andDraw

Opportunity Overview

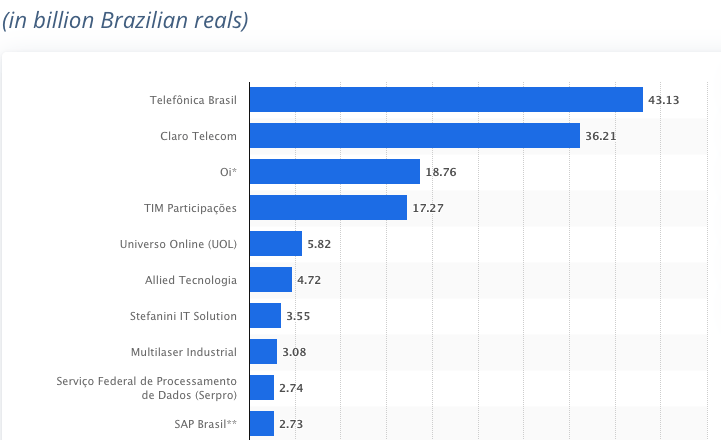

Telefônica Brasil S.A. (NYSE:VIV) (“Vivo”), which operates the Vivo brand in Brazil, is Brazil’s largest telecommunications company and ninth-largest brand in Brazil. Vivo offers voice services (fixed and mobile), fixed/ultra/broadband, pay-TV, IT services, and various digital services. The company has 97 million mobile lines in operation, which accounts for 38% of the market. It covers 95.2% of Brazil’s population with 4G and 85.5% with its 5g network. The company is present in 12 countries in Europe and Latin America.

Statista

Telefonica Brazil operates more than 1,700 stores in Brazil and has 19 million users on its app. This stock is an attractive pick for multiple reasons:

-

This industry has ample growth potential in Brazil, and Vivo is moving up to higher-end segments

-

Telecom is a very good industry to invest in during inflation/recessions, and this stock is a great defensive option that may outperform banks and exchange-traded funds (“ETFs”).

-

VIV has aggressive growth plans and a solid track record of growth

-

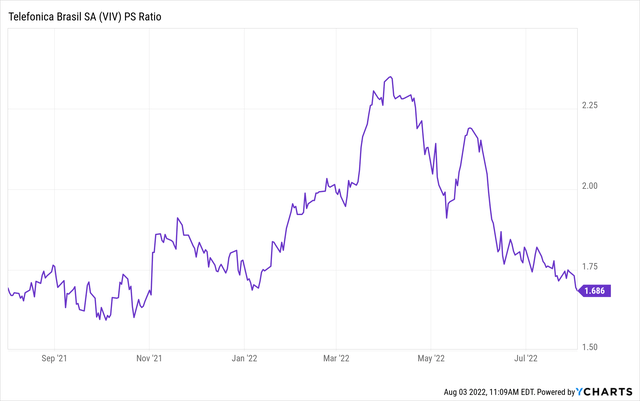

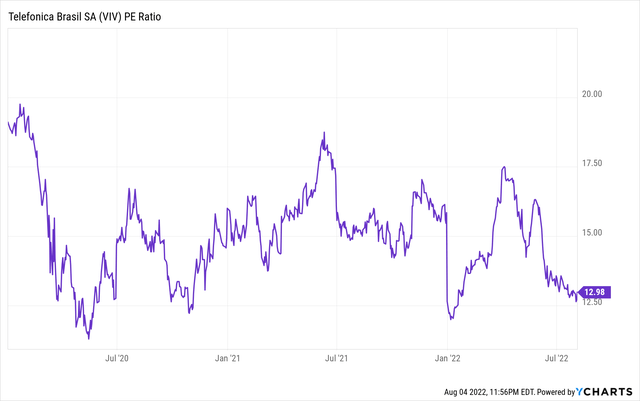

Valuation is still attractive, even based on historical norms.

The decline from Q1-Q2 peaks has created a more attractive entry point for Vivo, as the stock could trade at over 2x revenue under more optimistic conditions.

The Appeal Of The Brazilian Market

Brazil has an attractive telecommunications market because of its favorable demographics and large % of SMEs that are undergoing a digital transformation. Furthermore, rising incomes in the future can help boost additional growth, especially as a large % of the population has ample room to increase spending on phones/internet/etc.

Vivo

SME Growth Opportunity: There is ample room for companies like this to target smaller SMEs by offering services. Companies like Vivo can also benefit from expanding into rural areas, and gain new customers that have not had exposure to its products. This transition will likely come to fruition by 2024-2025.

Demographics: Another fact to note is that around 20% of Brazil’s population is 14 years old or younger. This fact further edifies the “favorable demographics” thesis that attracts capital flows to emerging markets. Growth in this sector may consequently peak 5-10 years out, as incomes rise and more younger consumers begin to spend more in their 20s.

Rapid Growth: Emerging markets are experiencing a setback in growth, and this has impacted a plethora of industries, including banking. However, areas like ICT tend to be more resilient, as consumers are not very price sensitive and have limited options. Brazil’s ICT sector grew by 18% in 2021 and now represents around 6.9% of GDP.

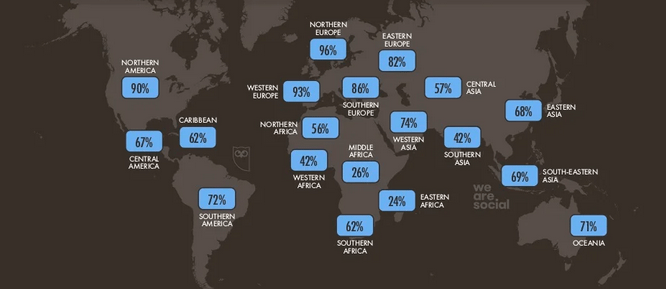

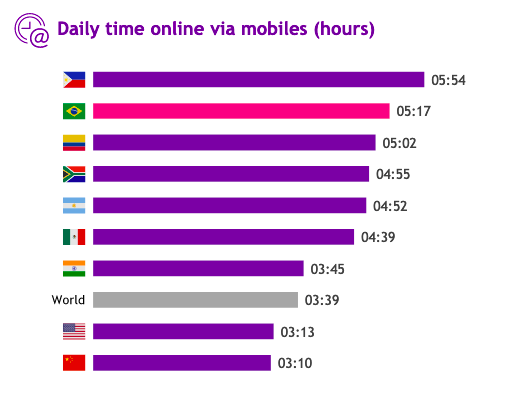

Datareportal

Regions like Southeast Asia and Latin America have ample growth potential this decade, as a large % of consumers still are not fully exposed to telecom.

Telefonica Brasil Outlook

Telefonica Brasil is poised to capture some of the industry growth and maintain its leading industry position in Brazil.

Expanding Fiber Segment

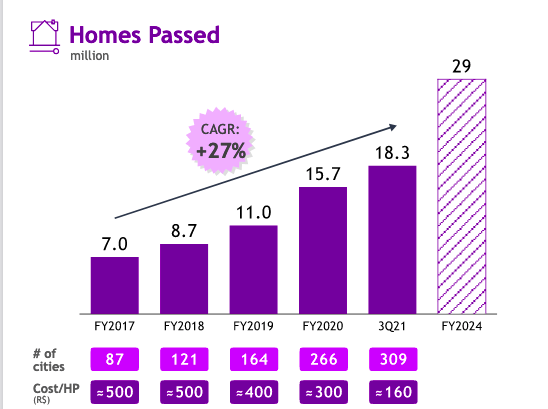

Brazil’s current fiber penetration is 26%, while broadband penetration is around 63%. Vivo has been aggressively expanding into fiber, with a CAGR of 27%, and plans to reach 29 million homes in Brazil by 2024.

Vivo

This is an ambitious but achievable goal, given that Brazil’s government is committing to improving access for rural populations. Around 5,500 municipalities in Brazil will have access to fiber-optic coverage, in line with Brazil’s Generalization Plan for Universal Goals. If Brazil meets its plans, then around 99% of Brazil will have access to this coverage. Furthermore, 29 million homes only represent around 13-14% of Brazil’s population. Even a CAGR of 10%, would allow VIV to have 24.4 million homes by Q3 2024. VIV plans to focus on mid-sized cities, but will also expand to other areas where it does not provide services currently. The market is somewhat competitive, and Vivo will have to take market share from smaller players. The top 3 companies control around 53-54% of the fixed broadband market, while there is an abundance of regional players with a 1-3% market share.

Mobile Segment: Stable, But No Growth Narrative

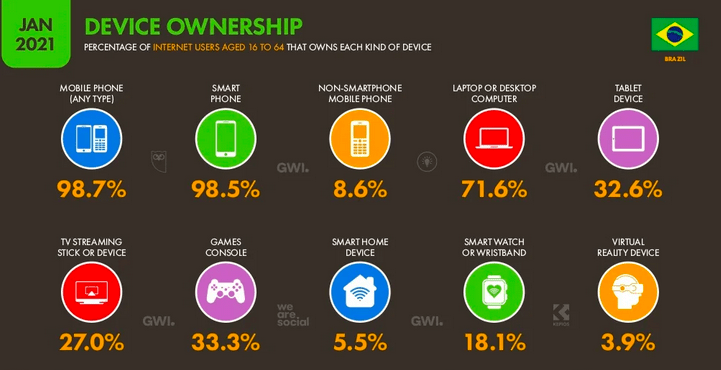

This segment will not be as strong of a growth driver, given that a large percentage of Brazil’s population already has access to mobile devices.

Datareportal

Most people in Brazil own a smartphone, and users spend a lot of time online on their mobile devices relative to other countries.

Vivo

The % of households in Brazil that had Internet access rose from 51% in 2019 to 71% in 2021. There is room for additional growth in the coming years as companies expand into rural areas.

Digital Services

Vivo is also well-positioned in these four high-growth areas, which still have room for growth during the next decade.

Vivo

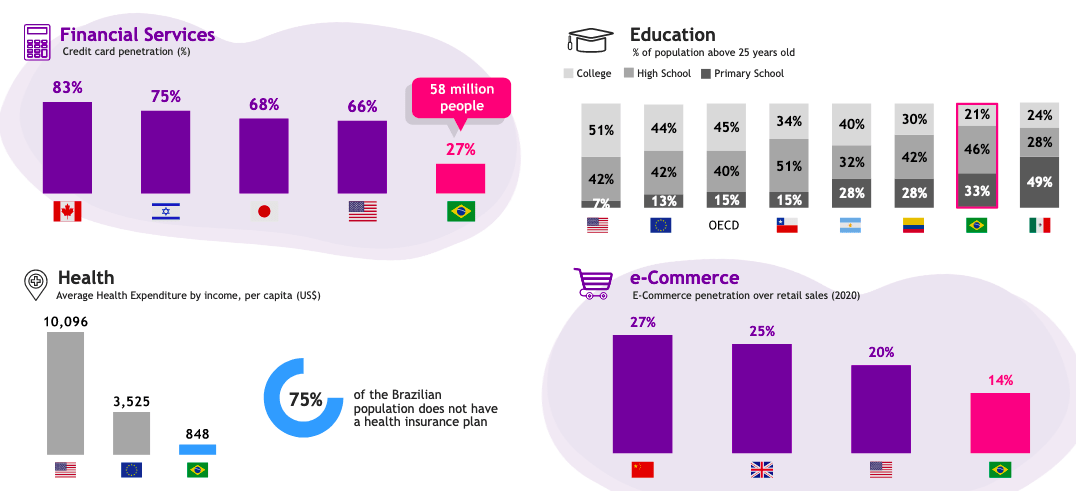

Another intriguing part of Vivo’s business is its digital services segment, which essentially gives investors exposure to financial services, health, eCommerce, and even education:

-

Brazil is a standout country globally because of the country’s much quicker adaptation of digital banking services. Banks in Brazil have had to respond by changing their business model or acquiring smaller competitors.

-

Brazil’s demographic profile is also very attractive for education. Vivo recently signed a contract with Anima Educao to provide digital courses on lifelong learning and employability.

-

Covid-19 resulted in legal changes in Brazil in 2020, which allowed for telemedicine to begin to gain traction in the country.

-

Ecommerce has been accelerating rapidly in Latin America, and penetration rates are still low.

Conclusion

Vivo is an interesting value stock in Brazil, which will likely experience milder drawdowns during any pullbacks seen in emerging markets in the coming years. I mentioned this in this article, which covered banks in Brazil and showed how consumer stocks were better bets.

Vivo is currently as undervalued as it was following the bottoms experienced following Covid-19 and Russia’s invasion of Ukraine. Key risks to investing in VIV include the following:

- Emerging Market Macro Risks: Elevated inflation and heightened political risks, as seen in countries like Sri Lanka and Turkey, will likely increase, which would result in capital fleeing riskier equities.

- Foreign Currency: Vivo is exposed to currency risks (especially the euro) as it operates in over 10 countries.

- Brazil’s economy will struggle with higher inflation and recession risks. Elections are approaching in Brazil, and further political risks in Brazil would not be a unique event in Latam.

- Heightened political risks in China and Taiwan would cause global tension, and EM outflows, as China and Taiwan are the two largest countries in MSCI Emerging markets, accounting for 47% of the MSCI Emerging Markets Index.

I plan to accumulate shares of Vivo during any pullback experience this year.

Be the first to comment