Natalia Lagutkina/iStock via Getty Images

Investment Thesis

Tellurian (NYSE:TELL) has huge ambitions to build an LNG terminal. Between ambition and reality, there’s a hole of $12 billion. How does Tellurian manage to raise $12-$13 billion for Driftwood in a higher rate environment if it couldn’t raise the equity and debt when the environment was meaningfully better in the summer?

The shot above is where Driftwood is getting slowly built in 2022. This analysis is a bullish outlook for Tellurian, peppered with a dose of reality.

The Dynamics at Play

Notwithstanding what you may think about China’s energy consumption, allow me to share a fact with you. China has been ramping up its green energy sources.

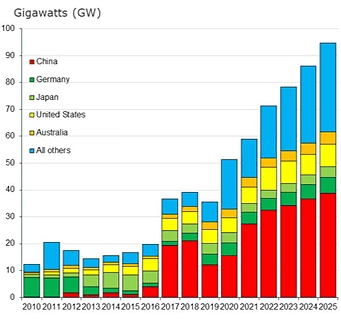

Rooftop solar installations, Rystad Energy

What you see above is that before 2017, China’s rooftop solar was only 4 GW of installed capacity in 2016. By this year it has jumped 8x in 6 years. Substantially faster adoption than anywhere else. And its adoption in China isn’t slowing down.

With that in mind, consider this headline below.

Reuters

The headline above describes the situation better than I can. This is an article from a few days ago. Together we can see that China takes energy security very seriously. China has an insatiable demand for energy. Europe has an insatiable demand for energy, as well as Latin America, India, Africa, the US – you get my point. There’s a direct correlation between energy and quality of life. And the developing world is only getting started with its insatiable demand for energy.

And while uranium has been touted as a crucial energy source, I don’t believe that uranium’s energy adoption is going to be a needle mover any time soon. That’s not to say that countries around the world are not reconsidering uranium energy.

I’m declaring that until uranium energy becomes a significant proportion of a country’s energy source, outside of France and few other countries, countries that want to get reliable, consistent, and “clean” baseload energy will turn to natural gas as the cleanest of the fossil fuels.

So, natural demand will remain high over the coming years. That’s a now foregone conclusion. The only question is where will countries source enough natural gas from? And at a price does it makes sense? I believe that natural gas in the US being significantly cheaper will lead to a long-term secular growth story for natural gas exports.

Driftwood?

Post Q3 results, Tellurian’s CEO Charif Souki took to YouTube.

Souki describes how the situation has dramatically changed over the past few months. Going on to describe how supply chains, inflations, labor shortages, and raising interest rates, all together make Driftwood’s opportunity slightly more muted (~3:00 mins).

Now, to be clear, slightly more muted isn’t the biggest issue here. After all, Souki notes getting the export of LNG will cost around $11 mmbtu and when prices around the world are going for approximately $30 mmbtu, there’s still an attractive opportunity, nearly a $20 margin for LNG on the water.

Souki asserts that of the approximately $12 to $13 billion that it costs to get Driftwood up and running, 35% would come in the form of equity. So, that would be approximately $4 billion. Or put another way, shareholders would see a dilution of 4x.

With the remaining 65% coming in the form of debt, what sort of interest rates would such a facility take? Of course, this depends on who the counterparts are. If it’s a government, this could perhaps be as low as 7%. But otherwise, we are looking at close to 12%, in my estimation.

Souki nevertheless maintains that even with LNG margins of $7 per mmbtu, this would bring approximately $6 billion in cash flows per year, meaning that the venture pays for itself in 3 years, if we assume that Driftwood costs closer to $15 billion, once all is considered.

TELL Stock Valuation – A Long-Dated Option, With No Expiry

The way that I describe Tellurian is as a long-dated option with no expiry. If at some point in the coming years Tellurian is able to get some traction, get its much-needed Final Investment Decision approved, and actually get Driftwood into operation, at that point, the investment thesis will work out tremendously well.

The problem is that, between where we stand right now, and the eventual “coming years”, there’s a lot of work, assumptions, emotions, and hope needed for Driftwood to get off a presentation slide, and into operations.

Hence, I argue that with this in mind, investors should appropriately size Tellurian in their portfolio. There are so many risks and the likelihood of success is so small that it’s a futile exercise to ponder over any sort of valuation assumption for Driftwood.

That being said, if we indeed do plow through the emotions, disappointments, anguish, and yet again, hope, the fact remains that Tellurian also has its core business.

Now, let’s be fair. Tellurian has a habit of being stretchy with the truth. And when Tellurian declares that its core business in 2023 will see approximately $400 million of EBITDA, I don’t believe we should take this figure at face value.

The Bottom Line

In sum, Tellurian’s market cap prices very little hope for Driftwood becoming a reality.

And in a moment of honesty, Souki admits that he was overconfident (5:36) about Driftwood. There was hope. The fundamentals look very compelling. But now we are facing reality. And Driftwood remains a pipe dream. A dream where investors can lose everything. Or where the upside could be significantly higher.

Be the first to comment