undefined undefined/iStock via Getty Images

In an increasingly competitive business as incumbent automakers introduce their own EVs, startups are in trouble as sales have been minimal, venture money has dried up, and share prices have plummeted.

I discussed in detail the lengths some of these startups have gone through to go public and get operating capital by forming Special Purpose Acquisition Companies (SPAC), which are shell companies that have no operations but go public with the intention of merging with or acquiring a company using the proceeds of the SPAC’s IPO. I noted in my July 27, 2022, Seeking Alpha article entitled “MOKE + EV Technology Group: The Cost And Value Of ‘Brand Equity’ In The EV Automotive Value Chain:“

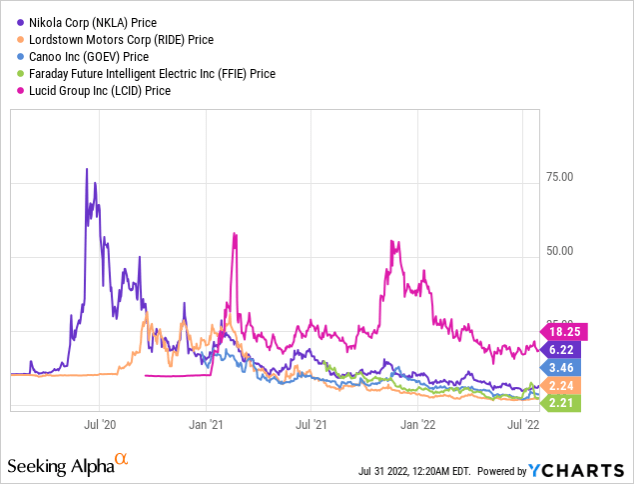

“SPACs contributed half of the $29 billion raised publicly by EV manufacturers, suppliers and charging firms in 2021. EV startups Nikola (NKLA), Lordstown Motors (RIDE), Canoo (GOEV), Faraday Future Intelligent Electric (FFIE), Fisker (FSR), and Lucid Group (LCID) all went public through SPAC deals over the last two years.”

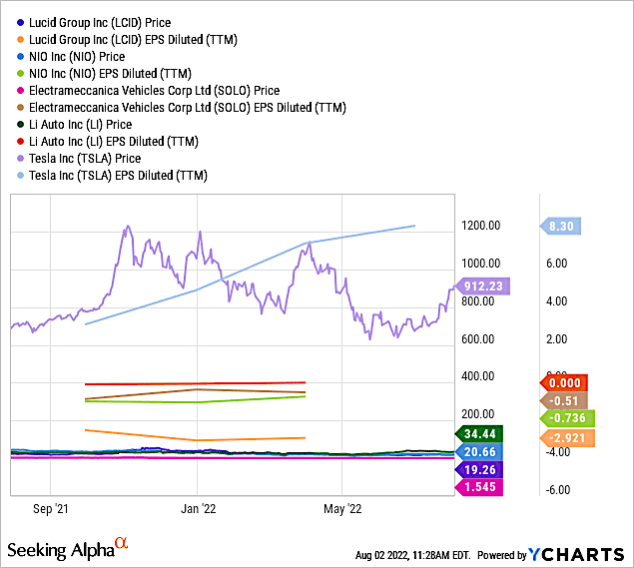

SPACs go public at $10 per share, a price point that serves as a simple benchmark for how those stocks have been received. Of these SPAC companies, only the share price of Lucid Group is above its IPO price at $18.25, as shown in Chart 1.

YCharts

Chart 1

Is There a Doctor in the House?

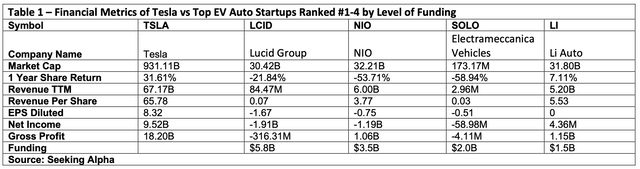

In Tables 1-3, I break down the current crop of EV startups by level of funding from all sources and compare each to Tesla (NASDAQ:TSLA). Table 1 shows the first five ranked companies. I don’t include Rivian Automotive (RIVN), which would top the list by accumulating $10.7 billion in funding. Rivian’s shares are down 65.95% since the IPO in 11/21, and the company continues to struggle. Layoffs at Rivian started in late July 2022 as the company races to cut costs amid a challenging economic climate and pressure to increase production. It delivered 1,227 vehicles in the first quarter and reported 4,467 deliveries in Q2. Rivian is targeting production of 25,000 vehicles this year, half of its initial production guidance for 2022.

Table 1 shows significant variations in financial metrics among the five companies. TSLA shows positive TTM revenue, Net Income, and Gross Profit. All the startups reported TTM Revenue, but only Li Auto (LI) reported a positive Net Income and Gross Profit.

Lucid Group was the top fund raiser on this list. Lucid delivered 360 EVs, helping to account for $57.7 million in revenue in Q1 2022, but revised its 2022 production volume outlook to a range of 6K to 7K vehicles following the release of its Q2 results. Guidance earlier in the year was for production volume of 12K to 14K vehicles.

China’s NIO (NIO) delivered 25,059 electric cars in Q2, which is slightly above the guidance of 23,000-25,000. So far this year, NIO globally sold 50,827 electric cars. But NIO reported a loss from operations was RMB2,445.1 million (US$383.7 million) in the fourth quarter of 2021, representing an increase of 162.5% from the fourth quarter of 2020 and an increase of 146.5% from the third quarter of 2021.

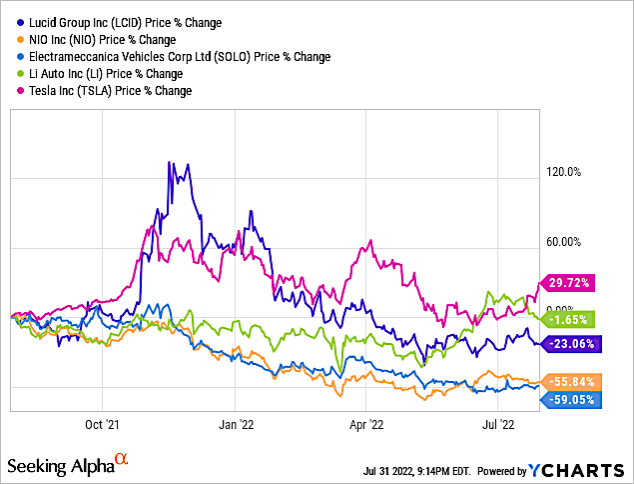

Chart 2 shows a similar story based on one-year share price percent change for the companies listed in Table 1. TSLA is the only company showing positive growth at 29.72% as of the close on July 29, 2022. LI share price was -1.65%. NIO share price is down 55.84% showing investors the COVID situation in China remains fluid and EV shares in general remain under a cloud amid rising interest rates and fears of a global recession.

YCharts

Chart 2

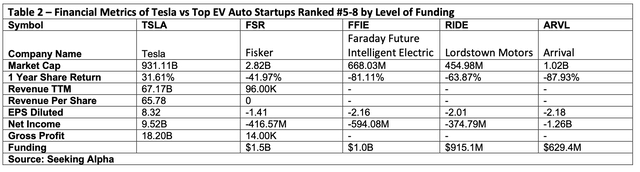

Table 2 shows TSLA compared with startups ranked #5-8 based on level of funding. Only Fisker reported TTM revenues of just $96,000. Wall Street was initially attracted to its asset-light business model based on contract manufacturing. However, declining investor appetite for pre-revenue companies has taken the focus away from companies like Fisker.

That will change as the Fisker Ocean is set to start production in November 2022 and sold exclusively through the Fisker app. According to the company, reservations for the Ocean electric SUV surpassed 50,000, a significant rise from the 40,000 preorders announced in early April. The Ocean with the base Sport trim priced at $37,499 before incentives.

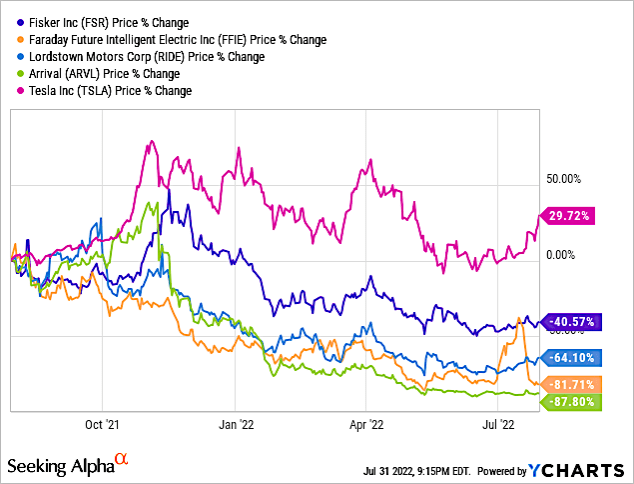

Chart 3 shows one-year share price percent change for the companies listed in Table 2. Again, TSLA is the only company showing positive growth at 29.72% as of the close on July 29, 2022. FSR share price is down 40.57%. The stock is trading below its IPO price.

YCharts

Chart 3

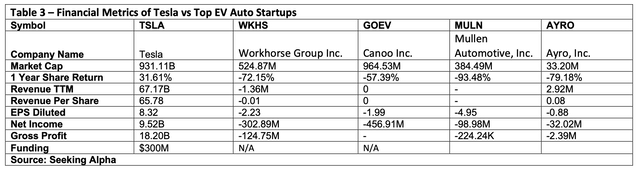

Table 3 shows the remaining EV startups, but funding has not been disclosed. Of the four startups, only Ayro (AYRO) showed positive TTM revenue of just $2.92M but net income was -$32.01M. Ayro has a different business model than the other companies included in this article as it designs and manufactures electric vehicles for closed campus mobility, urban and community transport, local on-demand and last mile delivery, and government use. The company provides four-wheeled purpose-built electric vehicles for universities, business and medical campuses, last mile delivery services, and food service providers.

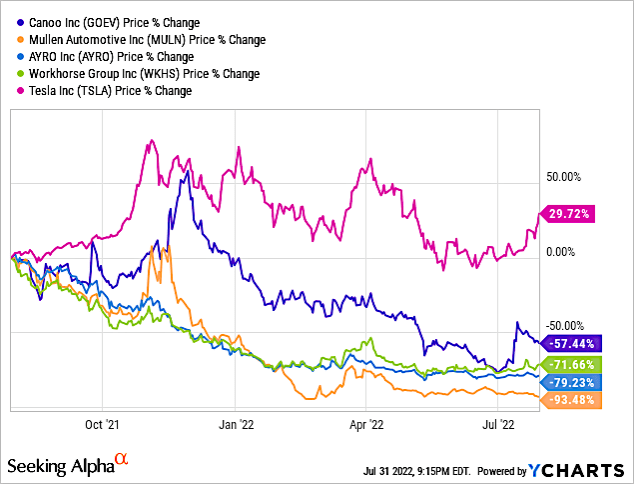

Chart 4 shows one-year share price percent change for the companies listed in Table 3. Again, TSLA is the only company showing positive growth at 29.72% as of the close on July 29, 2022. All others have exhibited large negative double-digit share performance.

YCharts

Chart 4

Tesla’s Performance

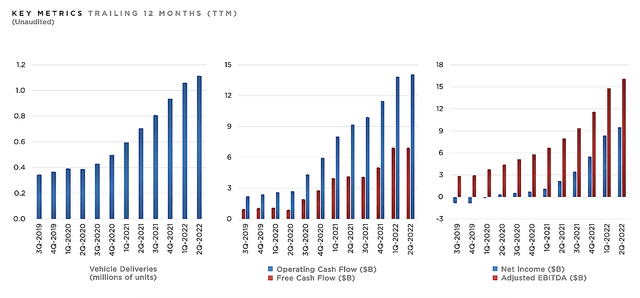

Tesla reported a mixed Q2 earnings report on in its Q2 earnings call on July 20, 2022. Adjusted earnings per share came in at $2.27 vs. $1.81 expected. Revenue missed at $16.93 billion vs. $17.1 billion expected. Chart 5 shows quarterly performance through Q2 2022.

Chart 5

In Q2 2022, TSLA achieved record production rates across the company, producing more than 258,000 vehicles and delivered 254,695 vehicles. That was below consensus estimates of 266,795 vehicles, and down from 310,048 in 1Q 2022, as the company faced a continuation of manufacturing challenges related to shutdowns, global supply chain disruptions, labor shortages and logistics and other complications, which limited its ability to consistently run our factories at full capacity.

While the Shanghai factory was shut down fully and then partially for the majority of Q2, TSLA ended the quarter with a record monthly production level. Recent equipment upgrades will enable the company to continue to increase its production rate further.

The Fremont Factory made a record number of vehicles in Q2. I see opportunities for further production rate improvements. The next generation of 4680 battery cell machinery has been installed in Texas and is in the process of commissioning. Factory output in Texas continues to grow.

Gigafactory Berlin-Brandenburg reached an important milestone of over 1,000 cars produced in a single week while achieving positive gross margin during the quarter. Tesla expect the production rate to continue improving through the rest of the year.

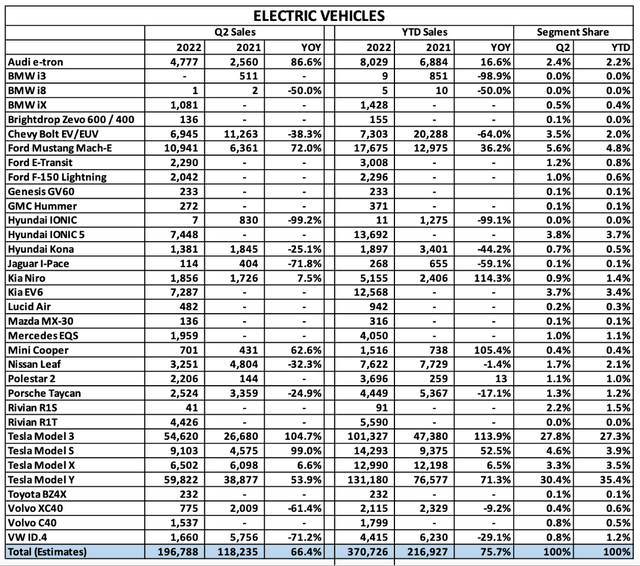

Table 4 shows U.S. EV shipments for Q2 2021 and Q2 2022 by model. In Q2, Tesla was the top-selling luxury brand in the U.S., outpacing all the established names: Audi, BMW, Cadillac, Lexus, Mercedes-Benz, as seen in Table 4.

EV sales as a percentage of total automobile sales. In Q2, EV sales accounted for 5.6% of the total market, an increase from 5.3% in Q1. EV share in Q2 2021 was 2.7%. In Q2 2021, there were 19 EV models for sale in the U.S. One year later, the number jumped to 33.

Table 4 – Source: Cox Automotive

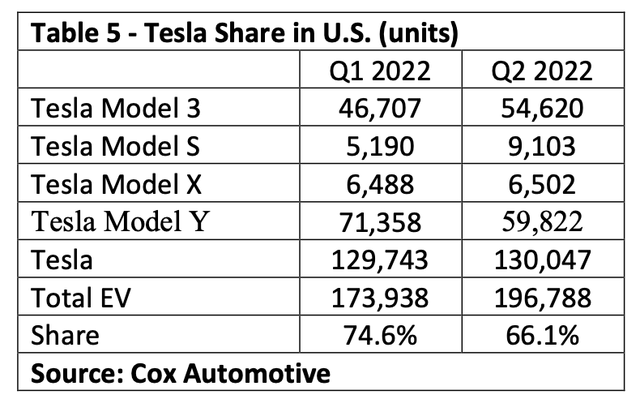

However, as new EV models continue to enter the market, Tesla’s share of the EV segment is dropping. Last quarter, it fell to 66.1%, down from 74.6% in Q1 2022, as shown in Table 5. Tesla shipments by model are also shown. Importantly, Tesla is losing market share to traditional automobile companies with EV entrants, rather than the EV startups discussed above.

Investor Takeaway

I discussed in my July 27, 2022, Seeking Alpha article entitled “MOKE + EV Technology Group: The Cost And Value Of ‘Brand Equity’ In The EV Automotive Value Chain” that Brand Equity would be critical to growth of a startup. The advantages of Brand Equity, which gives a product competitive edge in the marketplace include:

- Developing a greater market share

- Charging a price premium

- Ease of Recognition

- Differentiation from the competition

Brand equity can be defined as the additional value that a recognizable brand name adds to a product offering, and is created as customers becoming increasingly and more personally aware of a brand and build a connection with it.

None of the EV startups detailed in Tables 1-3 are on the radar in sales in the U.S., Europe, and China. Indeed, the only competition for Tesla in the U.S. and Europe are established automobile companies with EV offerings. China is different with little competition coming from traditional non-Chinese automobile manufacturers with EV offerings, yet Tesla is still within the Top 10 of sales through June 2022.

In Chart 7, I show share price for the five EV companies (including TSLA) listed in Table 1, and show EPS for the past one-year period. Indeed, only Tesla has a positive EPS.

YCharts

Chart 7

The point of this article is to expand on my thesis in my previous article the importance of Brand Equity. Tesla has achieved Brand Equity, as I showed in that article. But without it, EV startups are struggling. The competition to Tesla outside China is coming from established automobile makers with EV offerings, not these startups.

Be the first to comment