Aranga87/iStock Editorial via Getty Images

Tesla (NASDAQ:TSLA) faces mounting challenges to reaching full autonomy, and with it, mass robotaxi deployment, with five key reasons likely preventing this advancement over the course of the next 12 to 24 months.

- Tesla’s admittance of Autopilot/FSD solely offering L2 autonomous capabilities

- admittance of Autopilot’s inability to navigate city streets

- a reported one-second-before-impact Autopilot system shutoff, clearing itself of legal liability

- increased regulatory scrutiny, regarding multiple fatal crashes, special investigations, and possible recalls

- too high of a rate of driver disengagements

These five factors combined with Musk’s repeated failure to meet targets related to autonomous development (from 2016 to 2019 to today) are putting major doubt on Tesla’s path to manufacturing robotaxis, reaching mass scale, and developing the accompanying Level 4/5 autonomous software capabilities. The development of L4 autonomous software is vital for the eventual deployment of robotaxis — the two go hand in hand, with robots requiring L4 autonomous capabilities in order to operate without a driver. Without L4 autonomy, Tesla would not be able to mass deploy a driverless robotaxi fleet, thus the development of L4 autonomy determines the path and time to reaching robotaxi targets.

In 2019, Musk had promised that Tesla would deliver Level 5 autonomous capabilities to certain Tesla vehicles (Model S/X built in Feb. 2019 or later, Model 3 built in Apr. 2019) by the end of the year, while also explaining that he was “very confident” that Tesla would deliver 1 million robotaxis on the road by mid-2020 — that has yet to pan out. Musk also had noted that robotaxi development will put Tesla on a path to justify its $800 billion valuation in 2021.

The financial impact of robotaxi deployment is tremendously large: BloombergNEF’s 2022 EV outlook projected that China “will operate the world’s largest robotaxi fleet with about 12 million units by 2040, followed by the US which operates around 7 million autonomous vehicles.” IHS Markit projected that the robotaxi “sector is poised to witness robust growth in the coming years,” as the “market size of China’s self-driving taxi services is expected to surpass 1.3 trillion yuan by 2030, accounting for 60 percent of the country’s ride-hailing market by then.” Other projections place the overall robotaxi market reaching $61 billion to $108 billion by 2029; regardless of the exact amount, robotaxis hold a massive disruptive potential worth tens to hundreds of billions in the long run.

However, Tesla is far from ready to mass-deploy robotaxis, and facing significant challenges to reach 2024 targets — with Musk and influential analysts placing substantial emphasis on the importance of robotaxis for Tesla’s future valuation, more delays, or inability to reach robotaxi targets as anticipated increase downside risk to valuation.

With this in mind, let’s dive into the five factors in play.

Tesla’s Admittance Of L2 Autonomy

Tesla indicates on its website that the “currently enabled Autopilot, Enhanced Autopilot and Full Self-Driving features require active driver supervision and do not make the vehicle autonomous.”

While Tesla does not explicitly mention L2 on its website, discussions between Tesla and the California DMV bring to light that Tesla’s current software is solely offering L2 autonomous functions — nothing more, and nothing autonomous.

On December 28, 2020, Tesla submitted its autonomous vehicle disengagement report for 2020, under which it reported zero incidents — this is because Tesla explained that “neither Autopilot nor FSD Capability is an autonomous system” and does not fall under reporting guidelines. Tesla also explained that Autopilot “is an optional suite of driver-assistance features that are representative of SAE Level 2 automation” and FSD is “an additional optional suite of features that builds from Autopilot and is also representative of SAE L2.”

Neither of the two systems were developed to be higher than L2 — the software was not designed to provide autonomous capabilities, and still does not provide any autonomous capabilities.

A March 9, 2021 memo from the DMV, following a meeting with Tesla, further reiterated this point — the memo explained that “Elon’s tweet does not match engineering reality per [a former Tesla Autopilot engineer]. Tesla is at Level 2 currently.” The reference is reportedly towards Musk’s January 2021 comments that he was “highly confident the car will be able to drive itself with reliability in excess of human this year.” The DMV added in the memo that Tesla “indicated that they are still firmly in L2” when questioned about the advance of autonomous capabilities.

Furthermore, Tesla’s limited-scale City Streets pilot testing program “continues to firmly root the vehicle in SAE Level 2 capability and does not make it autonomous under the DMV’s definition.” City Streets’ object and event detection and response (OEDR) is “limited, as there are circumstances and events to which the system is not capable of recognizing or responding.”

Why it matters: Again, Tesla is being championed as a leader in autonomous driving, but the reality is that Tesla does not offer autonomous driving capabilities — what Tesla offers is simply an adaptive cruise control system, providing extra assistance to the driver, but remaining unable to drive the vehicle on its own. Musk had sold investors on multiple timelines to reaching full autonomy, none of which have come to light, while at the same time dangling the prospect of robotaxis as the key to “potentially justifying” Tesla’s near-trillion-dollar valuation. While ARK likely has sway over many investors with its sky-high targets implying triple-digit upside for shares based on $51 billion to $486 billion in robotaxi revenue, that vision is increasingly threatened by Tesla’s lack of progress in autonomous capabilities to date.

Tesla’s Admittance Of An Inability To Navigate City Streets

A key feature of L4 autonomy is the ability to operate in localized, geofenced conditions, typically within crowded city centers, as L4 paves the way for driverless robotaxi deployment. Cruise and Waymo (GOOG, GOOGL) operate in San Francisco, while Chinese leaders such as Apollo Go and Pony.ai operate in densely populated cities, including Beijing, Shanghai, Guangzhou, and Shenzhen.

Since the development and deployment of L4 robotaxis are targeted at disrupting the localized ride-hail industries, providing more equitable and accessible transportation options, a key function is precisely and safely navigating complicated, crowded city streets. A function that Tesla has explicitly expressed its inability to do so.

In a November 10, 2020 correspondence, the California DMV noted that the “description of Navigate on Autopilot only covers its current use on limited access highways and how it can guide the vehicle through freeway interchanges and off-ramps, which are still within the controlled access Operational Design Domain.”

The DMV asked if Tesla applies “any speed reductions to give the system a better possibility of detecting and responding to such hazards ” in “urban environments” or an “uncontrolled intersection,” conditions likely encountered in cities.

The agency also pointed out that Tesla’s “owner’s manual states to not use Autosteer on city streets, in construction zones, or in areas where bicyclists or pedestrians may be present.” The DMV also questioned if Autopilot has “sufficient field of view to detect vehicles or cyclists” when traversing through intersections.”

Here’s how Tesla responded:

Tesla told the DMV in a November 20, 2020 response that Autosteer [City Streets] is not capable of recognizing/responding to “static objects and road debris, emergency vehicles, construction zones, large uncontrolled intersections with multiple incoming ways, occlusions, adverse weather, complicated or adversarial vehicles in the driving path, unmapped roads.” Tesla also said that its Traffic Light and Stop Sign Control system “cannot recognize a T-junction because the junction does not have a stop sign or stop line or is not identified as a T-junction in the map data, then the vehicle may not stop.”

Tesla further clarified that the “driver is responsible for being fully attentive at all times” and “must supervise the system, monitoring both the driving environment and the functioning of City Streets, and [the driver] is responsible for responding to inappropriate actions taken by the system.”

Tesla also noted that it does “not expect significant enhancements in OEDR or other changes to the feature that would shift the responsibility for the entire [dynamic driving task] to the system. As such, a final release of City Streets will continue to be an SAE Level 2, advanced driver-assistance feature.”

These crucial admissions paint quite a stark appearance for the future development of Autopilot and FSD.

But Tesla stepped it up a notch with a recent admission in a court case in Germany, two years after a prior case alleging other misconduct on Tesla’s part.

A court in Munich “ordered [Tesla] to reimburse a customer most of the $112,884.80 she paid for a Model X SUV because of problems with the Autopilot function, Der Spiegel reported” in mid-July. A report of the customer’s vehicle “showed the vehicle did not reliably recognize obstacles like the narrowing of a construction site and would at times activate the brakes unnecessarily,” which “could cause a ‘massive hazard’ in city centers and lead to collisions, the court ruled. Tesla lawyers then “argued Autopilot was not designed for city traffic.”

In July 2020, another court in Munich alleged Tesla “misled consumers on the abilities of its automated driving systems,” and “banned Tesla Germany from including ‘full potential for autonomous driving’ and ‘autopilot inclusive’ in its advertising materials.”

Why it matters: This raises a key question — how will Tesla bridge the gap into handling inner-city situations, given that the software still struggles to handle edge cases such as construction? Tesla is fully aware of its inability to handle city traffic, per its discussions with the DMV, and this admission along with that commentary cements the notion that Tesla has not been advancing or attempting to advance the capabilities of its current Autopilot/FSD suite past L2 autonomy. Without an intent to push the suite past L2 — Tesla is continuously adding OTA updates to FSD to add new features, but none that will aid in the transferral of responsibility to the system instead of the driver to jump to L3 — Tesla is further delaying its pathway to L4 autonomy and a robotaxi fleet.

Bridging the gap to L3 autonomy and higher brings along considerations of liability in the case of accidents, to which Tesla is no stranger.

Tesla’s “One-Second” Shutoff, Liability Issues

The third key consideration in playing a role in Tesla’s challenge to reach L4 autonomy and robotaxis is a reported one-second shutoff before impact for Autopilot. Tesla’s growing list of incidents and fatalities and pending investigations by NHTSA will be covered in Part 2.

NHTSA upgraded an 830,000 vehicle Preliminary Examination probe into an Engineering Analysis probe in June, a crucial step in determining whether Autopilot requires a mandatory recall. The concern of NHTSA’s investigation isn’t simply the sixteen first responder and roadside safety vehicle incidents — a “key issue is whether or not some drivers think Autopilot is a self-driving feature that does not require their attention.”

NHTSA found that on average in the sixteen crashes, “Autopilot aborted vehicle control less than one second prior to the first impact.” So, Tesla’s Autopilot plays a major role in placing the driver in dangerous situations, but by aborting control and handing all control over to the driver with one second left, Tesla is likely cleared of any legal liability for any incident — the vehicle is not in control, as the driver is assumed to have full control and responsibility for the vehicle, given that Tesla maintains that the driver must be attentive at all times.

Why it matters: In order to advance Autopilot/FSD to L3, should Tesla aim to do so, Tesla will need to hand over more responsibility to its software in regards to driving tasks, including assuming responsibility for incidents that occur when the ADAS is driving. However, it is unclear if this is a deliberate shut-off or simply an uncorrelated action and result. From a technical standpoint, assuming liability for incidents allows OEMs to bridge the gap between L2 and L3.

Based on SAE’s standards, Mercedes is the first OEM to reach a commercial L3, semi-autonomous system for individual drivers, offering hands-free driving and protecting the driver from being held liable when the system is active. The system does have limited operating conditions, such as up to 60 km/h on highways. From a purely technological standpoint, Tesla’s system offers drivers the ability to use the functions anytime, anywhere, but assuming full liability for incidents is a key inhibitor preventing Tesla from reaching L3 and L4.

Increased Regulatory Scrutiny, More Accidents

Tesla’s pathway to reaching full autonomy is riddled with increased regulatory scrutiny from NHTSA, as numerous accidents have raised questions about Autopilot.

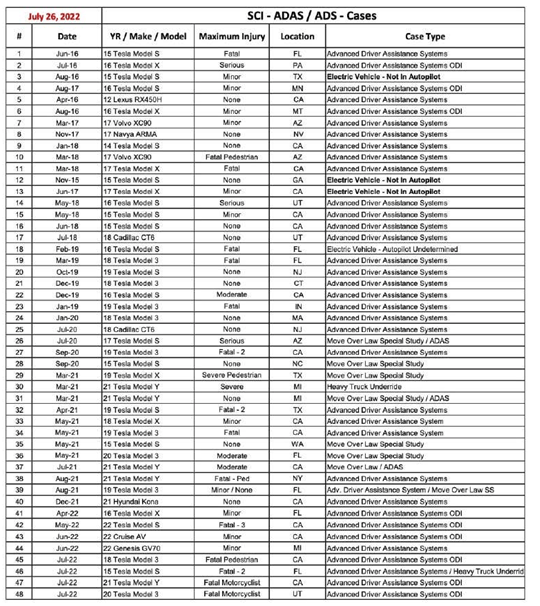

A July 24 crash in Utah marked the fifth fatality in four Autopilot crashes in July. The “driver was using Autopilot at the time of the crash, authorities said,” as he reportedly crashed into the back of a motorcycle around 1am in an HOV lane. This crash is the latest added to NHTSA’s Special Crash Investigation list, which involves 48 different crashes, 39 of which included a Tesla vehicle.

NHTSA Special Crash Investigation List (The Verge)

Of the 39 crashes involving a Tesla, 30 of the crashes definitively concern ADAS/Autopilot — 77% of all of Tesla’s crashes on the SCI list, and 63% of all crashes, regardless of manufacturer. For Tesla’s 30 ADAS/Autopilot-related crashes, there were 18 fatalities, and several cases of serious/severe injuries.

In addition to this list, there’s also NHTSA’s 830,000 vehicle Engineering Analysis probe as it continues to investigate sixteen incidents involving first responder and roadside assistance vehicles.

A NHTSA data release showed that Tesla “vehicles were involved in 70% of the reported crashes involving Level 2 technologies, 60% of those resulting in serious injuries and nearly 85% of the fatal ones.” Tesla vehicles were involved in 273 of the 392 accidents in the data set. However, it’s important to frame this in the context of the bigger picture — Tesla does have the most L2-equipped vehicles on the road, at over 830,000 compared to second-place Honda’s 560,000, so statistically speaking, Tesla was more likely to feature at the top of the list. Yet it does shine a prominent light into questions about the information and marketing of Tesla’s system — if drivers misjudge the capabilities of the system and believe that it is capable of fully driving itself when in reality, it is not.

Why it matters: For Tesla’s quest to mass produce and deploy a fleet of driverless robotaxis at scale over the next 24 to 36 months, increased regulatory scrutiny is the opposite of what Tesla needs for a quick and easy path to deployment.

In correspondence with the California DMV on December 14, 2020, Tesla noted that the “development of true autonomous features (SAE Levels 3+) will follow our iterative process (development, validation, early release, etc.) and any such features will not be released to the general public until we have fully validated them and received any required regulatory permits or approvals.”

When it comes to robotaxi development, there are three major roadblocks:

- autonomous capabilities only at L2

- not holding an autonomous permit

- threat of regulatory investigations preventing the approval of a robotaxi permit

Again, Tesla’s current Autopilot/FSD/City Streets are only L2, with little intent expressed on Tesla’s end to advance OEDR to allow for L3+ under these systems. The iterative process — development, validation, early release — will be complex and lengthy, even if Tesla can use its current suite as a foundation to build an L4-capable vehicle.

Per AV safety expert Philip Koopman, considering “if a failure of a particular type once every 1,000 hours is acceptable (because such failures result in a minimal-cost incident or slight disruption), then validation of that failure rate could be credibly achievable by testing for several thousand hours.” Increasing the time between failures (increasing time between incidents, increasing safety) will only increase the testing time, prolonging software development.

Tesla also would face lengthy validation of edge-case scenarios — these included the functions that Tesla’s Autopilot currently does not support. This includes inclement weather — flooding, fog, snow, hail/tornadoes, smoke — traffic rule violations, such as other drivers running through stop signs and lights, or signs and lines missing from intersections, to construction situations and animals, such as deer, to name a few. Since Tesla does not support many (or all) of these in its current OEDR, it would have to test and validate these extensively to meet L4 requirements.

From a robotaxi deployment point of view, Tesla faces obstacles to even acquiring a permit for small-scale testing. A risk of a potential recall from NHTSA’s Engineering Analysis puts any robotaxi development on a tightrope at the moment. The California DMV notes that a drivered/driverless testing permit for robotaxis will be suspended “if the manufacturer’s autonomous vehicles are subject to an open National Highway Traffic Safety Administration recall related to the vehicle’s autonomous technology.” Tesla faces risk of an Engineering Analysis recall, which the Office of Defects Investigation typically attempts to resolve within one year, but a more complex case may “require more time.”

Should Tesla be subject to a full-blown recall stemming from the EA, it’s highly likely that the California DMV will not allow Tesla to hold a drivered/driverless testing permit, which would push the small-scale testing timeline and permit approval to late 2023. Such a development would make a large-scale robotaxi operation by 2024 nearly impossible, and severely hinder a 2026 mass-scale and hundreds-of-billions in revenue forecast that ARK projects.

Take Pony.ai as an example of the strictness of the DMV — Pony.ai had both its drivered and driverless permits revoked, the drivered over “numerous violations on the driving records of active Pony.ai safety drivers,” and the driverless for an incident on October 28, 2021. According to Pony.ai, the incident was a “collision with a lane divider and street sign. No other vehicles were involved and no injuries occurred.”

An accident involving a street sign — no injuries, no other vehicle, no fatalities — a single incident that led to Pony.ai’s permit being revoked. Tesla’s four crashes and five fatalities in July 2022 alone is an extremely stark divide to Pony.ai’s safety record. If the DMV is this quick to respond to a single incident from a firm that boasts a zero-injury record in “over 6.8 million real-world autonomous miles,” Tesla’s track record of accidents, injuries, and fatalities are likely to lead to intense scrutiny from the DMV and inhibit permit approval without extensive safety validation.

Driver Disengagement Rates Too High

A memo from the California DMV on March 9, 2021 following a meeting with Tesla, noted that the agency asked a former Autopilot engineer to “address, from an engineering perspective, Elon’s messaging about L5 capability by the end of the year.” The person noted that the “ratio of driver interaction would need to be in the magnitude of 1 or 2 million miles per driver interaction to move into higher levels of automation. Tesla indicated that Elon is extrapolating on the rates of improvement when speaking about L5 capabilities.”

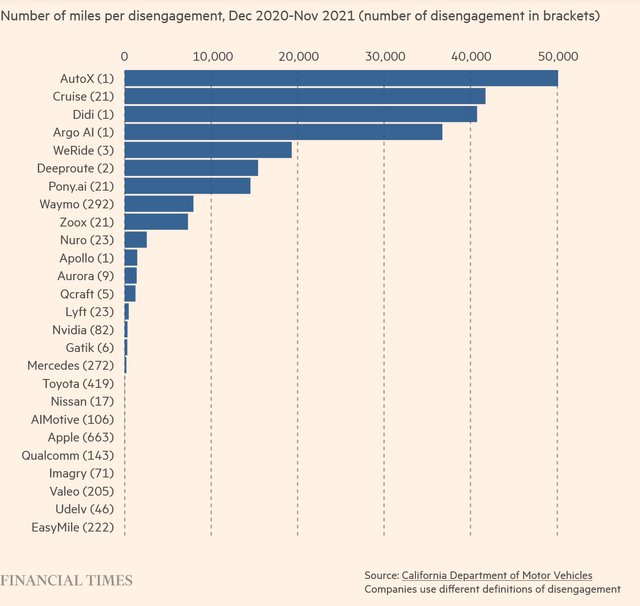

A 1 to 2 million miles per interaction is most likely too high of a rate to achieve this decade — for 2021, AutoX topped California DMV’s autonomous vehicle miles per disengagement list, with 50,108 miles per disengagement. GM’s (GM) Cruise, which has recently received approval in San Francisco to charge fares for driverless rides, reported 41,719 miles per disengagement. Note that Tesla does not feature on the autonomous miles per disengagement list since Tesla does not have any autonomous vehicles testing in California, and does not report any data.

AV Miles per Disengagement (FT [California DMV])

Only a handful of firms testing autonomous vehicles in California show disengagement rates above 20,000 miles. While Tesla’s data is limited in nature, as the company does not report to the DMV or publish disengagement data, a study from MIT AgeLab has provided a deeper look into disengagement metrics from Tesla.

Data from MIT showed that Tesla recorded 18,928 disengagements across 112,247 miles drive, a rate of 5.92 miles per disengagement; however, “46.2% of Autopilot disengagements are where the human driver is anticipating or responding to a tricky situation,” or ones that could be considered reportable by the California DMV. MIT says, “Normalizing this number of Autopilot miles driven during the day in our dataset, we determine that such tricky disengagement occur on average every 9.2 miles of Autopilot driving.”

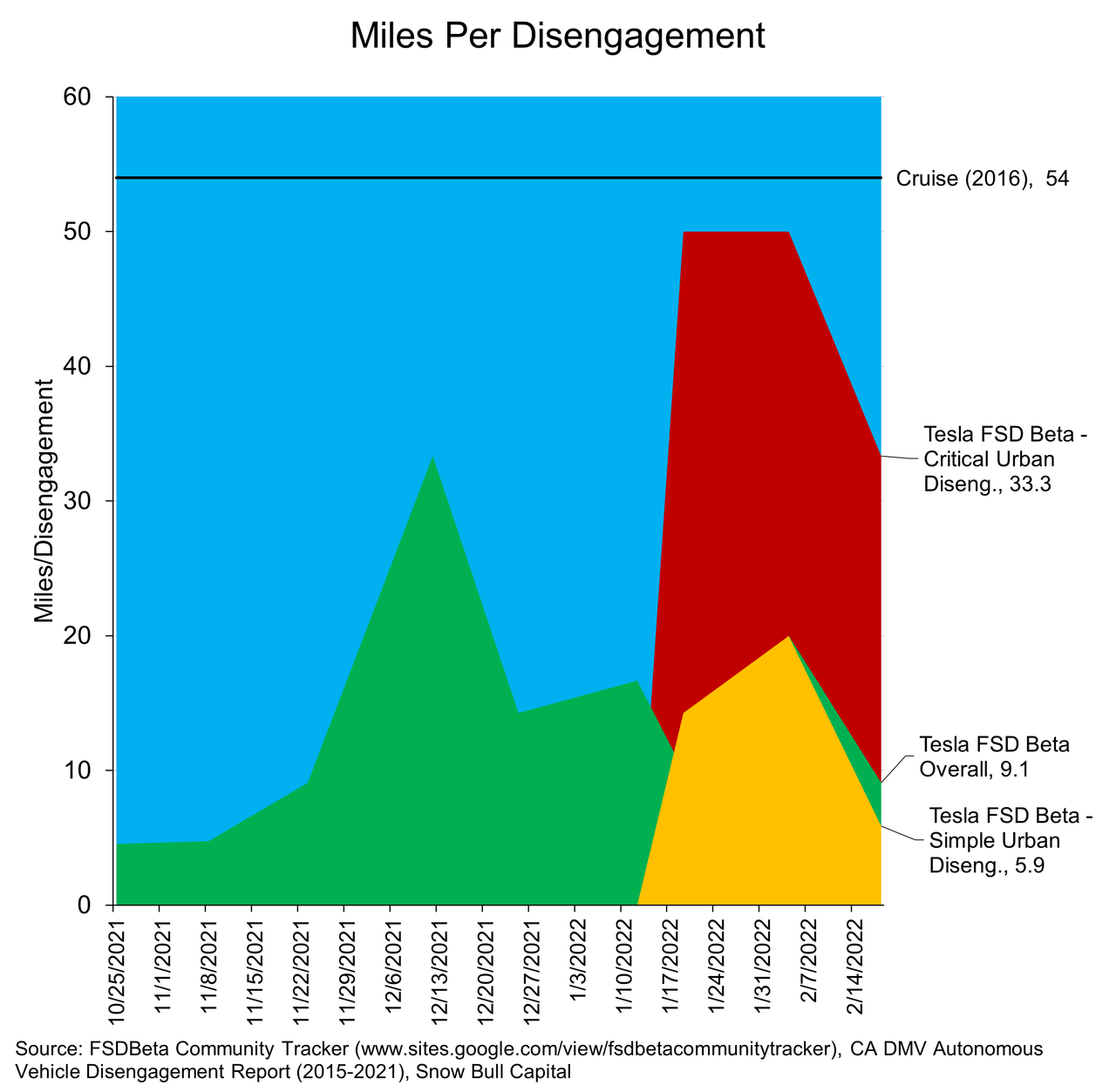

Why it matters: Comparing MIT’s 9.2 miles per disengagement substantially pales in comparison to current robotaxi testers. Snow Bull Capital CEO Taylor Ogan used a data collective from FSD Beta testers to determine that Tesla FSD Beta’s Urban Critical disengagement rate hovered around 33.3 miles per disengagement — scenarios most likely to be encountered in robotaxi deployment. FSD Beta’s average was calculated to be around 9.1 miles per disengagement.

Tesla FSD Miles per Disengagement (Twitter @TaylorOgan)

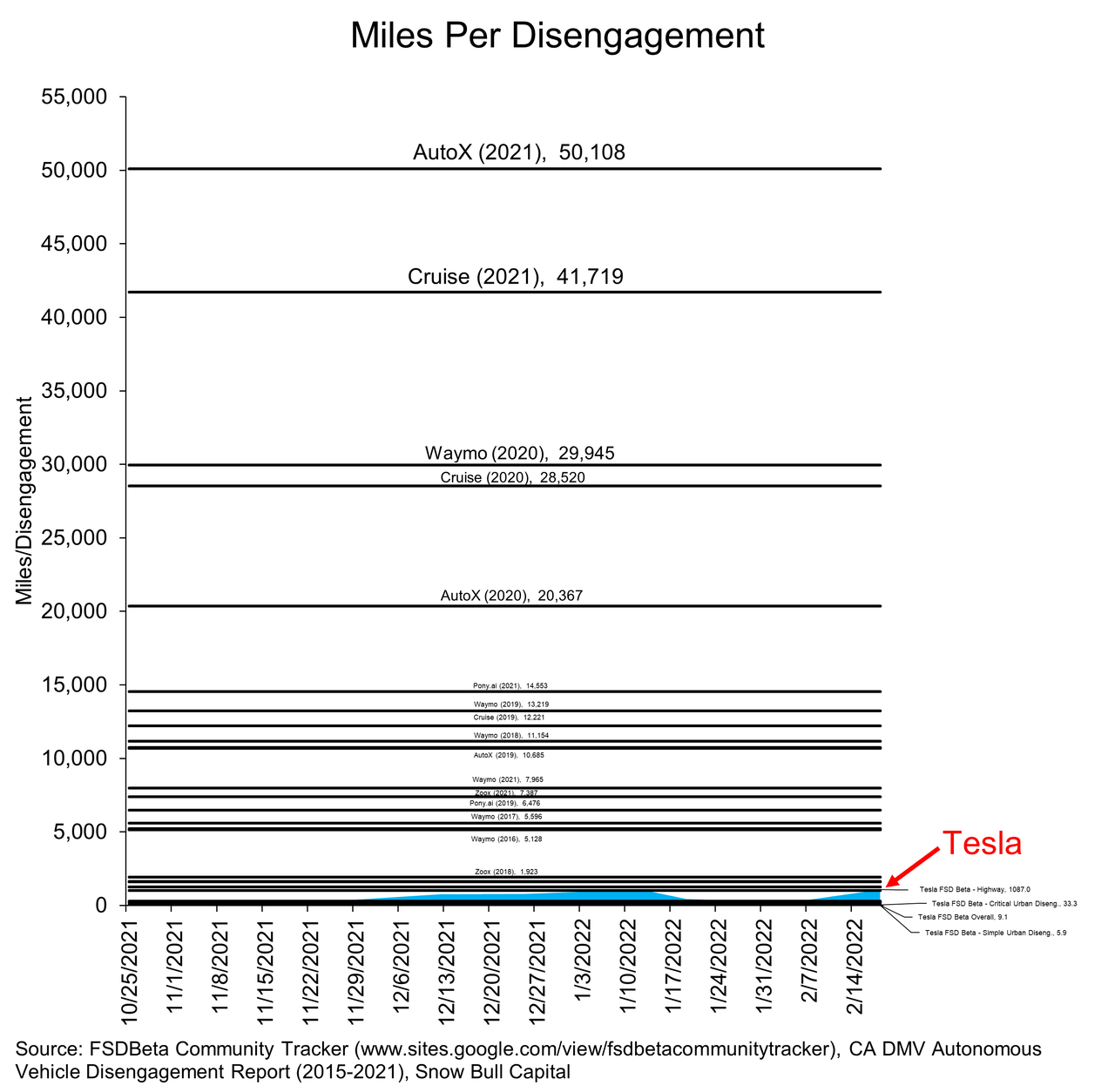

Tesla’s disengagement rate in February does not even match Cruise’s in 2016. Putting this into perspective against the leaders in disengagement metrics demonstrates that Tesla needs a significant rate of advancement to transform its L2 systems to become L4 capable — it may not be the best direct comparison as Tesla’s L2 does not compare to the other L4 systems, but it does go to show the extent that Tesla will need to improve in order to reach robotaxi deployment.

Tesla FSD Miles per Disengagement (Twitter @TaylorOgan)

Based on this data, Tesla has not yet reached disengagement metrics reported by Cruise in 2016, Zoox in 2018, or Waymo in 2016. Although Tesla is not testing an L4-capable vehicle, such as the rest of the developers in the data set, what is crucial to understand here is the development timeline — Cruise has just now received approval to charge for robotaxi rides, six years after it reported 54 miles per disengagement. Waymo is not far behind Cruise, with driverless rides available in limited scale in San Francisco and Phoenix, while AutoX began driverless testing in China in 2020, four years after its creation. The disengagement data forms a critical part in robotaxi validation and testing, and the length to small-scale commercialization for Cruise indicates that Tesla could spend years developing, validating, and testing robotaxis at small scale (ten to thirty vehicles) before potentially reaching mass deployment.

Operating At Scale

It’s important to note that Tesla operates at a significantly larger scale than robotaxi developers, and other OEMs with ADAS features in cars. Tesla has reported that it has over 100,000 testers using FSD Beta, compared to AutoX’s 1,000 robotaxi fleet, one of the larger fleets to date.

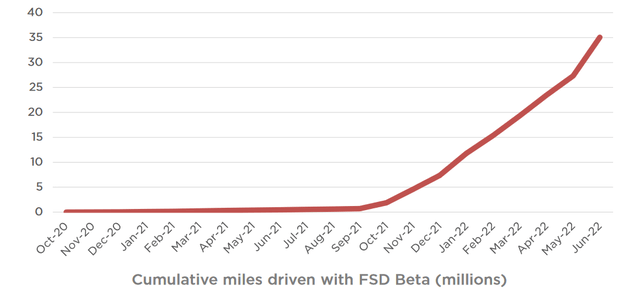

Tesla also noted that cumulative miles driven on FSD Beta surpassed 35 million (and over 1 billion miles on Autopilot), giving it a substantially larger scale than leading robotaxi developers, including Cruise and Waymo, who drove just over 3 million miles combined in 2021. As such is the case, it’s understandable why Tesla features more prominently in crash data as it operates at a significantly larger scale.

ARK’s Ambitious Robotaxi Forecasts

With ARK placing a 60% chunk of Tesla’s expected 2026 value on robotaxis, the success of the segment looks quite critical to Tesla generating substantial returns. Without robotaxis, ARK’s implied base-case target would be just $1,840 — a massive disconnect from $4,600.

According to SA data, of 8 analysts, Tesla’s 2026 revenue is forecast to be ~$198 billion, ranging from $137 billion on a low end to $343 billion on a high end, dependent on the success or failure of certain segments, such as robotaxis. ARK is forecasting robotaxi revenue to be over twice as high as analysts’ revenue expectations, not including EV revenues (which are likely to be >$100 billion), and other segment revenues. In total, ARK is likely projecting Tesla to generate $650 billion or more in revenues by 2026 under their bull-case scenario, a massive sum, even if robotaxis are commercialized.

Assuming Tesla can and does commercialize robotaxis by 2025, generating $100 billion in revenue would require almost immediate high-volume scale; again, highly unlikely to happen without proper validation and testing. Musk has said that the robotaxis “would cost less than a bus ticket — a subsidized bus ticket or a subsidized subway ticket.” Baidu’s (BIDU) Apollo Go service has not disclosed exact pricing, but testing in 2021 cost a flat 30 yuan (~$4.60) per ride. Assuming pricing is at similar levels, Apollo Go’s 500,000+ rides in the past two quarters have generated approx. ¥15.7 million ($2.3 million) in revenue.

So assuming Tesla follows Musk’s comments, and charges ~$2 per ride, Tesla would need to have a 50,000 robotaxi fleet, doing 250,000 rides per quarter, to reach $100 billion in annual revenue.

While that seems achievable, Apollo Go has yet to even reach 1,000 vehicles in its robotaxi fleet, as mass deployment of driverless vehicles is not something that can happen overnight. Tesla can’t immediately scale to 10,000+ robotaxis without proper testing and regulatory oversight, so assumptions about robotaxi revenues are likely significantly overexaggerating the segment’s near-term potential.

Assuming Tesla can get a fleet of 10,000 robotaxis in deployment by 2026, still a substantial volume compared to current timelines for deployment among leader autonomous players, revenues would be just $5.1 billion per quarter, or ~$20.4 billion per year under the same assumptions as before. Thus, it’s hard to see how robotaxi deployment by 2026 can generate such massive value for Tesla and generate nearly half a trillion in revenue.

Are Investors Overshooting Tesla’s Robotaxi Potential?

Although states are becoming more open to autonomous vehicles, there’s no guarantee that autonomous vehicles become mainstream in the next two to four years. Progress is being made with autonomous vehicle deployment, but the unpredictable nature of the industry coupled with public trust of driverless vehicles makes it hard to place firm timelines and forecasts about the sector. Commercial driverless vehicles (such as tractor-trailers) are likely to see an easier path to scale since there is no human liability of carrying a passenger. Thus, robotaxi development and deployment are likely to stretch out over the course of the decade as the technology, from a regulatory and safety standpoint, simply can’t be rolled out en masse overnight.

Given the surrounding factors, increased regulatory oversight on Tesla’s semi-autonomous functions, lack of federal framework to move robotaxis forward, human liability, and validation and testing time before mass deployment, ARK’s view for Tesla’s robotaxi segment to generate 60% of Tesla’s value at a $4,600 price target seems to greatly overestimate the segment’s potential.

Even if Tesla can validate and begin serial production of robotaxis during 2024, which is unlikely given the five factors outlined, the cost of each ride would necessitate a ludicrously large fleet size compared to robotaxi leaders to even chip away at ARK’s projected revenues. It’s hard to see Tesla starting robotaxi development years behind rivals and reaching a much higher fleet size given the increased regulatory scrutiny surrounding its autonomous capabilities from multiple regulatory bodies. Although Cathie is one of the most prominent Tesla bulls in the market, it’s worth taking these projections with more than a grain of salt, and understanding the difficult path that lies ahead for Tesla.

As such is the case, placing all eggs in one basket and buying hand-over-fist due to these targets from ARK, comments from Musk, along with the five factors discussed may result in underperformance of shares should robotaxis fail to pan out as expected, delaying a significant chunk of projected revenue for Tesla.

Be the first to comment