SDI Productions/E+ via Getty Images

The telemedicine leader didn’t report a big quarterly beat, but Teladoc Health (NYSE:TDOC) did provide more evidence business is stabilizing at solid growth rates. Nobody doubts the future of online doctor visits, but a lot of questions exist on the ultimate market size and profitability of participants in the business model. My investment thesis is far more Bullish now with the stock trading far below pre-Covid levels while the business plan is being fully executed.

Amazing Case Study

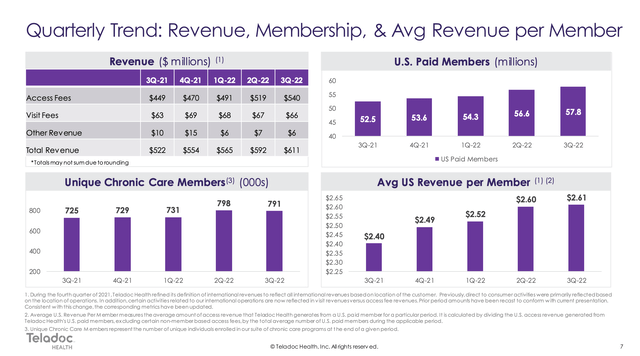

Despite Covid proving the benefits of telemedicine and Teladoc Health still thriving following normalization of online doctor visits, the stock remains in the dumps. The company reported Q3’22 revenues grew an impressive 17% to reach a record $611 million, but the stock only traded at $27 heading into the earnings report.

Teladoc regularly traded above $50 pre-Covid and the company produced a ton of growth during the last 3 years. The best news on the Q3 results was the company continued to grow U.S. Paid Members, but, most importantly, revenues grew without the company growing Visit Fees or most of the operating metrics that jumped during Covid.

Source: Teladoc Health Q3’22 presentation

The company continues to grow the avg U.S. revenue per member. Teladoc Health now obtains $2.61 per member, up 9% from $2.40 last Q3. The Holy Grail in telehealth is to generate more revenues per member by offering expanded products and services to those members.

The combination of higher members and revenue per member drove the solid growth in revenues. Maybe, even more importantly, Teladoc saw a strong build to the deal pipeline along with some signs clients are looking for a complete suite of solutions for telemedicine leading health organizations back to the market leader.

On the Q3’22 earnings calls, CEO Jason Gorevic discussed the improving deal environment with suggestion health organizations are returning to best-of-breed solutions:

Year-to-date bookings, which represents the estimated incremental annual revenue contribution from deals signed during the year, is roughly equivalent to the same period in the prior year. We are, however, encouraged by a number of new significant deals that we expect to contribute to our growth for the next few years.

Finally, while we typically close many new employer deals in any given quarter, I wanted to highlight one in particular as I think it underscores the value proposition of our broad integrated service offering. We’re replacing 3 different competitors all at once across chronic care, telemedicine and our myStrength mental health solutions at one of the largest providers of care to correctional facilities and other government-run institutions. We believe the market is shifting away from disparate point solutions and toward integrated offerings, a trend that we believe strongly favors Teladoc Health.

The margin picture appears to have improved in the quarter. Teladoc Health generated 8.4% adjusted EBITDA margins, up from 7.9% in the prior quarter. In addition, adjusted gross margins are up to 69.6% for a recent high.

The company will return to large EBITDA margins in Q4 with guidance for EBITDA of $93 million on revenues of $633 million. The 14.7% margin will soar beyond the 13.9% produced last Q4 another good sign some of the pricing pressures in the sector are disappearing.

The lack of capital and reduced interest in investing in sectors where stocks have been pummeled should help reduce some of the competitive pressures in the sector. The big downside of the demand surge during Covid is that fast growth attracts more capital while weak growth chases off fast money.

Giving Stock Away

Teladoc is forecasted to produce adjusted EBITDA of $245 million for the year. The stock only had a market cap of $4.9 billion following the big rally to $30 following the earnings report. With solid EBITDA margin expansion next year, Teladoc Health could actually trade at close to 10x EBITDA forecasts.

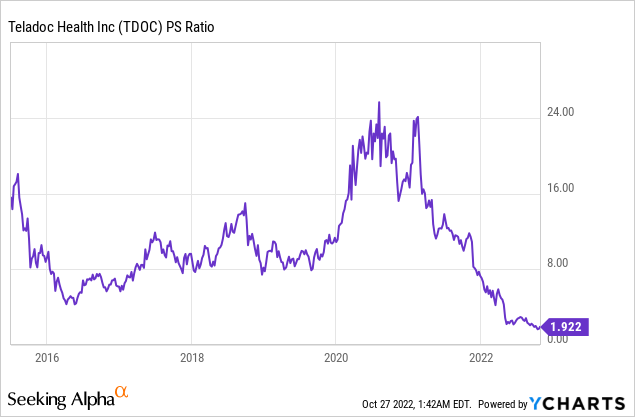

The market has clearly swung too far in the opposite direction here. The stock regularly traded at levels of 5x sales back pre-Covid when telemedicine offered a lot of promise, but the company didn’t always deliver strong results. Now the concept has been proven invaluable, but investors practically don’t want the stock.

The trailing P/S ratio isn’t the best metric for valuing a stock, especially in a volatile growth area. In this case, this ratio provides one of the best comparison tools. Teladoc Health now trades at the lowest multiple in its history.

In essence, the market has pretty much given up on the stock perceiving limited growth ahead. All indications actually suggest the normal business cycle now provides more opportunity and a similar situation as the 2016/17 period when Teladoc last traded in the $20s and the market didn’t appear much interested in the telehealth story. An investor isn’t likely to see a repeat of the Covid boost, but online doctor visits could get another boost at some point providing any investors lurking in the stock an unexpected jump.

Takeaway

The key investor takeaway is that Teladoc Health is far too cheap here. The market has given up on the telemedicine sector just as the business is starting to percolate again.

Be the first to comment