williamhc

Today I was planning on writing a report on the third quarter results of Textron Inc. (NYSE:TXT). The report would analyze the results, highlight the impact of supply chain disruptions but also recognize the opportunities for the company. One thing was clear, the rating would have been a Buy also based on the contest that Textron was involved in. As an aerospace analyst there is never a dull day, and that also was not the case today. While I was writing the report on the Q3 results, the news broke that Textron was the big winner of the Future Long-Range Assault Aircraft (FLRAA) in the contest issued by the U.S. Army. I guess being an aerospace reporter, sometimes you don’t have enough hands to write about everything that is going on in the industry. That is somewhat unfortunate, because it also means at times news develops faster than we can keep pace writing.

Today’s award for the FLRAA is one example and it also means that some of the upside materialized before I could highlight the opportunity for investors and that is unfortunate. At The Aerospace Forum, I did have some one-on-one discussions with subscribers marking Textron as the favorite to be selected for the next generation assault aircraft. So, those subscribers had an edge and likely have made quite a rewarding investment decision since the news of the win has led to an after-hours pop of 8% for Textron stock.

What is Future Long-Range Assault Aircraft or FLRAA?

The Future Long-Range Assault Aircraft is a 2019 program initiated by the U.S. Army that aims to develop the successor of the Sikorsky UH-60. The program is part of the overarching Future Vertical Lift initiative to develop the successor of the UH-60 Black Hawk, AH-64 Apache, CH-47 Chinook and the OH-58 Kiowa helicopters. Initially, as the Joint Multi-Role [JMR] program the Future Vertical Lift program was divided into several classes:

- JMR-Light, which became the Future Attack Reconnaissance Aircraft Program.

- JMR-Medium-Light

- JMR-Medium, which became the Future Long Range Assault Aircraft Program.

- JMR-Heavy, which intends to replace the CH-47 Chinook.

- JMR-Ultra, which provides vertical lift comparable to fixed-wing aircraft.

The JMR-Medium that resulted in the FLRAA program initially had been envisioned as a replacement to the AH-64 Apache and the Black Hawks. However, there already had been signs that the program would end up being split. That makes a lot of sense, as the Black Hawk is a helicopter that is mainly used for dropping soldiers and it can be armed when needed, while the Apache is a pure attack helicopter. So, these two helicopters have little in common other than being medium-lift helicopters. The Army envisions the FARA program to develop the helicopter used to do spotting and attacking creating a clear path for troops injection from the product that would be developed under the FLRAA program.

That means that the Apache helicopter is a bit beyond the scope of the medium-lift replacement program, and it is too much firing power to be in the light category. Boeing (BA) and the Army have diverging views, where Boeing sees a next generation Apache as the main attack helicopter rather than the Army’s FARA product. So, the FLRAA really is a Black Hawk replacement and not an Apache and Black Hawk replacement as envisioned earlier. I’ve been face-to-face with an Apache and that helicopters is built to let the enemy know they are coming with heavy weapons. So, it is a completely different class than light attack helicopters or the medium-lift Black Hawk. It lifts something else, weapons… lots of it coupled with an impressive sensor package.

That is not to say that with different capabilities, namely transport for one and gunship for the other, it is not possible to have it replaced by one platform, because that certainly is possible with different variants of the platform. However, we also see that while the Apache is set to be operating through 2045 and most likely beyond 2050, the Black Hawk replacement is set for 2030. So, there is a difference in capability and a difference in replacement timelines.

Textron and Lockheed Martin, Boeing Compete

To provide the Black Hawk replacement, Textron teamed up with Lockheed Martin (LMT) to build the Bell V-280 Valor, a tilt-rotor design, while Boeing teamed up with Sikorsky, now part of Lockheed Martin, to build the SB>1 or SB-1 Defiant. With Sikorsky now part of Lockheed Martin, the V-280 became essentially a Textron-Bell development.

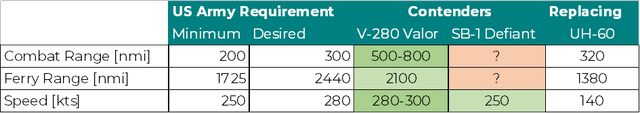

What the Valor really has as its main advantage is the tilt-rotor design. During transport, speeds of 300 knots can be reached while the cruising speed is 280 knots. In comparison, the UH-60 has cruising speed of 140 knots. With the FLRAA product, the U.S. Army wants to transform medium-lift capabilities with higher speeds, more agility and bigger range. It would significantly improve the reaction times and ability to deploy due to the combination of speed and range. The Army desires a combat radius of 300 nautical miles while the self-deployed range should be 2,440 nautical miles. The combat radius of the V-280 is 500 to 800 nautical miles, but with a range of 2,100 nautical miles, the V-280 falls short of the desired ferry range but performs better than the 1,725 nautical miles set as a minimum requirement. Again, for comparison purposes, the ferry range of the Black Hawk is 1,380 nautical miles with a 320 nautical miles combat radius.

Sikorsky’s answer is a compound helicopter with coaxial rotors called the SB-1 Defiant with Boeing as a subcontractor. The design has a 250 knots cruising speed meeting the Army’s minimum but not the desired cruising speed. Range figures from the SB-1 Defiant are not known, but due to the use of the T-55 engines it is expected that range requirement would not be met until a future engine is rolled out. Being a somewhat conventional helicopter, it could be possible that the Defiant has better hover capability and maneuverability at landing zones but there are no comparative results for that.

If we put it together, we see that both the V-280 Valor and the SB-1 Defiant are significantly better than the UH-60 they are expected to replace. What is somewhat problematic for a quantitative comparative analysis is the fact that range numbers for the SB-1 Defiant are not known but it is generally assumed that the range requirements are not met leaving the SB-1 Defiant with possible superior hover capability over the V-280 Valor and a speed that meets the minimum while the V-280 Valor meets desired combat range, meets and exceeds minimums on the ferry range while meeting the desired cruise speed requirement.

Just taking a global look at the two contenders, it does seem that the V-280 Valor is the best option.

Textron Wins

A global look already shows that the V-280 would very likely be selected. Looking just at the pictures, I do like the looks of the SB-1 Defiant more, but it’s not about the looks. The contract is not yet booked in the DoD’s daily contract overview, but it is already known that the initial contract value for the preliminary design and development of a virtual prototype is $1.3 billion with $232 million obligated and the engineering manufacturing and development contract coupled with an initial batch of low-rate initial production could be push the value to $7.1 billion with a $70 billion sales potential overall.

So, this is an extremely important win for Textron, which teamed via its subsidiary Bell with Boeing on the V-22 for which revenues are on the decline. This contract award and future contract awards push the revenue potential significantly higher. The U.S. Army has nearly 1,600 Black Hawk in its fleet and plans to have 1,227 helicopters eventually. It is not known how much a V-280 Valor will cost but if we take the $25 million sticker price, we get to a $30 billion to $40 billion revenue potential. Assuming roughly double the price to keep in mind the significantly better capabilities of the helicopter we would get to a revenue potential of $60 billion to $80 billion. So, this is really huge for Textron.

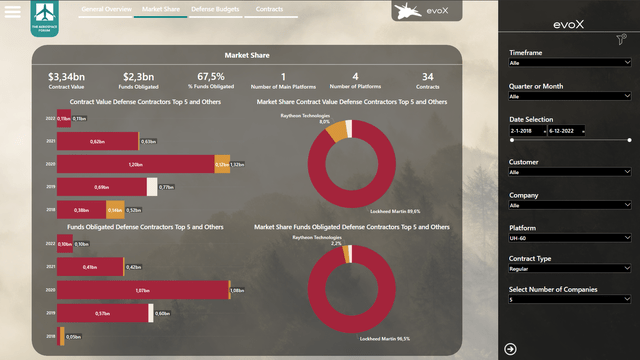

If we look at how much contract value the Black Hawk generated over the past 5 years for support and acquisition, we see that that there were $3.3 billion in contracts of which $1.2 billion are acquisitions. The remainder provides significant tail revenues to maintain the fleet. So, next to the huge potential the FLRAA selection has for Textron in terms of helicopters to be acquired, there will also be a significant revenue stream for spare parts and services.

Acquisition Strategy in Play

One thing we are seeing with the U.S. Army approach towards the FLRAA program is a significantly de-risked approach. It seems that with a look on military cost overruns and delays on the F-35 program, the medium-lift replacement has been split because while having a common platform is nice sometimes there is so much demanded from a single platform that keeping the project within budget and timeframe is too challenging. Additionally, the U.S. Army went with a proto-type approach where contenders actually build a first version of the aircraft that will eventually be transformed into the FLRAA product. By doing so, a significant timeline risk and risk of performance shortfalls is being eliminated. It sets the U.S. Army up for having the aircraft they want within the time frame they want with the capabilities they want, likely from day 1.

Now, it should also be noted that while the V-280 seems to be the best product, it was already somewhat expected this platform would win even if the SB-1 Defiant would be a closer contender in terms of capabilities.

Ron Epstein, an analysts for Bank of America, highlighted it in the Q1 2022 earnings call question and answer session for Lockheed Martin:

In the investment community, it seems like there’s this assumption. I’m just going to lay this out here and that Textron is going to win Future Vertical Lift.

You might wonder why that is the case or not. If you are not wondering why it is still worth highlighting why Textron would likely be slightly preferred. The answer is that the defense complex benefits from competition. More competition should lead to better capable products at vastly more attractive prices. Looking at how big programs have been assigned, we see that Lockheed Martin has the F-35 while Boeing has a core in tanker programs and the trainer jets. Absent of the trainer jet, the fighter jet business would be reserved to Lockheed Martin. Similarly, if Textron would not win this contract its military helicopter product would be under pressure reserving the space for Sikorsky and Boeing. So, this contracts also keeps the competition alive and you can also wonder to what extent Boeing’s failures on Defense programs has played a role in the decision.

Conclusion: Providing a Capable Product Textron is a Buy

Comparatively, the V-280 seems like the better fit for the U.S. Army, so it is not odd that Textron was ultimately selected as the winner of the FLRAA contest. What also plays a role is the need for continued competition in the Defense industry. Had Textron not won this contract, its helicopter business would be under significant pressure since the V-22 which it pioneered will see its revenues decline. By awarding this contract to Textron, healthy competition is kept alive with revenue streams for decades to come which also keeps the continued need for sharp pricing and strong capability packages on future developments alive. So, this is also a strategic decision for competition on future lift programs. After all, the medium-lift capability for which a contract is awarded now is just one piece of the future vertical lift modernization.

Be the first to comment