’s underwriting is exceptionally conservative. For the latest fiscal year, TFS’s average new loan was to a borrower with a FICO score of 777 and with only 59% loan-to-value “LTV”. It’s hard to imagine TFS losing much money on these sorts of ultra-safe loans regardless of what happens in the housing market in the near term. That’s especially true when you’re lending on 59% of value in Ohio rather than a more speculative state.

TFSL Stock’s Bottom Line

Now how do we get from a sub-$14 stock price now closer to book value or at least a more reasonable P/E ratio? The easiest option would be for the bank to convert to a regular structure, thus leaving behind the MHC, and then sell itself. The current CEO has said he doesn’t want to convert under his watch, but he’s getting up there in age. The bank could be up for sale fairly quickly if and when he decides to retire.

Otherwise, shares may drift higher thanks to its increasing book value. I believe shares should trade closer to 65-70% of book value to account for the MHC discount, which would put the stock around $22. At that price, it’d still offer a dividend of greater than 5%, giving enough incentive for yield investors to stick around.

That said, shares have reached compelling value levels here as they keep drifting lower. With the generous dividend from this exceptionally conservative and bland bank now topping 8%, this is a fantastic income stock. I expect some meaningful share price appreciation as well in addition once the current bloodbath in the fixed income market finally lets up.

Be the first to comment