Tesla (NASDAQ:TSLA) produced sparkling Q1 figures to surprise analysts who underestimated demand for the company’s products. The company continues to see strong demand for its products around the globe. The big question is whether they will yet again become supply-constrained as COVID-19 shuts down its U.S. plants. They seem likely to take longer to re-open than did the Shanghai plant.

The Chinese government has been very proactive in assisting Tesla. It recently announced new support for EVs in general. The strong future demand for EVs in Asia has been under-rated. I detailed this in an article in March.

European countries almost all have firm dates for transitioning to fully EV markets. The German gigafactory is proceeding full steam ahead.

Meanwhile, the Trump administration has been pulling back environmental safeguards for cars in the USA. In contrast, many U.S. states are very supportive of EVs.

Tesla may be wise to concentrate its manufacturing resources increasingly outside the USA as that is where its greatest sales revenue growth will come from in coming years.

In the short term, investors should be mindful of for how long the U.S. factories have to close and how quickly Tesla can ramp increased production at Shanghai. That will be crucial to meeting ambitious delivery targets for the year.

China Macro Picture

Nothing is certain in this pandemic. It appears, however, that, in the short run, China’s auto market will be functioning a lot better than most others will. The world’s largest auto market will become even more important.

In late March, the government announced new energy subsidies for a period of at least two years. This will benefit all quality EV manufacturers in China. The measures cover battery electric vehicles, plug-in hybrid electric vehicles, and fuel cell electric vehicles. In the continuing efforts to have only quality producers, the incentives will only apply to EVs with a range in excess of 400 kilometres. Such vehicles will enjoy a 25,000 yuan (US$3,600) subsidy.

Furthermore, the government announced details of how they were phasing out diesel vehicles which exceeded Stage III emission targets (that is, over 2.1 grams of carbon monoxide per kWh of energy). Of the approximately 300 million vehicles on the road, 7.8% are diesel trucks, which contribute 75% of airborne particulate matter.

China has become the biggest player in the world battery industry. My article here detailed the fast pace of battery development in the country. China is likely to be the place where the hotbed of battery innovation is centred. This was exemplified by the recent new battery announcement by the world’s second largest EV manufacturer BYD Auto (OTCPK:BYDDF). This will strengthen BYD’s position in EV manufacturing as a natural consequence of that. It is not just in batteries that China will lead. BYD and Toyota (NYSE:TM) have formed a new joint venture called BTET. Based in Shenzhen, it aims to bring together the best technology from China and Japan in the development of new EVs.

Tesla in China

The speed of the roll-out of the Shanghai Gigafactory has been breathtaking. As the company stated in their investor letter announcing the Q1 deliveries:

“Our Shanghai factory continued to achieve record levels of production, despite significant setbacks”.

Phase 1 was dedicated to Model 3 production. In January, the Model 3 became the first overseas model to be the best-selling fully electric car in the country. Phase 1.5 now nearing completion is thought to be for powertrains and battery assembly. Phase 2 is now proceeding apace and is a larger land area than Phase 1. It is likely to incorporate Model Y assembly lines, but nothing is confirmed as yet.

The progress made by the company during the trade war with the USA and then the COVID-19 pandemic illustrates Tesla’s engineering and managerial skills. This was backed up by strong support from the Chinese government. As China appears to be recovering from the pandemic, ramping up production from Shanghai will be key to helping meet demand this year. The factory was closed from 29th January to 10th February. Gradually, the sales outlets have been re-opening around the country. A significant step was the re-opening of the company’s Wuhan showroom which was closed from 6th February to 30th March.

The Q1 figures were very impressive across the range of Tesla vehicles. The company delivered 10,160 vehicles in March. It follows 3,958 deliveries in February. The March figure represents about 30% of the total BEV (battery electric vehicle) market. It is its highest ever unit monthly total in China. It seems to indicate a very strong level of demand as the company is only slowly emerging from its COVID-19 lockdown.

By comparison, the total auto market in China fell by 41% year on year in March. The CPCA (China Passenger Car Association) does expect April sales to improve over March.

China last year saw a 161% increase in Tesla sales over 2018. That was for a year when the overall auto market declined by 8.2%. By comparison, Ford (NYSE:F) saw its sales decline 26% and GM (NYSE:GM) saw its sales decline 15%.

Piper Sandler estimates that there could be demand for 650,000 Tesla vehicles annually from Chinese consumers. The present run rate at Shanghai is thought to be about 3,000 vehicles per week.

Even during the COVID-19 outbreak, Tesla does not have the capacity to supply the China market from Shanghai with total volumes or with model range. 150,000 vehicles does not make that much impact in the 500,000 vehicles Tesla has targeted to deliver this year worldwide. The delivery figure for last year was 368,000.

Tesla needs to keep ramping up production at an extraordinary pace to meet demand from China. That does not take into account growing demand elsewhere in Asia as well. The world auto market last year is illustrated below, with figures in millions of units:

Source: Statista

The China auto market is already 24% larger than that of the USA. If you add in major Asian auto markets such as Japan, India, South Korea and Indonesia, then the Asian market to be supplied, ex-Shanghai, becomes even more important.

A key development for Tesla meeting sales estimates this year will be how successful they are in increasing the model spread as well as the volume out of Shanghai. The factory has been making just the Standard Range Plus version of the Model 3 so far. Early in March, the Chinese government approved the Long Range RWD model. It is likely this will be the next to come off the Shanghai production line. The company surpassed all expectations with the speed and efficiency of its Model Y roll-out in the USA. However, with the COVID-19 outbreak, there is now a big question when this can resume. Another big question is whether Tesla can speed up its plans to manufacture the model in China.

Battery development is key, and Tesla’s battery performance is the main reason the company has such a technical (and sales) advantage over its competitors. The company has added the Chinese operations of L G Chem (OTCPK:LGCLF) to its traditional battery partner Panasonic (OTCPK:PCRFY).

The boost this has given to LG Chem figures can be seen by the fact that they became the largest supplier of batteries for EVs in the first 2 months of this year. The 1.8 GWh represented a 34.6% market share. Their NCM 811 cells are being supplied for the Tesla Model 3. The second largest supplier was Tesla’s other battery partner, Panasonic.

New battery developments for the company are likely to come out of this hotbed of battery innovation in China. The second building coming up rapidly now in Shanghai is thought to be a battery facility. Elon Musk has previously stated that the company is setting up an R&D centre in Shanghai as well. Further details should be made available at the company’s “Battery Investor Day”. Elon Musk tweeted this week that the event should take place in mid-May.

China has seized the initiative in lithium-ion battery production. Figures in 2019 showed it had 73% of worldwide capacity. The USA was a distant second with 12% of capacity. Planned capacity coming on-stream will increase China’s lead over the USA. The country is estimated to have lithium reserves 30 times those of the USA. This is another example of how China is seizing the initiative in renewables business. It is another example of why Tesla might be wise to concentrate much of its resources in Asia.

Further developments with Chinese companies are likely. Chinese behemoth Tencent (OTCPK:TCEHY), for instance, already has a 5% stake in the company. It would not be surprising if they took a further stake. It was recently reported that various Tencent games and apps are being made available in Tesla vehicles.

USA Macro Picture

At almost the same time that the Chinese government was announcing measures to encourage EVs and discourage diesel vehicles, the U.S. administration was rolling back on vehicle emission rules. The rather confusingly named “Safe Affordable Fuel-Efficient Vehicles Rule” was announced. This puts a target in place to attain 1.5% better fuel efficiency by 2026, replacing the previously mandated 5%. The previous rule was for cars to average 50 miles per gallon. This has been downgraded to only 40 miles per gallon.

Despite the effects of lobbyists in Washington, U.S. automakers may have mixed views on the new legislation. Originally led by Mark Fields who was then Ford CEO, they are believed to have lobbied hard behind the scenes to get more lax fuel standards. However, now, they are already trying to comply with the mandating by individual States (especially California) of better fuel economy rules. Twelve U.S. states are going their own way separate from the Federal government. These states account for at least a third of U.S. auto sales. So, Detroit is likely to have to manufacture different vehicles for different parts of the U.S. car market. Those manufactured with lower standards may not be viable for sales in other export markets where standards are being ramped up. In the meantime, the new measures are likely to face legal challenges which delay their implementation, causing further problems for the U.S. auto industry.

In this somewhat confused mix, the short to medium-term attraction of the U.S. market to Tesla must be doubted. Last year, 72% of auto sales were for polluting SUVs and trucks, which tend to cause higher levels of pollution than other vehicles. The new regulations, if implemented, will probably lead to an increase in this proportion.

The stock prices of the Detroit Big Three over recent years reflect their declining fortunes. The recent downgrading of Ford debt to junk status reinforces this. It looks quite likely that the Detroit auto companies may need a government bail-out again. At the time of writing, the stock price of Ford and GM have both about halved from a year ago. In that time, the stock price of Tesla has more than doubled (despite its recent falls). That is a good example of how the market views the EV future of Tesla, as against the mainly ICE future of Ford and GM.

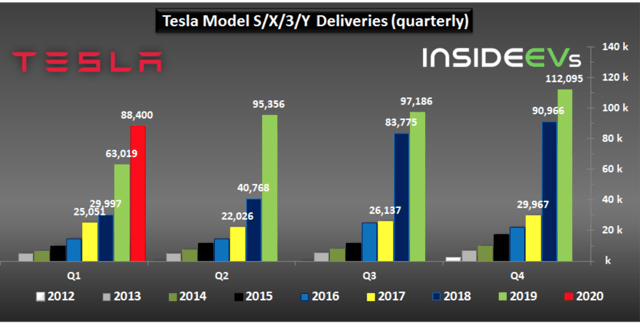

Tesla has enjoyed compounded revenue growth of 57% per annum over the past 4 years. Its delivery history shows a sales curve any company would love. It is all the more extraordinary for its continuation into Q1 2020 in this time of COVID-19:

Source: Insideevs

Tesla in the USA

It seems likely that Tesla’s US factories will suffer severe production setbacks for some time to come. The vertical integration of the company and its manufacturing efficiencies makes it less badly affected by supply chain breakdown than other U.S. manufacturers. Tesla’s vehicles require far less moving parts than ICE vehicles.

The Fremont factory was shuttered on 23rd March. It has been speculated that it will remain closed until mid-June. The latest news is the announcement that Tesla hopes to re-open plants in the USA on 4th May. Of course, no one knows how likely this is. Most employees are being put on furlough. This makes it quite possible that Tesla will be very supply-constrained again this year.

The regulatory and political picture in the USA arguably makes the USA a less attractive country for Tesla to focus its investments on. The one future product that could, however, be concentrated in the USA is the “Cybertruck”. Demand for this seems to be very strong, although there are no reliably confirmed numbers at present. Forward reservations are variously enumerated at 250,000 to 622,000. Trucks are more of a U.S. fashion than elsewhere in the world, so U.S. manufacture of this product will probably make sense.

Europe Macro Picture

My recent article here gave details of the moves being made by both the EU and individual European countries towards phasing out ICE vehicles. I will not repeat those facts and figures here but just highlight a few of them. It is not a matter of “if” but of “when”. Individual countries’ targets illustrate this. EV sales were 42.4% of the total in Norway in 2019, and the target is to be 100% by 2025. The U.K. has a target of 20% of sales to be EVs by 2026. The Netherlands has a target of no ICE vehicles on the road by 2050. New Bloomberg Energy Finance predicts a tripling of EV sales in the EU between 2019 and 2021.

The new rules for emissions brought in by the EU are again in stark contrast to what is happening in the USA. New strict rules on CO2 emissions for cars and vans applied as from 1st January this year. A further reduction of 15% is mandated as from 2025 and of 37.5% from 2030.

New rules are separately in place for big trucks. They will have to emit 30% less greenhouse gases by 2030.

The problem of U.S. automakers in this environment is shown by the failure of Fiat Chrysler (NYSE:FCAU) to produce cars that meet EU standards. Fiat Chrysler seems to have been particularly disdainful of the overseas trend towards EVs. New EU regulations allow for 95 grams of CO2 per kilometre across the fleet. Fiat Chrysler’s was quoted at an average of 123 grams last year.

As a result, as detailed here (paywalled), they have done a deal with Tesla whereby they can use Tesla credits against their fleet. It is hard to be accurate with calculations at this point, but this could be worth hundreds of millions of euros to Tesla. Fiat Chrysler is likely to face liabilities worth up to 2 billion Euros as new standards kick in, according to calculations by Jefferies. Recent analyst calls on Tesla have been bullish partly on these anticipated revenues.

The Fiat Chrysler CEO Mick Manley recently lauded his company’s close relationship with Tesla. He left open the possibility that Fiat Chrysler might buy batteries and drivetrains from Tesla as they strain to catch up with the new EV reality. Tesla’s potential for very substantial revenues from supplying component parts to existing ICE manufacturers may be under-valued by analysts.

As if that was not enough, the EU stated in December last year that they might tighten these requirements still further. They are aiming to have a clear path to “zero emissions mobility” by 2025. The EU in general aims to be carbon neutral by 2050.

In another way that Europe and the USA have a very different approach, petrol and diesel prices are much higher in Europe due to government taxation for environmental reasons.

Tesla in Europe

The new Gigafactory set to open in 2021 near to Berlin is already being fast-tracked to meet demand in the same way that Shanghai was. The scale of the project can be understood from the picture below:

Source: Teslarati

In the meantime, Tesla seems to be hard-pressed to meet European demand from its existing facilities. Tesla’s Model 3 ended 2019 as the best-selling fully electric car on the continent.

The company has been getting similarly enthusiastic support from German authorities as it got from the Chinese for the Shanghai facility. This is on the back of a surge in sales in Germany. The Model 3 was the best-selling fully electric car in March, beating the much-vaunted lower cost Renault Zoe. It is forecast that EV sales will total about 10% of the German market this year.

It is expected that the German facility will initially concentrate on manufacturing the Model 3 and the Model Y. However, the new EU rules to come into force could make the Tesla Semi an attractive product to manufacture there. It is likely that this is very much in Elon Musk’s game plan. It is known that he has held discussions with European regulators concerning allowing electric trucks to run 7 days a week where they are now banned on Sundays.

Conclusion

The U.S. may see demand for EVs remaining flat, especially if Detroit manufacturers enjoy government assistance.

In Europe and in China, the “zeitgeist” is a lot more with Tesla and with environmental consciousness. It makes sense for Tesla to focus its manufacturing and, ultimately, its sales in these areas where they get the support of government and arguably of the populace.

The rapid and ever-increasing scope of Shanghai, and subsequently Berlin, will reinforce this trend. In the short term, it seems Tesla will have problems with meeting demand because of U.S. factory shutdowns. Investors should be cognizant of Tesla’s production capacity in the USA and in Shanghai for the remainder of this year. That will be key to the stock price.

The revenue progress Tesla makes this year and next will depend primarily on their success in ramping up production in Shanghai and instituting production in Germany. The surging demand for EVs in Europe and Asia gives them a bright future for continuing the strong growth curve in the long term.

Disclosure: I am/we are long TSLA, BYDDF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment