krblokhin/iStock Editorial via Getty Images

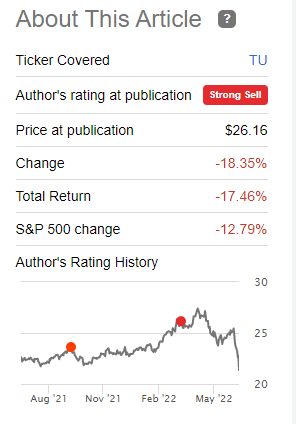

The last phase of the recently deceased bull market was characterized by just chasing stocks that had yet to break down. While technology, industrials and consumer discretionary sectors were hit, utilities and some areas within telecom had held up. So when we last covered TELUS (NYSE:TU) we upped the ante. Specifically we said:

We are downgrading shares to a Strong Sell from just a Sell. In this case we are now actually shorting the shares as the risk reward over the next year looks incredibly compelling. We have substantial long positions in the Telecom industry and see this hedge as a low risk one, compared to others available. Key catalysts for a revision will likely come as EBITDA growth stalls in 2022. Inflation is not a friend of slow-growing, richly valued companies and TELUS will be no different. We have a $25 CAD ($19.50 USD) price target in one year.

Source: One Growth Bubble Waiting To Implode

That was a deeply satisfying double down as TELUS not only dropped sharply, but dropped even more than the broader indices.

Seeking Alpha

We examine the recent earnings and the announced acquisition to update our thesis.

Q1-2022

The first quarter numbers had no surprises. The Non-GAAP earnings were of $0.30 CAD with revenues edging up 6.0%. Adjusted EBITDA increased by 7.0 per cent to more than $1.6 billion CAD. The firm stuck with the original guidance for the year and we expect $1.25 CAD earnings for fiscal 2022. The positives over here were that there were no negative surprises on the inflation front. As we have seen with several companies, inflation is creeping in and crushing margins.

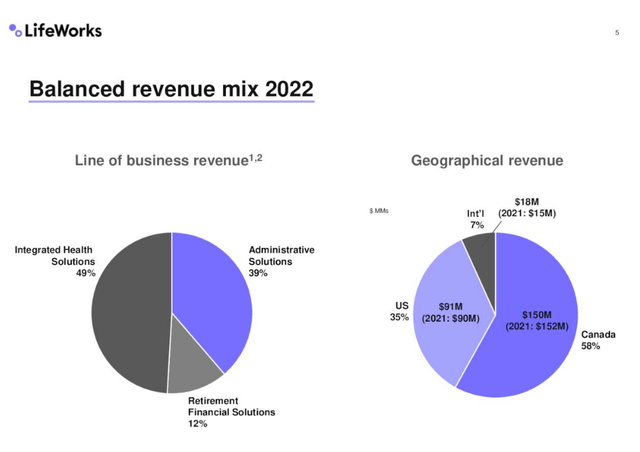

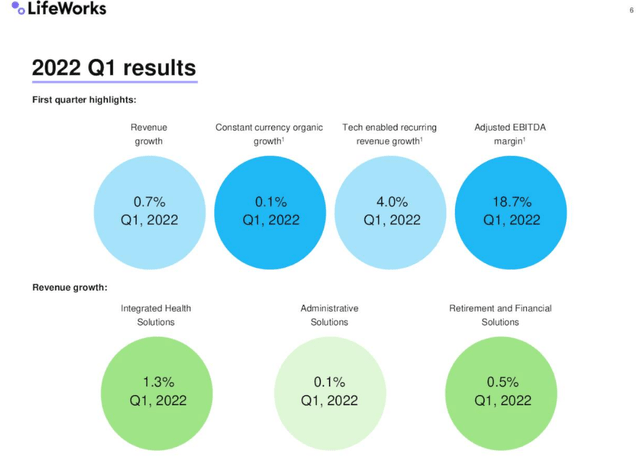

TELUS announced a deal to buy LifeWorks, Inc. for $33.00 CAD per share. The bulk of that is equity ($2.3 billion CAD) and the rest is debt (about $600 million CAD). LifeWorks provides employee and family assistance programs and benefits administration capabilities to leading companies including Pfizer Inc. (PFE) and Starbucks (SBUX).

LifeWorks Q1-2022 Presentation

This fits in well with the growth focus of TELUS Health segment and more than doubles the number of people covered.

Our Thoughts On The Deal

LifeWorks was trading at about $18 CAD before the deal. The near 80% premium is quite high in this market. LifeWorks is not that expensive on a price to sales level as TELUS is buying it close to 3.2X on estimated 2023 revenues. On an EV to EBITDA, TELUS is paying a 15X multiple, which rings on the high side. Our overall take here is that this is expensive, especially considering the slow growth from LifeWorks.

LifeWorks Q1-2022 Presentation

The good news? TELUS is financing this with cash on hand and 37 million TELUS shares. As we have previously said, TELUS shares are expensive and if you want to pay for an expensive acquisition, do it with your own expensive shares. The drop in the share price, reduces the price of the deal. This gets us to a more neutral stance on the purchase.

Valuation

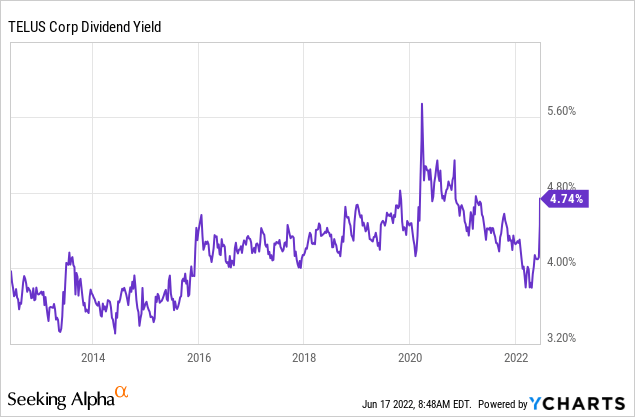

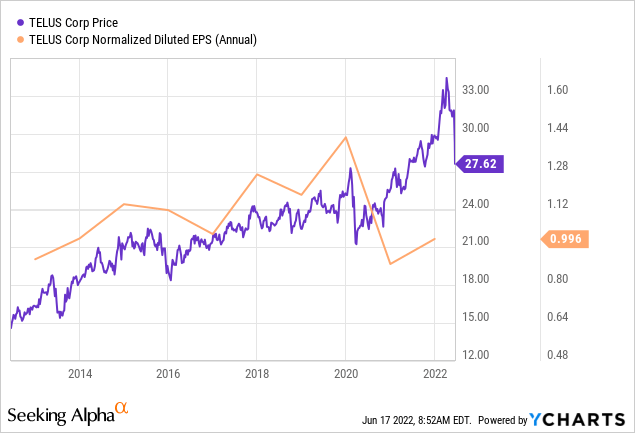

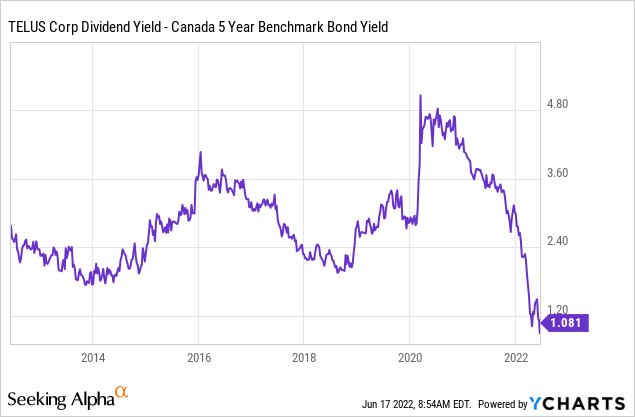

Last we talked about it, we were sauntering on a 10X plus EV to EBITDA for TELUS. Along with that, we had a stock trading at about 27X earnings. The recent drop alongside a roll-forward of our estimates to 2023 has done some good to the TELUS valuation case. We are now looking at about 8.0-8.5X EV EBITDA and just 18X earnings for 2023. That is healthy valuation compression. The dividend yield has also now rocketed to the top of its range for the past decade.

This is good progress in getting the stock to the right buy point. Two things we would caution about over here nonetheless. The first being that investors should not be misled by the “huge growth” from 2022 to 2023 in earnings. TELUS had a big drop in earnings from 2019 to 2020 and the market basically gave the company a free pass for that. While that may be fine, let us not extend the credit a second time by hallucinating that this is a growth story. It is not. The $1.50 CAD in 2023 will be about 5% higher than what we saw for 2019.

In other words, we are looking at a 1.25% annual growth rate in earnings over 4 years. The second thing we would caution about is to not get too excited over the dividend yield. While the earlier chart showed that the company’s dividend yield is at the high end of its range, it is now at a 10-year low relative to the 5-year Government of Canada bond yield.

Verdict

TELUS continues delivering steady results and its key competitor Rogers Communications Inc. (RCI), remains distracted with a host of issues. The acquisition of LifeWorks was expensive, but that was partially mitigated by using its own expensive shares for the purchase. Dividend yield appears appealing until you realize that the 5-Year GIC in Canada (what you Americans call Bank CDs) now yield 4.4%. Overall, we think valuation has compressed modestly and the roll-forward to 2023 helps us move this to a Neutral/Hold. We would only be excited to buy this if we see a 6% plus dividend yield alongside improvement in other valuation measures.

Be the first to comment