JamesBrey/E+ via Getty Images

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) is finally free of the meddlesome relationship with Twitter (TWTR) since Musk decided to terminate the deal. Though there will be legal issues that the CEO will need to face, the worst impact would only be the $1B break-up fee, which is a measly sum compared to the headwinds that the TSLA stock had faced thus far. Though not directly attributed to the deal, the stock had plunged by 30%, from $998.02 on 25 April 2022 to $699.21 on 12 July 2022. This directly translates to a gargantuan $300B of enterprise value lost in the past three months, which had spooked many TSLA investors, including myself.

Nonetheless, the coast is clear now with blue skies on the horizon, since Musk clearly gave Twitter the boot.

Shanghai’s Ramp-Up Is Also Much Better Than We Had Expected

In the meantime, TSLA also did better than expected in its Shanghai ramp-up post lockdowns, with total FQ2’22 productions of over 258K vehicles and delivery of over 254K vehicles, including from other Gigafactories. It is evident that the company managed to overcome the Zero Covid Policy in China since it was able to make 78.9K sales in June 2022 from its plant there, the highest monthly sale ever. Assuming that TSLA had managed to achieve its goal of over 71K monthly production rate in June and continue sustaining its overperformance through H2’22 in its Shanghai plant, we expect a massive turnaround ahead for the stock indeed.

With the aggressive projected weekly output of 22K Shanghai-made TSLA vehicles for H2’22 (after the two-weeks upgrade in early July 2022), we are looking at a high estimate of 286K vehicles quarterly, marking a tremendous 59% boost overall to its previous normal daily output of 2.1K. Otherwise, a more-than-decent 31% improvement to its record-high monthly production of 70.84K in December 2021 levels. That would bring the annual target to 1.1M for its Shanghai Gigafactory, more than double its original built capacity of 450K.

In addition, with the Chinese government promising continuous supply and stable pricing of auto chips and related raw materials, we expect TSLA’s Shanghai operations to benefit moving forward, despite the uncertainties of China’s Zero Covid Policy. Of course, this is assuming that the factory itself does not encounter any outbreaks.

Furthermore, with the ongoing upgrades to TSLA’s Berlin Gigafactories (despite only producing black and white models), we expect to see an improved FQ3’22 output overall. The company reported a 1K weekly production rate in Berlin, adding a total of 13K to its total quarterly output. Therefore, with a rough estimate of 132K quarterly output in TSLA’s Fremont Gigafactory (based on FQ4’21 numbers), we could be looking at a record high of 390K vehicle production in FQ3’22, a 25.8% jump from its FQ1’22 quarter, if not more.

Assuming a similar cadence, TSLA could report a total of 1.34M vehicle output for FY2022, a notable improvement of 43.1% YoY, though still a massive shortfall of -21.1% from original forecasts of 1.7M. Nonetheless, we believe that the market would still reward TSLA with some stock recovery by then, with more to come in 2023, assuming a successful ramp-up in Berlin and Texas. Investors take note.

TSLA Continues To Bring In Cold Hard Cash In The Unprofitable EV Market

TSLA is definitely the first few of many pure-play EV companies to have reported sustained net income profitability, given its early head start in the industry. In addition, the company continues to report improved margins, despite the macro issues, highlighting its mastery over the global supply chain issues thus far. For that alone, there is no doubt that TSLA is definitely operating leaps and bounds ahead of many legacy automakers, such as Ford (F) and General Motors (GM), which had continue posting losses/minimal profits for their EV segments.

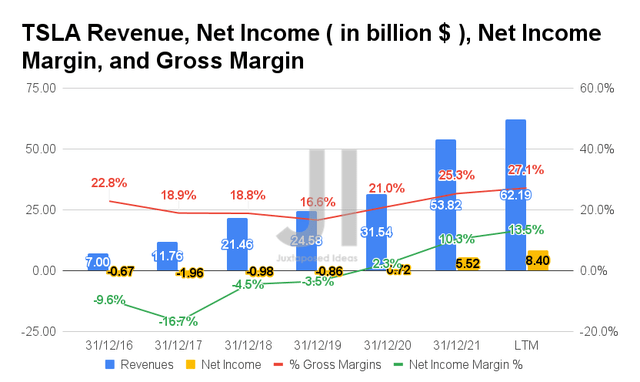

By the LTM, TSLA reported revenues of $62.19B and gross margins of 27.1%, representing a YoY improvement of 97.1% and 6.1 percentage points from FY2020 levels, respectively. In addition, the company reported impressive profitability with net incomes of $8.4B and net income margins of 13.5%, representing an increase of 1166.6% and 11.2 percentage points from FY2020 levels, respectively. Furthermore, we expect TSLA to sustain its improvement in profitability, given its mass layoffs and enhanced operating efficiencies.

Even though there are many who had claimed that TSLA’s regulatory credits had contributed massively to its revenues, one must also note that the credits at $0.95B in the LTM only account for 1.7% of its sales at $55.07 in the LTM. In contrast, the company had posted excellent gross profits of $16.99B with gross margins of 30.6% in the LTM, representing an excellent improvement of 256.2% and 9.6 percentage points from FY2020 levels, respectively. As a result, putting TSLA’s bears to sleep permanently.

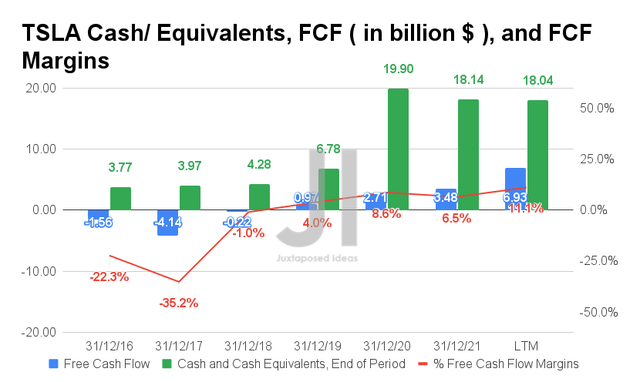

Therefore, we are not surprised by TSLA’s impressive generation of Free Cash Flow (FCF), given its net income profitability. By the LTM, the company reported an FCF of $6.93B and an FCF margin of 11.1%, representing an improvement of 255.7% and 2.5 percentage points from FY2020 levels, respectively. In addition, TSLA’s cash and equivalents also remained relatively stable by the LTM at $18.04B, negating the need to raise any more capital as it did in FQ3’19 for $5B. The massive war chest would also well-equip the company to continue improving its manufacturing capacity and supply chain, in order to boost its output moving forward.

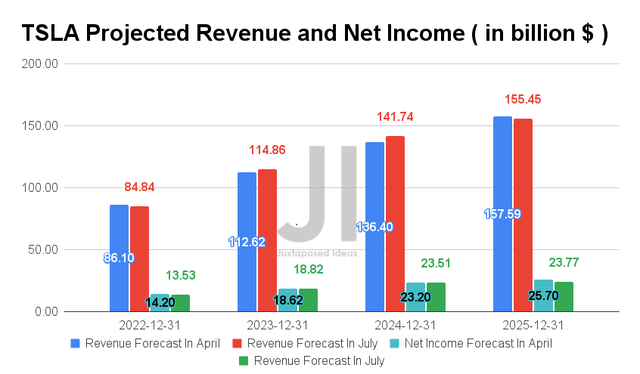

Despite the notable discount for TSLA’s revenues and net incomes in FY2022 by -1.4% and -4.7%, respectively, we are not overly concerned since its sales and profitability have been upgraded for FY2023 and FY2024. Furthermore, we expect an upwards rerating of its output, therefore, revenues from FY2023 onwards, given its aggressive ramp-up in Berlin and successful restart in Shanghai.

In the meantime, analysts will be closely watching TSLA’s operating and automotive gross margins on 20 July 2022, which will eventually translate to the company’s net income and FCF profitability for its FQ2’22. We will be comparing its reported revenues and EPS, against the consensus revenue estimates of $17.16B and EPS of $1.86, representing a YoY improvement of 43.54% and 28.03%, respectively.

For now, we encourage you to read our previous articles on TSLA, which would help you better understand its position and market opportunities.

- Tesla: Tragic Correction Could Be Coming

- Twitter Acquisition Impacting Tesla Stock: What Investors Should Know

So, Is TSLA Stock A Buy, Sell, or Hold?

Consensus estimates still rate TSLA stock as an attractive buy with a price target of $979.87 and a 40.14% upside. However, we are not hopeful for a meaningful stock rally post FQ2’22 earnings, given its obvious reduced deliveries for the quarter. Nonetheless, we believe that the pessimism has already been baked in, therefore reducing any chances of stock declines in the short term. It also helps a lot that Musk has finally put an end to the Twitter speculations, which cast a massive dark cloud on TSLA’s and its CEO’s future. Hopefully, this marks an end to Musk’s social media dreams.

In the intermediate term, we expect a healthy run to near $900s before its FQ3’22 earnings call, assuming a successful ramp in Berlin and new record outputs in Shanghai then. Therefore, interested investors with a higher tolerance for volatility may choose to nibble here, since we are potentially looking at a near bottom for 2022. Otherwise, we prefer to wait it out and see how it goes for the next few weeks while listening in to TSLA’s FQ2’22 earnings chatter.

Therefore, we rate TSLA stock as a Hold for now.

Be the first to comment