JL Images/iStock Editorial via Getty Images

Introduction

My thesis is that Tesla’s (NASDAQ:TSLA) new self-driving version 10.69 is a big leap forward.

CEO Elon Musk got my attention when he tweeted the following about full self driving (“FSD”) on August 21st:

After wide release of FSD Beta 10.69.2, price of FSD will rise to $15k in North America on September 5th.

Not wanting to miss out on the fun, I paid for FSD and enrolled in the beta program on September 4th. I had been using Autopilot on the freeway in my Model Y for over a year and wanted to see what else was possible. Autopilot is cool but it disengages whenever the driver changes lanes and this can be irritating. After getting FSD version 2022.20.8 on September 4th, I noticed that it is a substantial improvement over Autopilot. It didn’t take long for me to get comfortable with it in a wide variety of freeway situations. However, I didn’t use it much on surface streets. I got upgraded to FSD version 2022.20.9 a few weeks after September 4th; the upgrade from 2022.20.8 to 2022.20.9 was nice but it still wasn’t 10.69.

FSD Version 10.69

Tesla’s FSD 10.69 is an inflection point because it is the first version that truly shows what is possible on surface streets. Knowing that my beta safety score from 0 to 100 has always been above 80, this tweet about 10.69 from CEO Musk on September 19th got me excited:

Yes, all US & Canada cars with safety scores above 80 should receive an invitation to download FSD Beta by tomorrow

Now I understand why CEO Musk was so confident about the price increase. FSD 10.69 is amazing! I got it on September 20th and it is a big leap forward over previous FSD versions. The difference on surface streets is night and day; I use FSD regularly on streets now – especially large streets. There are different versions of 10.69 and the one I got is 2022.20.17 or 10.69.2.2.

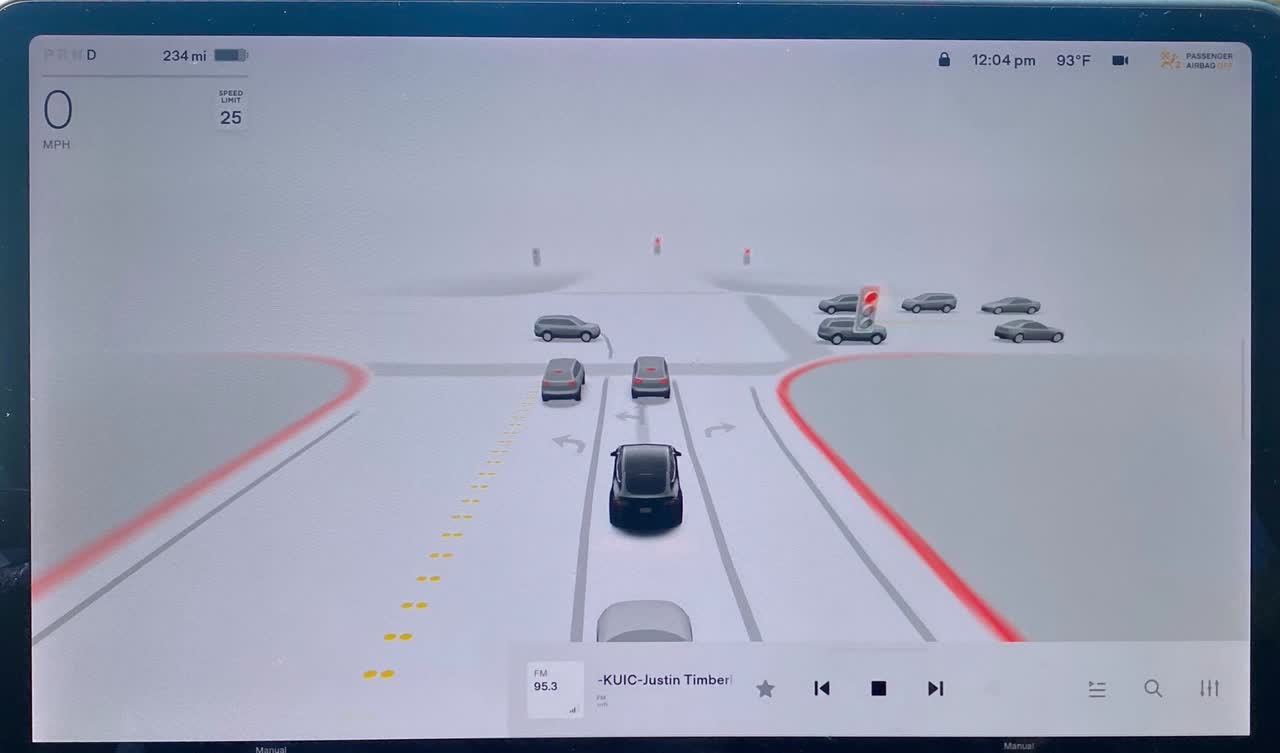

Even the older versions of FSD worked well for me on freeways but 10.69 takes things to a new level as the screen shows that the software is well aware of surroundings. 10.69 was an inflection point for me because it dramatically changed my comfort level with FSD on surface streets. 10.69 works really well for me on mainstream streets, especially when it isn’t necessary to do a lot of lane changes or turns. Even in parking lots, it is extremely evident that the 10.69 software is taking a detailed look at the surrounding environment:

Tesla Camera View (Author’s photo)

Image Source: Author’s photo

The screen shows that a vehicle is in FSD when there is a blue line in front of it:

Tesla 10.69 View (Author’s photo)

In some ways the 10.69 ride experience seems smoother when there is a car in front of me. This is kind of counterintuitive but the software knows how close to follow with respect to braking distances. It could be my imagination but it seems that sometimes FSD 10.69 is a bit more cautious at night:

Tesla 10.69 Night View (Author’s photo)

Despite enormous improvements in this 10.69 version, there is a reason why it is still in beta. Also, it is important to recognize that my sense of “good driving” is biased. There is a saying that anyone driving faster than you is a maniac and anyone driving slower than you is an idiot. Like other humans, I sometimes have these thoughts even though they aren’t rational. As such, it is hard to distinguish between changes that 10.69 needs to make as opposed to preferences I have that are off base.

Erratic drivers cause anxiety. We’ve all seen that one car that continually weaves towards each side of the lane, drifting partially outside of the lane from time to time. Human drivers give these cars extra space. I’d like to see 10.69 label these cars orange or something so that we know the self-driving software is aware of the danger. This type of label would help assure us that the software is making an effort to give the dangerous car an extra amount of space.

Iterative improvements have been ongoing and I am confident that they will continue quickly. One example where additions/improvements will come is when leaving gated communities. A human quickly looks at the gate and estimates the room needed for it to swing forward. The human driver then gets the vehicle close enough to the gate for the sensor to open it while leaving enough room for the gate to swing forward. The other day 10.69 never drove close enough to a gate for this to happen but I’m sure this type of thing will be addressed in the near future. I’m confident that future software versions will be smoother such that mysterious braking will be reduced, merging will feel more human-like and more decisiveness will be shown when there are multiple turn lanes.

These portrait photos are probably better for folks reading this article on their phones, but Tesla also lets drivers have visualization improvements by dragging the light gray visualization bar to the right such that it is easier to appreciate how the cameras are aware of the environment:

Tesla Landscape View (Author’s photo)

Valuation

Currently 30,000 Americans lose their lives annually in car accidents. We need to get this number down to 20,000 as soon as possible and I believe CEO Musk is right that cameras only without LIDAR are the fastest way to do this. Tesla is moving quickly as they now have 160,000 FSD vehicles on the road. Eventually it might be good to add LIDAR in special situations but I think we’re years away from that. Tesla’s strategic considerations with their camera-only approach impact valuation and I believe they are well ahead of peers with this approach.

Despite what critics say, self-driving will be part of the equation in terms of bringing down the car-related death toll from today’s level of 30,000 Americans per year. FSD 10.69 has shown me that Tesla is making meaningful strides in this area and I’m optimistic that they’ll be successful in a way that will add tremendous value. Moving forward, they should be selling more than a million vehicles per year worldwide and anything they can do to increase the percentage of buyers who pay the $15,000 for self-driving software can have tremendous valuation implications. Revenue goes up by $1.5 billion for every 100,000 vehicles that include the $15,000 FSD software. Many of the expenses for this are fixed so the economics are wonderful as long as Tesla is doing this at scale. In addition, Tesla hasn’t ruled out the possibility of licensing out their FSD offerings to other companies. In a June 14th interview, CEO Musk used some hyperbole but his point that FSD will do wonders for valuation is key:

But the overwhelming focus is solving full self-driving so um, yeah. And that that’s essential and like that’s really the difference between Tesla uh being worth a lot of money and being worth basically zero.

Tesla has a light balance sheet compared to others in the auto industry but it is important to distinguish between different types of debt. An excellent captive financing article on SeekingAlpha explains that much of the “debt” in the legacy auto industry is similar to what we see with banks. It can be a mistake to not think about balance sheet considerations like bank-type debt but it can be an even bigger mistake to only think about bank-type debt and ignore offsetting bank-type assets. One needs to consider the raw size of postretirement obligations and assets along with the balance sheet consideration which is the difference between the two. A November 2021 Bloomberg article talks about VW’s (OTCPK:VWAGY) postretirement issues:

Diess should better focus on some of the legacy issues plaguing the carmaker – like the 40 billion euros of unfunded pension liabilities – and consider ditching his Tesla fixation, according to Jefferies analyst Philippe Houchois.

The 2021 Volkswagen annual report shows €58,555 million in postretirement obligations and just €17,285 million in postretirement assets. As the above Bloomberg article pointed out, this difference of more than €40 billion between obligations and assets is not a good thing. Fortunately Tesla does not have these types of concerns.

Looking at Tesla’s reported numbers on the 2Q22 10-Q and the 2021 10-K, trailing-twelve-month (“TTM”) free cash flow (“FCF”), gross profit and revenue are$6,952 million [$2,849 million + $5,015 million – $912 million],$18,201 million [$9,694 million + $13,606 million – $5,099 million] and$67,166 million [$35,690 million + $53,823 million – $22,347 million], respectively. A June 2022 SeekingAlpha article points out that downward adjustments need to be made for FCF. I agree with the author’s point that stock-based compensation (“SBC”) is a real expense that needs to be considered. EV credits are another factor that needs to be accounted for when talking about FCF durability. Taxes and R&D are also areas of concern.

Tesla is a car company in the same way that Apple (AAPL) is a phone company. Both businesses are redefining products and enjoying margins that were unheard of in the past.

Given Tesla’s prodigious growth investments, it is hard to say what their steady-state FCF will look like in the future. Their gross profit went from $4.1 billion in 2019 to $6.6 billion in 2020. It then climbed to $13.6 billion in 2021 and finally to $18.2 billion for the TTM through the first half of 2022. I believe Tesla’s annual gross profit will be $50 billion within 3 or 4 years and I think the steady-state FCF margins will be healthy. It is hard to say what such a business is worth today but I don’t think $1 trillion is out of the question given the possibilities we have seen with FSD 10.69. The 2Q22 10-Q shows 1,044,490,015 shares outstanding as of July 19th. On August 5th, Tesla announced a three-for-one split such that each shareholder received two additional shares in late August. As such, there are now about 3,133,470,045 shares outstanding. Based on the September 23rd share price of $275.33, the market cap is about $862.7 billion.

Forward-looking investors should tune in closely for the upcoming AI Day on September 30th. CEO Musk tweeted that there might be an Optimus prototype working by then.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment