imaginima

An Absolute Bargain

The Semiconductor Test Equipment Industry is largely a duopoly of Teradyne (NASDAQ:TER) and its largest competitor Advantest (OTCPK:ATEYY), with the smaller Cohu (COHU) snapping at their heels.

The ATE (Automated Test Equipment) industry is totally dependent on the growth of the semiconductor industry with its biggest clients being pure play foundries such as Taiwan Semiconductor (TSM), IDMs (Integrated Device Manufacturers) such as Intel (INTC) and Samsung Electronics Co., Ltd. (OTCPK:SSNLF) (OTCPK:SSNNF)and fabless chip designers such as Nvidia (NVDA)and Advanced Micro Devices, Inc. (AMD). TSM alone was responsible for more than 15% of Teradyne’s revenues in 2021. A delay in moving to 3 nanometer processing for one of TSM’s largest clients, supposedly Apple Inc. (AAPL), led to a nightmarish drop of 30% in a day for Teradyne after its Q4-2021 earnings presentation.

Since the epic fall in January 2022 to $110, Teradyne has sunk to a new low of $79, bludgeoned by the Fed’s hawkish stance to keep increasing interest rates to tame inflation. Like most other tech stocks, Teradyne’s earnings multiple falls with higher rates. This is a huge opportunity – Teradyne’s 2023 and 2024 price earnings multiples have fallen to 16 and 11 respectively, multiples which offer a significant margin of safety in these uncertain times, especially when the move to 3nm is delayed but not cancelled; merely, what should have transpired in 2022 has moved further out to 2023 and 2024. To quote Mark Jagiela, CEO of Teradyne, from the Q2 2022 earnings presentation:

“The ramp of 3-nanometer starting in 2023, followed by gate all around and increasing multi-chip packaging remain unaltered drivers of growth ahead.”

The Bull Case for Teradyne

Sustainable growth from the semiconductor arms race – Semis are used in everything from games, computers, data centers, for artificial intelligence and machine learning, and in defense and automobiles to name a few.

Teradyne – Tearing growth in revenues and earnings

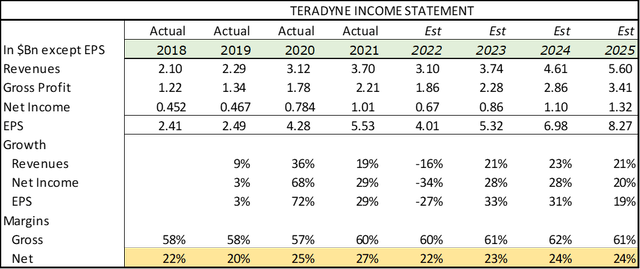

Teradyne benefited strongly from semiconductor manufacturing growth, growing revenues and earnings from 2018 to 2021 at a CAGR of 20% and 32% respectively; no mean feat for a company that was often lumped with other cyclicals growing at GDP growth rates. Going forward, based on a study by McKinsey, I expect the semiconductor industry to reach $1 trillion by 2030, growing between 6 and 8% per year.

TSMC postponed its 3nm production to 2023, which led to a drop of 16% in revenues in 2022. I expect Teradyne to resume growing revenue and earnings for the next three years at 22% on the back of 3nm production and faster growth in Industrial Automation. I believe this will result in a 2024 EPS of $7, at a PE of only 11.3 at today’s price of $79.

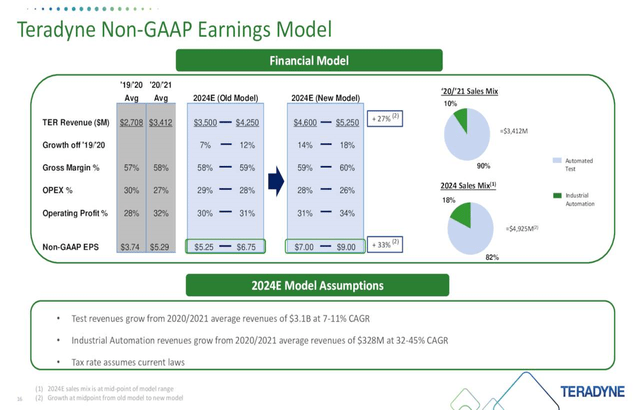

Teradyne’s own guidance is higher, they expect earnings to get to $7-$9 or an average of $8 by 2024, but I believe they’re being over optimistic on margins.

Teradyne Investor Presentation

On the other hand, consensus earnings estimates for 2024 from Seeking Alpha are slightly lower at $6.58.

Long term secular growth from Industrial Automation

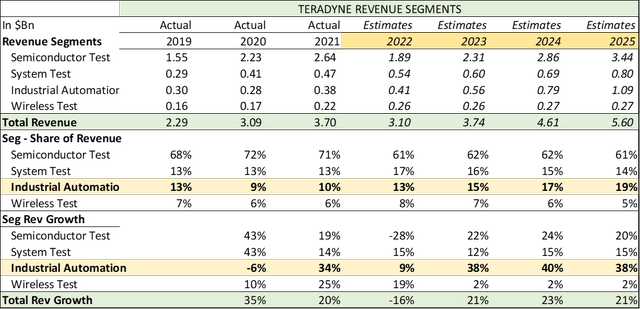

Teradyne 10K and Fountainhead Estimates

The industrial automation group should be the big revenue driver for Teradyne in the next decade. The Industrial Automation segment consists of collaborative robots from Universal Robots and Mobile Industrial Robots, which Teradyne purchased in 2015 and 2018, respectively.

Presently, the IA division is only about 13% of revenues, but is expected to grow the fastest in the next three years at 39% to reach 19% of revenues by 2025. Both Universal Robots and MIR are leaders in their fields. ABB (ABB) and Fanuc (OTCPK:FANUY) (OTCPK:FANUF) both larger engineering and industrial players are also in the field, expecting collaborative robots to be a major growth area, because of its relative cost, safety and ability to work under lighter human supervision instead of relying on complex automation and programming. Collaborative robots have good return on investments, low barriers to deployment and are safe working closely with people.

Given the massive supply chain disruptions due to COVID, this is a strong opportunity for manufacturers to use collaborative robots to reduce manufacturing costs in North America and Europe.

Increased complexity of testing and presence in all categories of testing

The increased complexity of testing due to the advent of 5G and the move to smaller nodes such as the 3nm allows Teradyne to price its products well, which shows up in net profit margins 22-23%.

Teradyne is versatile and offers testing for mobile phone semis, SOCs (Systems On Chips), besides having a strong presence in storage testing as well. It offers test automation equipment in virtually all segments of semiconductors, more than its chief rival Advantest and significantly more than Cohu. This allows it to mitigate much of the cyclicality in the semiconductor industry.

The ATE (Automated Test Equipment) industry duopoly of Teradyne and Advantest

Teradyne and Avantest control more than 75% of industry revenues, which allows them significant pricing power, and acts as a barrier to entrants.

Challenges

Production delays and a highly concentrated customer base

The delay of 3nm node production by a year led to a massive price drop of 30% for Teradyne in one day alone!. The ATE industry is highly concentrated with large players and a single customer like Taiwan Semiconductor delaying production has led to a 16% drop in revenue in 2022.

Digestion lull after heavy COVID growth

Going forward, supply chain disruptions, slowing demand in China, and a period of digestion after the heady growth of the last 4 years will slow the semiconductor industry a bit. Gartner predicts that the semiconductors will actually fall 2.5% in 2023, mainly on lower PC demand.

Automated Test Equipment lasts long

Teradyne doesn’t get revenues each time there is a test performed. Massive spikes in production don’t lead to large increases in revenue. Instead, it sells equipment which is often used for longer than its supposed book life and not replaced as estimated, leading to delays in demand.

User industries cyclicality and overcapacity

Semiconductor manufacturers often suffer from cyclicality and overcapacity, which reduces the need for testing. Storage and memory manufacturers are commodity players without significant product differentiation, competing only on price.

A SWOT Analysis Of Teradyne

The Compelling Case to Buy Teradyne

In the California gold rush, those selling shovels and spades made the most money. Teradyne is simply too vital a cog in the semiconductor industry arms race – nothing leaves the factory gate without a test.

The past decade has seen a great deal of secular industry growth and testing complexity, which make Teradyne’s earnings more sustainable.

The delay in 3nm production and interest rate increases, which have led to a multiple contraction of 50%, have turned Teradyne into an incredible bargain at only 11 times 2024 earnings.

I own Teradyne and rate it as a strong buy with a three year price target of $145, expecting to realize 22% a year.

Be the first to comment