jetcityimage

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) is a growth company. It actively exploits the power of its brand name to pass increased costs onto the consumer. In 2022, Tesla is doubling down on expansion by boosting production of existing electric vehicle (“EV”) models. Even as 2022 will be successful, it won’t reveal the company’s entire potential due to the lockdowns in China, which put the brakes on the plant in Shanghai.

However, Tesla is fully committed to the plan to launch Roadster, Semi and Cybertruck in 2023, and will release a new model, a robotaxi, in 2024, which will drive itself without human involvement.

Therefore, Tesla is a good investment for a long-term investor. The company not only develops cars that are sought after, but also builds infrastructure though its charging stations and solar panels for homes. Also, Tesla has plans to produce a robotic humanoid, the Optimus, to perform repetitive tasks at plants, but there has been no official announcement so far.

We are assigning a BUY rating to Tesla, Inc. shares.

Tesla has demonstrated strong financial results

Tesla generated $21.5 bn in revenue (+56% YoY) against our estimate of $21 bn. It was 7.5% above our expectations. The company sold 345,000 EVs compared to our estimate of 301,000 EVs. Its energy business also showed solid growth with revenue of 1.1 bn.

The company’s EBITDA amounted to $4.64 bn (+68% YoY) against our estimate of $3.6 bn. The company successfully shifted costs to consumers, resulting in a 71% or 1p.p. QoQ decrease in gross costs. Tesla also reduced operating costs more sharply than we expected.

Tesla has quickly returned to peak capacity at its production facilities and is selling almost everything it manufactures. Also, in Q4 2022, Tesla is launching FSD Beta version, which means that new vehicles already purchased will have access to FSD if the feature is paid for.

Moreover, the company has made considerable progress with production expansion, especially after easing of lockdown policy in China. So far, Giga Berlin has already reached a pace of 2,000 electric cars per week, a milestone soon to be reached by Giga Austin and Giga Texas.

Tesla also managed to triple the amount of battery cells 4680 produced QoQ. The production volume is growing rapidly, and Tesla expects to start using them in its electric vehicles soon. Back in 2020, when the company announced creation of proprietary batteries, it was claimed to help reduce the cost of batteries by 50%, as it was the most expensive EV part.

The company also has hidden unrealized potential with Testa bot Optimus. If it succeeds, it will be first implemented at the company’s own factories. It will transfer routine work from employees to robots and save additional money.

The EV market remains robust

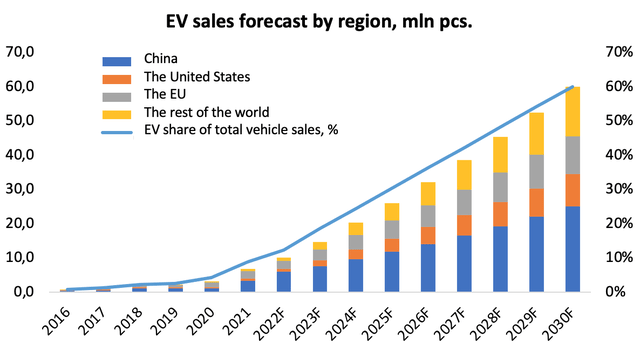

The electric vehicle market continues to grow rapidly, primarily driven by China, which will sell 6 mln EVs in 2022, based on data available from January to October. The EV share in car sales will grow to 22.5% by the end of the year, adding 9.8 p.p. YoY.

In general, there is a strong shift of the automotive industry towards EVs, and the major players in the market have already announced plans to expand the model range and production capacity.

We expect the EV market to grow fast, with an industry average growth rate of 25% YoY till 2030. Such a rate will bring the EV share of all vehicle sales to 60% by 2030, compared to 12.4% in 2022.

We expect China to retain the leading position, but its market share will fall from the current 60% to 41% by 2030 due to higher current EV concentration in the industry and a faster growth rate of emerging economies around the world.

The EU holds third place in the internal combustion engine (“ICE”) market, but will save the second place in terms of EV volume due to the high current share of EVs in total sales of vehicles (21%), greater population and government policy focus on green transition, shorter distances, and a stronger concentration of charging stations in comparison to the rest of the world. We expect EVs to account for 90% of all auto sales in the EU by 2030.

The U.S. market will continue to grow steadily due to Tesla’s leadership and the activation of large local manufacturers such as GM and Ford. However, we expect a lower level of population engagement in the transition to green energy due to a strong lag in the growth of charging stations compared to the growth of electric vehicles, longer distances and a particularly high share of large diesel cars, whose transition to EVs will take place later than standard crossovers. We expect EVs to account for ~60 % of all sales in the U.S. market by 2030.

Tesla will continue active development

Tesla continues to increase production capacity and will expand existing plants and build new facilities in the years to come.

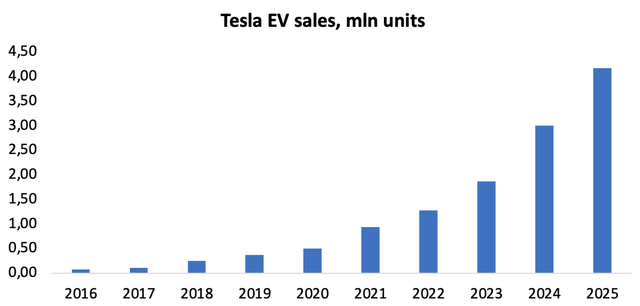

We expect Tesla to sell 1.87 mln EVs in 2023 and to increase EV sales up to 4.17 mln units by 2025. According to our estimate, Tesla’s global market share will reach 12.8% in 2023 and surge to 16% by 2025 due to its fast capacity growth as compared to other manufacturers.

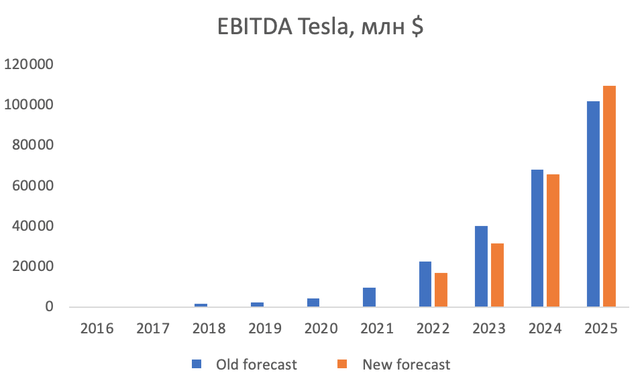

Tesla’s 2023 EBITDA will amount to $31.55 bn and will increase to $109.3 bn by 2025 due to production capacity growth and lower average costs per EV owing to the cheaper cost of the batteries. Given Tesla’s current price, forward EV/EBITDA 2023 multiples would be 24.3x, EV/EBITDA 2025 – 3.8x.

Valuation

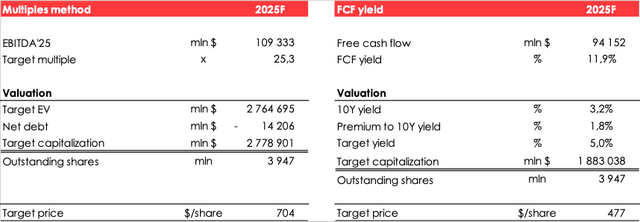

We are evaluating Tesla’s fair value price based on 2025 EV/EBITDA multiples and free cash flow (“FCF”) Yield methods, and think the fair value price for the stock is $449 (average discounted prices). We are evaluating the fair value price of Tesla stock by discounting projected prices in 2025 at the rate of 13%. Fair value prices in the tables depicted below are without discounting at the rate of 13%. We are assigning a BUY rating to the shares.. The potential downside is 265%.

Risks

The main risk for Tesla is the uncertain situation with semiconductors. We do not bet that it will worsen, but it is quite possible that it will last for a long time, until 2024. Now Tesla does not produce so many cars to really feel the strong effect of the crisis, but with the increase in the volume of EVs produced, the situation for Tesla will become more difficult.

Another risk for the company is the uncertain situation around the autonomous driving system — FSD. If the system is approved and released on the roads without a pilot, then this will lead to the development of the Tesla robotaxi, which they want to release in 2024

Conclusion

Now Tesla looks like an attractive long-term investment. On the one hand, in 2023, China will largely ease the lockdown restrictions to keep its economy afloat. On the other hand, the sale of shares by Elon Musk to finance the Twitter deal has been completed.

Tesla also has a strong production pipeline and vertical integration through the development of solar power, charging stations and battery cells. Over the medium-term horizon, the launch of Tesla bot Optimus and the company’s entry into the robotaxi market are expected.

Recession in the U.S. market is the potential risk for 2023. It could reduce demand for electric vehicles due to falling real income, elevated debt burden, and high cost of EVs. Another risk is the activation of large classic carmakers in the EV market, but it does not seem significant because Tesla has more experience in the EV development of electric cars in comparison with other manufacturers in the industry.

We now see a good opportunity for a long-term investor to get a full equity stake of 5% per portfolio amid a large recent selloff and Tesla being oversold locally compared to the broad stock market.

Be the first to comment